The impact of country - Level and fund - Level factors on mutual fund performance in Viet Nam

Purpose – The purpose of this paper is to examine the determinants of mutual funds’ performance at both a country level and a fund level in Vietnam.

Design/methodology/approach – The different types of funds with more than three-year operation are

selected to remove outliers of the stock market boom from 2015 to 2018. The data set includes 54 mutual

funds operating during the period from 2008 until November 2018.

Findings – The research finds that there is a positive relationship between macroeconomics and mutual

funds’ performance. Furthermore, country-level governance such as regulation effectiveness, political

stability, economic growth and financial development has a positive correlation with mutual funds’

performance. However, the impact of fund-level factors is diverse with the no significant impact of board size on mutual fund’s performance, while passive funds perform better than active funds in Vietnam.

Practical implications – The research results suggest that investors should pay attention to the types of

funds and operating expense when making an investment decision in mutual funds. There are some

recommendations for both government policy-makers and the mutual fund industry that are likely to

facilitate the development of this field in Vietnam.

Originality/value – The research contributes to the understanding of what are the factors that should be

considered when investing in mutual funds.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: The impact of country - Level and fund - Level factors on mutual fund performance in Viet Nam

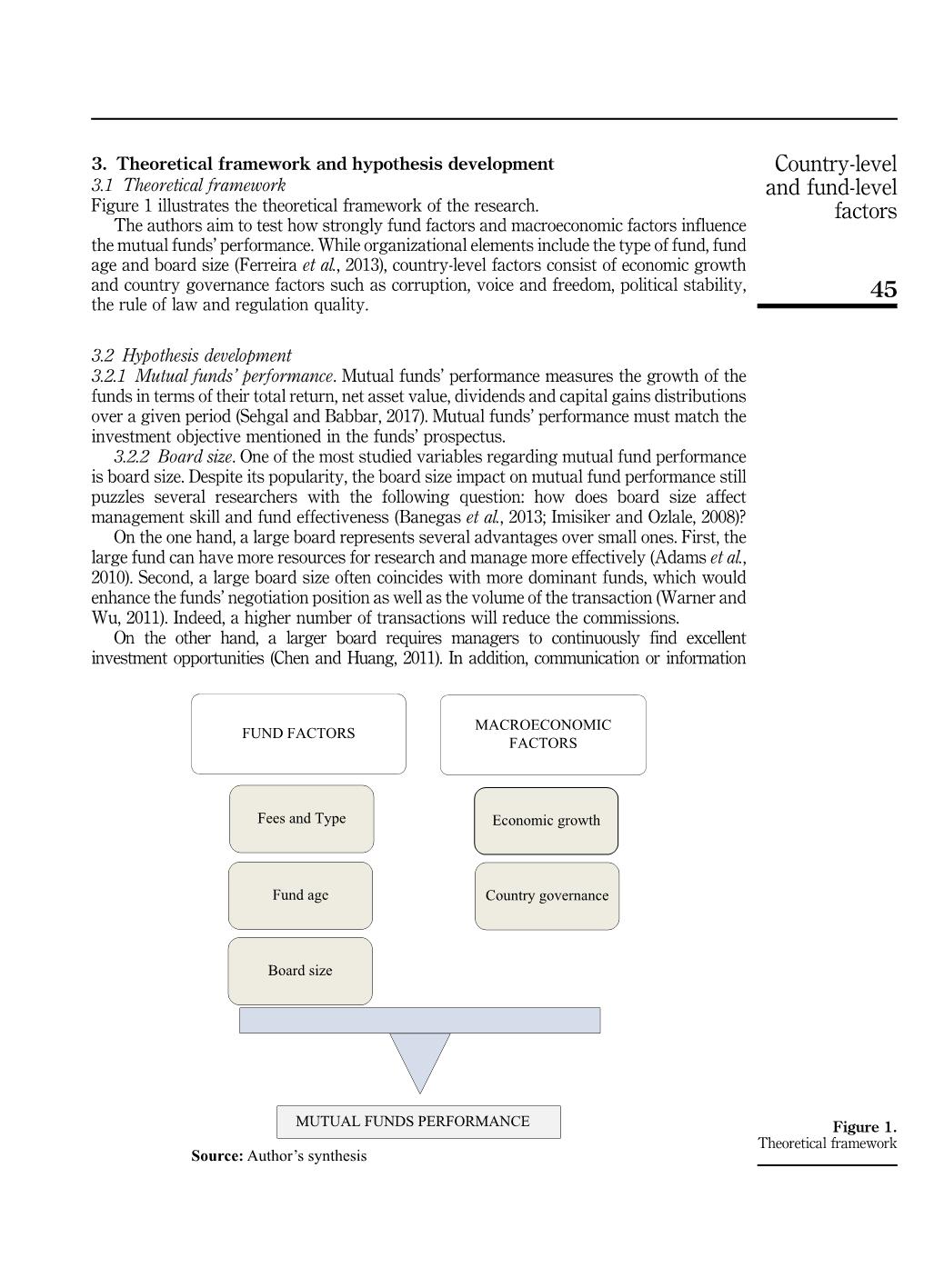

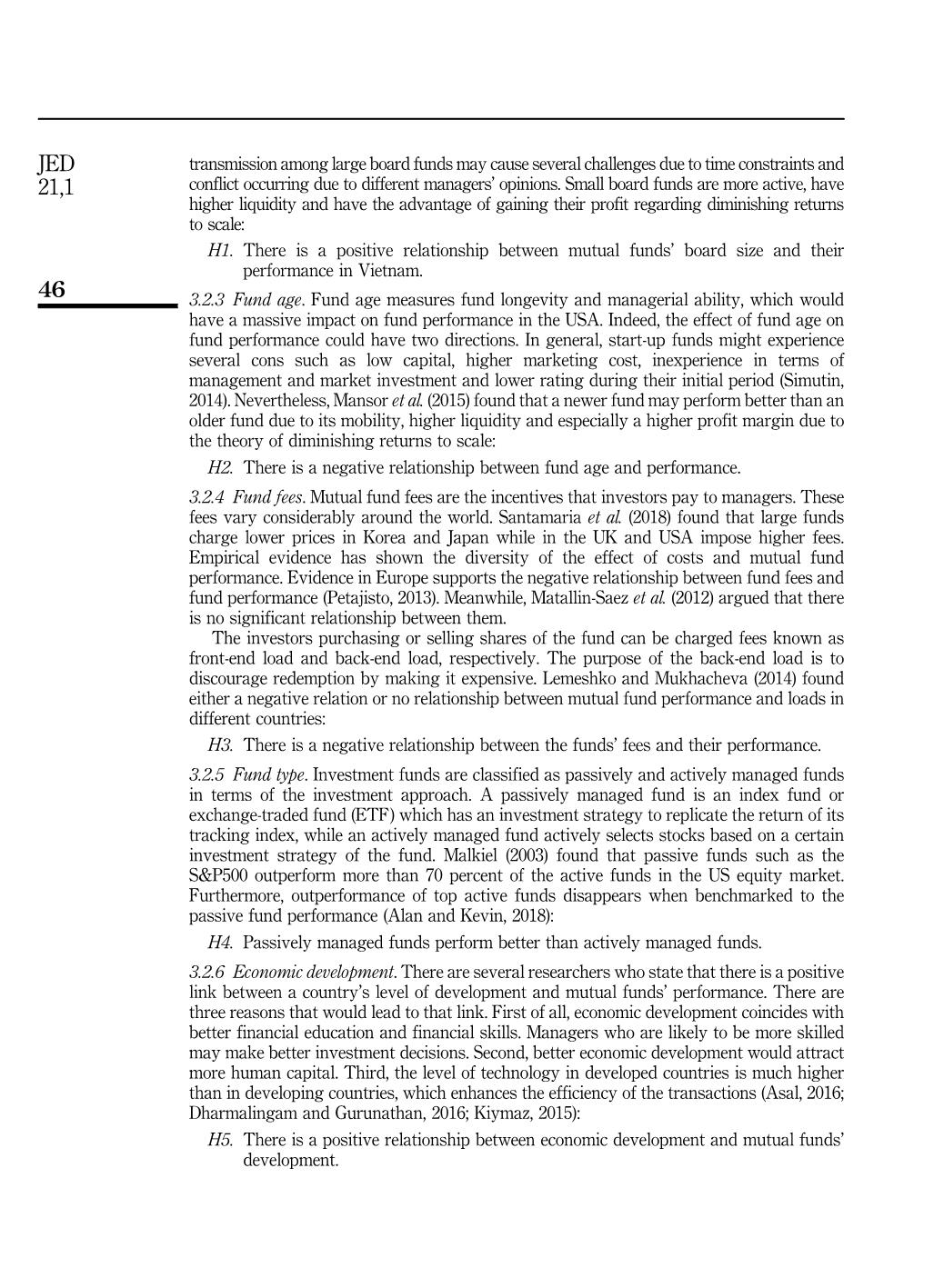

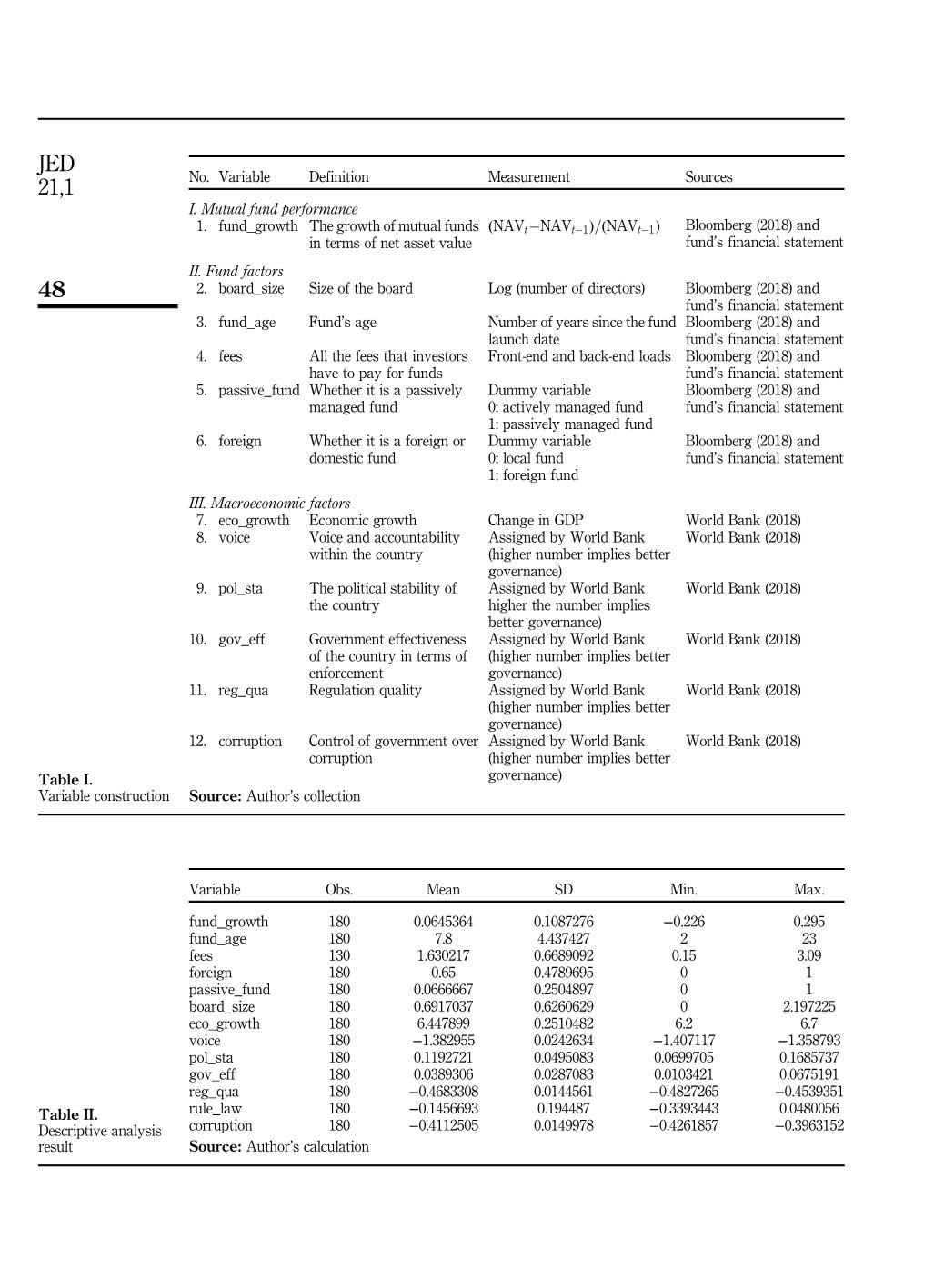

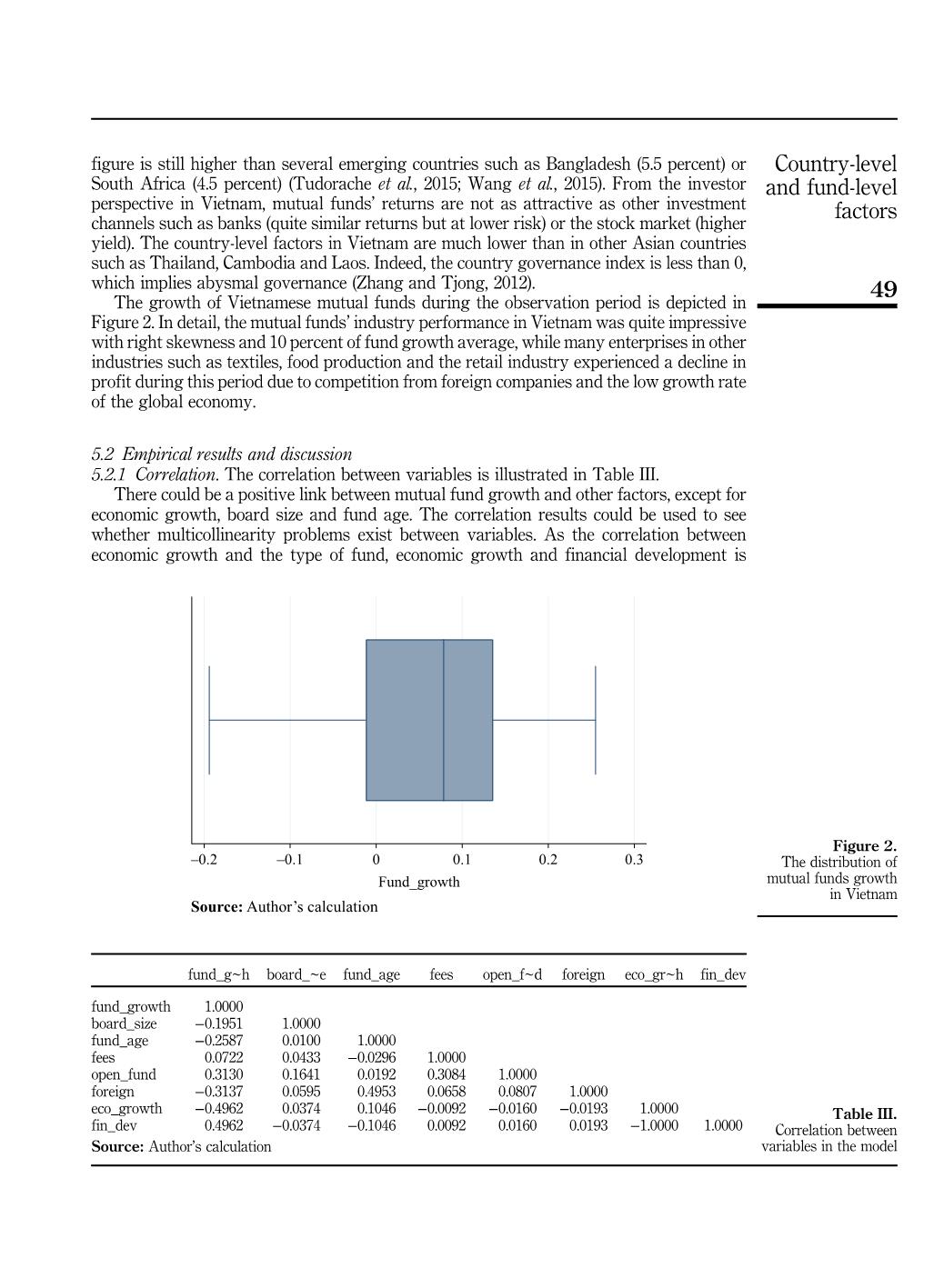

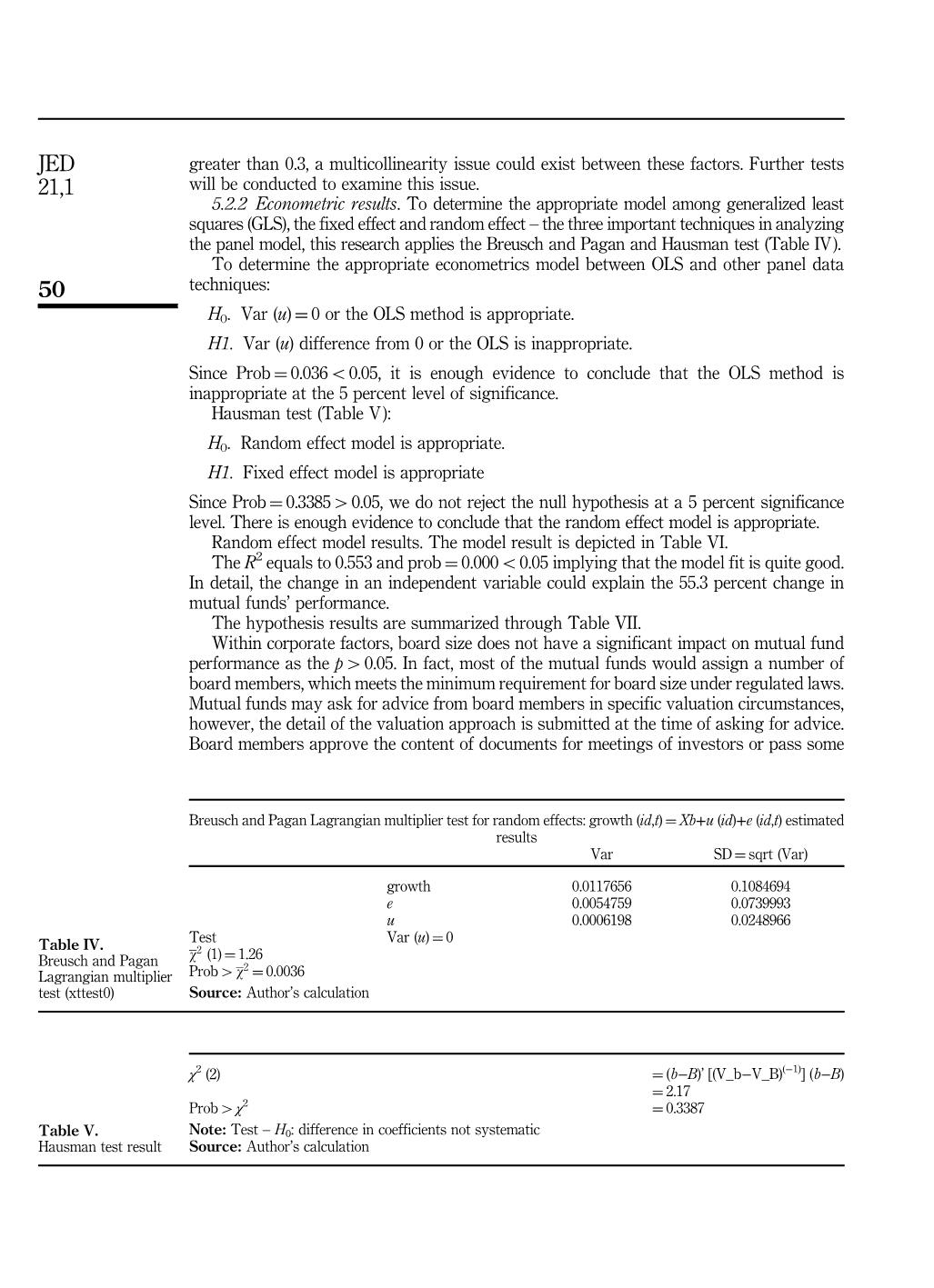

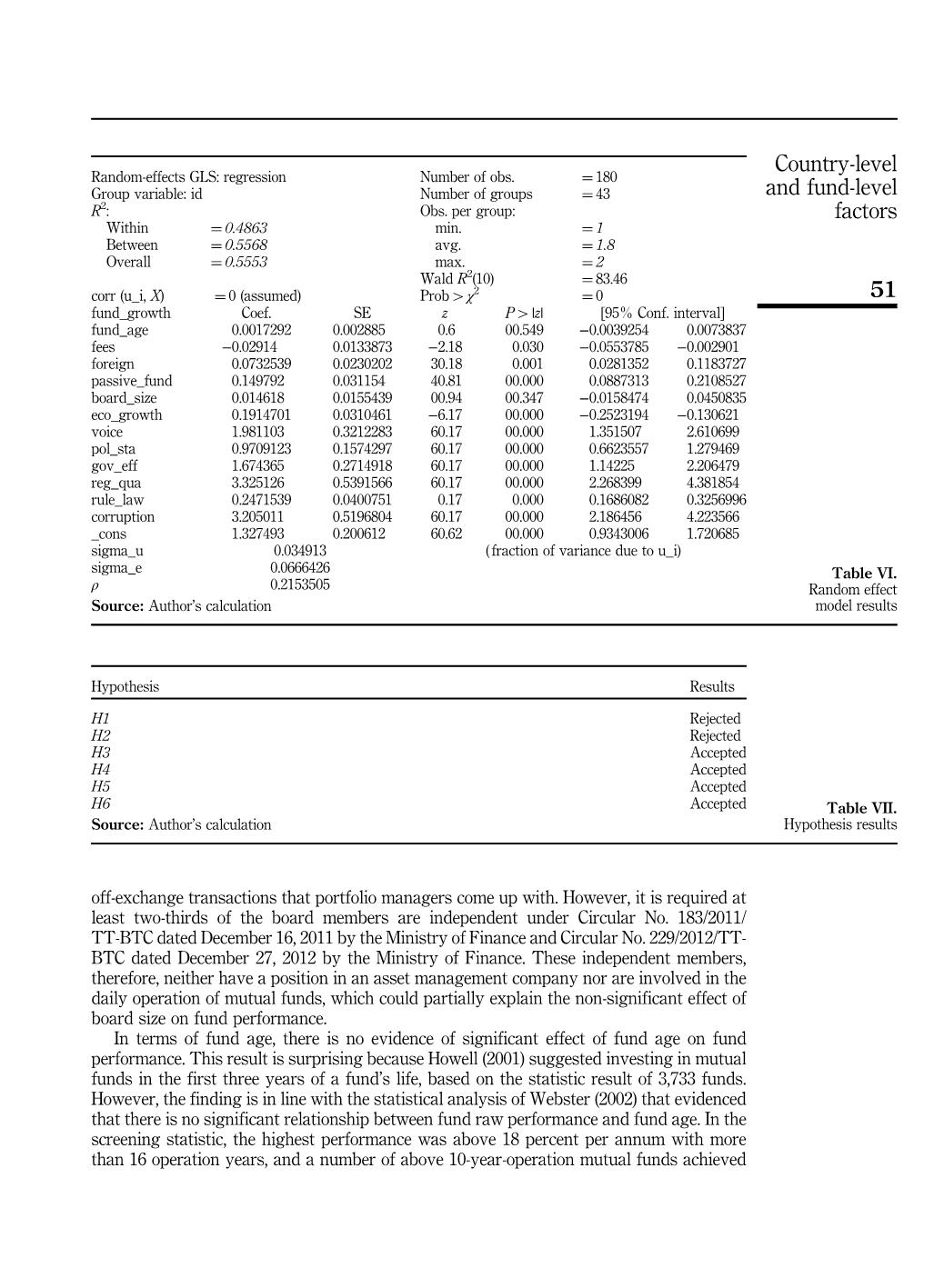

The impact of country-level and fund-level factors on mutual fund performance in Vietnam Hoa Thi Nguyen Fund Operation Department, SSI Asset Management Ltd, Hanoi, Vietnam, and Dung Thi Nguyet Nguyen Faculty of Business Management, Hanoi University of Industry, Hanoi, Vietnam Abstract Purpose – The purpose of this paper is to examine the determinants of mutual funds’ performance at both a country level and a fund level in Vietnam. Design/methodology/approach – The different types of funds with more than three-year operation are selected to remove outliers of the stock market boom from 2015 to 2018. The data set includes 54 mutual funds operating during the period from 2008 until November 2018. Findings – The research finds that there is a positive relationship between macroeconomics and mutual funds’ performance. Furthermore, country-level governance such as regulation effectiveness, political stability, economic growth and financial development has a positive correlation with mutual funds’ performance. However, the impact of fund-level factors is diverse with the no significant impact of board size on mutual fund’s performance, while passive funds perform better than active funds in Vietnam. Practical implications – The research results suggest that investors should pay attention to the types of funds and operating expense when making an investment decision in mutual funds. There are some recommendations for both government policy-makers and the mutual fund industry that are likely to facilitate the development of this field in Vietnam. Originality/value – The research contributes to the understanding of what are the factors that should be considered when investing in mutual funds. Keywords Macroeconomic factors, Investment decision, Fund performance, Determinants of performance Paper type Research paper 1. Introduction The growth of mutual funds has been considerable in recent years, which has been influenced by the financial market integration around the world. In detail, the total amount of financial assets managed by the global mutual fund industry reached nearly $30 trillion in 2017, nearly double the total assets of $14 trillion in 2013 (Champagne et al., 2018). At the moment, approximately 20,000 funds are operating around the world, with more than 9,321 funds in the USA and 1,324 funds in the UK (Foran and O’Sullivan, 2014; Ro and Gallimore, 2014). The trade volume of mutual funds around the world contributes significantly to economic development and provides financial liquidity and profit for investors (Champagne et al., 2018). Mutual funds in Vietnam have increased significantly in size and trading value since the first investment fund in 1991, to more than 130 funds in 2018. According to the State Securities Committee (2018), the total assets under management of onshore investment funds are more than 208,000bn Vietnamese Dong (VND), which doubles the size of 2016. During the Journal of Economics and Development Vol. 21 No. 1, 2019 pp. 42-56 Emerald Publishing Limited e-ISSN: 2632-5330 p-ISSN: 1859-0020 DOI 10.1108/JED-06-2019-0007 Received 12 December 2018 Revised 10 May 2019 Accepted 15 June 2019 The current issue and full text archive of this journal is available on Emerald Insight at: www.emeraldinsight.com/2632-5330.htm © Hoa Thi Nguyen and Dung Thi Nguyet Nguyen. Published in Journal of Economics and Development. Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article ( for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at licences/by/4.0/legalcode 42 JED 21,1 following period, Vietnamese mutual funds will experience several advantages because of the positive signs within the economy. One of the pros for Vietnamese mutual funds is that the low nominal interest in the banking system would encourage available funds from the society to transfer to other investment channels, which offer a higher interest rate such as investing through a mutual fund (Ban, 2015). According to General Statistics Office of Vietnam (2018), average income in Vietnam has increased steadily from $2,150 in 2015 to $2,385 in 2017, and is expected to continuously rise during the next period, thanks to several free trade agreements such as ASEAN Free Trade Area, Vietnam – European Union (EU) and the Industrial Revolution 4.0. However, it is inevitable that the mutual fund industry around the world will face several disadvantages due to global economy uncertainty such as the trade war between the USA and China, which will have remarkably negative impact on global economic development in general, and Vietnamese mutual funds in particular (Champagne et al., 2018; Ercolani et al., 2018; P ... on quality and corruption control have the highest impact compared to the others. This is understandable because regulating laws have a number of fixed rules on investments as well as on operation activities, such as a minimum number of investments and the cap rate for investing in a specific company and related parties, under Circular No. 183/2011/TT-BTC dated December 16, 2011 by the Ministry of Finance and Circular No. 229/2012/TT-BTC dated December 27, 2012 by the Ministry of Finance. This affects directly investment opportunities and fund performance. Therefore, the authors have come up with some suggestions to not only improve the investment environment for mutual funds, but also make the mutual funds become a more competitive alternative investment for investors besides traditional channels. First of all, easing investment restrictions on unlisted assets is necessary to open more investment opportunities for mutual funds. Currently, requirements for investing in unlisted securities are strict and hard to meet. To be passed as an unlisted deal by supervisory banks, mutual funds must provide official documents to prove that an unlisted company will be listed within the next 12 months. The official documents are defined differently based on the interpretation of related supervisory banks. Generally, the process for investing unlisted deals is time-consuming, and sometimes mutual funds are unable to go further with the deals due to their own supervisory bank regulations. Second, the government should encourage more custodian banks to enter the mutual fund market. Currently, there are only two entities that provide services for custody and supervision for domestic funds. This narrows the options of mutual funds and makes service fees uncompetitive. Services fee paid to supervisory banks and custodian banks usually account for more or less than 1 percent of total assets under management per annum, twice the management fee for bond or index funds of most asset management companies in the Vietnamese stock market, and it becomes the highest fee in operation of those bond and index funds. Therefore, the government should pay more attention to regulation quality and control over corruption in Vietnam. 5.2.3 Model validity. The first requirement when running an econometrics model is the normality of the variables. As shown in Figure 3, it can be seen that the main variables have a normal distribution. Breusch–Pagan/Cook–Weisberg test for heteroskedasticity (Table VIII): H0. There is constant variance. 52 JED 21,1 H1. The variance is not constant. Since p¼ 0.3078W0.05, there is not enough evidence to reject the null hypothesis at a 5 percent level or the variance is constant. Autocorrelation (Table IX): H0. There is no serial correlation. H1. There is a serial correlation within the model. Since p-value¼ 0.5892W0.05, there is not enough evidence to reject the null hypothesis at a 5 percent level or the model does not have a serial correlation issue. Multicollinearity (Table X). As the mean of variance inflation factors (VIF) is less than 10, there is no multicollinearity issue within the model in general. However, the voice of citizens 0 5 10 0 20 40 60 Fund_growth 0 50 0 20 40 Fund_expense 0 0.1 0 20 40 60 Fund_age 0 0.2 0.4 –5 15 35 55 Board_size Source: Author’s calculation Figure 3. The distribution of the main variables H0: Constant variance Variables: fitted values of growth χ2 (1) ¼ 1.04 ProbWχ2 ¼ 0.3078 Source: Author’s calculation Table VIII. Heteroskedasticity test result Breusch–Godfrey LM test for autocorrelation lags(p) χ2 df ProbWχ2 1 0.292 1 0.5892 H0: no serial correlation Source: Author’s calculation Table IX. Autocorrelation test result Variable VIF 1/VIF voice 16.35 0.061178 board_size 9.73 0.102759 age 6.12 0.16343 open_fund 4.39 0.227705 foreign_fund 3.15 0.317495 Mean VIF 7.95 Source: Author’s calculation Table X. Multicollinearity test result 53 Country-level and fund-level factors may experience this problem due to the high correlation with other country-level factors. Nevertheless, this is not a huge problem when running an econometrics model in the field of finance. 6. Conclusion Using a sample of 54 mutual funds in Vietnam from 2008 to November 2018, this study investigates the determinants of mutual fund performance such as country-level and fund-level factors. The effects of fund-level factors play an essential role in explaining mutual fund performance. Passive funds appear to have better performance than the active ones while higher expenses cause negative effects on performance. In addition, there is no significant difference between mutual funds managed by large boards and small boards. There is also an asymmetry in the fund performance–age relation within the mutual fund industry in Vietnam. Beyond fund characteristics, country governance could explain more regarding its impact on mutual fund performance in Vietnam. Indeed, there is a positive relationship between a country level of financial development and mutual fund performance. Stronger legal institutions with better investor protection and rigorous law enforcement would enhance funds’ performance. Regarding the absolute value of the economic effect, regulation quality is essential in explaining mutual fund performance in Vietnam. In order to enhance mutual fund industry performance, the government should pay more attention to regulation quality as it plays the most important role in explaining changes in mutual funds’ performance. There are some limitations to this study. First of all, the sample size is relatively small with only 54 mutual funds during the last 10 years. Second, the number of directors who have no material benefit (except for the sitting fees) with the funds would be incorrect due to the complicated relationship between board members within mutual funds as well as the high degree of corruption in Vietnam. The mutual funds in Vietnam often disclose their information annually or semi-annually rather than monthly, which also hinders the analysis result regarding the impact of seasonality on fund performance. References Adams, J.C., Mansi, S.A. and Nishikawa, T. (2010), “Internal governance mechanisms and operational performance: evidence from index mutual funds”, Review of Financial Studies, Vol. 23 No. 3, pp. 1261-1286. Alan, D.C. and Kevin, C. (2018), “Passive versus active fund performance: do index funds have skill?”, Journal of Financial and Quantitative Analysis, Vol. 53 No. 1, pp. 33-64, doi: 10.1017/s00221090 17000904. Angelidis, T., Giamouridis, D. and Tessaromatis, N. (2013), “Revisiting mutual fund performance evaluation”, Journal of Banking and Finance, Vol. 37 No. 5, pp. 1759-1776. Asal, M. (2016), “Testing for the presence of skill in Swedish mutual fund performance: evidence from a bootstrap analysis”, Journal of Economics and Business, Vol. 88, pp. 22-35. Ayadi, M.A., Chaibi, A. and Kryzanowski, L. (2016), “Performance of Canadian hybrid mutual funds”, North American Journal of Economics and Finance, Vol. 38, pp. 124-147. Ban, J. (2015), “Effects of sales expenses and management expenses on mutual fund performance and flows”, Asia-Pacific Journal of Financial Studies, Vol. 44 No. 1, pp. 129-173. Banegas, A., Gillen, B., Timmermann, A. and Wermers, R. (2013), “The cross section of conditional mutual fund performance in European stock markets”, Journal of Financial Economics, Vol. 108 No. 3, pp. 699-726. Barras, L., Scaillet, O. and Wermers, R. (2010), “False discoveries in mutual fund performance: measuring luck in estimated Alphas”, The Journal of Finance, Vol. 65 No. 1, pp. 179-216. 54 JED 21,1 Berkowitz, J.P., Schorno, P.J. and Shapiro, D.A. (2017), “Characteristics of mutual funds with extreme performance”, Review of Financial Economics, Vol. 34, pp. 50-60. Bialkowski, J. and Otten, R. (2011), “Emerging market mutual fund performance: evidence for Poland”, North American Journal of Economics and Finance, Vol. 22 No. 2, pp. 118-130. Bloomberg (2018), “Mutual funds with geographic investment in Viet Nam”, available at: www. bloomberg.com/markets/stocks (accessed October 30, 2018). Champagne, C., Karoui, A. and Patel, S. (2018), “ ‘Portfolio turnover activity and mutual fund performance”, Managerial Finance, Vol. 44 No. 3, pp. 326-356. Chen, C.R. and Huang, Y. (2011), “Mutual fund governance and performance: a quantile regression analysis of Morningstar’s Stewardship Grade”, Corporate Governance-an International Review, Vol. 19 No. 4, pp. 311-333. Cuthbertson, K., Nitzsche, D. and O’Sullivan, N. (2012), “False discoveries in UK mutual fund performance”, European Financial Management, Vol. 18 No. 3, pp. 444-463. Dharmalingam, N. and Gurunathan, K.B. (2016), “Performance of monthly income scheme in mutual fund industry in India”, Global Journal of Management and Business Research: C Finance, Vol. 16 No. 7, pp. 50-58. Ercolani, M.G., Pouliot, W. and Ercolani, J.S. (2018), “Luck versus skill over time: time-varying performance in the cross-section of mutual fund returns”, Applied Economics, Vol. 50 Nos 34/35, pp. 3686-3701. Fama, E.F. and Eugene, F. (1972), “Components of investment performance”, Journal of Finance, Vol. 27, pp. 551-567. Fama, E.F. and French, K.R. (2010), “Luck versus skill in the cross-section of mutual fund returns”, The Journal of Finance, Vol. 65 No. 5, pp. 1915-1947. Ferreira, M.A., Keswani, A., Miguel, A.F. and Ramos, S.B. (2013), “The determinants of mutual fund performance: a cross-country study”, Review of Finance, Vol. 17 No. 2, pp. 483-525, doi: 10.1093/rof/rfs013. Foran, J. and O’Sullivan, N. (2014), “Liquidity risk and the performance of UK mutual funds”, International Review of Financial Analysis, Vol. 35, pp. 178-189. General Statistics Office of Vietnam (2018), “Press release of the socio-economic situation in 2017”, General Statistics Office of Vietnam, Hanoi. Howell, M.J. (2001), “Fund age and performance”, The Journal of Alternative Investments, Vol. 4 No. 2, pp. 57-60, doi: 10.3905/jai.2001.319011. Imisiker, S. and Ozlale, U. (2008), “Assessing selectivity and market timing performance of mutual funds for an emerging market”, Emerging Markets Finance and Trade, Vol. 44 No. 2, pp. 87-99. Kiymaz, H. (2015), “A performance evaluation of Chinese mutual funds”, International Journal of Emerging Markets, Vol. 10 No. 4, pp. 820-836. Lemeshko, O. and Mukhacheva, G. (2014), “Emerging markets mutual funds performance evaluation: evidence from the central and Eastern Europe”, Political Sciences, Law, Finance, Economics and Tourism, Vol. 2, pp. 241-248. Liu, Y., Miletkov, M.K., Wei, Z. and Yang, T. (2015), “Board independence and firm performance in China”, Journal of Corporate Finance, Vol. 30, pp. 223-244. Malkiel, B.G. (2003), “Passive investment strategies and efficient markets”, European Financial Management, Vol. 9 No. 1, pp. 1-10. Mansor, F., Bhatti, M.I. and Ariff, M. (2015), “New evidence on the impact of fees on mutual fund performance of two types of funds”, Journal of International Financial Markets Institutions and Money, Vol. 35, pp. 102-115. Matallin-Saez, J.C., Soler-Dominguez, A. and Tortosa-Ausina, E. (2012), “Mutual fund performance: banking versus independent managers”, Applied Economics Letters, Vol. 19 No. 8, pp. 755-758. 55 Country-level and fund-level factors Moreno, D., Rodriguez, R. andWang, C. (2014), “Accurately measuring gold mutual fund performance”, Applied Economics Letters, Vol. 21 No. 4, pp. 268-271. Nanigian, D. (2018), “What matters in ETF selection?”, Proceedings of Academic Research Colloquium for Financial Planning and Related Disciplines, the CFP Board Center for Financial Planning, Washington, DC, February 21. Otero, L.A. and Reboredo, J.C. (2018), “The performance of precious-metal mutual funds: does uncertainty matter?”, International Review of Financial Analysis, Vol. 57, pp. 13-22. Parida, S. and Teo, T. (2018), “The impact of more frequent portfolio disclosure on mutual fund performance”, Journal of Banking and Finance, Vol. 87, pp. 427-445. Petajisto, A. (2013), “Active share and mutual fund performance”, Financial Analysts Journal, Vol. 69 No. 4, pp. 73-93. Pouliot, W. (2016), “Robust tests for change in intercept and slope in linear regression models with application to manager performance in the mutual fund industry”, Economic Modelling, Vol. 58, pp. 523-534. Ro, S. and Gallimore, P. (2014), “Real estate mutual funds: herding, momentum trading and performance”, Real Estate Economics, Vol. 42 No. 1, pp. 190-222. Santamaria, T.C., de Ibarreta, C.M. and Calvo, J.R. (2018), “Timid performance fees in mutual funds”, Journal of Asset Management, Vol. 19 No. 1, pp. 64-77. Sehgal, S. and Babbar, S. (2017), “Evaluating alternative performance benchmarks for Indian mutual fund industry”, Journal of Advances in Management Research, Vol. 14 No. 2, pp. 222-250. Simutin, M. (2014), “Cash holdings and mutual fund performance”, Review of Finance, Vol. 18 No. 4, pp. 1425-1464. State Securities Committee (2018), “Report on mutual fund industry”, State Securities Committee, Hanoi. Tudorache, F.G., Nicolescu, L. and Lupu, R. (2015), “Evolution of mutual funds in Romania: performance and risks”, Romanian Journal of Economic Forecasting, Vol. 18 No. 4, pp. 180-197. Wang, C.P., Huang, H.H. and Chen, C.Y. (2015), “‘Does past performance affect mutual fund tracking error in Taiwan?”, Applied Economics, Vol. 47 No. 51, pp. 5476-5490. Warner, J.B. and Wu, J.S. (2011), “Why do mutual fund advisory contracts change? Performance, growth, and spillover effects”, Journal of Finance, Vol. 66 No. 1, pp. 271-306. Webster, D. (2002), “Mutual fund performance and fund age”, working paper, SSRN Electronic Journal, available at: (accessed January 1, 2002). Wermers, R. (2011), “Performance measurement of mutual funds, hedge funds, and institutional accounts”, Annual Review of Financial Economics, Vol. 3 No. 3, pp. 537-574. World Bank (2018), “Data catalog”, available at: https://datacatalog.worldbank.org (accessed October 30, 2018). Yermack, D. (1996), “Higher market valuation of companies with a small board of directors”, Journal of Financial Economics, Vol. 40 No. 2, pp. 185-211. Zhang, Y. and Tjong, A. (2012), “Evaluating performance of Chinese and Japanese mutual funds’ listed in NASDAQ stock exchange”, 19th Annual Conference Proceedings of International Conference on Management Science & Engineering, Dallas, TX, pp. 1326-1335. Corresponding author Hoa Thi Nguyen can be contacted at: alice.hoani@gmail.com For instructions on how to order reprints of this article, please visit our website: www.emeraldgrouppublishing.com/licensing/reprints.htm Or contact us for further details: permissions@emeraldinsight.com 56 JED 21,1

File đính kèm:

the_impact_of_country_level_and_fund_level_factors_on_mutual.pdf

the_impact_of_country_level_and_fund_level_factors_on_mutual.pdf