Industrial revolution 4.0: Developing opportunities for Vietnamese commercial banks

Abstract

Today, the world is entering the Industrial Revolution 4.0. This revolution is a great

trend, affecting the socio-economic development of each country, each region and the

world, including Vietnam. This wave of revolution also creates opportunities for

significant changes in the banking sector in Vietnam, although it is not in the strongly

influenced areas. As the matter of fact, this paper studies the current status of Viet

Nam's commercial banking system in the period of 2014-2017, thereby, proposing

some recommendations for the improvement of Vietnamese banking system in the

context that influence of Industrial Revolution 4.0 is becoming increasingly powerful

in Vietnam.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Industrial revolution 4.0: Developing opportunities for Vietnamese commercial banks

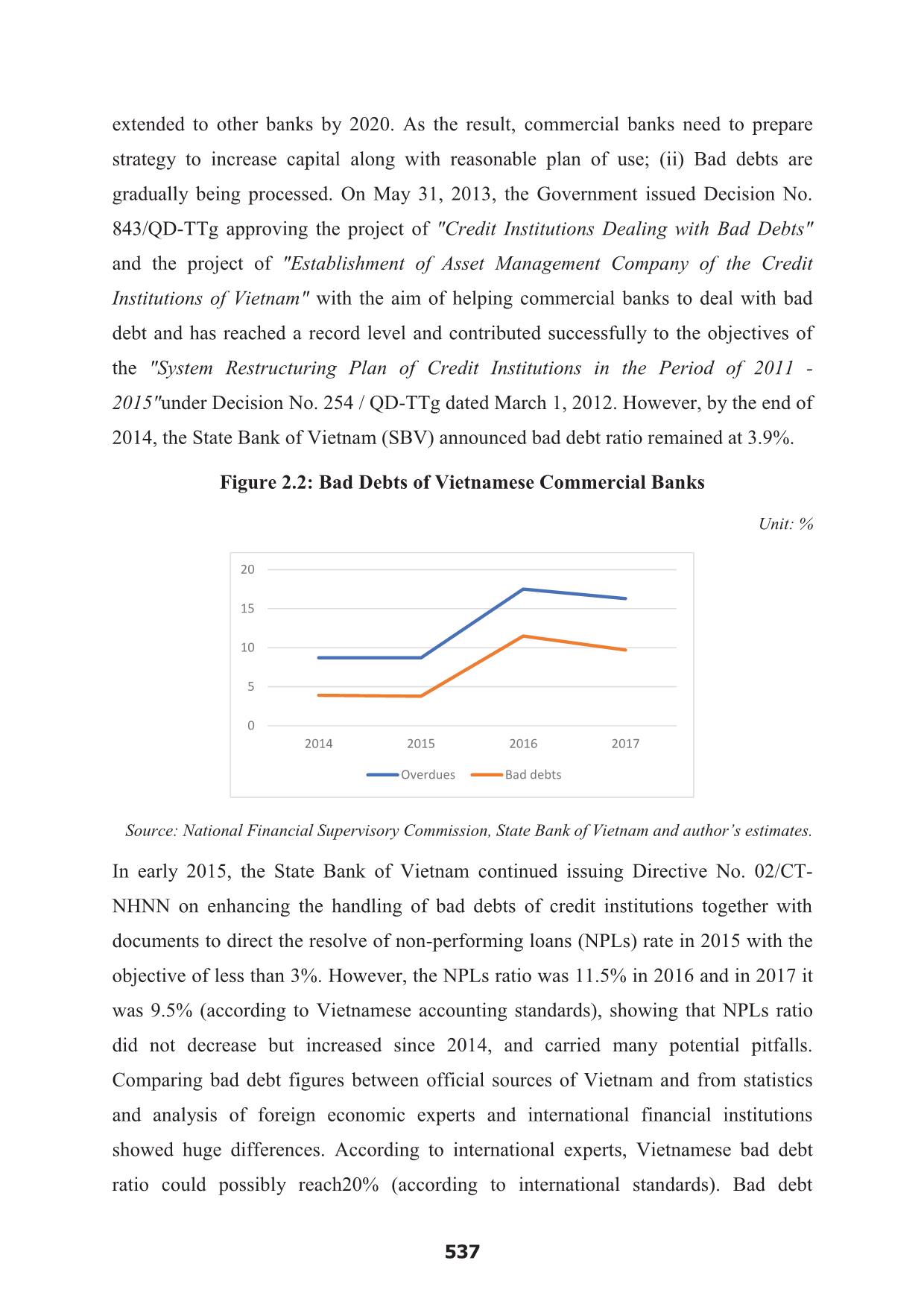

INDUSTRIAL REVOLUTION 4.0: DEVELOPING OPPORTUNITIES FOR VIETNAMESE COMMERCIAL BANKS Doan Phuong Thao, PhD. Ngo Thanh Xuan, MBA. National Economics University Abstract Today, the world is entering the Industrial Revolution 4.0. This revolution is a great trend, affecting the socio-economic development of each country, each region and the world, including Vietnam. This wave of revolution also creates opportunities for significant changes in the banking sector in Vietnam, although it is not in the strongly influenced areas. As the matter of fact, this paper studies the current status of Viet Nam's commercial banking system in the period of 2014-2017, thereby, proposing some recommendations for the improvement of Vietnamese banking system in the context that influence of Industrial Revolution 4.0 is becoming increasingly powerful in Vietnam. Keywords: Industrial Revolution 4.0, commercial banks, State Bank of Vietnam. 1. Introduction Industrial Revolution 4.0 was first mentioned in the High-Tech Strategy Action Plan adopted by the German government in 2012. According to Professor Klaus Schwab, President of the World Economic Forum, Industrial Revolution 4.0 is a term that encompasses a wide range of modern automation technologies, data exchange and manufacturing. Industrial Revolution 4.0 is a combination of technology in the fields of physics, digital and biotechnology, creating entirely new possibilities and profound impact on the political, social, economic aspects of the world. Then, robots and computers with artificial intelligence can possibly evolve to replace human beings in the judgment and management of complex systems. As the result, Industrial Revolution4.0 has been affecting the socio-economic development of each country, each region and the world, including Vietnam. 534 Responding to impacts from the Industrial Revolution 4.0, the commercial banking system has made some significant changes in order to promote the socio-economic development of Vietnam in the context of international economic integration. In fact, with strong growth both in terms of quantity and size, by the end of 2017, Vietnam’s banking system has narrowed down to two policy banks, five state-owned commercial banks, and increased to about 40 joint-stock banks, 10 joint-venture banks along with the availability of other 100% foreign-owned banks and foreign branches in Vietnam. However, in the process of development, the banking system of Vietnam still has many limitations, forcing banks to take vigorous steps to ensure sustainable growth. Furthermore, on the management side, the State Bank of Vietnam has been actively putting through many activities of the sector to concretize tasks under Directive No.16/CT-TTg dated May 4, 2017 of the Prime Minister on enhancing the capacity to approach the Industrial Revolution 4.0. Accordingly, the legal corridor was born to support the operation of commercial banks such as payment system, development of information technology infrastructure, security, confidentiality, etc. and in particular, reinforcing the communication and scientific research on the application of 4.0 technology in the banking industry. 2. Research Methodology The article uses the method of data synthesis and analysis. Based on the data collection, statistics and synthesis regarding the impact of Industrial Revolution 4.0 on system operations of global commercial banking system and of Vietnam, which are found in reputable articles, scientific journals, archives and mass publications of commercial banks as well as financial organizations, the authors then analyze impacts from the Industrial Revolution 4.0 to commercial banks in Vietnam. 3. Research Content 3.1. Opportunities for Vietnamese Commercial Banks in the Context of the Industrial Revolution 4.0 In the period of 2014-2017, Vietnam's economy achieved a macroeconomic stability with an average economic growth rate of 5.8%, moderate inflation and export surplus, increasing foreign exchange reserves and stabilized exchange rates. This contributed 535 significantly to the positive change in the operation of the commercial banking system with regards to the successful restructuring program of commercial banks. In the context of the Industrial Revolution 4.0, the opportunities for the commercial banking system in Vietnam are still at early stage compared to other countries in the region in terms of: First, there is an opportunity to change the scale of capital. Vietnamese largest banks by capitals such as Agribank, Vietcombank and BIDV are still smaller compared to the largest banks in the region (Malaysian Maybank has more than 4,000 million US Dollars in capitals, BDS Bank of Singapore has over 9,000 million US Dollars in capitals, Bangkok Bank of Thailand has more than 3,000 US Dollars in capitals), so the pressure to increase working capitals is ma ... ement model of banks is unclear, overlapping functions and duties. The three-round model of control at banks is relatively new, so it has not been implemented as effectively as expected. The approach to implement the risk management framework mainly depends on the specialized functions. Therefore, there are still existing risks in retailing activities, 539 especially with banks stressing to increase market share, pressure on business targets, building products quickly to market while risk and quality management have not been keeping up. Sixthly, Industrial Revolution 4.0 brings the opportunity to improve information technology support in banking operations. Artificial intelligence is the focus of development of many large technology companies in the world. Consequently, commercial banks must apply information technology in the portfolio risk management, consumers management, data facilities management and above all, they must always grasp the trend, the application of information technology to ensure the safe and effective banking operations. Presently, many Vietnamese banks have started the digital transformation process, deploying a number of innovative banking services such as TPBank with LiveBank; VPBank with Timo digital banking application; Vietcombank with digital space; MB with ChatBot virtual assistant application to serve 24x7 customers on social networks, etc. With this requirement, the digital banking model operating on the basis of technology through digital devices connected with computer software through the Internet environment has in fact been and will change the whole system structure of the banks. Industrial Revolution 4.0 will also provide new insights into how communication and business processes can be transformed through interactions and communication. As the telecommunications infrastructure grows, conversations tend to be video-calls with increased levels of quality and stability. Therefore, customer care at banks may also be required additional telemarketing skills. In the distant future, virtual-reality and holographic technology will be able to completely replace human communication. Besides, 3D calls like in fiction films may not be far off. In addition, information technology is also increasingly involved in matters such as liquidity risk management, credit risk, interest rate risk, and operational risk at international standards. In response to these requests, in recent years, the number of IT staff and IT infrastructure serving the bank have been constantly growing in both quantity and quality; the database has been encrypted and computerized. Better support in ensuring information is provided for the planning and implementation of policies. Core-banking systems are applied in risk management, accounting system, payment operations, etc. at most commercial banks. 540 However, the process of gathering, screening and processing data is always in shortage of the database. The core-banking system have several different varieties such as Flexcube (Oracle) or T24 (Temedos) and sometimes they are jointly used by one bank. The fragmentation in data management, which does not meet standardization also leads to system inefficiencies. This shows that although commercial banks have made active investments in technology development, the pace of development has not been keeping up with the rapid growth of the world. Seventh is the opportunity to enhance the quality of human resources. The biggest pressure of the commercial banks in Vietnam is the shortage of high-quality human resources, especially international banking and finance professionals. Both redundant and non-existent human resources are commonly found in many Vietnamese banks in specialized fields such as risk management, international payment, international investment, development strategy, etc. It is not only a matter of professionalism but also the professional ethics of bankers are big challenge to the security of the banking system. 3.2. Recommendations Industrial Revolution 4.0 conducts many opportunities for Vietnamese commercial banking system and speeds up the process of innovation in banking towards sustainable development. From the above analysis, in the upcoming time, opportunities from Industrial Revolution 4.0 will only really bring about sustainable development for Vietnamese commercial banks from the efforts of commercial banks themselves to continue building the comprehensive operating system, synchronous implementation, compliance discipline in order to overcome the remaining limitations; and together with the active support from the management agency. Therefore, the authors propose some specific recommendations as follows: 3.2.1. For commercial banks Firstly, financial autonomy should be encouraged in order to promote the independence of commercial banking operations. This is considered a prerequisite because like other enterprises in the market economy, commercial banks must be fully responsible for business results and financial activities within the framework of the 541 law for the aim of sustainable development. Financial and business autonomy will allow commercial banks to enact their independent creativity and push their capacity beyond the challenges they face without relying on the State’s support. In addition, financial autonomy is meaningful for the implementation of the capital growth policy and financial capacity of each commercial bank, while also ensuring the operating capacity, increasing transparency in business operations, demonstrating consistency with the requirements of socio-economic development, legal rights and effectiveness in the context of the Industrial Revolution 4.0. Transparency in the operation of commercial banks means that commercial banks must report to the State Bank and publicly disclose their financial data on business activities to the whole market economy. Besides, commercial banks must publicize their numbers on the mass media. In other words, information transparency will help commercial banks clarify their activities with consumers in accordance with compliance to the law and help raise responsibility of commercial banks. As the matter of fact, management agency will be able to supervise and ensure the smooth operation of commercial banks towards safety and sustainable development. Secondly, to strengthen financial capacity and promote compliance with safety standards in banking operations. To ensure that commercial banks are able to meet the need to expand and develop their business in a safe way and in line with international standards and the Basel Committee, all commercial banks are first required to maintain equity capital at appropriate level to total assets so that a minimum capital adequacy ratio of does not exceed over 12%, overdue debt ratio of less than 3% and meeting other Basel II and Basel III standards. It can be seen that the strengthening of financial capacity is not only reflected by the increase in charter capital, especially the increase of charter capital in accordance with regulations of the SBV, because at the time of meeting the requirements of the SBV, the commercial banks can ensure the safety and adequacy of capital. However, if commercial banks increase their business scale later (increasing scale of mobilization and lending), the safety situation will be broken again.Therefore; the increase of banks’ financial resources must be maintained regularly. The commercial banks must consolidate and develop sustainably in order to regain the public's trust by attracting all sources of 542 capital in the form of non-financial assets, cash, gold and foreign currencyfrom the residences. Based on that, the financial capacity of commercial banks will be improved, which will be an opportunity to increase investment, modern equipment and technology in line with the new organizational model and operating mechanism in order to compete with foreign banks in the region and globally. Thirdly, to diversify business activities and enhance the ability to penetrate deeply into the economy. Commercial banks need to diversify their business to penetrate the economy by developing and perfecting their products, approaches to customers, consolidating their distribution channels to provide customers with products and services that are effective and ensuring the sustainable development of the banks; enhance the provision of utility banking services to increase fee incomes and to reduce risk; apply the development of information technology and e-commerce to provide modern and convenient services such as telephone banking, internet banking, home banking services, etc. Fourthly, to further enhance the capacity of leadership and management. Commercial banks need to restructure operations from headquarters to branches according to some models of other modern commercial banks; to expand agent relationships, businesses cooperation, product development, application and technology transfer with foreign financial institutions; to expand the scale of business associated with strengthening the capacity of self-inspection, risk management, ensuring safety and business efficiency; to ensure that internal auditors, internal control systems operating independently and professionally; to develop management systems in accordance with international standards and practices of commercial banks; gradually overcome the shortcomings in the operations due to inadequate qualified staff and deep trainings. Currently, not many banking managers of all levels in Vietnam are trained in basic management and management for commercial banks, thus, few commercial banks have business action plans and medium-term to long-term developing strategies. More often, every commercial bank simply has a slogan or business philosophy. Therefore, the management of commercial banks should be prioritized in the direction of standardization and individuals take responsibility for the results of business 543 operations. Leadership and management must be professionalized, have the level of both basic management and management for commercial banks; have expertise and practical experience. In parallel with the development of management and human resources, commercial banks need to build a business strategy to identify the market segments, customers and products for those target markets. Based on that, policies on mobilization, lending, investments, reserves and risk management should be formulated to ensure business efficiency and the safety of commercial banks. Fifthly, to take more positive actions in technology modernization. International integration and competition in the context of Industrial Revolution 4.0 is an indispensable trend, forcing commercial banks to be developed in a compatible manner in order to not only compete in the country but also compete with global financial intermediaries. The investment in technology modernization should ensure the ability for Vietnamese commercial banks to connect and be compatible with the banking system of countries in the region and the world. To do so, first of all commercial banks need to develop investment projects for technology development; enlist the help of the State Bank of Vietnam and international organizations such as the World Bank to implement investment projects and modernize technology according to international standards. Next, each commercial bank needs to develop a development strategy, identify the target market, constantly improve the quality of products and services and distribution channels. Sixthly, continue to develop quality human resources with professionalism, compliance and business ethics. Educational levels of Vietnamese banking staff (bachelor's degree, master's degree, PhD / total human resources) may be higher than any commercial banks staff in the world. However, comparing with labor productivity, professionalism, sense of compliance, etc., Vietnamese commercial banks need to strive to further improve the capacity of the staff. It is time for the commercial banks to seriously consider the international standards and recruitment as well as trainings to develop quality human resources with professionalism and business ethics; prioritize training, equipping soft skills for bank staff to enhance professionalism, compliance capacity and professional sense. 544 3.2.2. For the State Bank of Vietnam Industrial Revolution 4.0 will continue to fabricate rapid changes in business operations of the commercial banks, so the State Bank of Vietnam should further strengthen the management of the operation of commercial banking system according to international standards and codes of conducts to ensure safety and efficiency in replacement of incidental and rigid management. This is very important because the direction and leadership of SBV will determine the concrete actions of commercial banks in the right course and towards sustainable development. Moreover, in order to timely prevent systemic risks and other potential risks, the State Bank of Vietnam should ensure effective supervision, increase management role through the legal system of banking operations and to strictly handle violations of commercial banks. Furthermore, the SBV should regularly review and finalize legal documents to limit the inconsistency, duplication and to comply with international standards, yet still be applicable in the context of Vietnam's situation. This is to strengthen the law enforcement as well as ensure the compliance of commercial banks. 4. Conclusions In the context of international economic integration, the effects from the Industrial Revolution 4.0 are becoming more powerful. The Vietnamese banking system has been receiving many opportunities but also facing a number of challenges in the development process. The demands for innovation and the direction of international practice therefore becomes more specially concerned. In order to achieve business efficiency, to ensure sustainable development, to move banking activities forwards on a regional and global levels, Vietnamese commercial banks must strive for special efforts, alongside with supports from thegovernment and regulators so that the banking system meets its objectives. References 1. IMF Report on Vietnam's Economy (2014-2017). 2. Scheme (2012), Project on restructure of credit institutions in the period 2011 - 2015, according to Decision No. 254 / QD-TTg dated March 1, 2012. 545 3. Vietnamese Commercial Banks (2014-2017), Annual Report. 4. https://www.sbv.gov.vn 5.https://www.nfsc.gov.vn 6. https://www.chinhphu.vn 7. https://www.gso.gov.vn 546

File đính kèm:

industrial_revolution_4_0_developing_opportunities_for_vietn.pdf

industrial_revolution_4_0_developing_opportunities_for_vietn.pdf