Impact of liquidity transformation to Vietnamese commercial banks adequacy ratio

The purpose of this research is to findout the impact of liquidity

transformation on capital adequacy ratio (CAR) of Vietnamese commercial banks.

By using Generalized Least Square regression model for 16 Vietnamese banks

in the period 2012-2020 with dependent variable ‘capital adequacy ratio CAR’,

independent variable ‘lag liquidity transformation LTG t-1’ and some additional

control variables (namely: the lag capital adequacy ratio CARt-1, return on equity

ROE, credit risk CRSK, gross domestic product GDP, inflation rate INFL), this

study finds that liquidity transformation (LTGt-1) has negative effect on capital

adequacy ratio (CAR), while the variables lag capital adequacy ratio (CARt-1) and

credit risk (CRSK) are positively related to CAR, while, ROE, GDP and INFL have

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Impact of liquidity transformation to Vietnamese commercial banks adequacy ratio

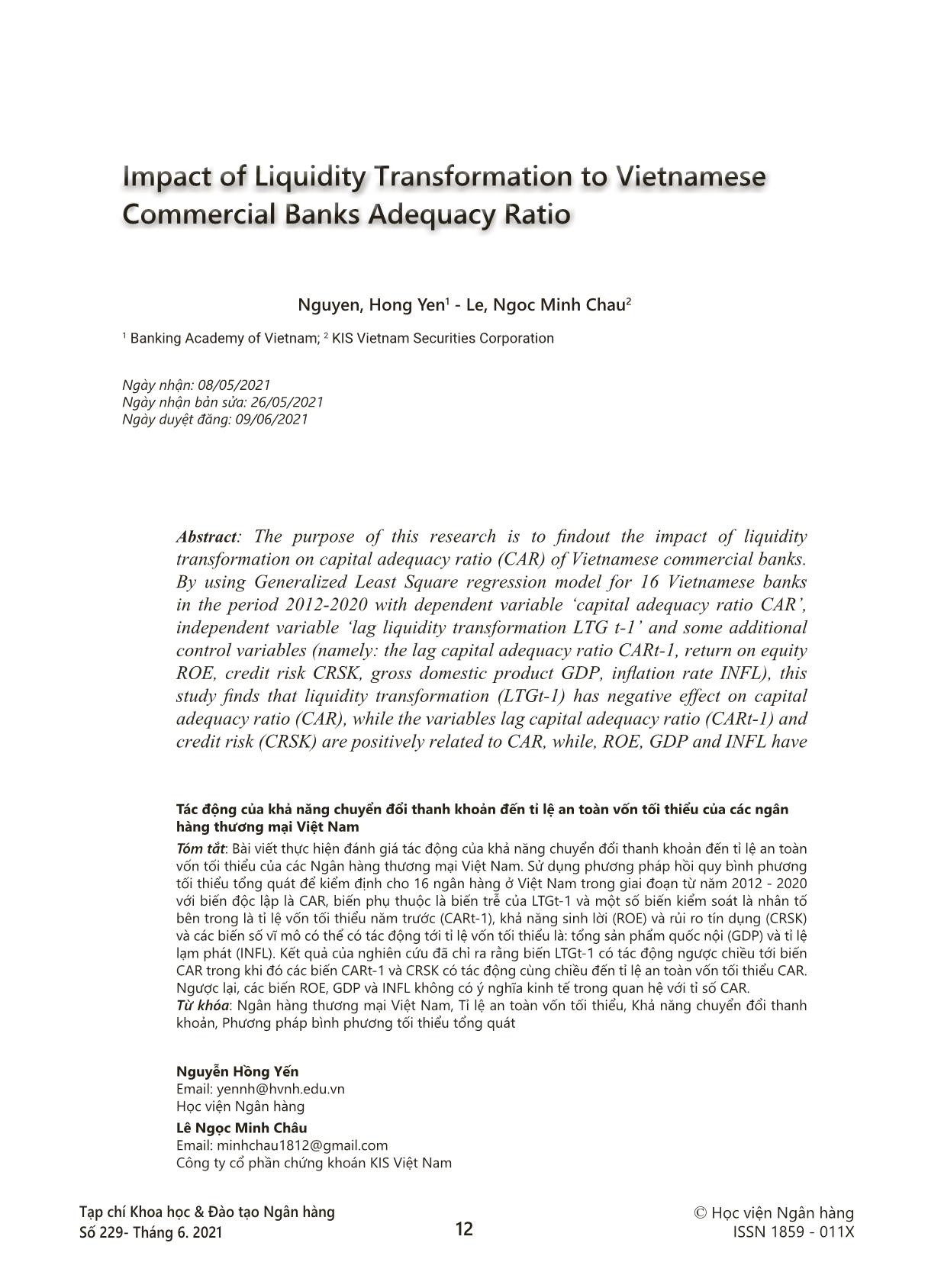

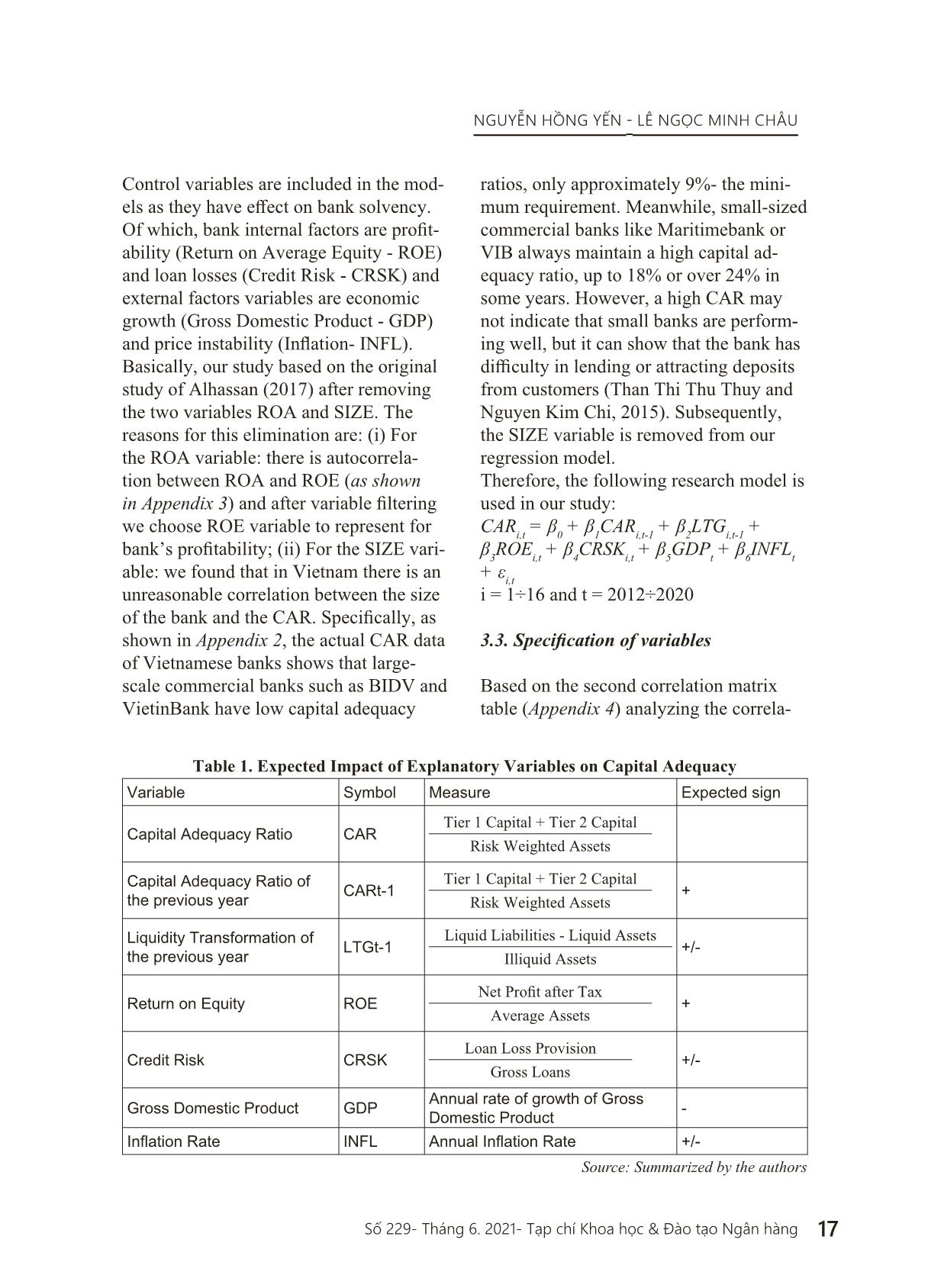

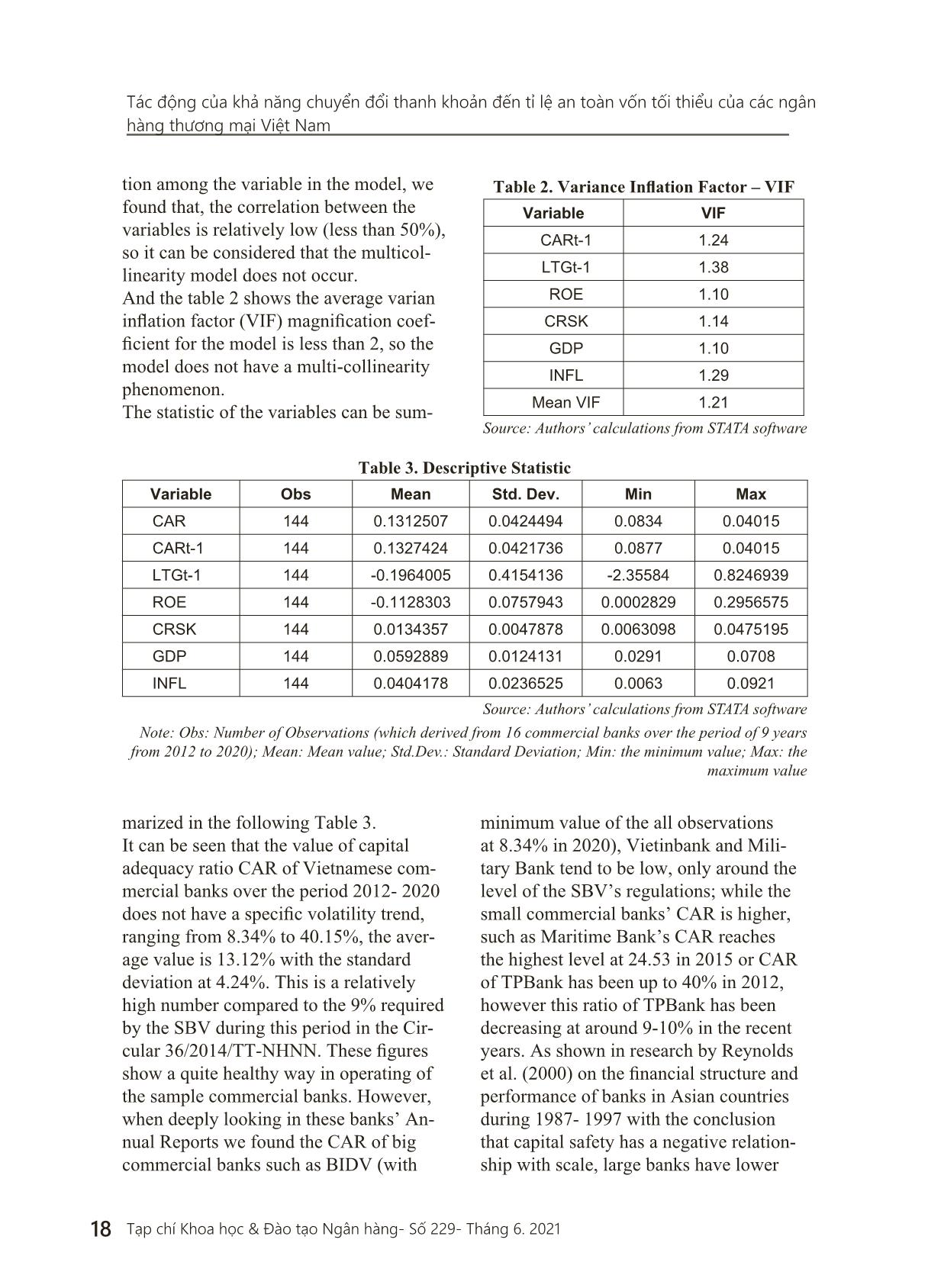

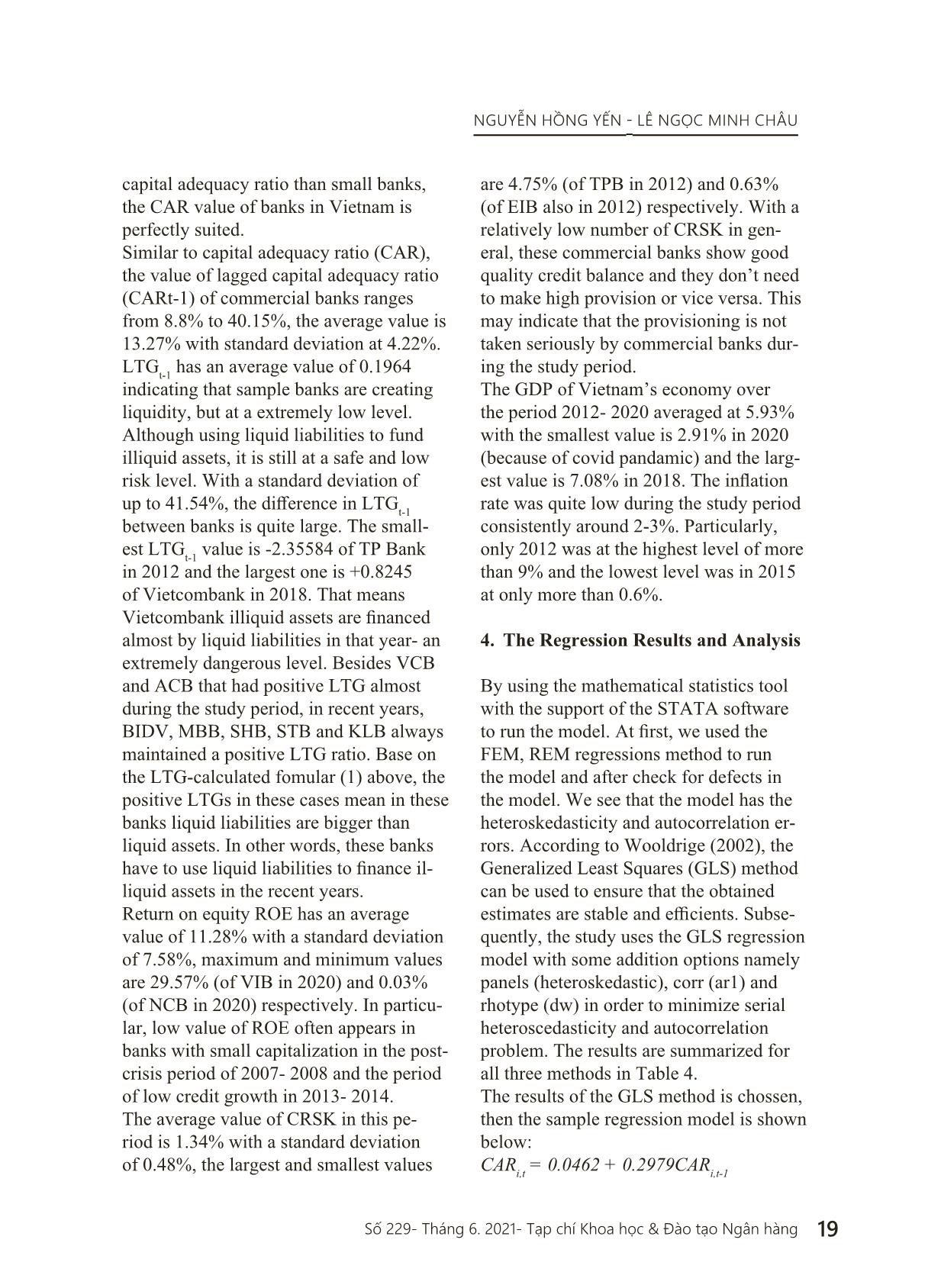

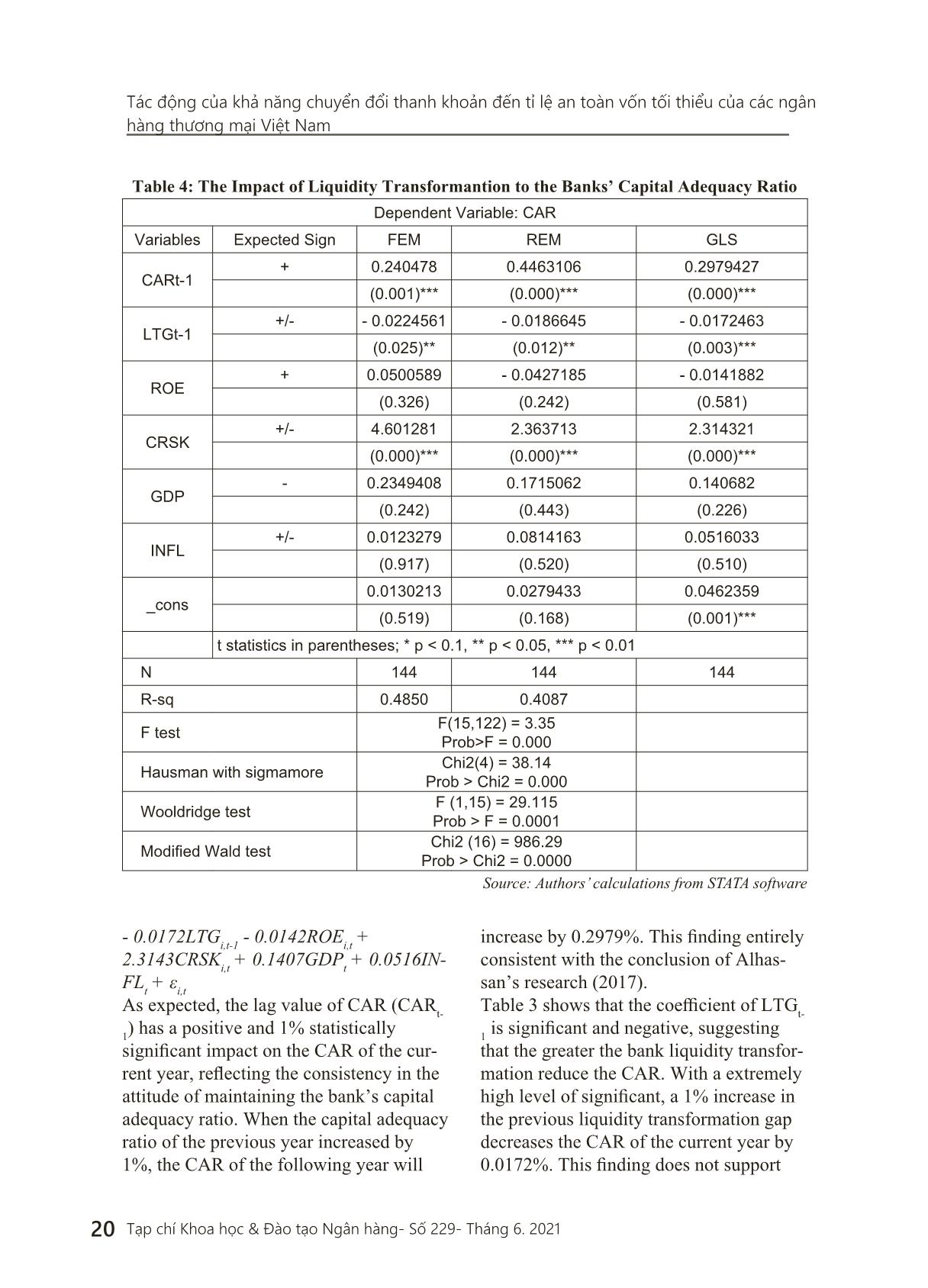

12 Tạp chí Khoa học & Đào tạo Ngân hàng Số 229- Tháng 6. 2021 © Học viện Ngân hàng ISSN 1859 - 011X Impact of Liquidity Transformation to Vietnamese Commercial Banks Adequacy Ratio Nguyen, Hong Yen1 - Le, Ngoc Minh Chau2 1 Banking Academy of Vietnam; 2 KIS Vietnam Securities Corporation Ngày nhận: 08/05/2021 Ngày nhận bản sửa: 26/05/2021 Ngày duyệt đăng: 09/06/2021 Abstract: The purpose of this research is to findout the impact of liquidity transformation on capital adequacy ratio (CAR) of Vietnamese commercial banks. By using Generalized Least Square regression model for 16 Vietnamese banks in the period 2012-2020 with dependent variable ‘capital adequacy ratio CAR’, independent variable ‘lag liquidity transformation LTG t-1’ and some additional control variables (namely: the lag capital adequacy ratio CARt-1, return on equity ROE, credit risk CRSK, gross domestic product GDP, inflation rate INFL), this study finds that liquidity transformation (LTGt-1) has negative effect on capital adequacy ratio (CAR), while the variables lag capital adequacy ratio (CARt-1) and credit risk (CRSK) are positively related to CAR, while, ROE, GDP and INFL have Tác động của khả năng chuyển đổi thanh khoản đến tỉ lệ an toàn vốn tối thiểu của các ngân hàng thương mại Việt Nam Tóm tắt: Bài viết thực hiện đánh giá tác động của khả năng chuyển đổi thanh khoản đến tỉ lệ an toàn vốn tối thiểu của các Ngân hàng thương mại Việt Nam. Sử dụng phương pháp hồi quy bình phương tối thiểu tổng quát để kiểm định cho 16 ngân hàng ở Việt Nam trong giai đoạn từ năm 2012 - 2020 với biến độc lập là CAR, biến phụ thuộc là biến trễ của LTGt-1 và một số biến kiểm soát là nhân tố bên trong là tỉ lệ vốn tối thiểu năm trước (CARt-1), khả năng sinh lời (ROE) và rủi ro tín dụng (CRSK) và các biến số vĩ mô có thể có tác động tới tỉ lệ vốn tối thiểu là: tổng sản phẩm quốc nội (GDP) và tỉ lệ lạm phát (INFL). Kết quả của nghiên cứu đã chỉ ra rằng biến LTGt-1 có tác động ngược chiều tới biến CAR trong khi đó các biến CARt-1 và CRSK có tác động cùng chiều đến tỉ lệ an toàn vốn tối thiểu CAR. Ngược lại, các biến ROE, GDP và INFL không có ý nghĩa kinh tế trong quan hệ với tỉ số CAR. Từ khóa: Ngân hàng thương mại Việt Nam, Tỉ lệ an toàn vốn tối thiểu, Khả năng chuyển đổi thanh khoản, Phương pháp bình phương tối thiểu tổng quát Nguyễn Hồng Yến Email: yennh@hvnh.edu.vn Học viện Ngân hàng Lê Ngọc Minh Châu Email: minhchau1812@gmail.com Công ty cổ phần chứng khoán KIS Việt Nam NGUYỄN HỒNG YẾN - LÊ NGỌC MINH CHÂU 13Số 229- Tháng 6. 2021- Tạp chí Khoa học & Đào tạo Ngân hàng insignificant effect on CAR. Keywords: Capital adequacy ratio, Liquidity transformation, generalized Least Square, Vietnam 1. Introduction The modern theory of financial interme- diation suggest that banks perform two basic functions: risk transitions and li- quidity transitions (Berger & Bouwman, 2009). It is evident that to fulfill these two transformational roles, maintaining capital adequacy is always extremely important for banks, hence why much concern is be- ing expressed in the relationship between these two transition fuctions and bank’s capital. However, the relationship between bank captital and bank risk-taking has been mentioned in many studies, there is not much attention paid to the liquidity transformation - the use of highly liquid sources to finance low-liquidity bank assets. People often approach bank liquid- ity from the perspective of liquidity risk management, but the empirical studies on liquidity transformation are quite rare (Horvath, Seidler & Weill 2012). So far, the studies on the two issues CAR and liquidity are quite detached. The relation- ship between liquidity transformation and CAR is not interested in researches (Novokmet & Marinovic, 2016). Alhassan (2017) is the only one which studied the effect of liquidity convertibility on CAR of 20 banks in Ghana. This study con- cludes that the liquidity of banks in Ghana is positively correlated with CAR. In Vietnam, the implementation of the Basel II Capital Agreement in particular as well as compliance with the capital ade- quacy ratio (CAR) for commercial banks in general is extremely urgent. Studies on the factors affecting the minimum capital ade- quacy ratio of commercial banks have been conducted by many authors from different angles. In which, there are only two studies on factors affecting capital adequacy from a liquidity perspective, which are the studies of Vu Huu Thanh et al. (2016) and Le Tu (2018). Both of these studies talk about the correlation between liquidity conversion and bank capital, not about CAR. These two studies conclude that liquidity conver- sion and bank capital are negatively related. Up to date, in Vietnam, there has been no research on the impact of liquidity transfor- mation on the CAR of banks. With these research gaps, in ord ... e banks for the earlier period of time. While the effect found by Le Tu (2018) is quite high, our finding is more consistent with Vu Huu Thanh (2016) of relatively small effect. This negative effect confirm the Financial Fragility-Crowding Out Hypothesis is ap- propriate in Vietnam. Accordingly, with the underdeveloped capital market in Viet- nam, both Vietnamese banks and enter- prises find it difficult to raise fund through this market. On the one hand, with only a handful of investment chanels, people tend to deposit their idle money into bank. And banks, of course, have better access to de- posit facilities while have lower ability to access capital markets. On the other hand, enterprises have to raise fund by borrow- ing more money with a longer term at the bank, making the risk-weighted assets of the bank increase. Both of these trends cause CAR (the ratio of bank’s capital over risk-weighted assets) to decline. The Nextremely high and positve coef- ficient of CRSK (+2.3143) with p-value< 1% represents a significant effect on CAR. This finding is perfectly consistent when facing bigger risk banks have to keep higher capital adequacy ratios because they are required to set aside more capital as a buffer against losses. This conclu- sion is consistent with the research results of Mili et al (2014), Masood and Ansari (2016) on the banking system at Pakistan and Alhassan’s research (2017) on the Ghana banks. However, the conclusion is different from the results of empirical evidence of banks in Jordan (Al-Sabbagh, 2004) and research of Le Thanh Tam et al. (2017) on the determinants of capital adequacy ratios of 26 Vietnamese com- mercial banks in the period of 2009- 2015. The variables Gross Domestic Product (GDP), Return on Equity (ROE) and Infla- tion rate (INFL) have statistically non- significant effect on CAR at all (as shown in Table 4). 5. Conclusion and Recommendation The authors successfully completed the goals of the research, which is empirical study impact of liquidity transformation on the Capital Adequacy Ratio (CAR) of the bank and it showed that the impact is inversely proportional in Vietnam. This impact clearly showed that liquidity trans- formation is a signal to show in which di- rection the CAR is developing in. Because of this, it is one of the most important statistic for banks to follow in managing their business in general and in control- ling capital adequacy ratio to be specific. Based on the results of the research, the authors came up with some following recommendations: 5.1. Recommendations for commercial banks Banks need to build a large database in order to accurately identify their liquid- ity convertibility (represented by liquid- ity transformation gap) to manage their capital adequacy ratio. As explained in the research, liquidity transformation gap is calculated by determining the actual du- ration of bank assets and liabilities. This determination is in fact based not only on the terms of assets and liabilities but also on the behavior of the customer which must be based on a big database to help the bank clearly identify. Based on the big database, banks can identify the factors affecting customer behavior in early deposit with- drawal or early loan repayment. There for, Tác động của khả năng chuyển đổi thanh khoản đến tỉ lệ an toàn vốn tối thiểu của các ngân hàng thương mại Việt Nam 22 Tạp chí Khoa học & Đào tạo Ngân hàng- Số 229- Tháng 6. 2021 building the database system is a problem that banks should put an eye on, especially in the Fourth Industrial Revolution. Reduce the amount of liquidity created. The result of the research show that bank’s liquidity transformation gap has an inverse impact on capital adequacy ratio. There- fore, the overuse of short-term funds for medium and long-term loans will not only affect bank liquidity risk as known prior but it’ll also reduce the bank’s capital ad- equacy ratio. Because of this, banks need to reduce their liquidity transformation if they want to improve their capital ad- equacy ratio. There are two requirements in order to perform this. Firstly, increasing long term mobilized funds by creating big gap between short-term and long-term de- posit interest rates to encourage long-term deposits. Besides, banks need to increase mobilization through issuing valuable papers, which shows a more stable term compared to deposit. Secondly, bank need to use funds with duration corresponding to mobilized funds. In fact, the impact from liabilities is more difficult, since depositing in the bank is solely a cli- ent’s decision. The impact from the asset side is needed. Therefore, in addition to extending the term of mobilized capital, banks need to have strategies to develop short-term credit products or to invest in corporate bonds (when the corporate bond market has developed). Improve bank’s credit risk management capacity. Overdue debts will on one hand lengthen the actual loan maturities more than the maturity in loan contact. This will unexpectedly increase liquidity trans- formation ratio and then reduce capital adequacy ratio. On the other hand, these overdue debts are factors that increase the denominator (risk-weighted assets) leading to reduce capital adequacy ratio. Therefore, banks need to control overdue debts. 5.2. Recommendations for management agencies Management agencies need to be aware of the importance of the liquidity transforma- tion of the banking system. Supervising authorities need to see the importance of managing liquidity transfor- mation of commercial banks. From that, they need to establish a reasonable range boundary for liquidity transformation for commercial banks in order to balance between profits and risks of the banks, which will increase their capital adequacy ratio. For the liquidity transformation gap measurement used in research, authors suggest the range for liquidity transforma- tion gap to be at a range from 0.1 to 0.25 because of the fact that banks in this range had ROE at above 10% and CAR at above 9% during the study period. Therefore, if LTG is maintained at this range, the bank will not only be safe but also ensure good profitability. Besides reporting about the status of li- quidity, supervising authorities need to ask commercial banks to report about liquid- ity transformation gap by day, changes of duration of each assets and liabilities and not just focusing mainly on managing high liquid asset or non-term deposits as cur- rent rules. As mentioned above, statistics about liquidity that are being managed by supervising authorities have never been the whole chain but rather showed only in particular banks, supervising the transformed liquidity will help authorities understand the liquidity transformation of the whole banking system. This will solve liquidity problems between banks can be solve in a more connective way in the NGUYỄN HỒNG YẾN - LÊ NGỌC MINH CHÂU 23Số 229- Tháng 6. 2021- Tạp chí Khoa học & Đào tạo Ngân hàng future, instead of the disjointed solutions being used now. 5.3. Recommendations for further research Our research employs all the banks in one sample, therefore, we can not see the detail impact of liquidity transformantion to banks capital adequacy ratio in different size of banks. The researchers can expand the scope of research both in space and time and break up research space into spe- cific banking groups. Because the differ- ence in liquidity status between large and small commercial banks can be noticed, the impact of liquidity conversion on bank groups may be different or even contra- dictory according to Berger & Bouwman (2009) research on United State commer- cial banks. In addition, research on other classifica- tions of liquidity levels of assets and liabilities, and refer to the liquidity being created off-balance sheet should be con- ducted. Research on the impact of liquidity trans- formation on each factor that calculates capital adequacy ratio CAR including equity and risky assets will help to clarify the extent and direction of the impact of li- quidity transformation to each component of CAR, thereby more detailed policies can be recommended. ■ References Ahmad, R., Ariff, M. & Skully, M. (2008), ‘The Determinants of Bank Capital Ratios in a Developing Economy’, Asia- Pacific Finan Markets, 15. pp. 255–272. Aktas, R., Acikalin S., Bakin B., Celik G., 2015, ‘The Determinants of Banks’ Capital Adequacy Ratio: Some Evidence from South Eastern European Countries’, Journal of Economics and Behavioral Studies, Vol. 7, No. 1, p. 79-88. Al-Sabbagh, N. (2004). Determinants of Capital Adequacy Ratio in Jordanian Banks. Master thesis. Yarmouk University. Irbid, Jordan. Alhassan A. S., 2017, ‘Capital adequacy of banks in Ghana: Does liquidity transformation matter?’, Thesis, University of Ghana. Bateni L., Vakilifard H. & Asghari F., 2014, ‘The Influential Factors on Capital Adequacy Ratio in Iranian Banks’, International Journal of Economics and Finance, Vol. 6, No. 11; 2014 Berger, A. N. & Bouwman, C. H., 2009, ‘Bank liquidity creation’, Review of Financial Studies, No. 22(9), pp. 3779- 3837. BIS, (1999) ‘Basel Committee on Banking Supervision: A new capital adequacy framework’, online, available from: https://www.bis.org/publ/bcbs50.pdf (Accessed 12 March 2017), [online]. Available from: https://www.bis.org/ publ/bcbs50.pdf (Accessed 12 March 2017). Bhattacharya, S., & Thakor, A. V. (1993). Contemporary Banking Theory. Journal of Financial Intermediation, 3(1), 2-50. Coval & Thakor, 2005, Financial intermediation as a beliefs-bridge between optimists and pessimists, Journal of Financial Economics 75(3):535-569 Deep, A., & Schaefer, G. (2004), Are Banks Liquidity Transformers? Harvard University, John F. Kennedy School of Government. Diamond D. W., 2007, ‘Banks and liquidity creation: a simple exposition of the Diamond-Dybvig model’, FRB Richmond Economic Quarterly, Vol.93(2), pp. 189-200. FiinPro, Horvath, R., Seidler, J., & Weill, L. (2012). Bank Capital and Liquidity Creation. Social Science Research Network. Le Thanh Tam and Nguyen Dieu Linh, 2017, “Cac yeu to quyet dinh toi ty le an toan von cua ngan hang: bang chung thuc nghiem tu Viet Nam” (Factors affect bank’s capital adequacy ratio: an empirical study in Vietnam), NEU publisher, Hanoi, pp. 84-107. Le Tu (2018), The interrelationship between liquidity creation and bank capital in Vietnamese banking, Managerial Finance, Vol. 45 Issue: 2, pp.331-347 Masood, U., & Ansari, S. (2016), ‘Determinants of Capital Adequacy Ratio - A Perspective from Pakistani Banking Sector’, International Journal of Economics, Commerce and Management, 4(17), 247-273. Tác động của khả năng chuyển đổi thanh khoản đến tỉ lệ an toàn vốn tối thiểu của các ngân hàng thương mại Việt Nam 24 Tạp chí Khoa học & Đào tạo Ngân hàng- Số 229- Tháng 6. 2021 APPENDICES Mili, M., Sahut, J. M., & Trimeche, H. (2014), Determinants of the Capital Adequacy Ratio of a Foreign Bank’s Subsidiaries: The Role of the Interbank Market and Regulation of Multinational Banks (No. 2014-366). Novokmet & Marinović, 2016, Solvency and Liquidity Level Trade-off: Does it Exist in Croatian Banking Sector?, Scientific Annals of Economics and Business 63(3):429-440 Repullo, R. (2004). Capital Requirements, Market Power, and Risk-taking in Banking. Journal of Financial Intermediation, 13(2), 156-182. Than Thi Thu Thuy and Nguyen Kim Chi, 2015, ‘Nghien cuu cac yeu to anh huong den he so an toan von tai cac NHTM CP Viet Nam’ (Studying factors affect capital adequacy ratio of Vietnamese joint stock commercial banks), Banking Review, No. 11 June, 2015. The State Bank of Vietnam (2014). Circular No. 36/2014/TT-NHNN dated November 20, 2014 on stipulating minimum safety limits & ratios for transactions performed by credit institutions & branches of foreign banks [online]. Available from: (Accessed 1 March 2017). The World Bank, Data/Vietnam, https://data.worldbank.org/country/vietnam?view=chart Tran, V. T., Lin, C. T., & Nguyen, H. (2016), ‘Liquidity Creation, Regulatory Capital, and Bank Profitability’, International Review of Financial Analysis, 48, pp. 98-109. Von Thadden, E. L. (2004), ‘Bank Capital Adequacy Regulation under the New Basel Accord’, Journal of Financial Intermediation, 13(2), pp. 90-95. Vu Hung Phuong and Dang Ngoc Duc (2020), Determinants influencing capital adequacy ratio of Vietnamese commercial banks, Accounting, 6 (2020), p. 871–878 Vu Huu Thanh et. al, 2016, ‘Von ngan hang, su tao thanh khoan va hieu qua cua ngan hang’ (Bank capital, liquidity creation and bank efficiency), Science Magazine, Open University of Ho Chi Minh City, No. 4(49)2016. Wooldridge, J. (2002), Econometric Analysis of Cross Section and Panel Data, MIT Press. Yuanjuan, L. &Shishun, X., 2012, ‘Effectiveness of China’s Commercial Banks’ Capital Adequacy Ratio Regulation, A Case Study of The Listed Banks’, Inter disciplinary Journal of Contemporary research in busines, 4 (1) p. ijcrb. webs.com. Appendix 1. List of Sample Banks Acronyms Name of Banks 1 ACB Asia Commercial Joint Stock Bank 2 BID JSC Bank for Investment and Development of Vietnam 3 CTG Vietnam Joint Stock Commercial Bank for Industry and Trade 4 EIB Vietnam Joint Stock Commercial Export Import Bank 5 HDB Ho Chi Minh City Housing Development Bank 6 KLB Kien Long Commercial Joint Stock Bank 7 MBB Military Commercial Joint Stock Bank 8 MSB Vietnam Maritime Joint – Stock Commercial Bank 9 NCB National Citizen Commercial Joint Stock Bank 10 SHB Saigon – Hanoi Commercial Joint Stock Bank 11 STB Sai Gon Thuong Tin Commercial Joint Stock Bank 12 TCB Viet Nam Technological and Commercial Joint Stock Bank 13 TPB Tien Phong Commercial Joint Stock Bank 14 VCB JSC Bank for Foreign Trade of Vietnam 15 VIB Vietnam International and Commercial Joint Stock Bank 16 VPB Vietnam Prosperity Joint Stock Commercial Bank Source: Summarized by the authors NGUYỄN HỒNG YẾN - LÊ NGỌC MINH CHÂU 25Số 229- Tháng 6. 2021- Tạp chí Khoa học & Đào tạo Ngân hàng Appendix 2. Reclassified Assets and Liabilities Liquidity Catagories Tác động của khả năng chuyển đổi thanh khoản đến tỉ lệ an toàn vốn tối thiểu của các ngân hàng thương mại Việt Nam 26 Tạp chí Khoa học & Đào tạo Ngân hàng- Số 229- Tháng 6. 2021 Source: Reclassified by the authors Appendix 3: The first correlation matrix between variables Source: Authors’ canculations from Stata software Appendix 4: The second correlation matrix between variables Source: Authors’ canculations from Stata software

File đính kèm:

impact_of_liquidity_transformation_to_vietnamese_commercial.pdf

impact_of_liquidity_transformation_to_vietnamese_commercial.pdf