Tín dụng phi chính thức và hoạt động tài chính của doanh nghiệp vừa và nhỏ ở Việt Nam

Bài viết này nghiên cứu về việc sử dụng tín dụng phi chính thức (informal loan) và tác

động của nó tới hoạt động tài chính của doanh nghiệp vừa và nhỏ (DNVVN) ở Việt Nam giai

đoạn 2011-2015. Tín dụng phi chính thức bao gồm tín dụng mang tính xây dựng (constructive

informal loan) và tín dụng đen (underground loan). Hoạt động tài chính được đo bằng chỉ số lợi

nhuận trên tài sản. Kết quả hồi quy cho thấy xác suất của doanh nghiệp sử dụng tín dụng phi

chính thức tăng lên khi hoạt động trong ngành có cạnh tranh, có kiểm toán bên ngoài, và doanh

nghiệp gặp khó khăn trong việc vay vốn ngân hàng. Sử dụng tín dụng phi chính thức có tác động

tích cực tới hoạt động tài chính của doanh nghiệp, tuy nhiên số tiền tín dụng phi chính thức có

mối quan hệ hình U ngược với hoạt động tài chính của doanh nghiệp. Lãi suất khoản vay này có

tác động tiêu cực tới hoạt động tài chính trong khi thời hạn vay lại không có ảnh hưởng. Giữa

hai loại hình tín dụng phi chính thức, tác động của tín dụng mang tính xây dựng đối với hoạt

động tài chính rõ ràng hơn so với tín dụng đen. Kết quả này có hàm ý quan trọng cho các doanh

nghiệp trong việc sử dụng tín dụng phi chính thức một cách hiệu quả.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Tín dụng phi chính thức và hoạt động tài chính của doanh nghiệp vừa và nhỏ ở Việt Nam

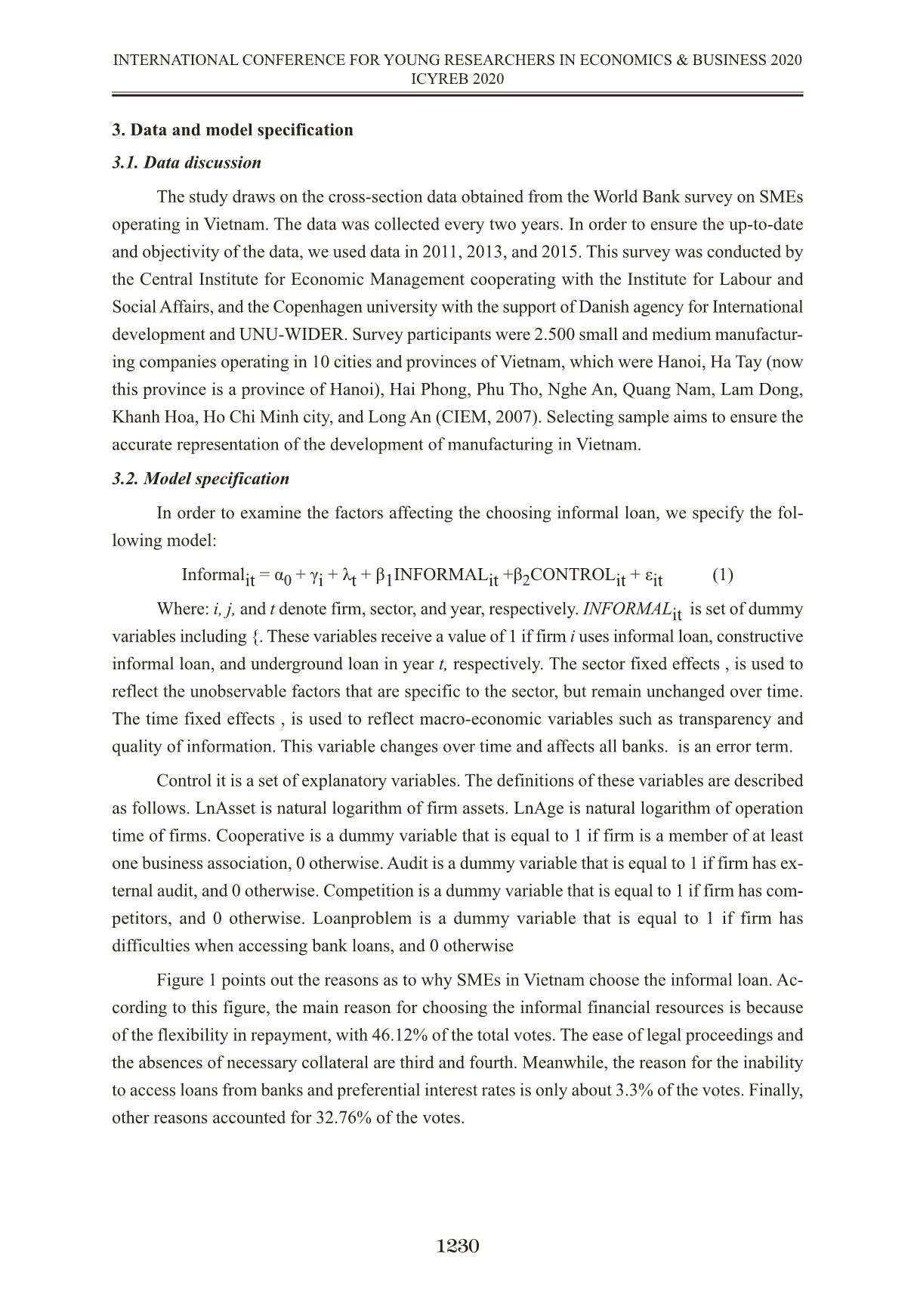

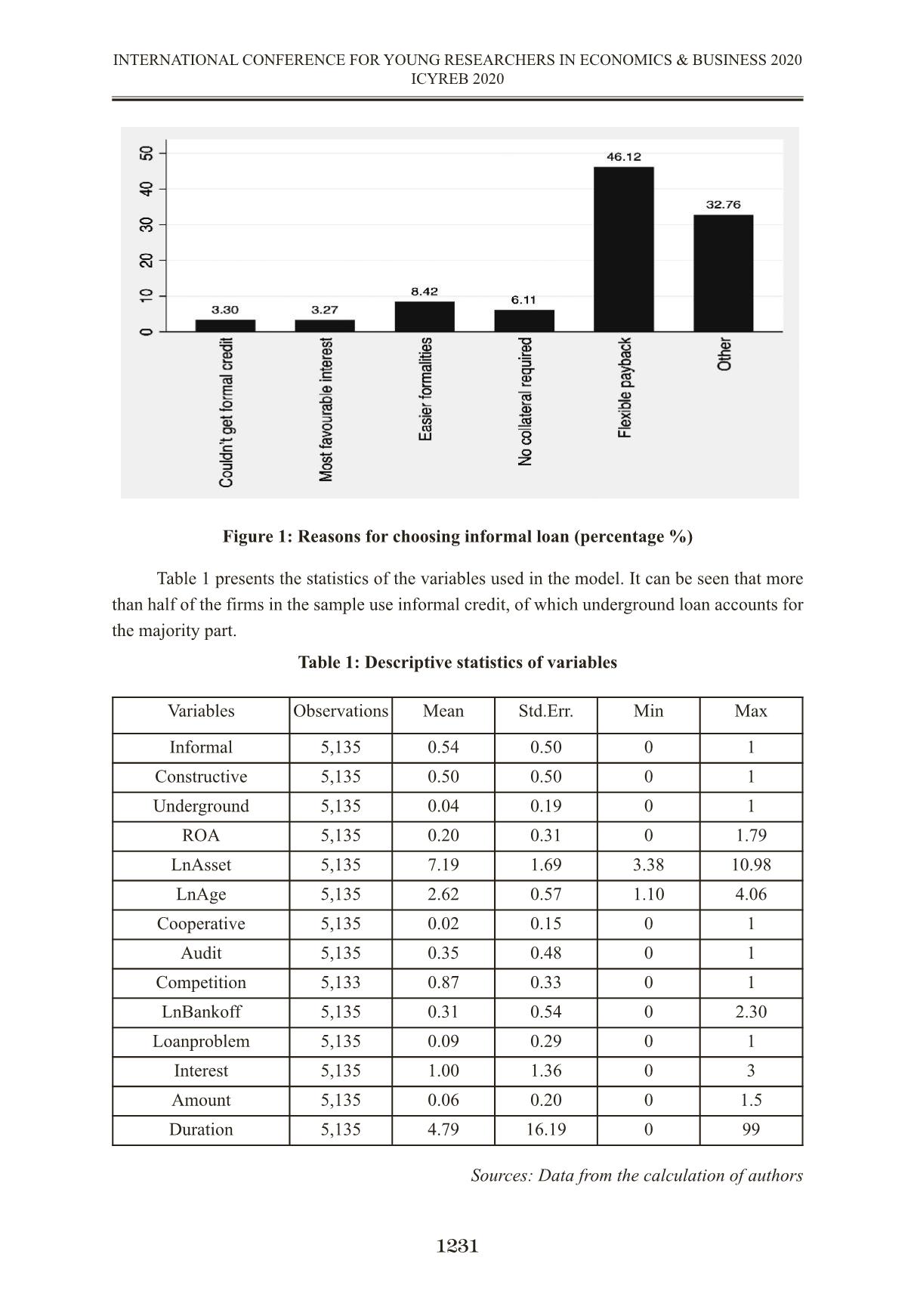

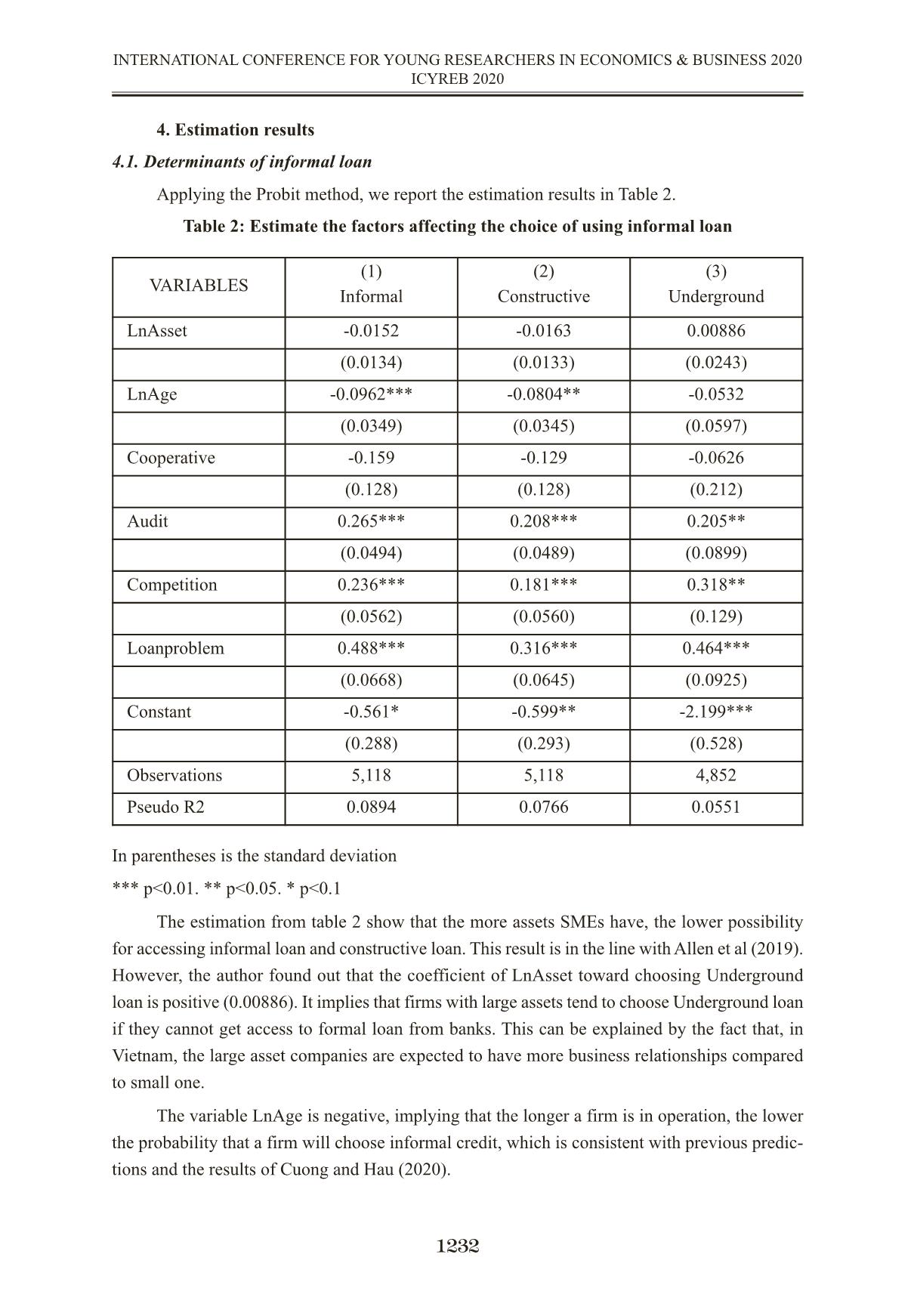

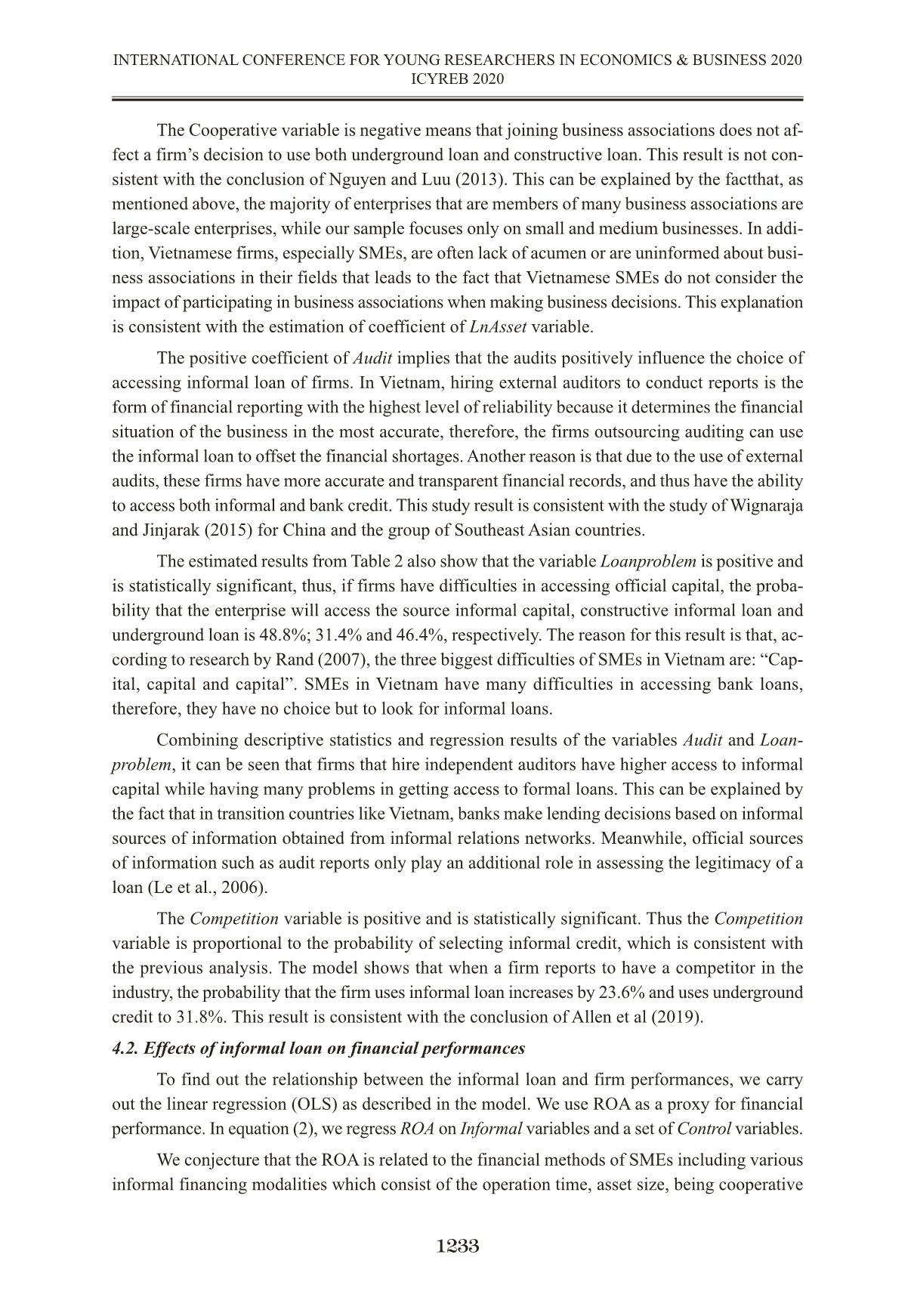

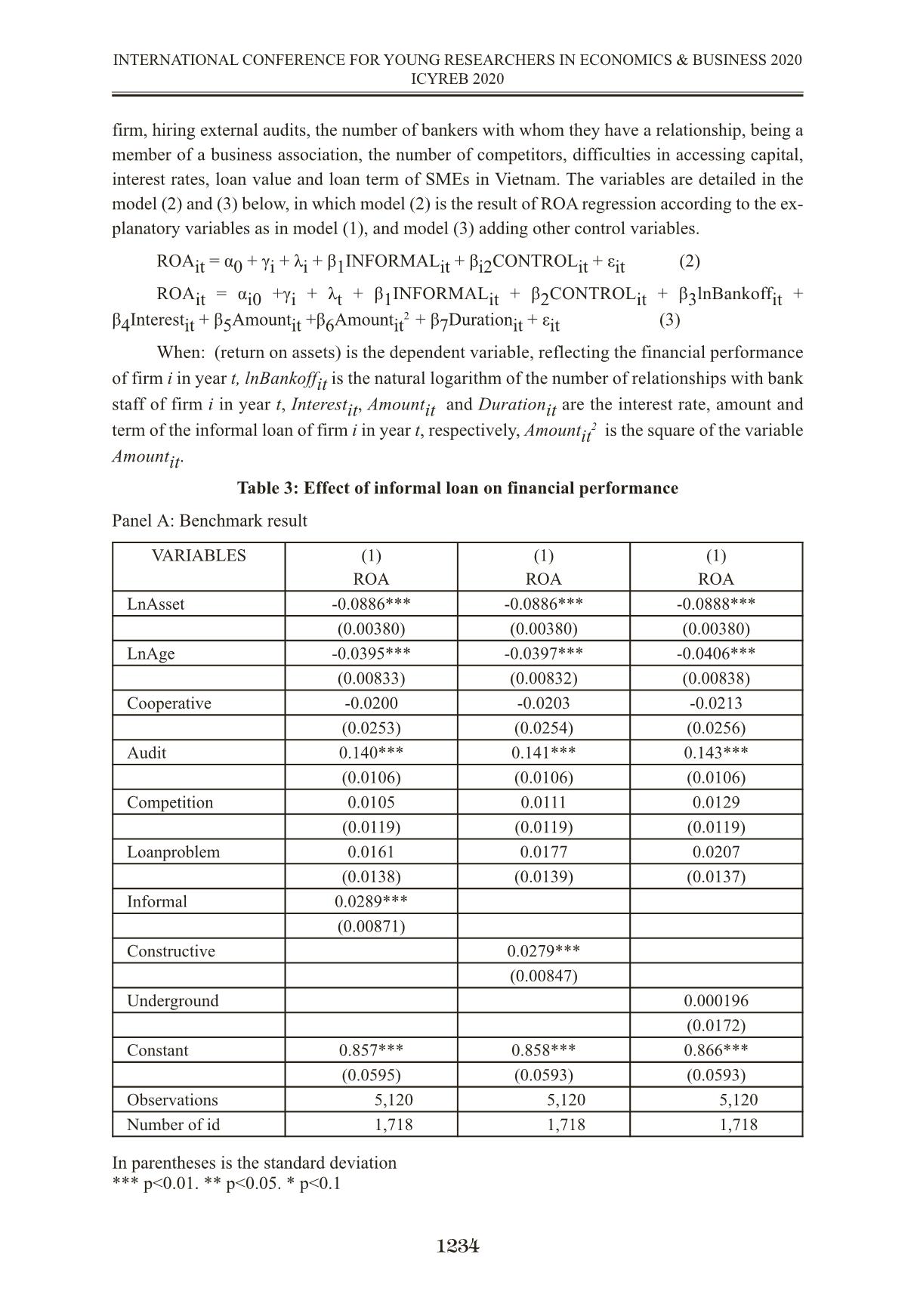

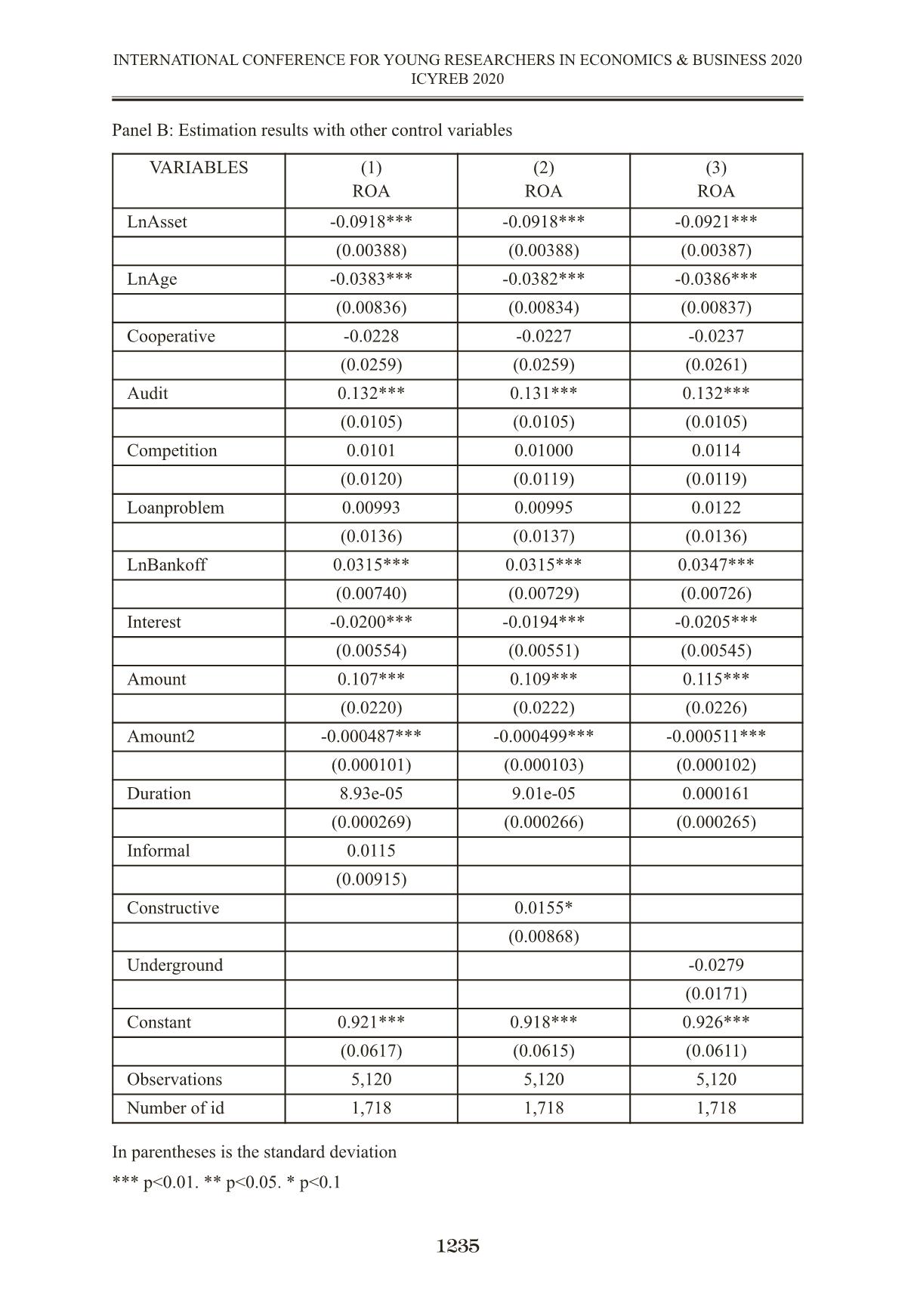

INFORMAL LOAN AND FINANCIAL PERFORMANCE OF SMALL AND MEDIUM-SIZED ENTERPRISES IN VIETNAM TÍN DỤNG PHI CHÍNH THỨC VÀ HOẠT ĐỘNG TÀI CHÍNH CỦA DOANH NGHIỆP VỪA VÀ NHỎ Ở VIỆT NAM TS. Đoàn Ngọc Thắng ; ThS. Đỗ Phú Đông Biện Thanh Huyền ; Hà Thị Thùy Dung ; Trần Thị Thêu Học viện ngân hàng dongdp@hvnh.edu.vn Abstract This paper studies the use of informal loans and its effects on the financial performance of Small and Medium-sized Enterprises (SMEs) in Vietnam for the period 2011-2015. The informal loan includes constructive and underground loan. Financial performance is measured by return on assets (ROA). The empirical results show that informal loan is likely to be used when firms face industry competition, have an external audit, and bank loan problem. Using informal credit has a positive effect on the business’s financial performance; however, the amount of informal loans has a U-inverted relationship with financial performance. The interest rate has a negative effect on financial performance, while loan duration plays no role. Among these informal loans, the effects of instructive loan are more evident than that of underground one. Our findings have practical meanings for the firms to use the informal loan effectively. Keywords: informal loan, SMEs, financial performance Tóm tắt Bài viết này nghiên cứu về việc sử dụng tín dụng phi chính thức (informal loan) và tác động của nó tới hoạt động tài chính của doanh nghiệp vừa và nhỏ (DNVVN) ở Việt Nam giai đoạn 2011-2015. Tín dụng phi chính thức bao gồm tín dụng mang tính xây dựng (constructive informal loan) và tín dụng đen (underground loan). Hoạt động tài chính được đo bằng chỉ số lợi nhuận trên tài sản. Kết quả hồi quy cho thấy xác suất của doanh nghiệp sử dụng tín dụng phi chính thức tăng lên khi hoạt động trong ngành có cạnh tranh, có kiểm toán bên ngoài, và doanh nghiệp gặp khó khăn trong việc vay vốn ngân hàng. Sử dụng tín dụng phi chính thức có tác động tích cực tới hoạt động tài chính của doanh nghiệp, tuy nhiên số tiền tín dụng phi chính thức có mối quan hệ hình U ngược với hoạt động tài chính của doanh nghiệp. Lãi suất khoản vay này có tác động tiêu cực tới hoạt động tài chính trong khi thời hạn vay lại không có ảnh hưởng. Giữa hai loại hình tín dụng phi chính thức, tác động của tín dụng mang tính xây dựng đối với hoạt động tài chính rõ ràng hơn so với tín dụng đen. Kết quả này có hàm ý quan trọng cho các doanh nghiệp trong việc sử dụng tín dụng phi chính thức một cách hiệu quả. Từ khóa: tín dụng phi chính thức, doanh nghiệp vừa và nhỏ, hoạt động tài chính 1226 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 1. Introduction Small and medium enterprises (SMEs) play an important role in the development of the Vietnamese economy. Indeed, the number of SMEs accounts for more than 90% of the total num- ber of firms operating in Vietnam. Moreover, the number of workers working in SMEs makes up 77% of the total Vietnamese labor force. In terms of contribution, SMEs contribute 40% of the GDP of Vietnam. However, according to MPDF (1997), credits have been the major obstacle to the growth of firms. SMEs face severer ddifficulties than the large ones when getting access to formal financing and this is true for the case of Vietnam. The burden of administrative procedure, institutional constraints, and collateral requirements force Vietnamese SMEs to approach the in- formal financial sources that can provide an easy-to-assess and flexible-payback loan (Archer et al., 2020). In Vietnam, the term “informal loan” brings on the negative thoughts because of the misunderstanding that it only includes underground credits accompanying with bad images such as usury. This paper uncovers the informal loan’s usage, its driving forces of informal loan’s usage, and its effect on financial performance of SMEs. According to Hsu and Li (2009), an informal loan is a financial activity without banks as intermediaries. It includes money borrowed from family and friends, private money houses, and other financial associations. Allen et al. (2019) show that informal loan could be categorized into constructive and underground informal loan. The former includes trade credits and loans from family and friends. This loan is legal because its interest rate is not higher than the interest rate ceiling, and therefore, it is controlled by the governments. On the other hand, underground loan is coercive. This kind of financing includes pawnshop loans. This paper uses the data from the Vietnamese enterprise survey conducted by the Central Institute for Economic Management of Vietnam (CIEM) under the funding of the World Bank in the period from 2011 to 2015. We apply a Probit method in order to examine the probability of using informal loan and the ordinary least square regression to estimate the effects of informal loan on the financial performances. The empirical results show that enterpr ... (0.0136) (0.0137) (0.0136) LnBankoff 0.0315*** 0.0315*** 0.0347*** (0.00740) (0.00729) (0.00726) Interest -0.0200*** -0.0194*** -0.0205*** (0.00554) (0.00551) (0.00545) Amount 0.107*** 0.109*** 0.115*** (0.0220) (0.0222) (0.0226) Amount2 -0.000487*** -0.000499*** -0.000511*** (0.000101) (0.000103) (0.000102) Duration 8.93e-05 9.01e-05 0.000161 (0.000269) (0.000266) (0.000265) Informal 0.0115 (0.00915) Constructive 0.0155* (0.00868) Underground -0.0279 (0.0171) Constant 0.921*** 0.918*** 0.926*** (0.0617) (0.0615) (0.0611) Observations 5,120 5,120 5,120 Number of id 1,718 1,718 1,718 The regression results of the model (3) are presented in Panel A of Table 3. The coefficient of Informal implies positive effects on ROA with the value at 0.0289 and is statistically significant at 1%. In which, Constructive has a positive impact on the financial performance of the business while Underground is not statistically significant. Constructive (0.0279) is positive which means that if firms increase the use of constructive informal loan, their performances tend to increase. This result is consistent with the study of Su and Sun (2011) and Allen et al. (2019). This is ex- plained by the fact that constructive informal loan is loans from relatives, friends, social rela- tionships with very low or without interest rates, and there are no complicated procedures, or, the repayment deadline is not constrained, thus, firms can mobilize money quickly, and the re- payment period is not a concern. Moreover, these are loans that are under the control of the gov- ernment, so unethical activities such as violence, raising interest rates exceed a high level, shortening the repayment period, ... are unlikely to happen. Meanwhile, the proportion of using underground loan in our sample is quite small, only about 4%, so the underground loan’s role may not be large enough to affect the performance of the SMEs. However, the results relating to informal loan is not consistent with the study of Cuong and Hau (2020) on informal loan in Viet- nam. Indeed, Cuong and Hau (2020) investigated on projects of both institutions and individuals. That is reason why they concluded that informal loan brings on the negative effect on the return of the projects. LnAsset and LnAge are negative and statistically significant. These variables are inversely proportional to the firm’s performance, which is completely consistent with Rand (2007). In par- ticular, when the assets of the business increase by 1%, the use of informal loan will reduce the efficiency of operations by about 9%. Similarly, the ROA of an enterprise will be reduced by 4% if the business has more years of operation. The coefficients of the variables LnAsset and LnAge were substantially consistent with the theory. Audit variable is positive with a statistical signifi- cance of 1%. The meaning of the above results is that when firms access informal loan with out- sourced accounting, their performance will increase. The reason is that hiring an external accountant will help firms to control their finances more closely. The efficient use of informal loan and combining with external accounting will help firms to save time, money, and be more flexible with cash flow. Meanwhile, Cooperative, Competition, and Loanproblem will not affect the firm’s performance. In Panel B of Table 3, variables related to the use of informal loan are added as control variables. The interest rate on informal loan, Interest, negatively affects ROA. Particularly, when interest rates increase to 1%, ROA decreases by 2%. The negative effect of underground credit on ROA is higher than on constructive informal credit. According to Rand (2007), informal loan typically does not require collateral, but interest rates range from 0% up to 6% per month. This corresponds to the findings of McMillan and Woodruff (1999) when interest rates paid by private producers in the informal credit market in Vietnam are up to 4-7% per month. The increase in interest rates will reduce the profits that businesses earn. Therefore, firms will have difficulties in not having enough capital to improve their business operations as well as reinvest in new profitable projects. Thus, operational efficiency will not be enhanced. 1236 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Amount positively affects the financial performance of the firms at 10.9% when they use constructive informal loan and at 11.5% when they borrow an additional VND 1 billion in un- derground credit. This means that when businesses increase their loan value, their ROA also in- creases. However, when the loan value becomes too large, it harms the financial performance of the business, as shown by the coefficient of Amount2 is negative and statistically significant at 1%. This is because a moderate informal credit will have a positive effect on solving liquidity problems and financing day-to-day business operations. However, when the value of this loan is too large, the pressure to pay interest and principal is burdened on the business, making the firms less efficient. Duration does not affect the firm’s performance because the estimation coefficient of this factor is not statistically significant (p>0.1). This result is contrary to the study of Nderitu and Githinji (2015). This can be explained by the fact that the informal loan is mainly based on re- lationships, there is no contract to extend the payment period, so the loan period can be more flexible than original payment commitments. LnBankoff positively affects business perform- ance. As the company has more relationships with bank staff, the firm can access formal loans and reduce access to informal finance. This result is consistent with findings from the United States (Berger and Udell, 1995; Uzzi, 1999) that when firms have a longer banking relationship, they can borrow at lower interest rates. That means the risk will be reduced, the operational ef- ficiency will increase. 4.3. Endogeneity problem Up to now, we ignore the potential bias caused by the endogeneity of informal loan. A weak financial performance may prevent firms from borrowing from banks as the banks depreciate the firms that have bad financial reports. In this case, if the firms still need external finance, they only use the informal channel. To mitigate the estimation bias, we apply the instrumental variable. We construct a variable Flexible that takes a value of one if a firm answer that flexible payback is a reason why firm use informal loan and zero otherwise. This variable is expected to have a strong correlation with the use of informal loan (Archer et al., 2020). In our data sample, 46% of firm chooses this reason. To the best of our knowledge, we find no consensus about the relation- ship between flexible payback and financial performance. Hence, our instrumental variable is valid. We report the IV regression in Table 4. The results show that when controlling the endo- geneity problem, the effects of Informal and Constructive become pronounced. Table 4: IV regression 1237 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 VARIABLES (1) ROA (2) ROA LnAsset -0.0884*** -0.0883*** (0.00380) (0.00380) LnAge -0.0379*** -0.0382*** (0.00829) (0.00829) In parentheses is the solid standard deviation *** p<0.01. ** p<0.05. * p<0.1 5. Conclusion In this paper, we use the Probit and OLS models to study the probability of informal loan selection and its effect on the financial performance of the SMEs. The empirical results, without endogenity, show that having a competitor in the industry, using external audit or having diffi- culties in accessing formal loan are factors leading to SMEs choosing to use informal credit. In contrast, the size of assets and the number of years in operation are factors that reduce a firm’s access to informal loan. When evaluating the impact of informal loan on the financial performance of SMEs, the results show that informal loan in general and, in particular, constructive informal credit have positive effects on the financial performance of the firms. Meanwhile, using underground loan does not affect ROA. 1238 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Cooperative -0.0181 -0.0184 (0.0250) (0.0251) Audit 0.136*** 0.137*** (0.0108) (0.0107) Competition 0.00713 0.00811 (0.0122) (0.0121) Loanproblem 0.00916 0.0126 (0.0144) (0.0142) Informal 0.0723*** (0.0213) Constructive 0.0750*** (0.0221) Constant 0.842*** 0.843*** (0.0601) (0.0599) Observations 5,120 5,120 Number of id 1,718 1,718 R2 0.240 0.239 Wald test p-value 0.000 0.000 Based on the above analysis results, to increase operational efficiency for SMEs, we suggest some practical policies as follows. The government needs to lay down a strict fiscal mechanism, take detailed steps to regulate informal finance in order to promote positive aspects such as in- creasing the use of constructive informal loan, play a supporting role, avoiding destabilization and establishing multifaceted funding to meet the necessary needs that helps to develop the SMEs. Additionally, the Vietnamese authorities need to play an important role in controlling underground loans. For examples, the government is advisable to review the operation of potential underground sources like pawnshops in order to manage successfully interest rates and payback method. Free- man and Le (2007) have pointed out that rental, subscription and credit guarantee funds are often not known as the usual and effective channels to raise funds for SMEs due to their mechanisms are not suitable. Therefore, banks should develop new financial services or tailored credit products for SMEs, linking the provision of credit to technical advisory, financial advisory or managing loan services to businesses / customers to improve loan efficiency. Disseminate supporting serv- ices to support SMEs such as factoring, credit guarantees, rental funds, etc., simultaneously, SMEs should actively improve their understanding of trade finance methods, limit maximum use of underground loan. Last but not least, according to Cuong and Hau (2020), innovations play an important role in reducing accessing informal loan of SMEs. Therefore, governmental support to facilitate innovation of SMEs should be considered by authorities. Due to research limitation, this paper did not examine fully the endogeneity between in- formal and formal loans in the Vietnamese market. Therefore, evaluating endogeneity is a sug- gested research in the future. Additionally, although governments play an important role in laying down regulations on accessing informal and formal loans, this study did not cover this issue. Thus, future research on informal loans in Vietnam should focus on the policy regulations. REFERENCES Allen, F., Qian, M., & Xie, J. (2019). Understanding informal financing. Journal of Financial Intermediation, 39, 19-33. Archer, L., Sharma, P., & Su, J. J. (2020). SME credit constraints and access to informal credit markets in Vietnam. International Journal of Social Economics, 47(6), 787-807. Berger, A. N., & Udell, G. F. (1995). Relationship lending and lines of credit in small firm finance. Journal of business, 351-381. Bose, P., 1998. Formal–informal sector interaction in rural credit markets. Journal of Development Economics, 56(2), pp.265-280. Cuong, L. K., & Hau, H. T. (2020). Does innovation promote access to informal loans? Evidence from a transitional economy. Finance Research Letters, 101718. Freeman, N. J., & Le, B. N. (2007). SME Finance in Vietnam: Reviewing Past Progress and 1239 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Scoping Future Developments. Working Draft of Technical Report. 12th. Hakim, F., & Omri, A. (2009). Does auditor reputation reduce information asymmetry? Evidence from Tunisia. International Journal of Managerial and Financial Accounting, 1(3), 235-247. Hoff, K. & Stiglitz, J. (1994). Some surprising analytics of rural credit subsidies. Mimeo., Department of Economics, University of Maryland Hsu, S., & Li, J. (Eds.). (2009). Informal finance in China: American and Chinese perspectives. Oxford University Press. Karaivanov A., Kessler, A. (2018). (Dis)advantages of informal loans – Theory and evidence, European Economic Review, (102), 100-128 Kim, J. B., Simunic, D. A., Stein, M. T., & Yi, C. H. (2011). Voluntary audits and the cost of debt capital for privately held firms: Korean evidence. Contemporary accounting research, 28(2), 585-615. Le, N. T., Venkatesh, S., & Nguyen, T. V. (2006). Getting bank financing: A study of Viet- namese private firms. Asia Pacific Journal of Management, 23(2), 209-227. McMillan, J., & Woodruff, C. (1999). Interfirm relationships and informal credit in Vietnam. The Quarterly Journal of Economics, 114(4), 1285-1320. MPDF (1997). The Emerging Private Sector and the Industrialization of Vietnam, MPDF Private Sector Discussion Paper No. 1, Hanoi. Mungiru, J. W., & Njeru, A. (2015). Effects of informal finance on the performance of small and medium enterprises in Kiambu County. International Journal of Scientific and Research Publications, 5(11), 338-62. Nderitu, G. P., & Githinji, K. (2015). Debt financing and financial performance of small and medium size enterprises: Evidence from Kenya. Journal of Economics and Accounting, 2 (3), 473-481. Nguyen, N., & Luu, N. (2013). Determinants of financing pattern and access to formal-in- formal credit: the case of small and medium sized enterprises in Viet Nam. Rand, J. (2007). Credit constraints and determinants of the cost of capital in Vietnamese manufacturing. Small Business Economics, 29(1-2), 1-13. Su, J., & Sun, Y. (2011). Informal finance, trade credit and private firm performance. Nankai Business Review International. Tsai, K.S. (2004). Imperfect substitutes: the local political economy of informal finance and microfinance in rural China and India. World Development, 32(9), pp.1487-1507. 1240 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Uzzi, B. (1999). Embeddedness in the making of financial capital: How social relations and networks benefit firms seeking financing. American Sociological Review, 481-505. Wignaraja, G., & Jinjarak, Y. (2015). Why Do SMEs Not Borrow More from Banks? Ev- idence from the People’s Republic of China and Southeast Asia, ADBI Working Paper No. 509. Zhang, G. (2008). The choice of formal or informal finance: Evidence from Chengdu, China. China Economic Review, 19(4), 659-678. 1241 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020

File đính kèm:

tin_dung_phi_chinh_thuc_va_hoat_dong_tai_chinh_cua_doanh_ngh.pdf

tin_dung_phi_chinh_thuc_va_hoat_dong_tai_chinh_cua_doanh_ngh.pdf