Evaluating the group lending development at the Viet Nam bank for agriculture and rural development: A case study in Bac Giang branch ii

Group-based lending is a form of loan provision for individuals and

households in rural areas for production and consumption purposes.

Proceeding from the imbalance between demand and supply on

small-scale capital, and also Government policies on sustainable

poverty reduction, the Vietnam Bank for Agriculture and Rural

Development (Agribank) has coordinated with its local authorities

and socio-political organizations to provide loan services via group

lending. The purpose of this paper was to evaluate the status of group

lending development of the Agribank-Bac Giang Branch II. The

paper used secondary data collected from the branch and primary data

gathered from 50 representative customers and 10 credit officers

related the group lending of the branch. Data analysis methods

consisted of descriptive statistics and comparative analysis,

incorporated with the measurements for bank performance and

quality. The findings show positive prospects in both the bank and

customers for the development of group lending activity and

obstacles in the group lending development of the branch. The paper

also proposes some solutions for the branch to tackle difficulties and

promote the development of group lending in the branch in Bac

Giang province.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: Evaluating the group lending development at the Viet Nam bank for agriculture and rural development: A case study in Bac Giang branch ii

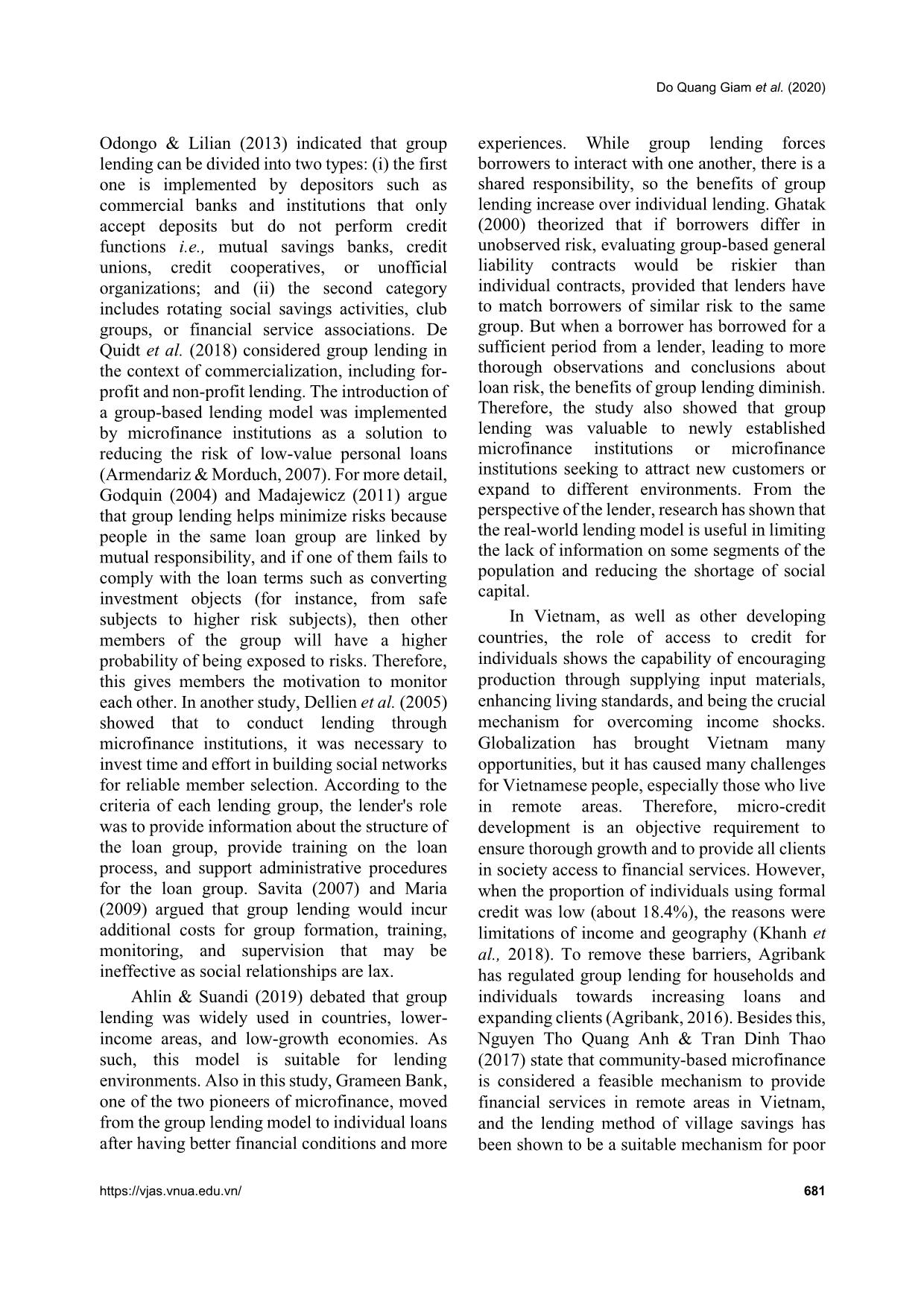

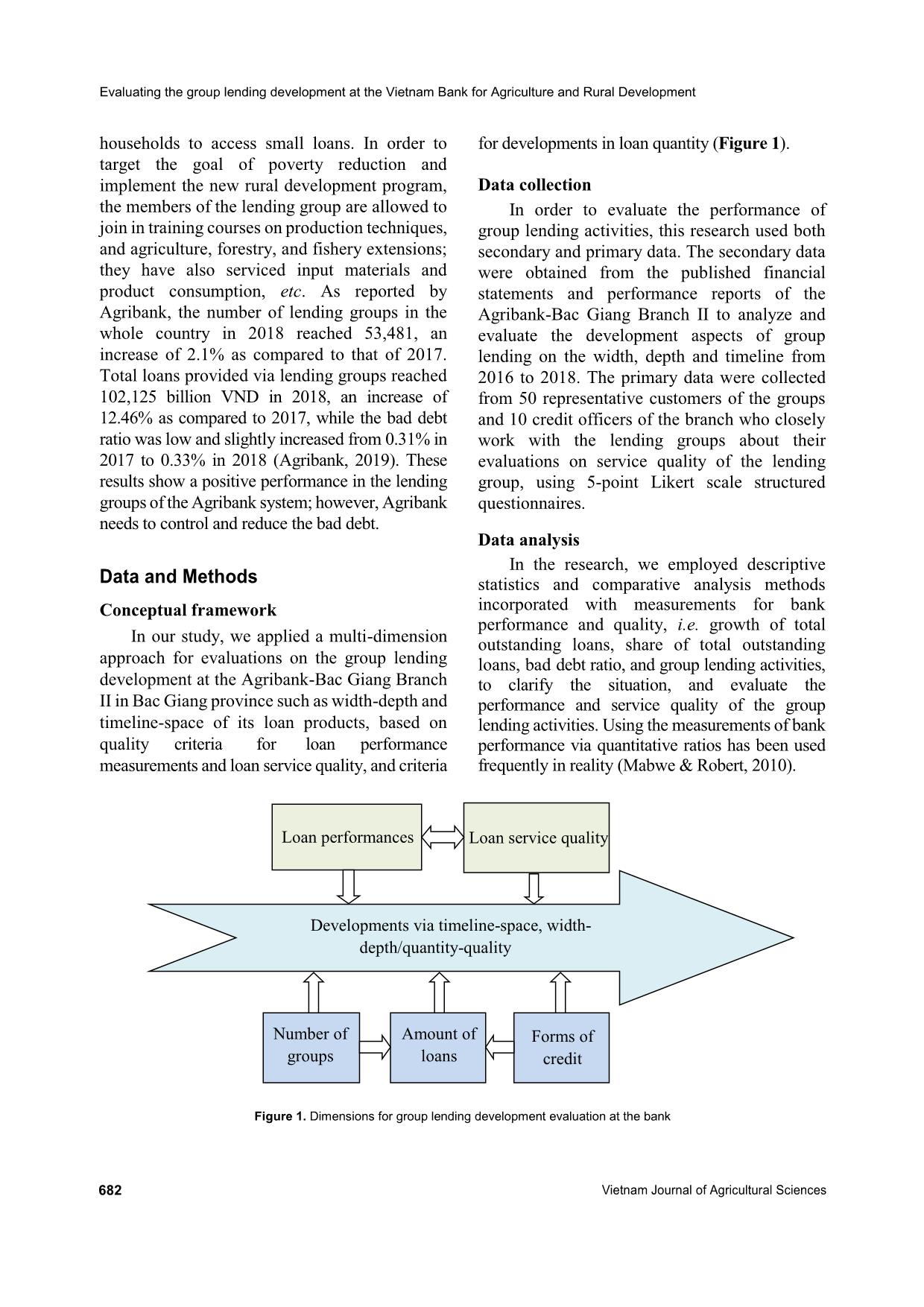

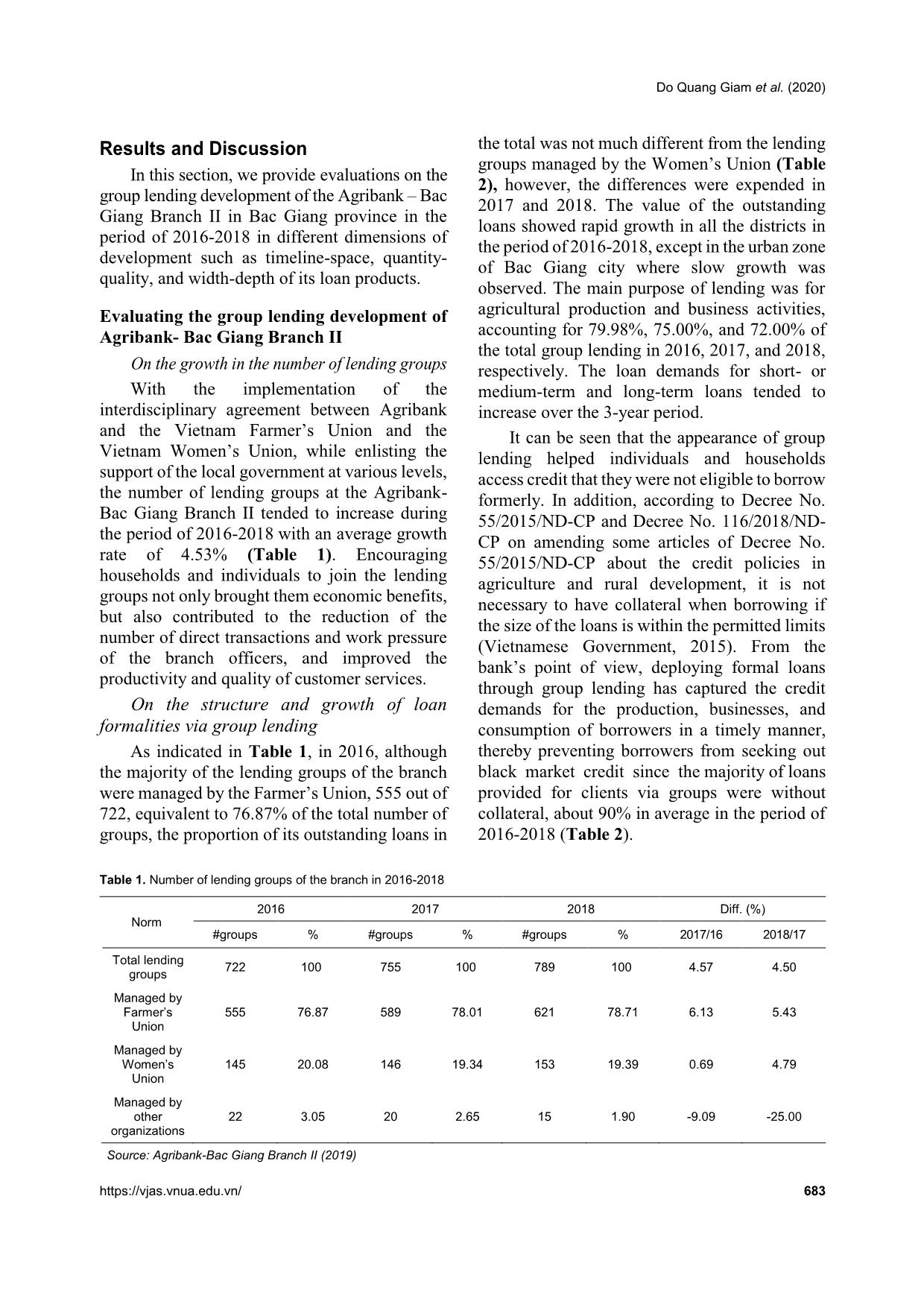

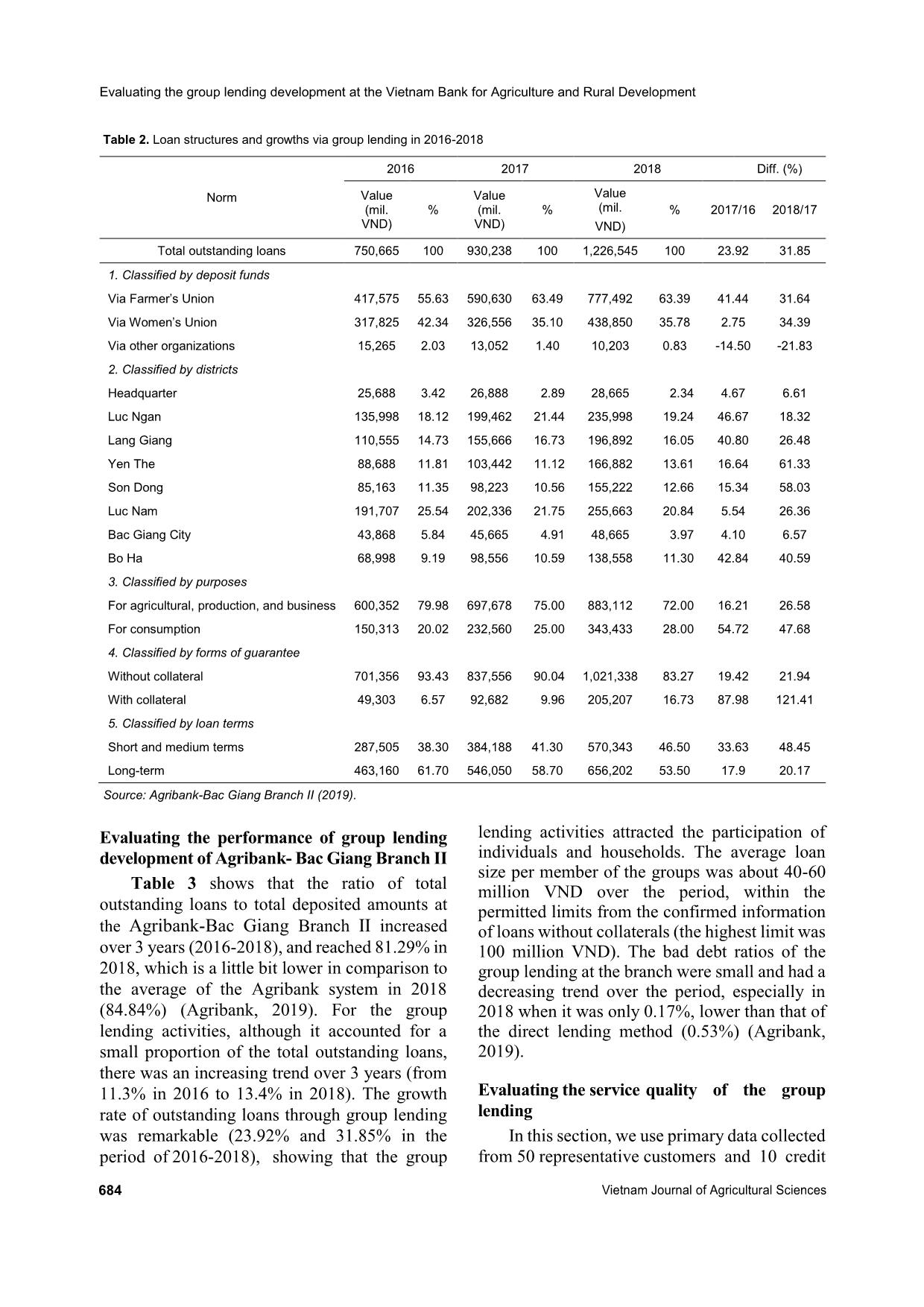

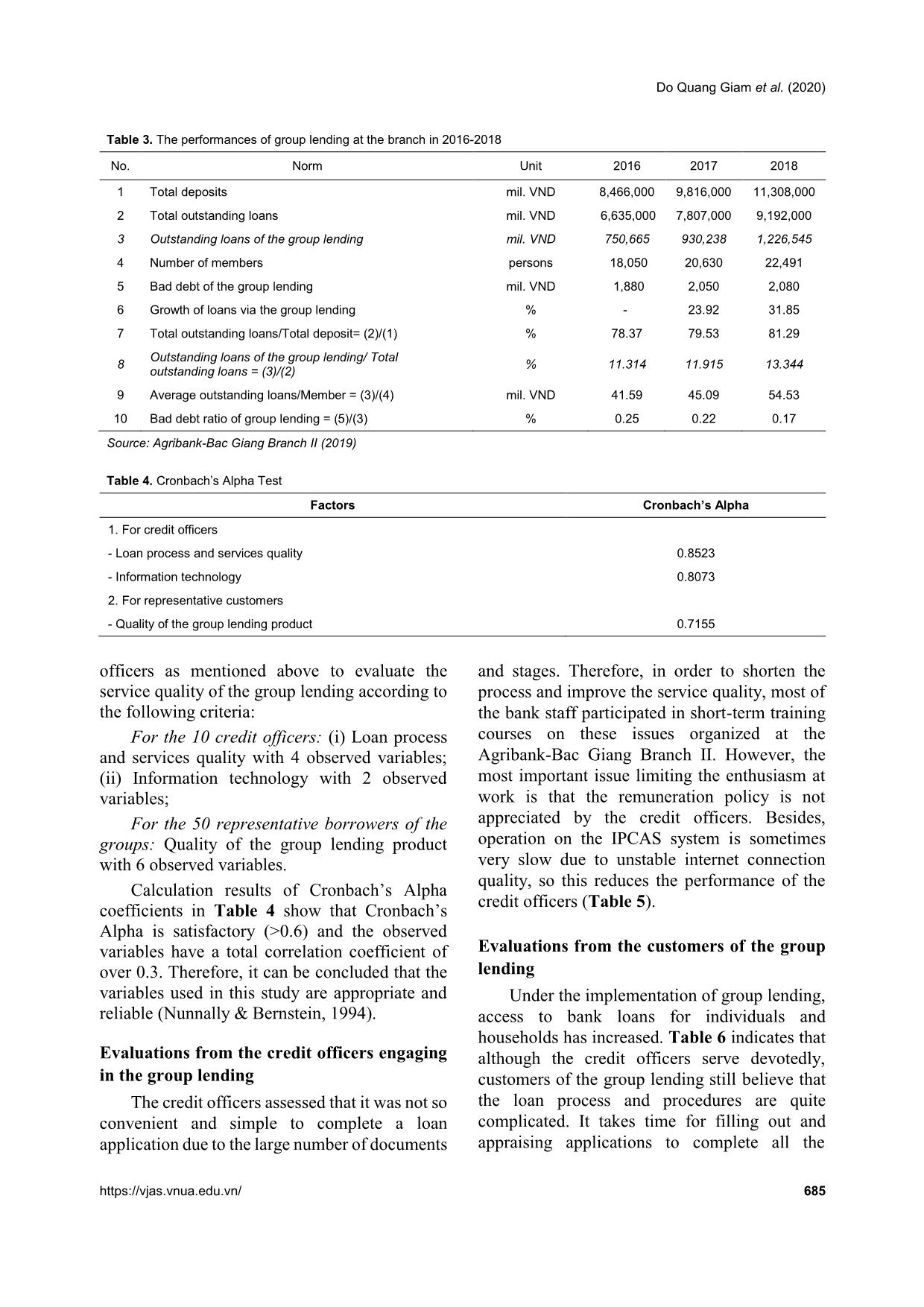

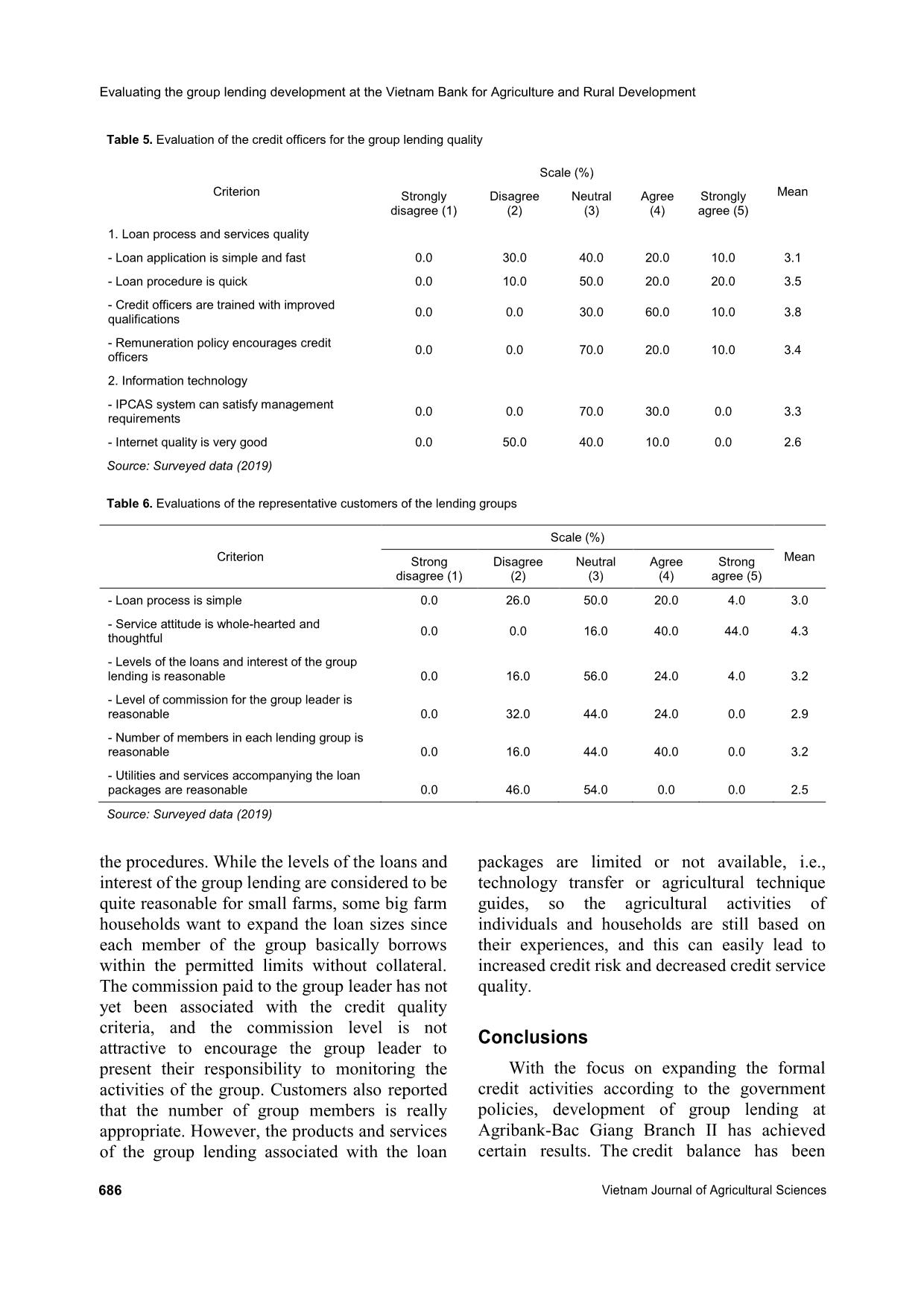

Vietnam Journal of Agricultural Sciences ISSN 2588-1299 VJAS 2020; 3(3): 679-688 https://doi.org/10.31817/vjas.2020.3.3.02 https://vjas.vnua.edu.vn/ 679 Received: June 1, 2020 Accepted: November 10, 2020 Correspondence to dqgiam@vnua.edu.vn Evaluating the Group Lending Development at the Vietnam Bank for Agriculture and Rural Development: A Case Study in Bac Giang Branch II Do Quang Giam1, Dao Thi Hoang Anh1, Vu Ngoc Huyen1, Lai Phuong Thao1, Dao Huu Bao2 & Do Thi Minh Van3 1Institute Faculty of Accounting and Business Management, Vietnam National University of Agriculture 2The Vietnam Bank for Agriculture and Rural Development-Bac Giang Branch II 3Master student, University of Paris Dauphine & ESCP Europe Abstract Group-based lending is a form of loan provision for individuals and households in rural areas for production and consumption purposes. Proceeding from the imbalance between demand and supply on small-scale capital, and also Government policies on sustainable poverty reduction, the Vietnam Bank for Agriculture and Rural Development (Agribank) has coordinated with its local authorities and socio-political organizations to provide loan services via group lending. The purpose of this paper was to evaluate the status of group lending development of the Agribank-Bac Giang Branch II. The paper used secondary data collected from the branch and primary data gathered from 50 representative customers and 10 credit officers related the group lending of the branch. Data analysis methods consisted of descriptive statistics and comparative analysis, incorporated with the measurements for bank performance and quality. The findings show positive prospects in both the bank and customers for the development of group lending activity and obstacles in the group lending development of the branch. The paper also proposes some solutions for the branch to tackle difficulties and promote the development of group lending in the branch in Bac Giang province. Keywords Group lending development, microfinance, microcredit, Agribank, Vietnam Introduction Microfinance has developed in many countries for decades since it first appeared and succeeded in 1976 in Bangladesh with the purpose of poverty reduction, and since then, has propagated to several Evaluating the group lending development at the Vietnam Bank for Agriculture and Rural Development 680 Vietnam Journal of Agricultural Sciences neighboring countries (Odongo & Lilian, 2013). Nowadays, it has become a useful tool for reducing poverty, enabling poorer households to build assets, increasing incomes, and decreasing a family’s vulnerability to shocks. In Vietnam, microfinance is identified as a credit service that provides low-income households and individuals with small loans without guaranteed assets to help them engage in productive activities or small start-up businesses, contributing to their enhancement of income and living conditions (Vietnamese Government, 2005). The formal system, organized from the central Government to the local levels in Vietnam, consists of the People’s Credit Funds, Vietnam Bank for Social Policies, and Agribank. The involvement of commercial banks in microfinance is extremely necessary to extend credit to meet the needs of households (Robin et al., 2002). Although the poor or low-income residents have great demand for financial services such as credit, savings, and insurance, it is very difficult for them to access credit by themselves, especially from formal credit sources, therefore, getting a loan via a lending group becomes a better solution for this problem. Realizing the importance and significance of lending groups, the President of Agribank issued regulations on lending for households and individuals through the group/mobile group in the Agribank system (Agribank, 2016). Accordingly, lending groups were voluntarily established from households and individuals living in the same settlement or unit, managed by the Vietnam Farmer’s Union, Vietnam Women’s Union, and other socio- political organizations. The strength of this model is that Agribank has cooperated with these organizations to effectively provide loans to meet the needs of households and individuals via the lending groups. Through these organizations, the borrowers are guided to plan and manage consumption, investments, and income, as well as to cope with risks. The Agribank-Bac Giang Branch II was selected for a case study since the branch is one of the biggest commercial banks in Bac Giang province. In general, clients of the branch are small farm households living in rural and mountainous areas in Bac Giang province. Currently, the branch targets lending for agricultural production and rural development to gain benefits from the lending purposes, while narrowing down lendin ... c Ngan 135,998 18.12 199,462 21.44 235,998 19.24 46.67 18.32 Lang Giang 110,555 14.73 155,666 16.73 196,892 16.05 40.80 26.48 Yen The 88,688 11.81 103,442 11.12 166,882 13.61 16.64 61.33 Son Dong 85,163 11.35 98,223 10.56 155,222 12.66 15.34 58.03 Luc Nam 191,707 25.54 202,336 21.75 255,663 20.84 5.54 26.36 Bac Giang City 43,868 5.84 45,665 4.91 48,665 3.97 4.10 6.57 Bo Ha 68,998 9.19 98,556 10.59 138,558 11.30 42.84 40.59 3. Classified by purposes For agricultural, production, and business 600,352 79.98 697,678 75.00 883,112 72.00 16.21 26.58 For consumption 150,313 20.02 232,560 25.00 343,433 28.00 54.72 47.68 4. Classified by forms of guarantee Without collateral 701,356 93.43 837,556 90.04 1,021,338 83.27 19.42 21.94 With collateral 49,303 6.57 92,682 9.96 205,207 16.73 87.98 121.41 5. Classified by loan terms Short and medium terms 287,505 38.30 384,188 41.30 570,343 46.50 33.63 48.45 Long-term 463,160 61.70 546,050 58.70 656,202 53.50 17.9 20.17 Source: Agribank-Bac Giang Branch II (2019). Evaluating the performance of group lending development of Agribank- Bac Giang Branch II Table 3 shows that the ratio of total outstanding loans to total deposited amounts at the Agribank-Bac Giang Branch II increased over 3 years (2016-2018), and reached 81.29% in 2018, which is a little bit lower in comparison to the average of the Agribank system in 2018 (84.84%) (Agribank, 2019). For the group lending activities, although it accounted for a small proportion of the total outstanding loans, there was an increasing trend over 3 years (from 11.3% in 2016 to 13.4% in 2018). The growth rate of outstanding loans through group lending was remarkable (23.92% and 31.85% in the period of 2016-2018), showing that the group lending activities attracted the participation of individuals and households. The average loan size per member of the groups was about 40-60 million VND over the period, within the permitted limits from the confirmed information of loans without collaterals (the highest limit was 100 million VND). The bad debt ratios of the group lending at the branch were small and had a decreasing trend over the period, especially in 2018 when it was only 0.17%, lower than that of the direct lending method (0.53%) (Agribank, 2019). Evaluating the service quality of the group lending In this section, we use primary data collected from 50 representative customers and 10 credit Do Quang Giam et al. (2020) https://vjas.vnua.edu.vn/ 685 Table 3. The performances of group lending at the branch in 2016-2018 No. Norm Unit 2016 2017 2018 1 Total deposits mil. VND 8,466,000 9,816,000 11,308,000 2 Total outstanding loans mil. VND 6,635,000 7,807,000 9,192,000 3 Outstanding loans of the group lending mil. VND 750,665 930,238 1,226,545 4 Number of members persons 18,050 20,630 22,491 5 Bad debt of the group lending mil. VND 1,880 2,050 2,080 6 Growth of loans via the group lending % - 23.92 31.85 7 Total outstanding loans/Total deposit= (2)/(1) % 78.37 79.53 81.29 8 Outstanding loans of the group lending/ Total outstanding loans = (3)/(2) % 11.314 11.915 13.344 9 Average outstanding loans/Member = (3)/(4) mil. VND 41.59 45.09 54.53 10 Bad debt ratio of group lending = (5)/(3) % 0.25 0.22 0.17 Source: Agribank-Bac Giang Branch II (2019) Table 4. Cronbach’s Alpha Test Factors Cronbach’s Alpha 1. For credit officers - Loan process and services quality 0.8523 - Information technology 0.8073 2. For representative customers - Quality of the group lending product 0.7155 officers as mentioned above to evaluate the service quality of the group lending according to the following criteria: For the 10 credit officers: (i) Loan process and services quality with 4 observed variables; (ii) Information technology with 2 observed variables; For the 50 representative borrowers of the groups: Quality of the group lending product with 6 observed variables. Calculation results of Cronbach’s Alpha coefficients in Table 4 show that Cronbach’s Alpha is satisfactory (>0.6) and the observed variables have a total correlation coefficient of over 0.3. Therefore, it can be concluded that the variables used in this study are appropriate and reliable (Nunnally & Bernstein, 1994). Evaluations from the credit officers engaging in the group lending The credit officers assessed that it was not so convenient and simple to complete a loan application due to the large number of documents and stages. Therefore, in order to shorten the process and improve the service quality, most of the bank staff participated in short-term training courses on these issues organized at the Agribank-Bac Giang Branch II. However, the most important issue limiting the enthusiasm at work is that the remuneration policy is not appreciated by the credit officers. Besides, operation on the IPCAS system is sometimes very slow due to unstable internet connection quality, so this reduces the performance of the credit officers (Table 5). Evaluations from the customers of the group lending Under the implementation of group lending, access to bank loans for individuals and households has increased. Table 6 indicates that although the credit officers serve devotedly, customers of the group lending still believe that the loan process and procedures are quite complicated. It takes time for filling out and appraising applications to complete all the Evaluating the group lending development at the Vietnam Bank for Agriculture and Rural Development 686 Vietnam Journal of Agricultural Sciences Table 5. Evaluation of the credit officers for the group lending quality Criterion Scale (%) Mean Strongly disagree (1) Disagree (2) Neutral (3) Agree (4) Strongly agree (5) 1. Loan process and services quality - Loan application is simple and fast 0.0 30.0 40.0 20.0 10.0 3.1 - Loan procedure is quick 0.0 10.0 50.0 20.0 20.0 3.5 - Credit officers are trained with improved qualifications 0.0 0.0 30.0 60.0 10.0 3.8 - Remuneration policy encourages credit officers 0.0 0.0 70.0 20.0 10.0 3.4 2. Information technology - IPCAS system can satisfy management requirements 0.0 0.0 70.0 30.0 0.0 3.3 - Internet quality is very good 0.0 50.0 40.0 10.0 0.0 2.6 Source: Surveyed data (2019) Table 6. Evaluations of the representative customers of the lending groups Criterion Scale (%) Mean Strong disagree (1) Disagree (2) Neutral (3) Agree (4) Strong agree (5) - Loan process is simple 0.0 26.0 50.0 20.0 4.0 3.0 - Service attitude is whole-hearted and thoughtful 0.0 0.0 16.0 40.0 44.0 4.3 - Levels of the loans and interest of the group lending is reasonable 0.0 16.0 56.0 24.0 4.0 3.2 - Level of commission for the group leader is reasonable 0.0 32.0 44.0 24.0 0.0 2.9 - Number of members in each lending group is reasonable 0.0 16.0 44.0 40.0 0.0 3.2 - Utilities and services accompanying the loan packages are reasonable 0.0 46.0 54.0 0.0 0.0 2.5 Source: Surveyed data (2019) the procedures. While the levels of the loans and interest of the group lending are considered to be quite reasonable for small farms, some big farm households want to expand the loan sizes since each member of the group basically borrows within the permitted limits without collateral. The commission paid to the group leader has not yet been associated with the credit quality criteria, and the commission level is not attractive to encourage the group leader to present their responsibility to monitoring the activities of the group. Customers also reported that the number of group members is really appropriate. However, the products and services of the group lending associated with the loan packages are limited or not available, i.e., technology transfer or agricultural technique guides, so the agricultural activities of individuals and households are still based on their experiences, and this can easily lead to increased credit risk and decreased credit service quality. Conclusions With the focus on expanding the formal credit activities according to the government policies, development of group lending at Agribank-Bac Giang Branch II has achieved certain results. The credit balance has been Do Quang Giam et al. (2020) https://vjas.vnua.edu.vn/ 687 expanded while the proportion of outstanding loans via group lending has increased in recent years. This reduces the workload of credit officers. In addition, the bad debt ratios of the group lending are controlled at low levels and have a downtrend over the years, which contribute to the reduction of the overall bad debts ratio of the branch and consequently increase the credit quality. However, through the evaluations of customers and credit officers of the group lending, some obstacles limit development of group lending such as the complexity of loan documents, lack of customer information management, unspecified regulations in the loan packages, and ineffective attraction to customers of the group lending. In order to strengthen the group lending development for the branch in Bac Giang province, some crucial policy implications should be considered by the government and president of Agribank such as (i) Building flexible lending mechanisms by improving loan processes and procedures; diversifying lending methods; increasing the level of loans without collateral or considering the form of security with future properties to create favorable conditions for borrowers in accessing bank loans; (ii) Consolidating and perfecting the network of customer information collection and processing for common use of the bank in order to reduce the time for loan processing; (iii) Improving the capability of credit officers in particular and bank officers in general based on the criteria of recruiting new employees, and requiring staff to participate in professional training courses; (iv) Strengthening the implementation and coordination between banks, local authorities, and social associations through seminars, and improving the responsibilities of the parties to achieve common benefits; and (v) Introducing mechanisms on commission levels to the group leaders by linking the payments to certain performances in order to create pressure for them as well as leverage that stimulates the development of the group lending, e.g., reducing overdue debts, bad debts, and actual interest rates. References Agribank (2016). Decision No. 5199/QD-NHNo-HSX issued on December 30, 2016 on the lending regulations for households and individuals via lending groups, linkage groups, mobile lending groups applied in the Agribank system (in Vietnamese). Agribank (2019). Annual report of Agribank 2018 (in Vietnamese). Agribank-Bac Giang Branch II (2019). Annual reports (2016, 2017, 2018) of the Agribank- Bac Giang Branch II (in Vietnamese). Ahlin C. & Suandi M. (2019). A master of experience? Understanding the decline in group lending. Oxford Bulletin of Economics and Statistics. 81(6): 1252- 1279. DOI: 10.1111/obes.12305. Armendariz B. & Morduch J. (2007). The Economics of Microfinance. MIT Press, Cambridge, MA. Dellien H., Burnett J., Gincherman A. & Lynch E. (2005). Product diversification in microfinance: Introducing individual lending. Women’s World Banking Report, New York: 1-36. De Quidt J., Fetzer T. & Ghatak M. (2018). Commercialization and the decline of joint liability microcredit. Journal of Development Economics. 117: 119-133. FAO (2005). FAO Forestry Paper 146: Microfinance and forest-based small-scale enterprises. Food and Agriculture Organization of the United Nations, Rome, ISBN 92-5-105412-6, 88p. Ghatak M. (2000). Screening by the company you keep: Joint liability lending and the peer selection effect. Economic Journal. 110(465): 601-631. Godquin M. (2004). Microfinance repayment performance in Bangladesh: How to improve the allocation of loans by MFIs. World Development. 32: 1909-1926. Hoang Cong Gia Khanh, Nguyen Thi Canh, Le Ho An Chau, Nguyen Thanh Liem, Hoang Trung Nghia, Dao Thi Ngoc, Nguyen Ton Nhan, Nguyen Anh Phong, Nguyen Thi Dan Que, Pham Phu Quoc, Tran Hung Son, Nguyen Hong Thang, Nguyen Dinh Thien, Tran Quang Van & Pham Thi Thanh Xuan (2018). Annual report 2017 on financial market: Access to finance. Ho Chi Minh City National University Publishing House, 162p (in Vietnamese). Ledgerwood J. (1999). Microfinance Handbook: An Institutional and Financial Perspective (Sustainable Banking with the poor). The World Bank, Washington, D.C., ISBN 0-8213-4306-8, 262p. Mabwe K. & Robert W. (2010). A financial ratio analysis of commercial bank performance in South Africa. African Review of Economics and Finance. 2(1): 30-53. Madajewicz M. (2011). Joint liability versus individual liability in credit contracts. Journal of Economic Behavior and Organization. 77: 107-123. Maria L. (2009). Group lending versus individual lending in microfinance. Discussion paper No. 299. University of Munich. Nguyen Tho Anh & Tran Dinh Thao (2017). Evaluating the impact of village savings and loans model on living Evaluating the group lending development at the Vietnam Bank for Agriculture and Rural Development 688 Vietnam Journal of Agricultural Sciences conditions of rural women: A case study in Quang Binh and Quang Tri province. Vietnam Journal of Agricultural Sciences. 15(9): 1309-1321 (in Vietnamese). Nunnally J. C. & Bernstein I. H. (1994). The assessment of reliability. Psychometric Theory. 3: 248-292. Odongo K. & Lilian G. K. (2013). Individual lending versus group lending: An evaluation with Kenya’s microfinance data. Review of Development Finance. 3: 99-108. Robin B., Annie H. & Dyson M. (2002). Can commercial banks do microfinance? Lessons from the Commercial Bank of Zimbabwe and Co-operative Bank of Kenya. Small Enterprise Development Journal. 13(4): 35-46. Savita S. (2007). Transaction costs in group microcredit in India. Management Decisions. 45: 1331-1342. Vietnamese Government (2005). The Decree No.28/2005/ND-CP, issued on March 9, 2005 on organization and operation of microfinance institutions in Vietnam (in Vietnamese). Vietnamese Government (2015). Decree No. 55/2015/ND- CP and Decree No.116/2018/ND-CP on amending some articles of Decree No. 55/2015/ND-CP on credit policy in agriculture and rural development (in Vietnamese). World Bank (2013). CGAP Annual report 2013: Advancing financial inclusion to improve the lives of the poor (English). The World Bank, Washington, D.C., 52p.

File đính kèm:

evaluating_the_group_lending_development_at_the_viet_nam_ban.pdf

evaluating_the_group_lending_development_at_the_viet_nam_ban.pdf