Portfolio optimization: Some aspects of modeling and computing

The paper focuses on computational aspects of portfolio optimization (PO) problems.

The objectives of such problems may include: expectedreturn, standard deviation and variation

coefficient of the portfolioreturn rate. PO problems can be formulated as mathematical

programming problems in crisp, stochastic or fuzzy environments. To compute optimal solutions

of such single- and multi-objective programming problems, the paper proposes the use of a

computational optimization method such as RST2ANU method, which can be applied for nonconvex programming problems. Especially, an updated version of the interactive fuzzy utility

method, named UIFUM, is proposed to deal with portfolio multi-objective optimization problems.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Tóm tắt nội dung tài liệu: Portfolio optimization: Some aspects of modeling and computing

VNU Journal of Science: Policy and Management Studies, Vol. 33, No. 2 (2017) 1-9

1

RESEARCH

Portfolio Optimization: Some Aspects

of Modeling and Computing

Nguyen Hai Thanh*, Nguyen Van Dinh

VNU International School, Building G7-G8, 144 Xuan Thuy, Cau Giay, Hanoi, Vietnam

Received 20 April 2017

Revised 10 June 2017, Accepted 28 June 2017

Abstract: The paper focuses on computational aspects of portfolio optimization (PO) problems.

The objectives of such problems may include: expectedreturn, standard deviation and variation

coefficient of the portfolioreturn rate. PO problems can be formulated as mathematical

programming problems in crisp, stochastic or fuzzy environments. To compute optimal solutions

of such single- and multi-objective programming problems, the paper proposes the use of a

computational optimization method such as RST2ANU method, which can be applied for non-

convex programming problems. Especially, an updated version of the interactive fuzzy utility

method, named UIFUM, is proposed to deal with portfolio multi-objective optimization problems.

Keywords: Portfolio optimization, mathematical programming, single-objective optimization,

multi-objective optimization, computational optimization methods.

1. Introduction

*

Modern portfolio theory, fathered by Harry

Markowitz in the 1950s, assumes that an

investor wants to maximize a portfolio's

expected return contingent on any given amount

of risk, with risk measured by the standard

deviation of the portfolio's return rate. For

portfolios that meet this criterion, known as

efficient portfolios, achieving a higher expected

return requires taking on more risk, so investors

are faced with a trade-off between risk and

expected return. Modern portfolio theory helps

investors control the amount of risk and return

they can expect in a portfolio of investments

such as stocks and shows that certain weighted

_______

* Corresponding author. Tel.: 84-987221156.

Email: nhthanh.ishn@isvnu.vn

https://doi.org/10.25073/2588-1116/vnupam.4090

combinations of investments offer both lower

expected risk and higher expected return than

other combinations. Modern portfolio theory

also shows that certain combinations only offer

increased reward with increased risk. This set

of combinations is referred to as the efficient

frontier [1].

In this paper, the classical PO problem is

considered: There are k assets (stocks)for

possible investment. For each asset i with return

rate Ri, i = 1, 2, ,k, expected returni= E(Ri)

and standard deviation i = can be

calculated based on the past data. Also the

variance - covariance matrixfor the assets can

be obtained. The PO problem is to choose the

weights w1, w2, , wk of investments into the

assets in order to optimize some objectives

subject to certain constraints (see [2, 3]).

For the PO problem we need the notations:

N.H. Thanh, N.V. Dinh / VNU Journal of Science: Policy and Management Studies, Vol. 33, No. 2 (2017) 1-9

2

w = (w1, w2, , wk)

T

,

= (1, 2, ,k)

T

,

and the variance - covariance matrix:

The following objectives may be

considered:

io) Maximize Portfolio Expected Return:

Max P = E(RP) = w

T;

iio) Minimize Portfolio Standard Deviation:

Min P = =(w

Tw)1/2;

iiio) MinimizePortfolio Variation

Coefficient Min VCP = P/P or Max (VCP)

-1

=

P/P

The constraints may be specified as follows

ic) w1 + w2 + + wk = 1;

iic) P α, where α usually is set as

Max{i};

iiic) P , where usually is set as Min

{i};

ivc) P/P .

It should be noted that the first constraint is

the “must” requirement and, for the sake of

simplicity, all the weights are proposed to be

non-negative. The other constraints are optional

ones that may be included in the problem

formulation depending on circumstances.

Moreover, other additional objectives and/or

constraints may also be considered if required.

If we choose to optimize only one objective

out of the three as shown above, then we have a

single-objective optimization problem. The 1

st

objective function is a linear function, the 2

nd

objective is a quadratic function, and the 3

rd

objective is a fraction function of a linear

expression over a quadratic expression. The 2

nd

objective and the 3

rd

objective are not always

guaranteed to be convex / concave functions. If

we choose to optimize at least two of the three

objectives (or some other additional objectives),

then we have a multi-objective optimization

problems. In the traditional, classical setting,

when all the coefficients of the programing

problem are real numbers, the PO problem is to

be solved in the crisp environment (see [4-6]).

The 1

st

objective may be formulated as a

stochastic function with return rates being

treated as random variables which are assumed

to follow normal distributions. In this modeling

setti ... 2 (2017) 1-9

4

contain at least one non-linear function either in

the objective or in the constraints, where there

is the expression:

Min P = (w

Tw)1/2 =

=

Moreover, in most situations the variance-

covariance matrix is not a positive definite one,

and the realistic problemsneed not to be of

convex, concave or d.c. programming type (see

[2, 3]). Therefore, most deterministic

computational optimization methods can not

guarantee to provide global optima but only

local optima. Hence, in this paper we propose

to use acomputational optimization method

called RST2ANU method (see [5-7]) to compute

the optima of PO problems 2a, 2b and 2c.

Illustrative example: There are 08 stocks

with the return rates Ri as given in the

following table:

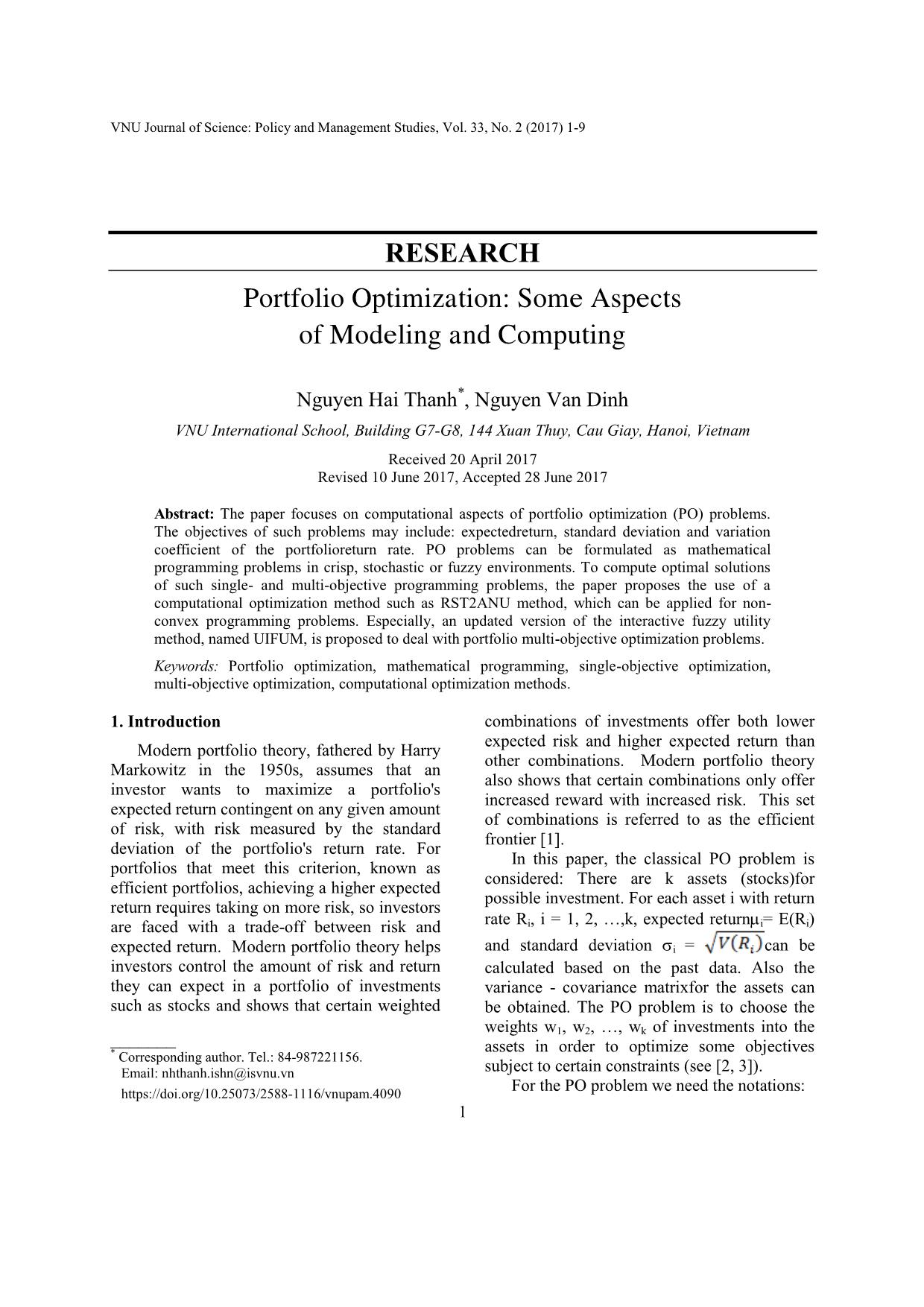

Ri i i

R1 -0.033% 5.465%

R2 0.235% 6.544%

R3 0.228% 7.204%

R4 -0.439% 6.946%

R5 0.124% 8.707%

R6 0.818% 4.594%

R7 0.539% 2.858%

R8 1.462% 6.016%

For the return rates, the variance–

covariance matrix = [ij] 8 8, whose

elements are calculated based on the past data,

can also be provided:

f

0.002987 0.003433 0.003759 0.003552 0.004195 -0.000069 0.000566 0.0003

0.003433 0.004282 0.004645 0.004051 0.005018 -0.000098 0.000624 0.000498

0.003759 0.004645 0.000519 0.004387 0.005371 -0.000104 0.000662 0.000352

0.003552 0.004051 0.004387 0.004824 0.005585 -0.000057 0.000899 0.000767

0.004195 0.005018 0.005371 0.005585 0.007582 -0.000108 0.000921 0.001528

-0.000069 -0.000098 -0.000104 -0.000057 -0.000108 0.002111 0.000516 0.000425

0.000566 0.000624 0.000662 0.000899 0.000921 0.000516 0.000817 0.000291

0.000345 0.000498 0.000352 0.000767 0.001528 0.000425 0.000291 0.003619

g

The problem 2a now becomes:

Max P =

-0.033%w1+0.235%w2+0.228%w3-

0.439w4+0.124w5+0.818w6+0.539w7

+1.462%w8

subject to:

w1 + w2 + + w8= 1;

P = (0.002987 + 0.004282 +

0.000519 0.004824

+ 0.007582 + 0.002111 +

0.000817 0.003619

+0.006866w1w2+ 0.007518w1w3 +

0.007104w1w4 +0.00839w1w5

- 0.000138w1w6 + 0.001132w1w7 +

0.00069w1w8 +0.00929w2w3

+ 0.008102w2w4 + 0.010036w2w5 -

0.000196w2w6 + 0.001284w2w7

+ 0.000996w2w8 + 0.008774w3w4 +

0.010742w3w5 - 0.000208w3w6

+ 0.001324w3w7 + 0.000704w3w8 +

0.01117w4w5 - 0.000114w4w6

+ 0.001798w4w7 + 0.001534w4w8-

0.00216w5w6 + 0.001842w5w7

+ 0.003056w5w8 + 0.001032w6w7 +

0.00085w6w8 + 0.000582w7w8)

1/2

2.8585%;

w1, w2, , w8 0.

The use of the RST2ANU computational

software package (which was designed based

on the RST2ANU method) with the initial

guess point w = (0, 0, 0, 0, 0, 0, 1, 0) provides

the following numerical solutions:

w = (0.000012, 0.000035, 0.000000,

0.000000, 0.000010, 0.193295, 0.533904,

0.272745)

T

,

N.H. Thanh, N.V. Dinh / VNU Journal of Science: Policy and Management Studies, Vol. 33, No. 2 (2017) 1-9 5

w = (0.000012, 0.000035, 0.000000,

0.000000, 0.000010, 0.193295, 0.533904,

0.272745)

T

,

w = (0.000002, 0.000034, 0.000036,

0.000001, 0.000001, 0.193085, 0.534023,

0.272819)

T

,

w = (0.000000, 0.000000, 0.000016,

0.000000, 0.000000, 0.193239, 0.533987,

0.272757)

T

.

All these weight vectors give the same

optimal value of the largest expected return rate

of the portfolio: P= 0.008447 = 0.8447%.

The answer to the problem 2a can be

written as:

w

2a

= (0%, 0%, 0%, 0%, 0%, 19.33%,

53.40%, 27.27%), i.e. w1 = w2 = w3 = w4 = w5 =

0%, w6 = 19.33%, w7 = 53.40% and w8 =

27.27%.

With the data as provided in this illustrative

example, the problem 2b (where the lower

threshold for P is set to be 1.46%) and the

problem 2c have the following numerical

solutions (as provided by employing the

RST2ANU computational software package):

w

2b

= (0.000000, 0.000000, 0.000000,

0.000000, 0.000000, 0.000000, 0.000000,

1.000000) = (0%, 0%, 0%, 0%, 0%, 0%, 0%,

100%) providing the lowest standard deviation

of the portfolio return rate: P= 6.0158%;

w

2c

= (0.000000, 0.000000, 0.000000,

0.000000, 0.000000, 0.229138, 0.411787,

0.359075) = (0%, 0%, 0%, 0%, 0%, 0%, 0%, 1)

providing the largest value of the inverse of the

variation coefficient of the portfolio return rate:

(VCP)

-1

= 0.300103.

4. Some aspects of computing optima of the

multi-objective optimization model of the

PO problem

In this section our discussion is focused on

a computational method for solving the

problem 3.

Problem 3:

Max z1 = P = E(RP) = w

T;

Min z2 = P = (w

Tw)1/2 ;

Max z3 = (VCP)

-1

= P/P;

subject to:

w1 + w2 + + wk = 1;

w1, w2, , wk 0.

We can update “the interactive fuzzy utility

method” (IFUM method), which initially was

proposed for solving multi-objective linear

programming problems (see [4, 5]),to solve

multi-objective nonlinear programming

problems. This updated version of the IFUM

method is first time proposed in this paper (the

updated version is named as UIFUM). In

particular, the UIFUM method can be used to

solve the problem 3.

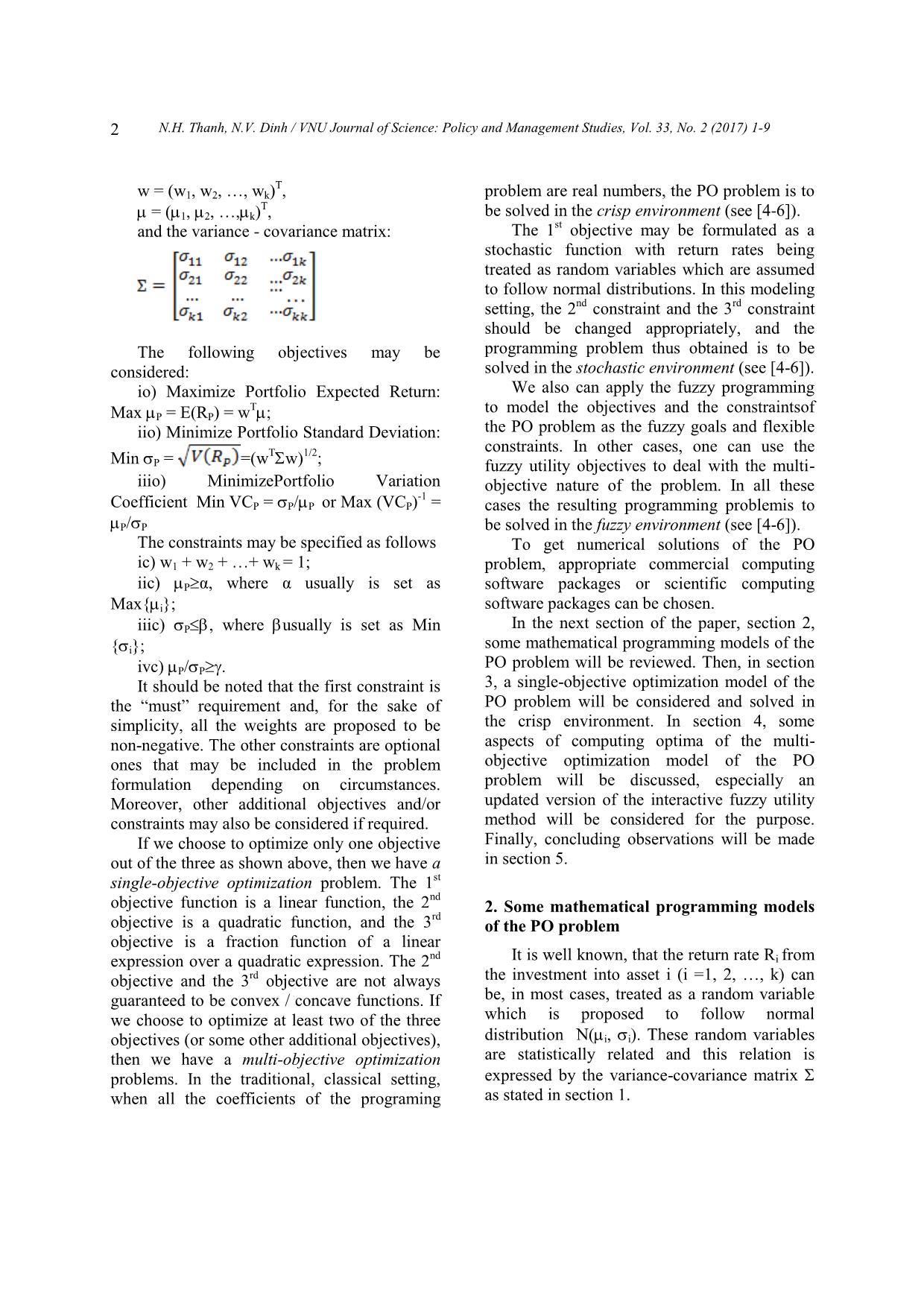

4.1. The UIFUM algorithm

The initialization step

i) Input data for the objectives and

constraint(s);

ii) Using the RST2ANU procedure to find

out the optimal solutions for each of the

(three) objectives subject to the given

constraints. The results are summarized in the

pay-off table as follows:

f

N.H. Thanh, N.V. Dinh / VNU Journal of Science: Policy and Management Studies, Vol. 33, No. 2 (2017) 1-9

6

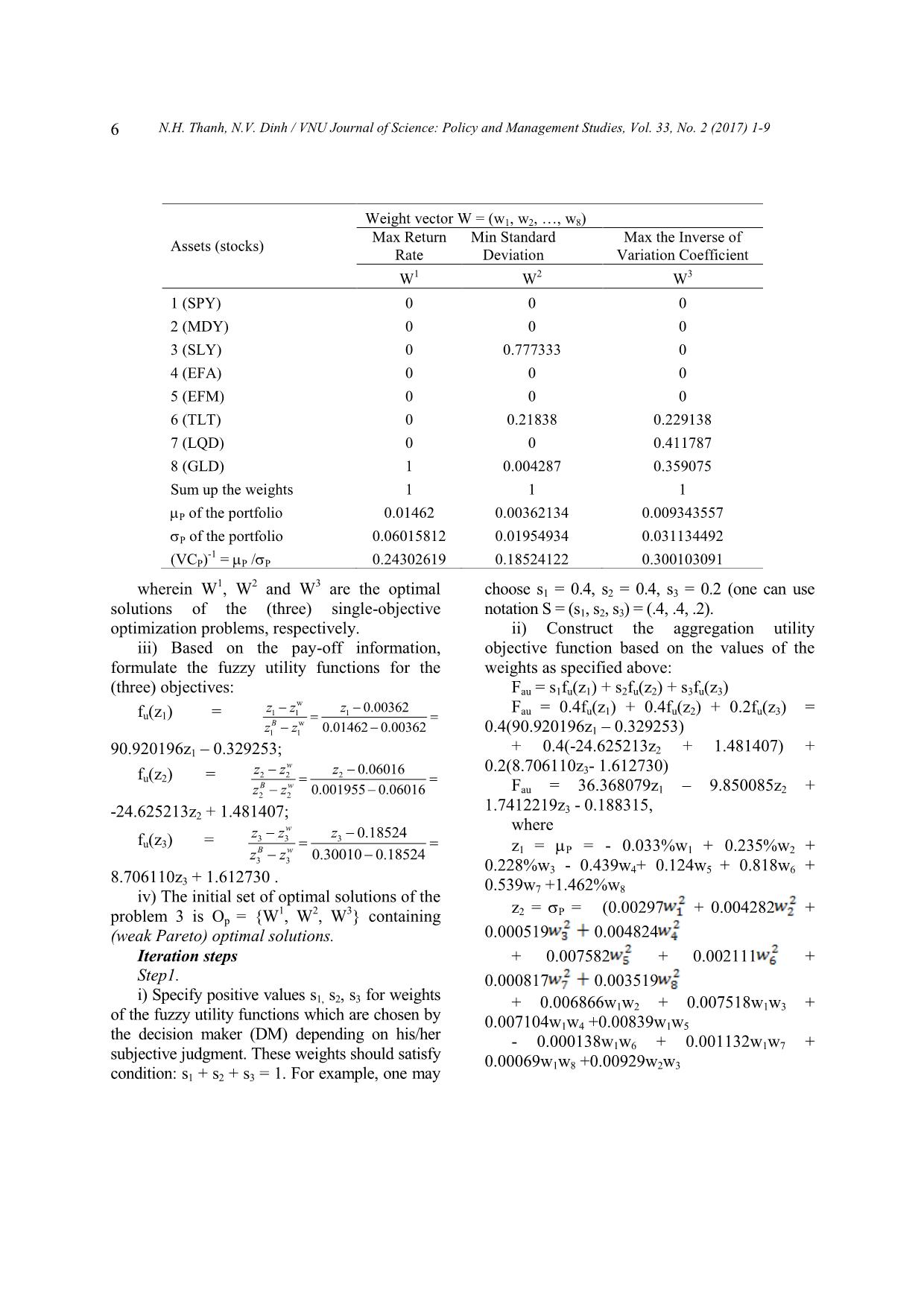

wherein W

1

, W

2

and W

3

are the optimal

solutions of the (three) single-objective

optimization problems, respectively.

iii) Based on the pay-off information,

formulate the fuzzy utility functions for the

(three) objectives:

fu(z1) =

w

1 1 1

w

1 1

0.00362

0.01462 0.00362B

z z z

z z

90.920196z1 – 0.329253;

fu(z2) = 2 2 2

2 2

0.06016

0.001955 0.06016

w

B w

z z z

z z

-24.625213z2 + 1.481407;

fu(z3) = 3 3 3

3 3

0.18524

0.30010 0.18524

w

B w

z z z

z z

8.706110z3 + 1.612730 .

iv) The initial set of optimal solutions of the

problem 3 is Op = {W

1

, W

2

, W

3

} containing

(weak Pareto) optimal solutions.

Iteration steps

Step1.

i) Specify positive values s1, s2, s3 for weights

of the fuzzy utility functions which are chosen by

the decision maker (DM) depending on his/her

subjective judgment. These weights should satisfy

condition: s1 + s2 + s3 = 1. For example, one may

choose s1 = 0.4, s2 = 0.4, s3 = 0.2 (one can use

notation S = (s1, s2, s3) = (.4, .4, .2).

ii) Construct the aggregation utility

objective function based on the values of the

weights as specified above:

Fau = s1fu(z1) + s2fu(z2) + s3fu(z3)

Fau = 0.4fu(z1) + 0.4fu(z2) + 0.2fu(z3) =

0.4(90.920196z1 – 0.329253)

+ 0.4(-24.625213z2 + 1.481407) +

0.2(8.706110z3- 1.612730)

Fau = 36.368079z1 – 9.850085z2 +

1.7412219z3 - 0.188315,

where

z1 = P = - 0.033%w1 + 0.235%w2 +

0.228%w3 - 0.439w4+ 0.124w5 + 0.818w6 +

0.539w7 +1.462%w8

z2 = P = (0.00297 + 0.004282 +

0.000519 0.004824

+ 0.007582 + 0.002111 +

0.000817 0.003519

+ 0.006866w1w2 + 0.007518w1w3 +

0.007104w1w4 +0.00839w1w5

- 0.000138w1w6 + 0.001132w1w7 +

0.00069w1w8 +0.00929w2w3

Assets (stocks)

Weight vector W = (w1, w2, , w8)

Max Return

Rate

Min Standard

Deviation

Max the Inverse of

Variation Coefficient

W

1

W

2

W

3

1 (SPY) 0 0 0

2 (MDY) 0 0 0

3 (SLY) 0 0.777333 0

4 (EFA) 0 0 0

5 (EFM) 0 0 0

6 (TLT) 0 0.21838 0.229138

7 (LQD) 0 0 0.411787

8 (GLD) 1 0.004287 0.359075

Sum up the weights 1 1 1

P of the portfolio 0.01462 0.00362134 0.009343557

P of the portfolio 0.06015812 0.01954934 0.031134492

(VCP)

-1

= P /P 0.24302619 0.18524122 0.300103091

N.H. Thanh, N.V. Dinh / VNU Journal of Science: Policy and Management Studies, Vol. 33, No. 2 (2017) 1-9 7

+ 0.008102w2w4 + 0.010036w2w5 -

0.000196w2w6 + 0.001284w2w7

+ 0.000996w2w8 + 0.008774w3w4 +

0.010742w3w5 - 0.000208w3w6

+ 0.001324w3w7 + 0.000704w3w8 +

0.01117w4w5 - 0.000114w4w6

+ 0.001798w4w7 + 0.001534w4w8 -

0.00216w5w6 + 0.001842w5w7

+ 0.003056w5w8 + 0.001032w6w7 +

0.00085w6w8 + 0.000582w7w8)

1/2

z3 = P / P .

Step2.

i) Using the RST2ANU procedure to find

out the optimal solution of the obtained single-

objective programming problem:

Max Fau = 36.368079z1 – 9.850085z2 +

1.7412219z3 - 0.188315;

subject to:

w1 + w2 + + wk = 1;

w1, w2, , wk 0.

The optimal solution is: Max Fau =

0.694239 attained at W = (0, 0, 0, 0, 0, 0.2345,

0.3930, 0.3724). With this weighting set, P =

0.009481683, P = 0.031604131 and P/P =

0.300014058.

ii) If this optimal solution is different from

those solutions in set Op, the DM may include /

not include it into the set Op. If the DM wants to

update Op, he/she can go back to step 1.

Otherwise, the DM goes to

Termination.

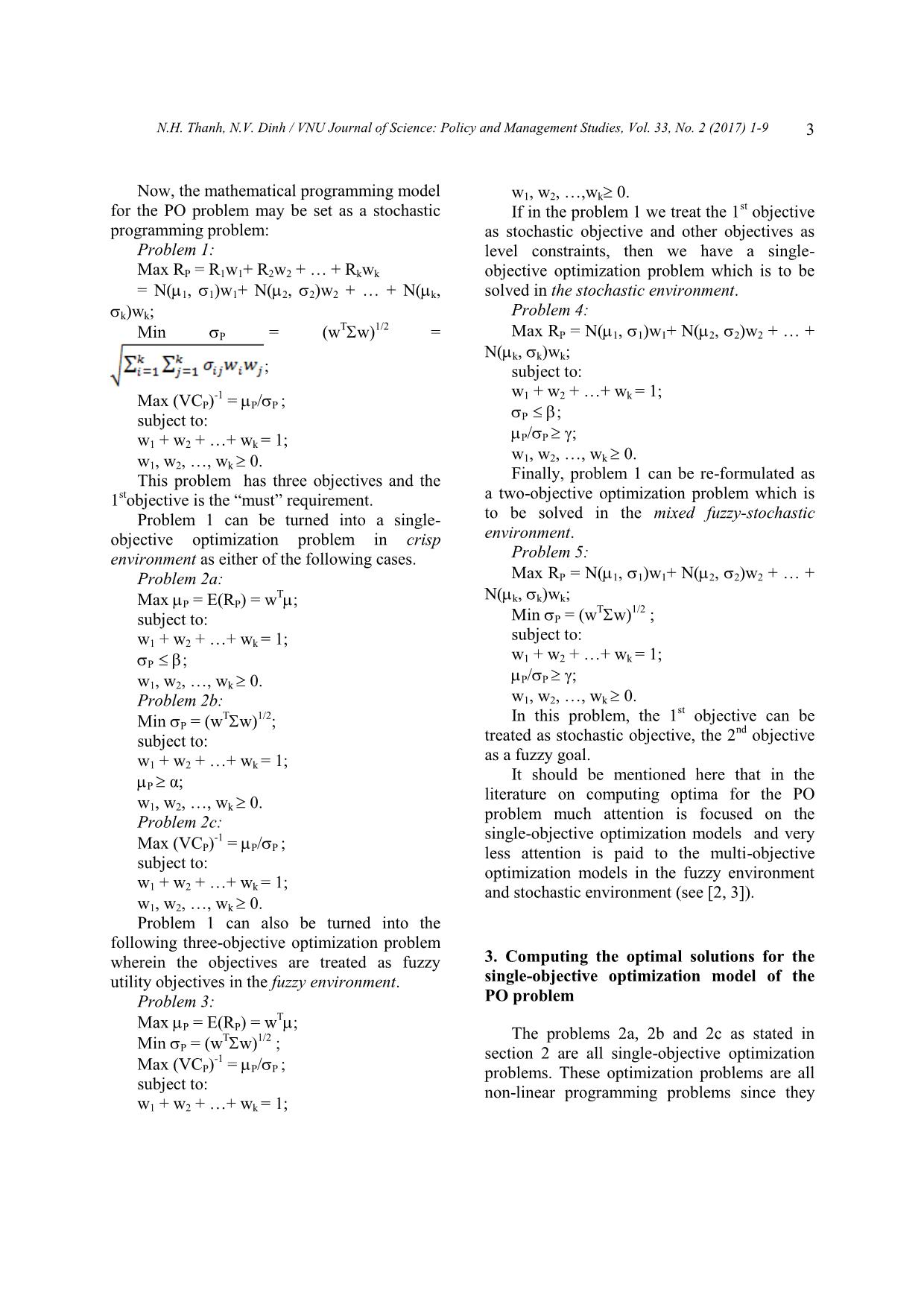

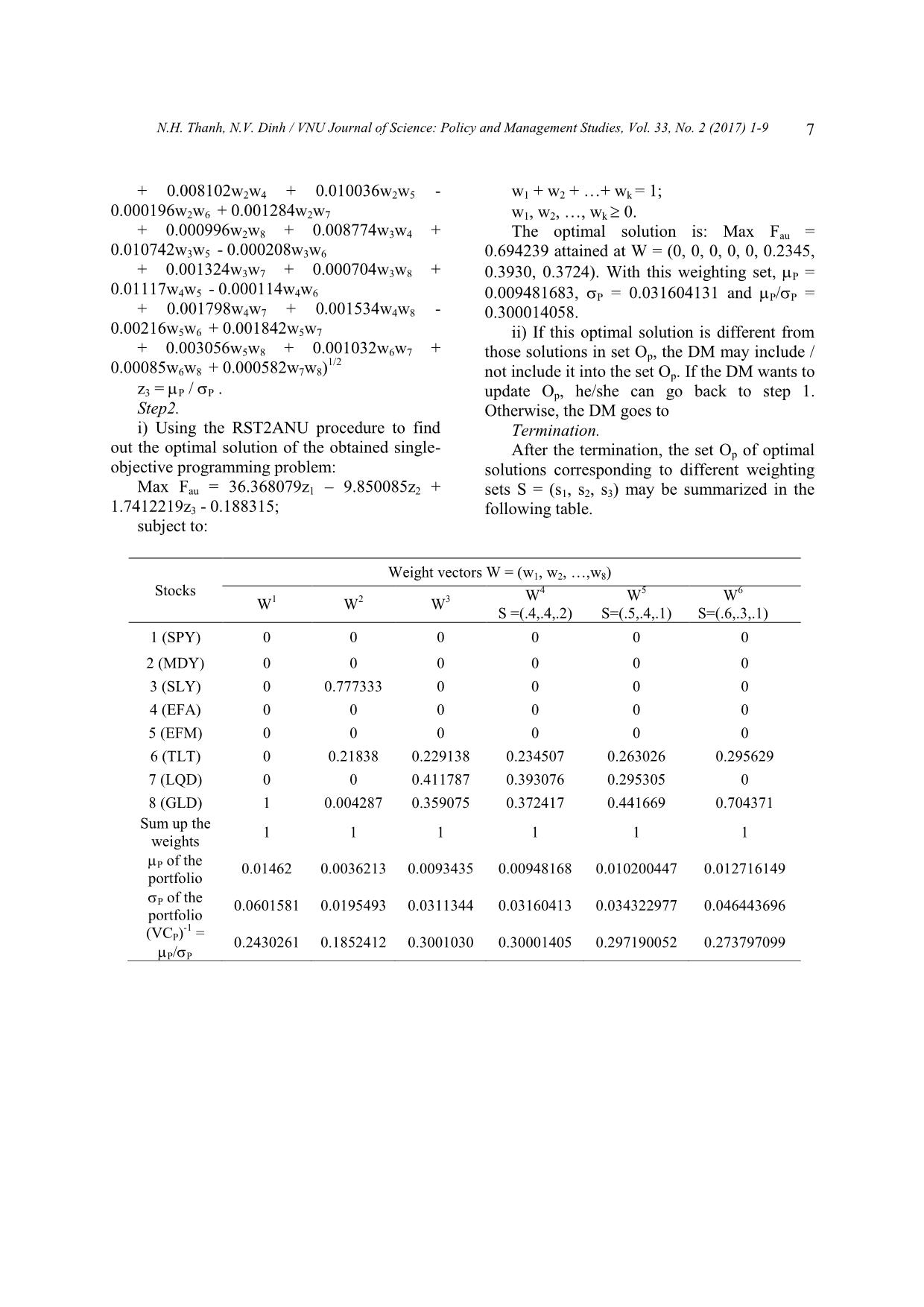

After the termination, the set Op of optimal

solutions corresponding to different weighting

sets S = (s1, s2, s3) may be summarized in the

following table.

D

r

Stocks

Weight vectors W = (w1, w2, ,w8)

W

1

W

2

W

3

W

4

S =(.4,.4,.2)

W

5

S=(.5,.4,.1)

W

6

S=(.6,.3,.1)

1 (SPY) 0 0 0 0 0 0

2 (MDY) 0 0 0 0 0 0

3 (SLY) 0 0.777333 0 0 0 0

4 (EFA) 0 0 0 0 0 0

5 (EFM) 0 0 0 0 0 0

6 (TLT) 0 0.21838 0.229138 0.234507 0.263026 0.295629

7 (LQD) 0 0 0.411787 0.393076 0.295305 0

8 (GLD) 1 0.004287 0.359075 0.372417 0.441669 0.704371

Sum up the

weights

1 1 1 1 1 1

P of the

portfolio

0.01462 0.0036213 0.0093435 0.00948168 0.010200447 0.012716149

P of the

portfolio

0.0601581 0.0195493 0.0311344 0.03160413 0.034322977 0.046443696

(VCP)

-1

=

P/P

0.2430261 0.1852412 0.3001030 0.30001405 0.297190052 0.273797099

N.H. Thanh, N.V. Dinh / VNU Journal of Science: Policy and Management Studies, Vol. 33, No. 2 (2017) 1-9

8

Based on the information of the above table,

the DM may choose the most preferred optimal

solution to implement his/her investment

portfolio. If desired, the DM may also use a

group decision making method to make the

investment decision. For example, the following

investment decision seems to be quite good:

Invest 26.30% of the total fund into the 6

th

stock

(TLT), 29.53% into 7

th

stock (LQD) and 44.17%

into the 8

th

stock (GLD) to get a good level of P

= 1.02% at a reasonable low level of risk P =

3.43%.

It is interesting to note that the optimal

solutions as summarized in the above table all

belong to the set of Pareto optimal solutions (also

called efficient solutions). This set may be

considered as the theoretical extension of the

efficient frontier, which graphically represents the

efficient portfolios obtained when only two first

objectives out of the three are considered.

5. Concluding observations

This paper deals with some modeling and

computing aspects of the classical PO problem. It

has been shown that the PO problem can be

modeled as a single- objective or a multi-

objective programming problem which may be,

depending on the realistic circumstances, treated

in a crisp, stochastic and / or fuzzy environment.

Although the illustrative example is quite a

classical and simple one, it has been indicated

that the PO programming problem is not a linear

programming and not necessarily to be a convex

or d.c. programming problem. Because of this

reason, the PO problem is challenging all the

experts in the field of mathematical programming

and computational optimization to find out the

global optima or the best investment decisions of

the PO problem.

This paper has also shown that the RST2ANU

method can be of use in computing optima for the

PO single-objective as well as multi-objective

programming problems. The method is in nature a

stochastic optimization method. The possibility to

improve the method (or any other stochastic

method) is in incorporating it with a suitable

deterministic optimization method to find most of

local optimal solutions which may contain the

global solution with a high probability. An updated

version of the interactive fuzzy utility method

(IFUM) has been proposed first time in this paper to

find the optima of the PO multi-objective

programming problem. Because of the time

limitation, we could not show how to use the

updated versions of multi-objective optimization

methods (the reference direction interactive method,

called RDIM, and the interactive satisficing method,

named PRELIME [6, 8, 9], which were developed

by us, to solve the PO problem as has been

formulated in section 2 (see Problem 4 and

Problem 5).

Therefore, the scope for further research in

modeling and computing optima of the PO

problem is, first of all, to improve the efficiency

of the existing computational optimization

methods, including all computational techniques

as mentioned in this paper as well as some others.

Also, the essential matter of realistic PO

problems is that the data for PO realistic

problems is a kind of so called big data, which is

often characterized by 3Vs: the extreme volume

of data, the wide variety of data types and the

velocity at which the data must be processed.

Hence, another research direction is to combine

data mining and statistical analysis with

optimization tools.

N.H. Thanh, N.V. Dinh / VNU Journal of Science: Policy and Management Studies, Vol. 33, No. 2 (2017) 1-9 9

References

[1] Sabbadini, Tony, Manufacturing Portfolio

Theory, International Institute for Advanced

Studies in Systems Research and Cybernetics,

working paper, 2010.

[2] Wai-Sum Chan and Yiu-KuenTse, Financial

Mathematics for Actuaries, Updated Edition,

McGraw - Hill Education, Singapore, 2013.

[3] Jaehyun Park, Ahmed Bou-Rabee and Stephen

Boyd, Portfolio Optimization, EE103 Stanford

University Lecture note, 2014.

[4] Nguyen Hai Thanh, Applied Mathematics (in

Vietnamese), The Hanoi National University of

Education’s Publishing House, Hanoi, 2005.

[5] Nguyen Hai Thanh, Optimization (in Vietnamese),

The Hanoi University of Science and Technology’s

Publishing House, Hanoi, 2006.

[6] Nguyen Hai Thanh, Optimization in Fuzzy-

Stochastic Environment and its Applications in

Industry and Economics, Internationalization

Studies, 1 (2012), 131.

[7] Chander Mohan, Nguyen Hai Thanh, A

Controlled Random Search Technique

Incorporating the Simulated Annealing Concept

for Solving Integer and Mixed Integer Global

Optimization Problems, Computational

Optimization and Applications, 14 (1999), 103.

[8] Chander Mohan, Nguyen Hai Thanh, Reference

Direction Method for Solving Multi-objective

Fuzzy Programming, European Journal of

Operational Research, 107 (1998), 599.

[9] Chander Mohan, Nguyen Hai Thanh, An

Interactive Satisficing Method for Solving Multi-

objective Mixed Fuzzy-Stochastic Programming

Problems, International Journal for Fuzzy Sets and

Systems, 117 (2001), 61.

T

g

File đính kèm:

portfolio_optimization_some_aspects_of_modeling_and_computin.pdf

portfolio_optimization_some_aspects_of_modeling_and_computin.pdf