Determinants affecting tax compliance: A case of business households in Ho Chi Minh City, Vietnam

This paper aims to identify key factors influencing the tax

compliance of business households in Ho Chi Minh City, Vietnam.

The researchers surveyed 215 owners of business households in Ho

Chi Minh City from June 2020 to July 2020. Analysis of the model

includes the 4 phases following: (i) Applying the expert

methodology; (ii) Cronbach’s test for reliability of the scale and

exploratory factors analysis (EFA); (iii) Pearson correlation

coefficient analysis; (iv) Regression analysis and hypothesis test of

a model. The results of this study revealed that factors affecting tax

compliance of business households in Ho Chi Minh City, Vietnam

in descending order of importance: Tax Rate, Tax Knowledge, Tax

Penalty, Personal Norm, and Perceived Fairness (of the system).

Moreover, the tax rate had a negative relationship with tax

compliance and the others had a positive one with tax compliance.

Finally, the research also proposes some implications to enhance

tax compliance of business households and directions for further

research.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Determinants affecting tax compliance: A case of business households in Ho Chi Minh City, Vietnam

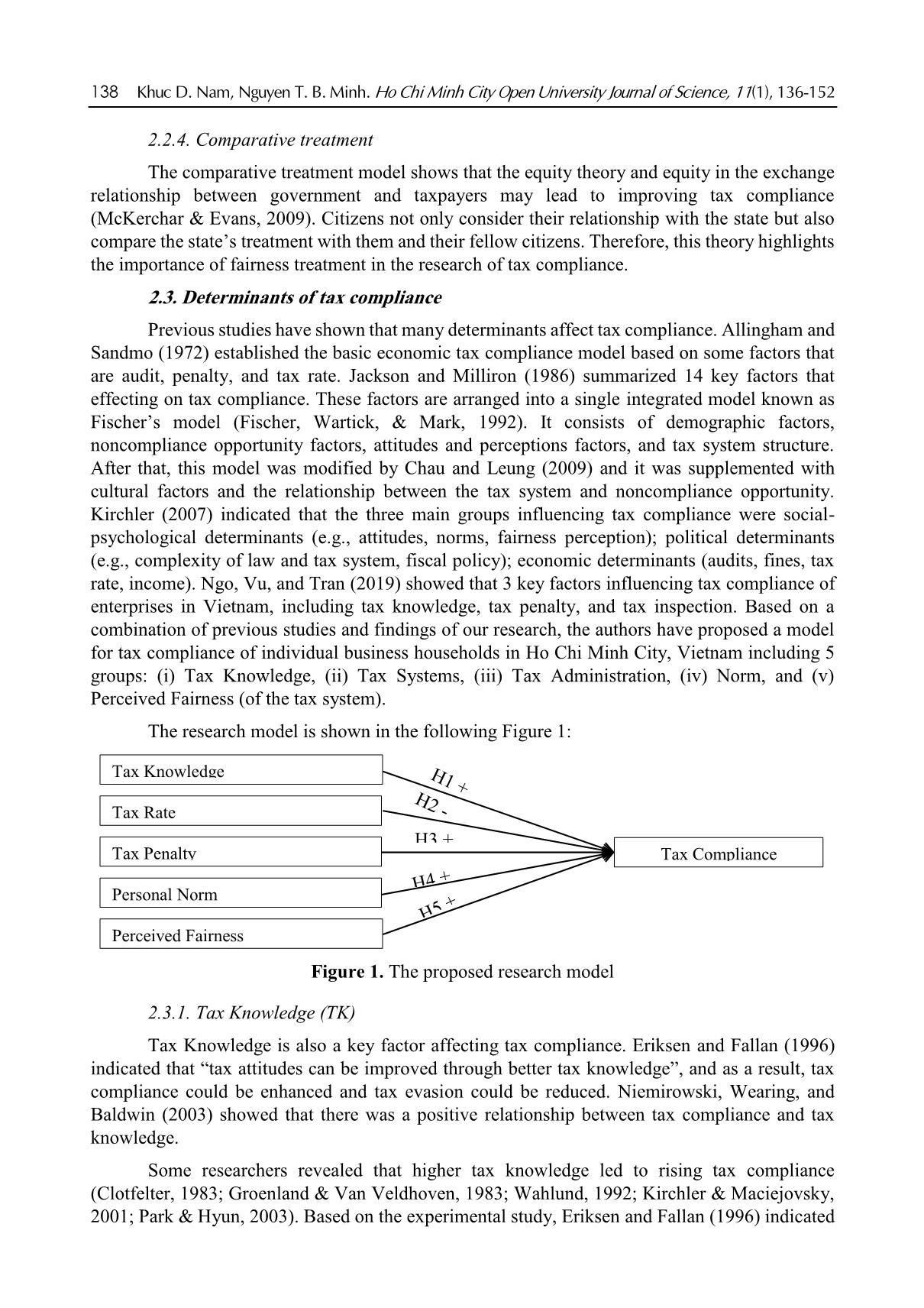

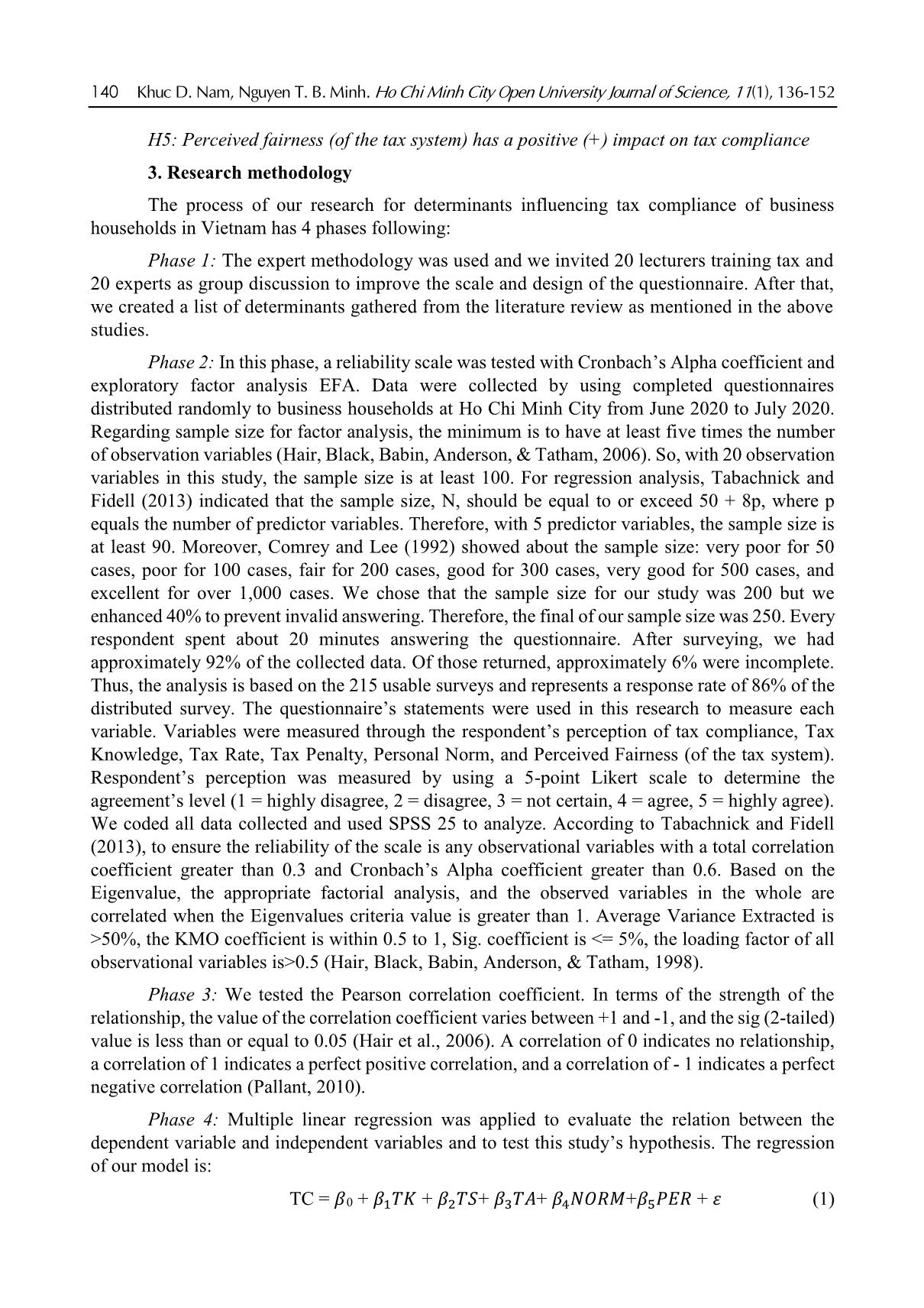

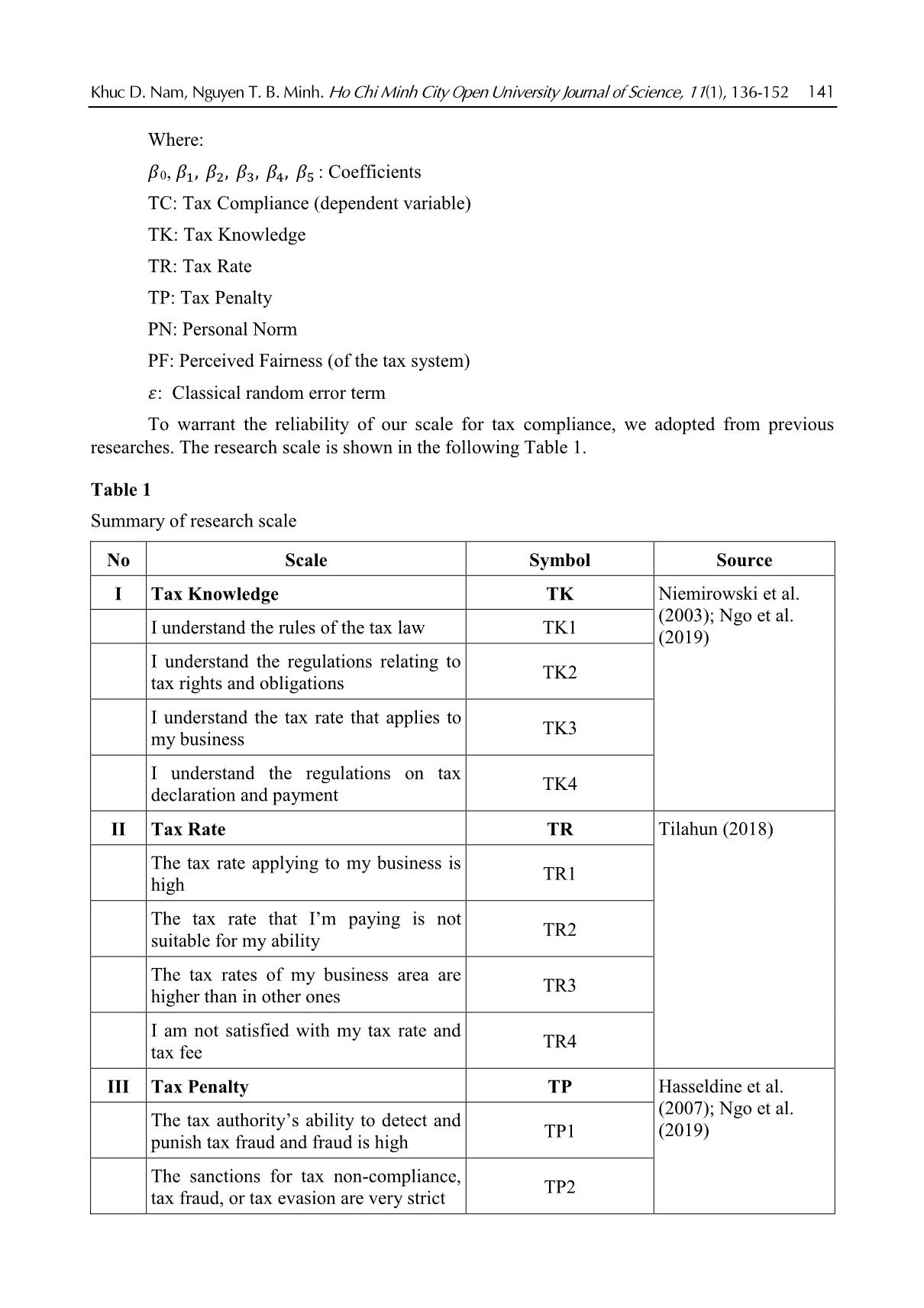

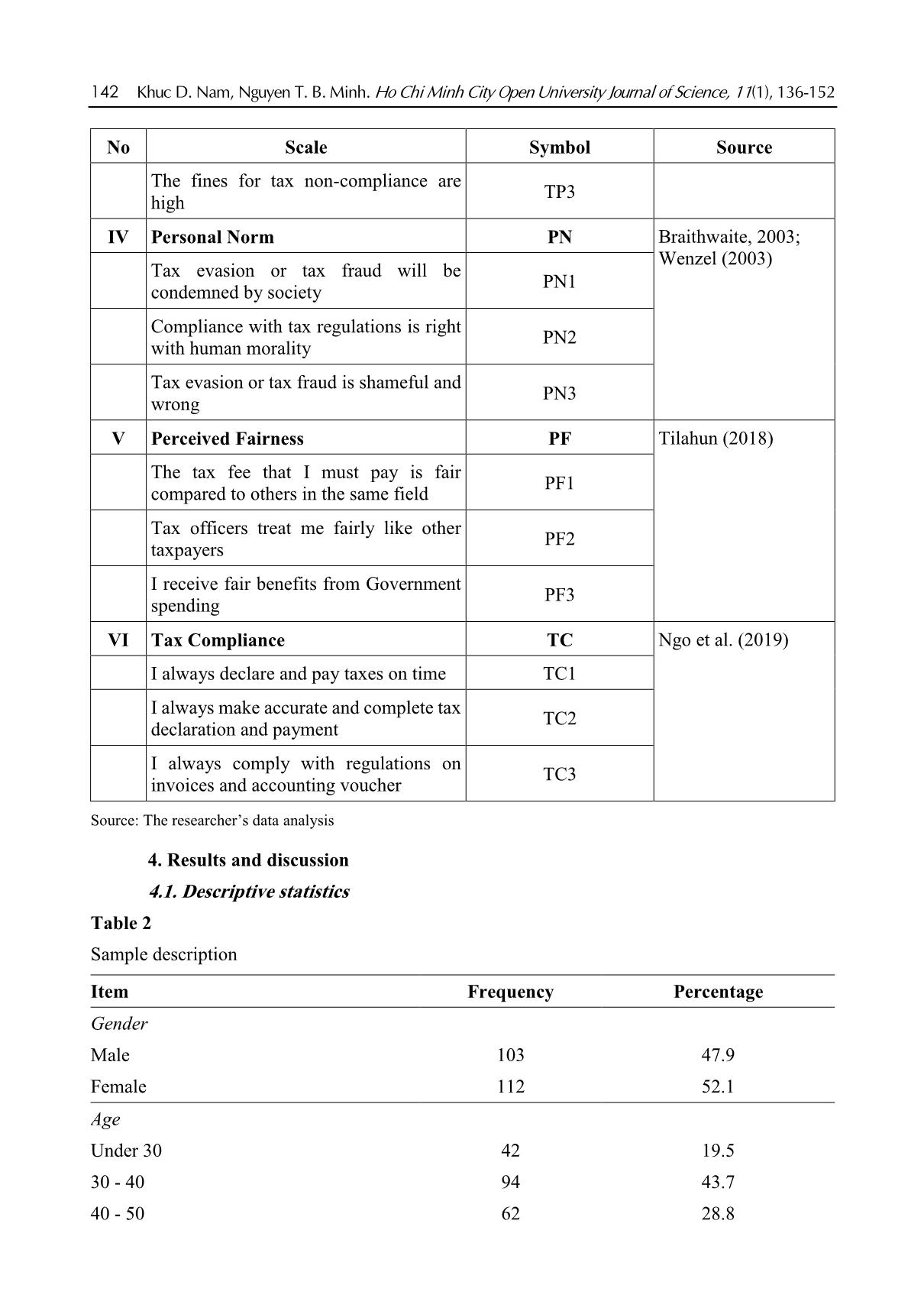

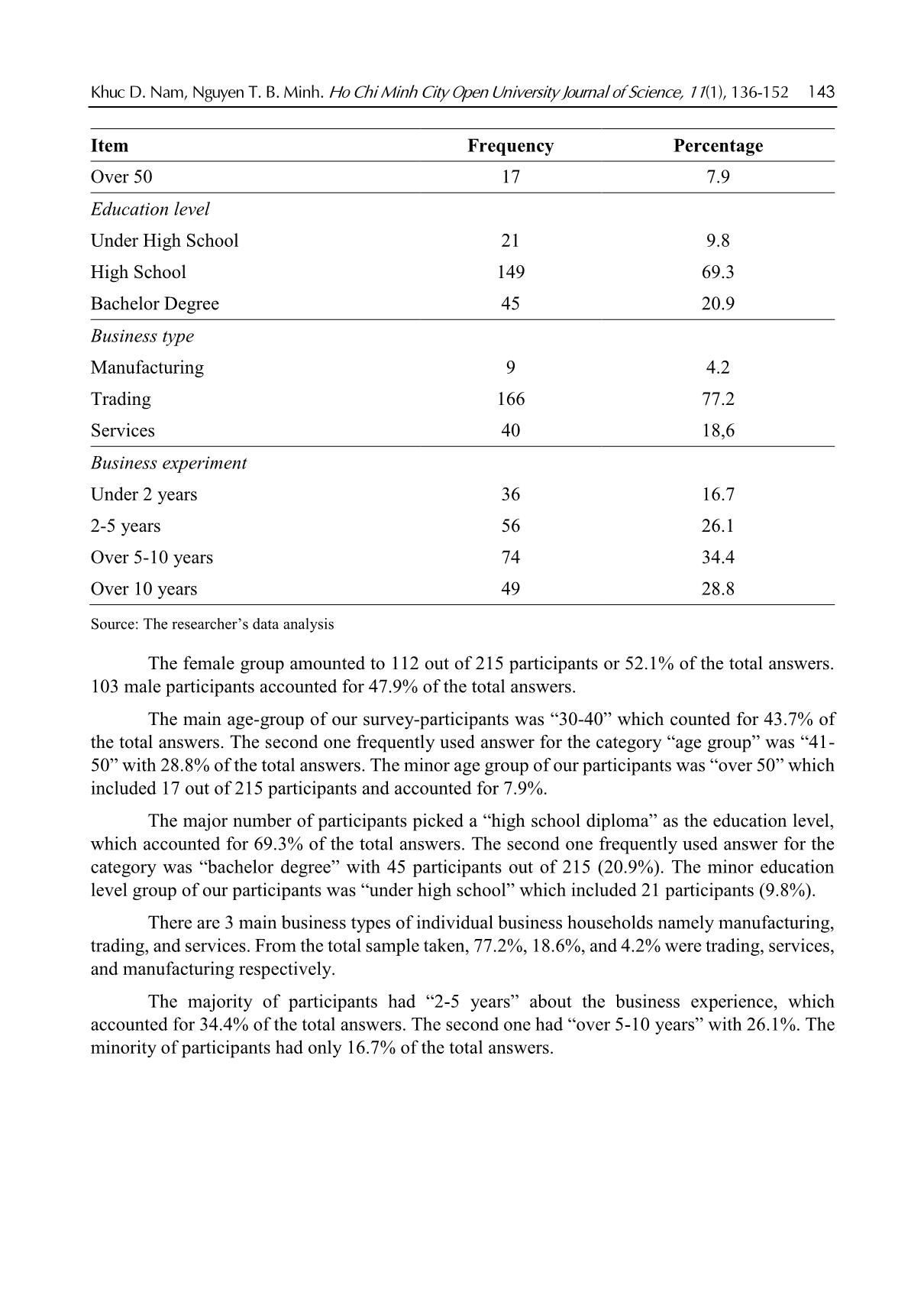

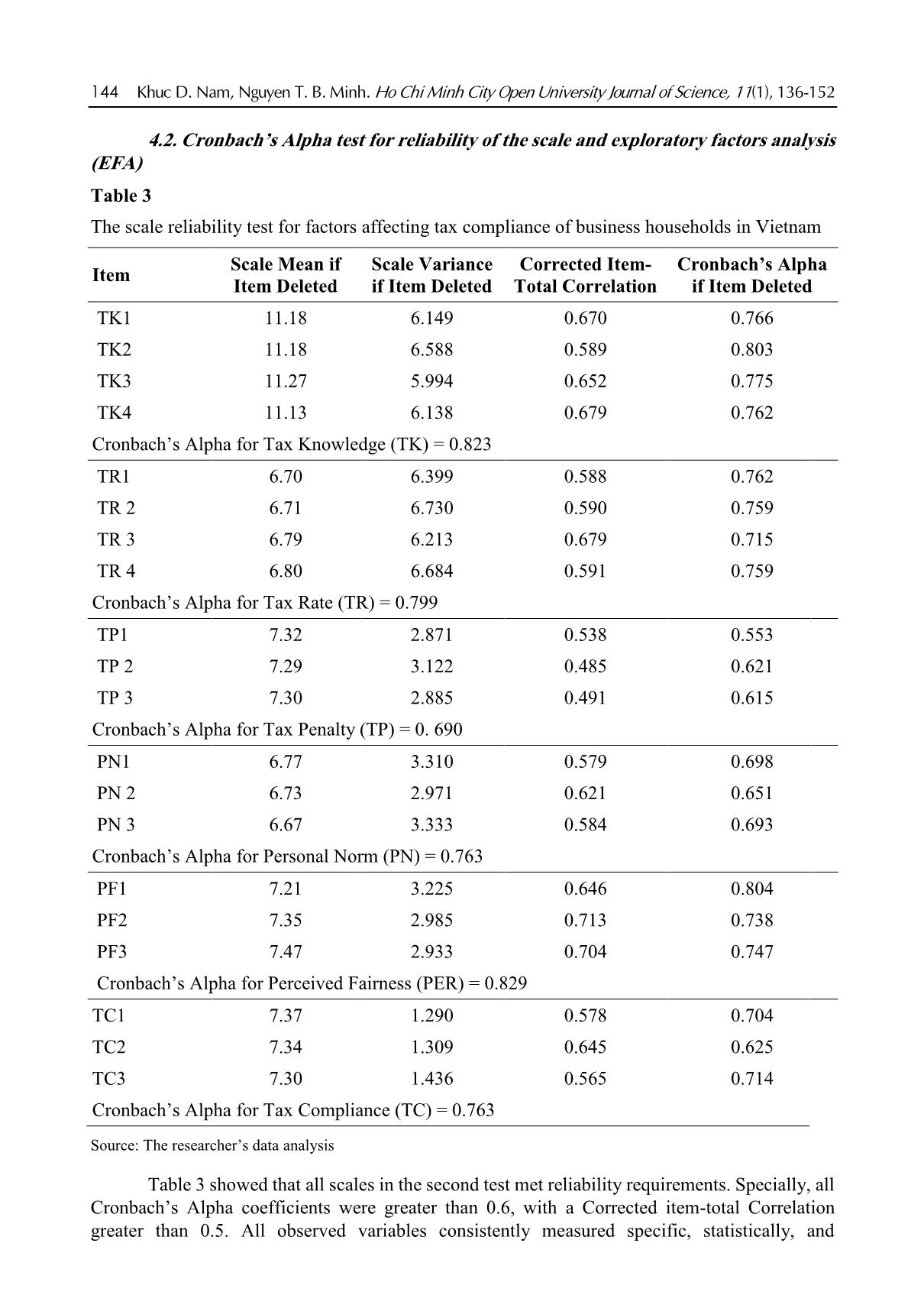

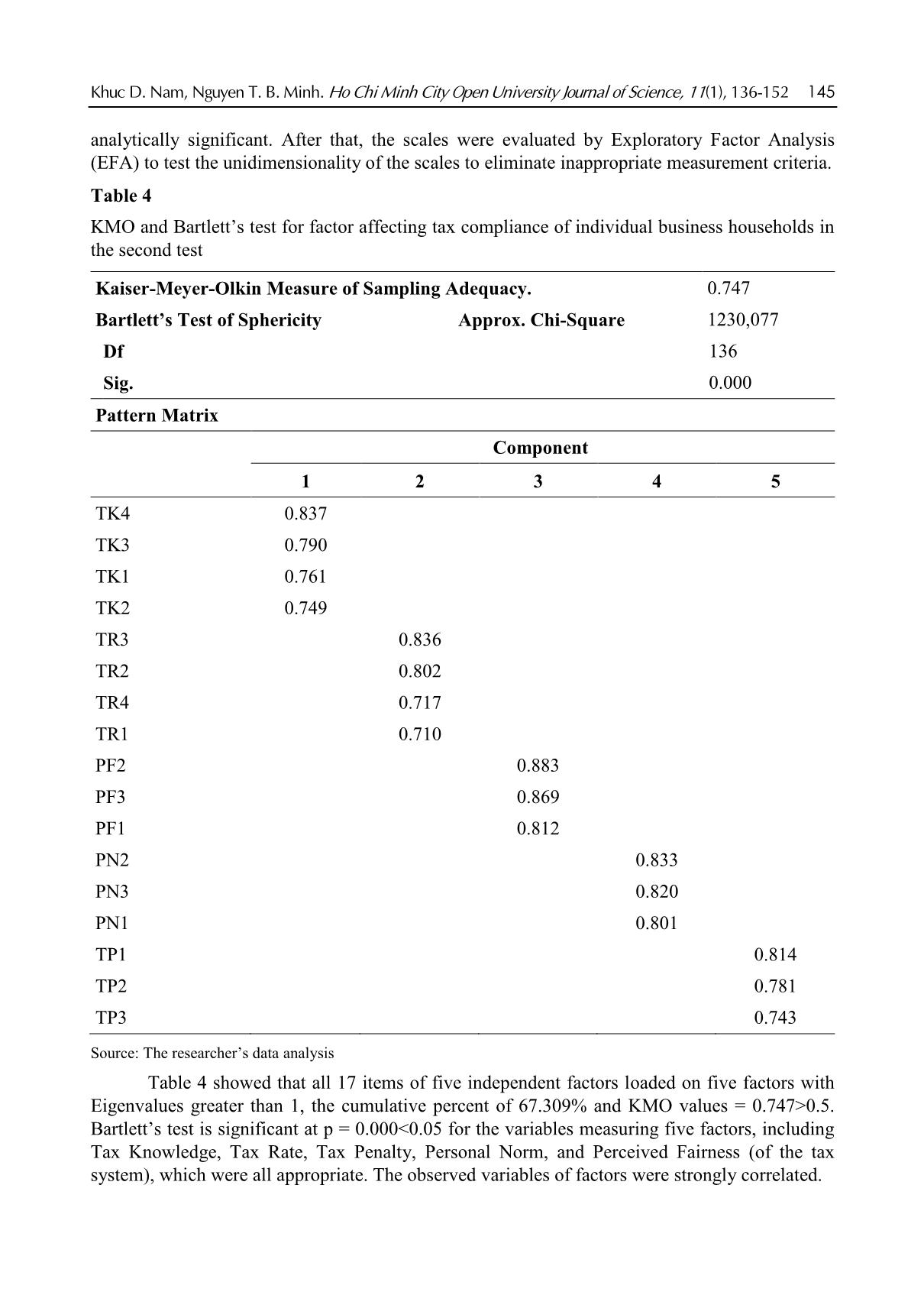

136 Khuc D. Nam, Nguyen T. B. Minh. Ho Chi Minh City Open University Journal of Science, 11(1), 136-152 Determinants affecting tax compliance: A case of business households in Ho Chi Minh City, Vietnam Khuc Dinh Nam1*, Nguyen Thi Binh Minh1 1Nong Lam University, Vietnam *Corresponding author: khucdinhnam@hcmuaf.edu.vn ARTICLE INFO ABSTRACT DOI:10.46223/HCMCOUJS. econ.en.11.1.984.2021 Received: September 21st, 2020 Revised: January 14th, 2021 Accepted: January 18th, 2021 Keywords: tax compliance, business households, personal norm, tax rate, tax knowledge This paper aims to identify key factors influencing the tax compliance of business households in Ho Chi Minh City, Vietnam. The researchers surveyed 215 owners of business households in Ho Chi Minh City from June 2020 to July 2020. Analysis of the model includes the 4 phases following: (i) Applying the expert methodology; (ii) Cronbach’s test for reliability of the scale and exploratory factors analysis (EFA); (iii) Pearson correlation coefficient analysis; (iv) Regression analysis and hypothesis test of a model. The results of this study revealed that factors affecting tax compliance of business households in Ho Chi Minh City, Vietnam in descending order of importance: Tax Rate, Tax Knowledge, Tax Penalty, Personal Norm, and Perceived Fairness (of the system). Moreover, the tax rate had a negative relationship with tax compliance and the others had a positive one with tax compliance. Finally, the research also proposes some implications to enhance tax compliance of business households and directions for further research. 1. Introduction In Vietnam, business households are also one of the important economic sectors contributing to Vietnam’s economy. However, the General Statistics Office of Vietnam showed that there were more than 5.6 million business households in 2018, but according to the General Department of Taxation’s data, the whole country had just over 1.7 million business households having tax payments in 2018. Statistics from the General Department of Taxation show that from 2015 to 2018, the tax revenue collected from business households only increased slightly over the years, while the proportion of contribution to the state budget decreased. Ho Chi Minh City is an economic, financial, commercial, and service center of the country, and is the nucleus of the southern key economic region. With a high economic growth rate, the city size accounts for only 0.6% of the area and 8.3% of the population but has contributed 20.2% of the gross national product and one-third of the State budget every year. Therefore, Ho Chi Minh City is home to many business households that provide accommodation services as well as other services related to the residents such as catering, entertainment, and essentials, etc. Although tax compliance has been researched for a long time, the factors influencing tax compliance are very different among different countries and individuals. Moreover, most of the previous studies are done in developed countries having comprehensive infrastructure and a stable tax law system and the number of tax compliance research in developing countries like Vietnam is low in numbers. Particularly, no study has been reported to identify determinants impacting on Khuc D. Nam, Nguyen T. B. Minh. Ho Chi Minh City Open University Journal of Science, 11(1), 136-152 137 tax compliance of business households in Vietnam although the role of business households is important to Vietnam’s economy. Therefore, this study “Determinants affecting tax compliance: A case of business households in Ho Chi Minh City, Vietnam” is the first study on tax compliance of business households in Vietnam to fill the gap and is very necessary and meaningful in current Vietnam’s economic conditions. The results of the study provide a framework for assessing the impact of determinants on tax compliance of business households to help tax authorities to come up with appropriate tax management policies for business households. Moreover, the study also proposes some recommendations that can help the tax authorities propose solutions to enhance tax compliance of business households in Ho Chi Minh City in particular and in Vietnam in general. The main objective focuses on: (i) a literature review of factors affecting tax compliance, (ii) identifying determinants impacting on tax compliance of business households in Vietnam, and (iii) policy implications. 2. Literature review 2.1. The definition of tax compliance For a long time, many researchers have tried to define tax compliance. For example, Allingham and Sandmo (1972) defined tax compliance as reporting all actual income. Andreoni, Erard, and Feinstein (1998) showed that tax compliance related to the willingness of taxpayers to accomplish the tax laws, to truly report tax bases to correctly ... ty, Vietnam. Therefore, decreasing the tax rate for business households can enhance tax compliance of business households. Regarding Tax Knowledge (β = 0.395), the result of this study shows a significant positive impact on tax compliance. Thus, hypothesis H1 is accepted. This result is as like as results of Niemirowski et al. (2003); Ngo et al. (2019). This result also suggests that Tax Knowledge is a key factor influencing tax compliance of business households. It means that providing and training knowledge about tax to business households can help to prevent tax evasion and enhance tax compliance of business households. Regarding Tax Penalty (β = 0.361) had a significant positive impact on tax compliance. Thus, hypothesis H3 is accepted. This result is consistent with Hasseldine et al. (2007) and Ngo et al. (2019) that increasing the tax penalties led to increasing tax compliance of business households. Regarding Personal Norm (β = 0.313), this study found a positive and significant relationship between Personal Norm and tax compliance. Thus, hypothesis H4 is accepted. This finding is similar to the following studies Braithwaite (2003); Wenzel (2003) that the more developed the moral reasoning or tax ethics, the more likely it is voluntary tax compliance of business households. Regarding the Perceived Fairness (of the tax system) (β = 0.085), this study found that a positive and slight relationship between Perceived Fairness and Tax Compliance. Thus, hypothesis H5 is accepted. This result is consistent with Tilahun (2018). The result also suggests that if business households think that the tax system is fair, Tax Compliance is more like occur. For example, if a business household feels that their tax burden is similar to the same income group, their Tax Compliance probably increases. 6. Conclusions and recommendations This paper focuses on identifying determinants affecting Tax Compliance of business households in Ho Chi Minh City, Vietnam. The results of qualitative research proposed a model for Tax Compliance with 5 factors and 17 observed variables: Tax Knowledge, Tax Rate, Tax Penalty, Personal Norm, and Perceived Fairness. Quantitative research used a 5-point Likert scale to evaluate observed variables. The valid sample size for quantitative research was 215 and SPSS 25 was used for data processing. The results of EFA showed that 17 observed variables were measuring 5 factors as the proposed model. After analyzing regression, Tax Knowledge, Tax Penalty, Personal Norm, and Perceived Fairness had a positive relationship with tax compliance while the tax rate had a negative one. These determinants are organized according to the level of influence from high to low following: Tax Rate, Tax Knowledge, Tax Penalty, Personal Norm, and Perceived Fairness respectively. According to business households in Ho Chi Minh City, Vietnam, the “Tax Rate” had the strongest and negative impact. To enhance tax compliance of business households, the tax authorities need to reduce tax rates and the local authorities need to improve the responsibility of the Local Tax Consultative Council for determining taxable income and tax rate of business households and avoiding omitting business households that have not been included in the tax administration. Because “Tax Knowledge” had a second impact on tax compliance of business households in Ho Chi Minh City, Vietnam, the government in general and tax authorities, in particular, should Khuc D. Nam, Nguyen T. B. Minh. Ho Chi Minh City Open University Journal of Science, 11(1), 136-152 149 develop professional training programs related to tax laws, tax issues, and modes of tax payment and collection for business households. With the help of tax education, business households can improve compliance with tax. Despite the “Tax Penalty” had the third impact on tax compliance of business households in Ho Chi Minh City, Vietnam, there are 2 solutions to enhance tax compliance. Firstly, the tax authorities need to publicize the list of individual business households having high tax risks and tax debts in the media like making with companies in Vietnam. As a result, other business households may be more active in tax compliance. Finally, the tax authorities should strictly punish those cases that deliberately file incorrect returns or evade tax, or commit tax fraud to increase tax compliance of business households. “Personal Norm” had a fourth impact with a positive impact on tax compliance of business households in Ho Chi Minh City. Therefore, the tax authorities should set up good propaganda groups to communicate how to behave correctly about tax and to disapprove non-compliance behaviors. Especially, these groups can help business households by sharing tax experiments. Moreover, legal education should be included in all level educational programs in Vietnam. Although the least impact on tax compliance of business households in Ho Chi Minh City was “Perceived Fairness” (of the tax system), there were also some solutions concerning this. Firstly, the government must build transparent, non-bureaucratic, and responsible institutions and must use the collected tax wisely for the benefits of the public such as good infrastructure facilities. Secondly, the tax authorities should assess the taxable income based on the information provided by business households and checked by the Local Tax Consultative Council. Finally, the tax authorities should consider the available market condition, inflation, and fairness among business households. Therefore, the tax authorities and the Local Tax Consultative Council need to coordinate closely and work seriously and fairly. In conclusion, this study focused on bringing evidence that some determinants do have an impact on tax compliance of business households in Ho Chi Minh City, Vietnam. However, this research also has some limitations. First of the survey ample has trust been limited to 215 observations conducted in Ho Chi Minh City, so further research can broaden this study to cover some other provinces and cities of Vietnam or the whole country. Moreover, this study only researched some factors affecting tax compliance. Some other factors need to be considered in future further studies, such as tax compliance cost, income level, income source, tax audit, etc. References Adams, C., & Webley, P. (2001). Small business owners’ attitudes on VAT compliance in the UK. Journal of Economic Psychology, 22(2), 195-216. Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1(3/4), 323-338. Alm, J., Jackson, B. R., & McKee, M. (1993). Fiscal exchange, collective decision institutions, and tax compliance. Journal of Economic Behavior & Organization, 22(3), 285-303. Alm, J., McClelland, G. H., & Schulze, W. D. (1992). Why do people pay taxes? Journal of Public Economics, 48(1), 21-38. Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of Economic Literature, 36(2), 818-860. 150 Khuc D. Nam, Nguyen T. B. Minh. Ho Chi Minh City Open University Journal of Science, 11(1), 136-152 Anh, P. T., Nam, K. D., & Minh, N. T. B. (2018). Tax (in Vietnamese). Hanoi, Vietnam: Labour Publisher. Australian Government - Australian Tax Office (ATO). (2009). Australian tax office. Retrieved November 10, 2009, from 00107941.htm Azmi, A. A. C., & Perumal, K. A. (2008). Tax fairness dimensions in an Asian context: The Malaysian perspective. International Review of Business Research Papers, 4(5), 11-19. Baldry, J. C. (1987). Income tax evasion and the tax schedule: Some experimental results. Public Finance, 42(30), 357-383. Blamey, R., & Braithwaite, V. (1997). The validity of the security‐harmony social values model in the general population. Australian Journal of Psychology, 49(2), 71-77. Braithwaite, V. (2003). Dancing with tax authorities: Motivational postures and non-compliant actions. In V. Braithwaite (Ed.), Taxing democracy (pp. 15-39). Aldershot, UK: Ashgate Publishing. Chau, G., & Leung, P. (2009). A critical review of Fischer tax compliance model: A research synthesis. Journal of Accounting and Taxation, 1(2), 34-40. Clotfelter, C. T. (1983). Tax evasion and tax rates: An analysis of individual returns. The Review of Economics and Statistics, 65(3), 363-373. Comrey, A., & Lee, H. (1992). A first course in factor analysis (2nd ed.). Mahwah, NJ: Lawrence Earlbaum Associates. Eriksen, K., & Fallan, L. (1996). Tax knowledge and attitudes towards taxation; A report on a quasi-experiment. Journal of Economic Psychology, 17(3), 387-402. Etzioni, A. (1986). Tax evasion and perceptions of tax fairness: A research note. The Journal of Applied Behavioral Science, 22(2), 177-185. Fischer, C. M., Wartick, M., & Mark, M. M. (1992). Detection probability and taxpayer compliance: A review of the literature. Journal of Accounting Literature, 11, 1-46. Fjeldstad, O. H., & Semboja, J. (2001). Why people pay taxes: The case of the development levy in Tanzania. World Development, 29(12), 2059-2074. Groenland, E. A., & Van Veldhoven, G. M. (1983). Tax evasion behavior: A psychological framework. Journal of Economic Psychology, 3(2), 129-144. Hai, O. T., & See, L. M. (2011). Intention of tax non-compliance: Examine the gaps. International Journal of Business and Social Science, 2(7), 79-83. Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (1998). Multivariate data analysis. Upper Saddle River, NJ: Prentice Hall. Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis. Upper Saddle River, NJ: Pearson Prentice Hall. Hasseldine, J., Hite, P., James, S., & Toumi, M. (2007). Persuasive communications: Tax compliance enforcement strategies for sole proprietors. Contemporary Accounting Research, 24(1), 171-194. Lembaga Hasil Dalam Negeri Malaysia (LHDN). (2009). Inland revenue board of Malaysia. Retrieved March, 14, 2009, from Khuc D. Nam, Nguyen T. B. Minh. Ho Chi Minh City Open University Journal of Science, 11(1), 136-152 151 Internal Revenues Services (IRS). (2009). Update on reducing the federal tax gap and improving voluntary compliance. Retrieved November 10, 2009, from newsroom/tax_gap_report_-final_version.pdf Jackson, B. R., & Milliron, V. C. (1986). Tax compliance research: Findings, problems, and prospects. Journal of Accounting Literature, 5(1), 125-165. Keith, S. (1990). Governmental policies to reduce tax evasion: Coerced behavior versus services and values development. Policy Sciences, 23(1), 57-72. Kirchler, E. (2007). The economic psychology of tax behavior. Cambridge, UK: Cambridge University Press. Kirchler, E., & Berger, M. M. (1998). Macht die gelegenheit den dieb? Einstellungen zu steuern und tendenzen zur steuerhinterziehung [Does the opportunity make the thief? Control attitudes and tax evasion tendencies]. Jahrbuch der Absatz-und Verbrauchsforschung, 44, 439-462. Kirchler, E., & Maciejovsky, B. (2001). Tax compliance within the context of gain and loss situations, expected and current asset position, and profession. Journal of Economic Psychology, 22(2), 173-194. Kirchler, E., Hoelzl, E., & Wahl, I. (2008). Enforced versus voluntary tax compliance: The “slippery slope” framework. Journal of Economic Psychology, 29(2), 210-225. Lang, O., Nöhrbaß, K. H., & Stahl, K. (1997). On income tax avoidance: The case of Germany. Journal of Public Economics, 66(2), 327-347. McKerchar, M., & Evans, C. (2009). Sustaining growth in developing economies through improved taxpayer compliance: Challenges for policy makers and revenue authorities. eJournal of Tax Research, 7(2), 171-201. Ngo, H. T., Vu, L. T. P., & Tran, T. T. (2019). Determinants affecting tax compliance: A case of enterprises in Vietnam. Academy of Accounting and Financial Studies Journal, 23(3), 1-8. Niemirowski, P., Wearing, A. J., & Baldwin, S. (2003). Tax related behaviors, beliefs, attitudes. Journal of Australian Taxation, 6(1), 132-165. Palil, M. R., & Mustapha, A. F. (2011). The evolution and concept of tax compliance in Asia and Europe. Australian Journal of Basic and Applied Sciences, 5(11), 557-563. Pallant, J. (2010). SPSS survival manual (4th ed.). London, UK: Open University Press. Park, C. G., & Hyun, J. K. (2003). Examining the determinants of tax compliance by experimental data: A case of Korea. Journal of Policy Modeling, 25(8), 673-684. Pommerehne, W. W., & Weck-Hannemann, H. (1996). Tax rates, tax administration and income tax evasion in Switzerland. Public Choice, 88(1/2), 161-170. Richardson, G. (2005). An exploratory cross-cultural study of tax fairness perceptions and tax compliance behavior in Australia and Hong Kong. International Tax Journal, 31, 11-67. Scott, W. J., & Grasmick, H. G. (1981). Deterrence and income tax cheating: Testing interaction hypotheses in utilitarian theories. The Journal of Applied Behavioral Science, 17(3), 395-408. Slemrod, J. B. (1985). An empirical test for tax evasion. The Review of Economics and Statistics, 67(2), 232-238. 152 Khuc D. Nam, Nguyen T. B. Minh. Ho Chi Minh City Open University Journal of Science, 11(1), 136-152 Spicer, M. W., & Lundstedt, S. B. (1976). Understanding tax evasion. Public Finance = Finances Publiques, 31(2), 295-305. Tabachnick, B. G., & Fidell, L. S. (2013). Using multivariate statistics (6th ed.). Boston, MA: Pearson. Tilahun, M. (2018). Economic and social factors of voluntary tax compliance: Evidence from Bahir Dar City. International Journal of Accounting Research, 6(2), 182-188. Trivedi, V. U., Shehata, M., & Lynn, B. (2003). Impact of personal and situational factors on taxpayer compliance: An experimental analysis. Journal of Business Ethics, 47(3), 175-197. Wahlund, R. (1992). Tax changes and economic behavior: The case of tax evasion. Journal of Economic Psychology, 13(4), 657-677. Webley, P., Cole, M., & Eidjar, O. P. (2001). The prediction of self-reported and hypothetical tax- evasion: Evidence from England, France and Norway. Journal of Economic Psychology, 22(2), 141-155. Weck-Hannemann, H., & Pommerehne, W. W. (1989). Einkommensteuerhinterziehung in der Schweiz: Eine empirische analyse [Income tax evasion in Switzerland: An empirical analysis]. Swiss Journal of Economics and Statistics (SJES), 125(4), 515-556. Wenzel, M. (2003). Tax compliance and the psychology of justice: Mapping the field. Aldershot, UK: Ashgate Publishing. Witte, A. D., & Woodbury, D. F. (1985). The effect of tax laws and tax administration on tax compliance: The case of the US individual income tax. National Tax Journal, 38(1), 1-13.

File đính kèm:

determinants_affecting_tax_compliance_a_case_of_business_hou.pdf

determinants_affecting_tax_compliance_a_case_of_business_hou.pdf