Tax compliance of small and medium enterprises: A case study in Thua Thien Hue

Abstract. Tax compliance is the concern of many researchers and tax managers. Based on secondary data

from tax authorities and primary data collected from 362 small and medium enterprises (SMEs), we assess

the tax compliance of small and medium enterprises. Descriptive statistics and one-way analysis of

variance are used to analyse the data. The results show that SMEs receive various types of support to

enhance their tax compliance. Further, both secondary and primary data indicate that SMEs have an

adequate level of tax compliance. However, there are differences among sectors concerning tax declaration

assessment. Based on these results, we discuss and propose several managerial and policy measures to

improve SMEs’ tax compliance.

Keywords: tax compliance, small and medium enterprises, tax declaration assessment, managerial and

policy measures

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Tax compliance of small and medium enterprises: A case study in Thua Thien Hue

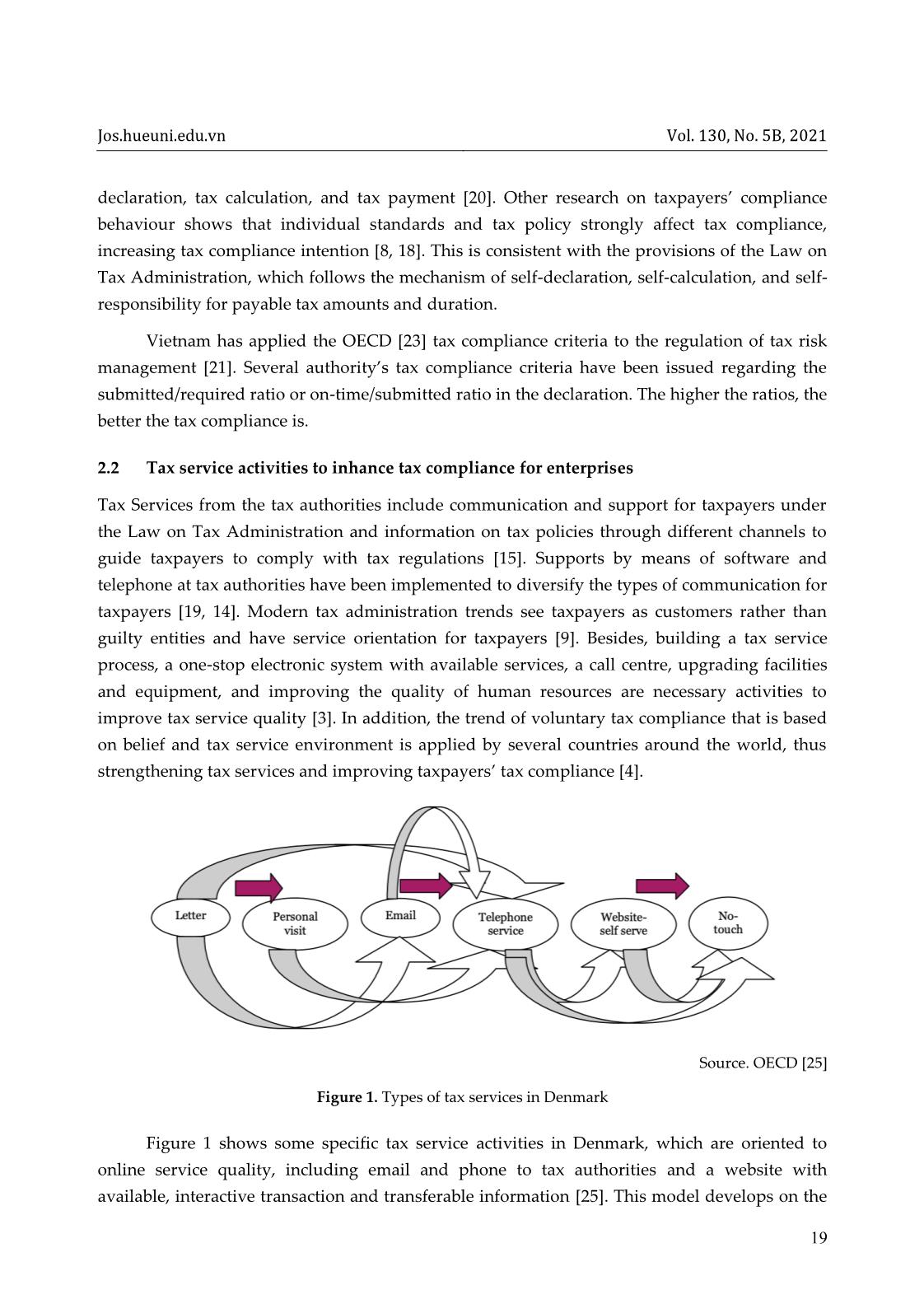

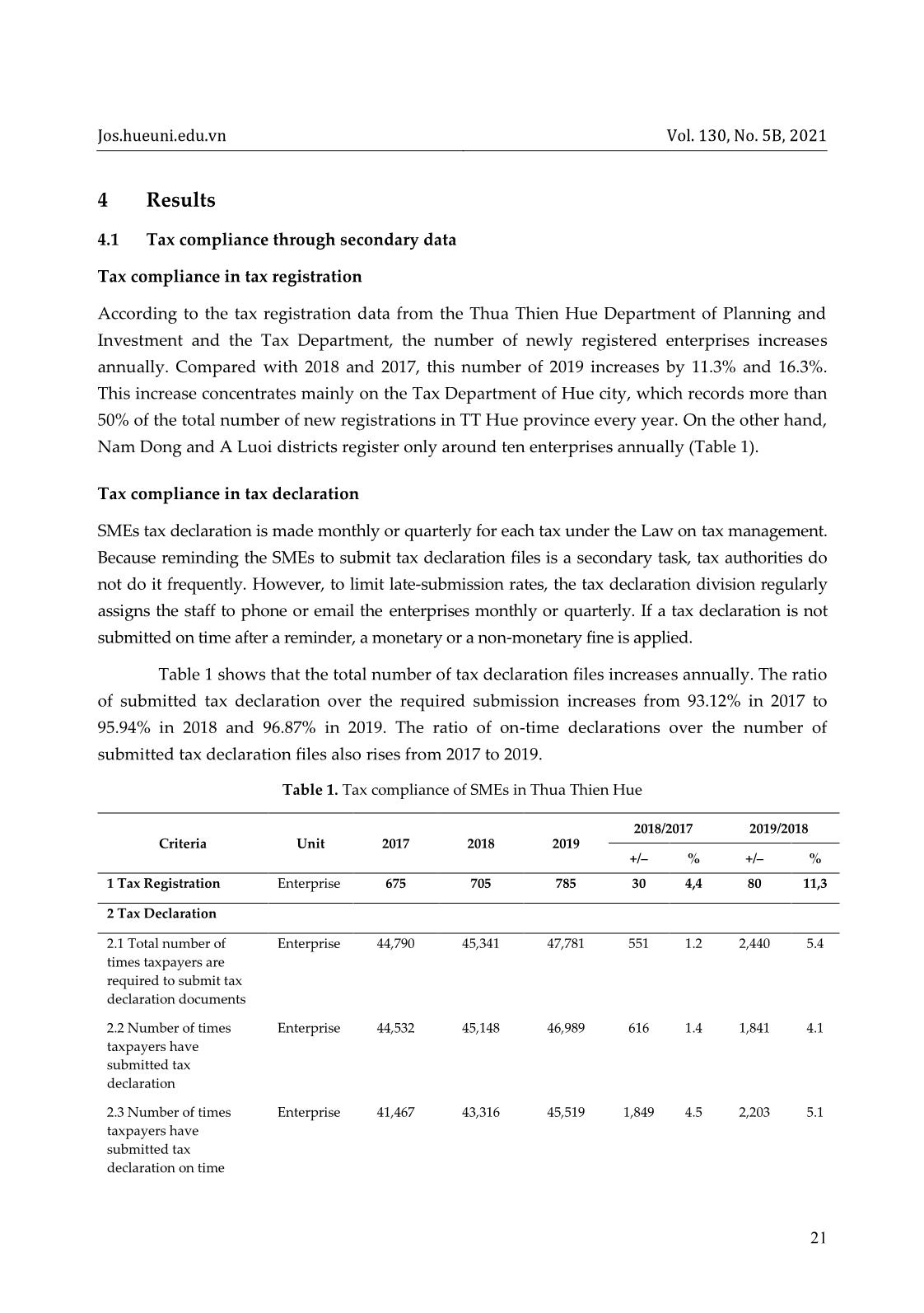

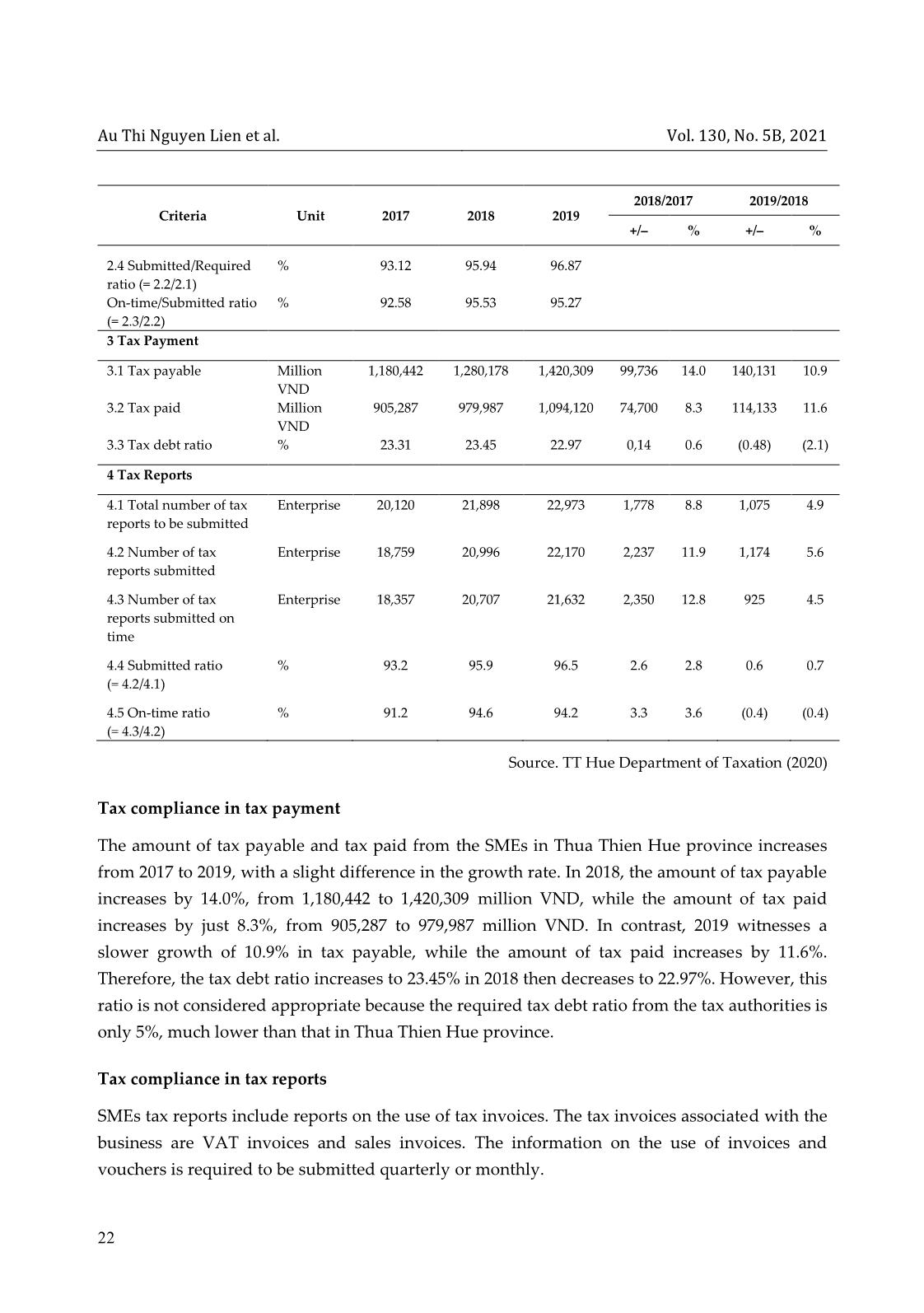

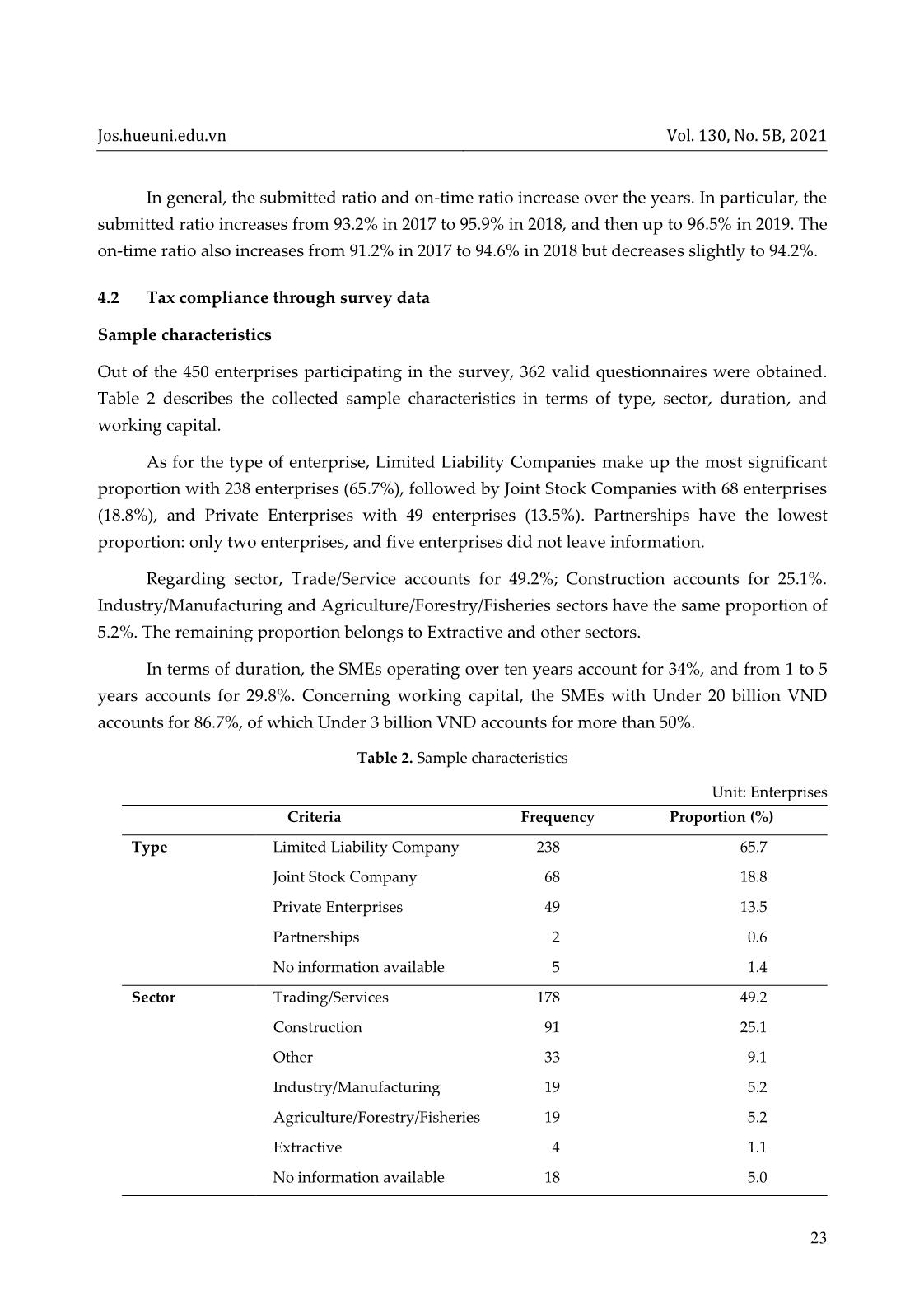

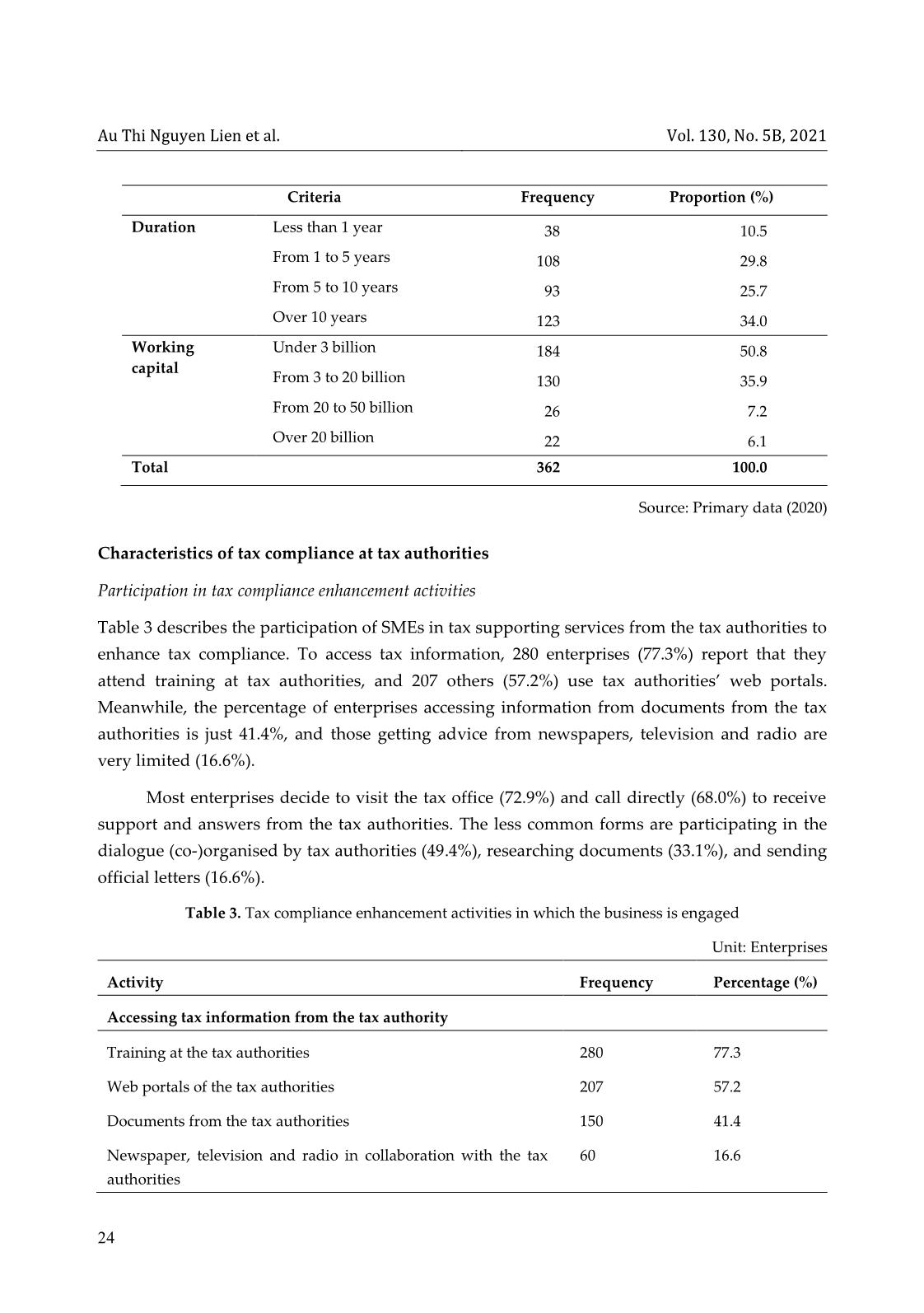

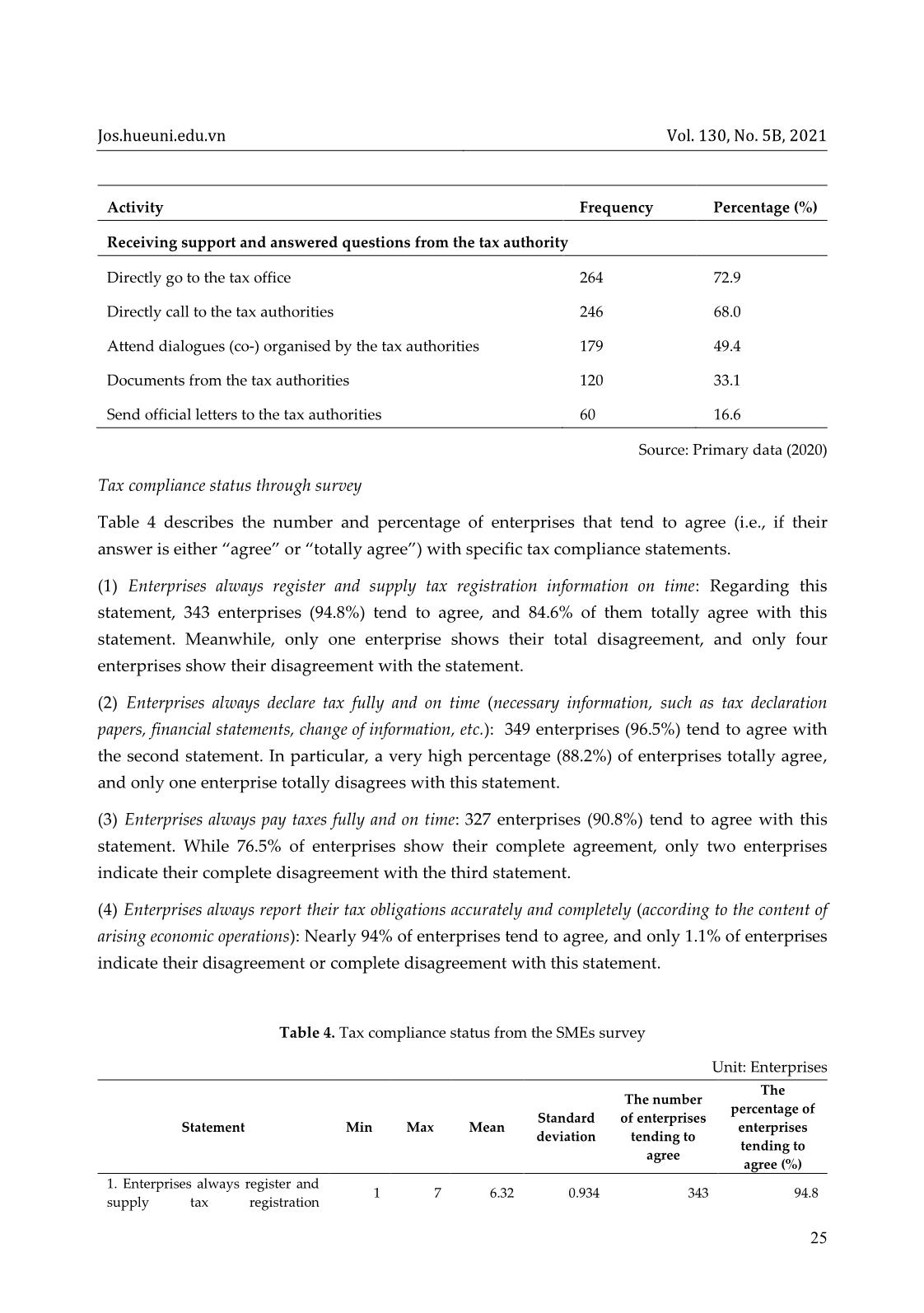

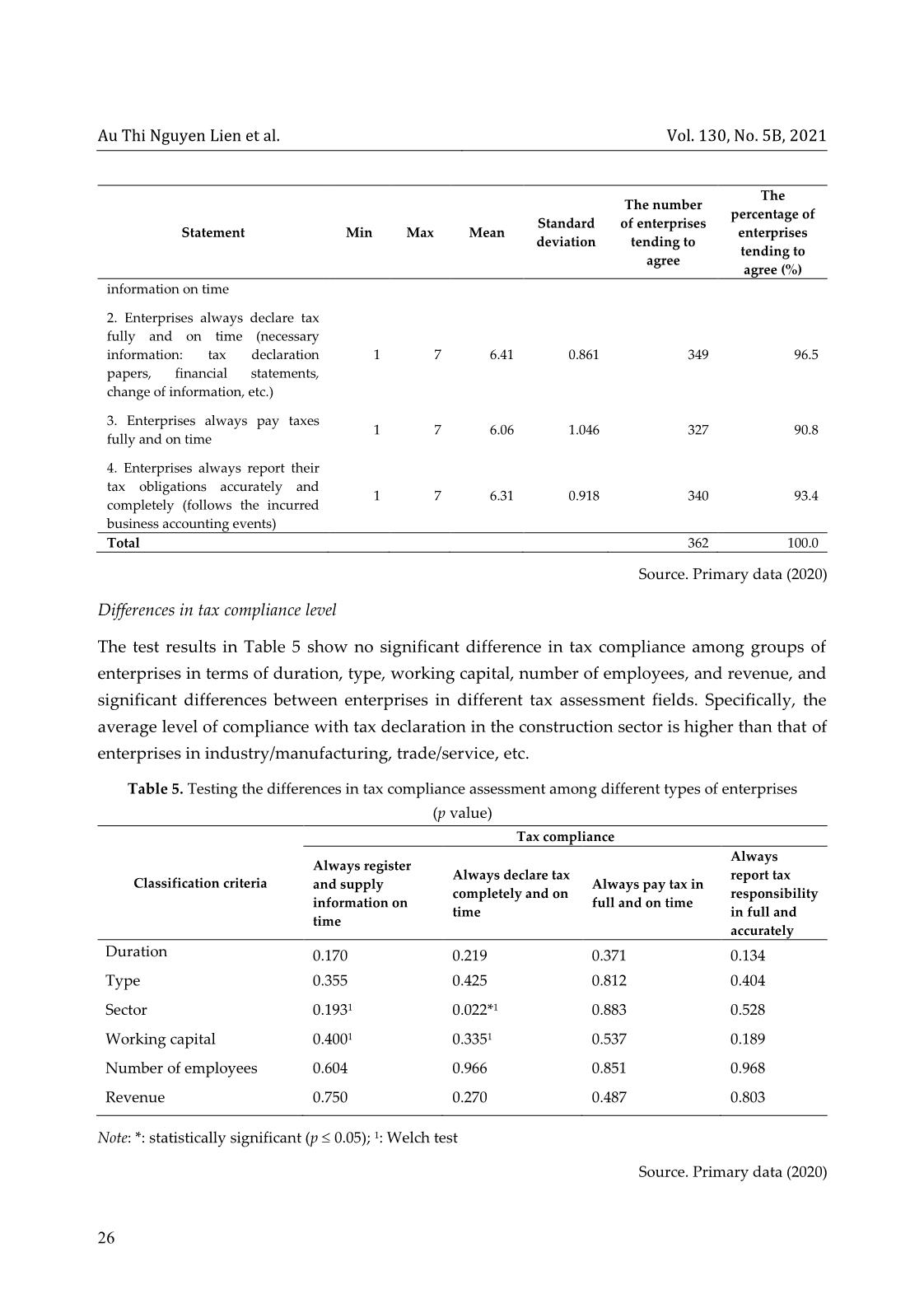

Hue University Journal of Science: Economics and Development pISSN 2588-1205; eISSN 2615-9716 Vol. 130, No. 5B, 2021, pp. 17–30; DOI: 10.26459/hueunijed.v130i5B.6273 * Corresponding: atnlien@hueuni.edu.vn Submitted: April 1, 2021; Revised: April 13, 2021; Accepted: April 17, 2021 TAX COMPLIANCE OF SMALL AND MEDIUM ENTERPRISES: A CASE STUDY IN THUA THIEN HUE Au Thi Nguyet Lien*, Hoang Trong Hung, Nguyen Dang Hao, Tran Duc Tri University of Economics, Hue University, 99 Ho Dac Di St., Hue, Vietnam Abstract. Tax compliance is the concern of many researchers and tax managers. Based on secondary data from tax authorities and primary data collected from 362 small and medium enterprises (SMEs), we assess the tax compliance of small and medium enterprises. Descriptive statistics and one-way analysis of variance are used to analyse the data. The results show that SMEs receive various types of support to enhance their tax compliance. Further, both secondary and primary data indicate that SMEs have an adequate level of tax compliance. However, there are differences among sectors concerning tax declaration assessment. Based on these results, we discuss and propose several managerial and policy measures to improve SMEs’ tax compliance. Keywords: tax compliance, small and medium enterprises, tax declaration assessment, managerial and policy measures 1 Introduction Tax compliance has attracted the attention of tax managers and researchers in recent years. Most countries have developed general compliance strategies for managing tax effectively and efficiently. The Organisation for Economic Co-operation and Development (OECD) believes that the private sector plays a critical role in economic growth and development [22, 28]. However, tax evasion and tax non-compliance still exist and cause some risks for tax administration and the state budget. Therefore, domestic and international tax authorities need to spend considerable resources to ensure fairness. One of the biggest challenges for tax compliance is high compliance cost, even though numerous enterprises want to comply [27]. This challenge comes from a flawed tax system and an inadequate understanding of the tax system. Therefore, it is urgent to create a favourable environment and modern and straightforward tax management to facilitate small and medium-sized enterprises (SMEs) to carry out production and business. By the end of 2019, Thua Thien Hue province had 6,500 enterprises, of which 4,568 were SMEs. SMEs contributed VND 1,094 billion to the state budget revenue from enterprises (equivalent to 27.32%) [3] and created over 36,986 jobs (equivalent to 41.01%) of the total number of employees working in enterprises. The present reality shows that enterprises have Au Thi Nguyen Lien et al. Vol. 130, No. 5B, 2021 18 difficulties understanding and complying with tax policies, mainly due to the lack of legal knowledge [7]. Besides, businesses often face challenges in implementing tax policies and administrative procedures. Although various enterprises want to comply voluntarily, they do not have enough information to conform to regulatory procedures [26]. The inspection and examination from tax authorities reveal that the number of enterprises that declare tax rates, withhold and pay tax incorrectly increases annually. Such violation includes late tax payment and no tax payment, which lead to a large amount of tax arrears, administrative penalties for tax and late fines payment [10–12]. Indeed, although tax authorities in recent years have offered tax service programs to support businesses to implement tax compliance [34, 35], the improvement in tax compliance of enterprises is insignificant in terms of tax fines. In recent years, there have been numerous studies focusing on tax compliance of individuals [1], tax costs [5], taxpayer characteristics [29, 31, 32], tax audits [13], and the complexity of tax policy [31]. However, a few enterprises’ tax compliance studies have been conducted [5, 6]. Moreover, these studies focused only on a particular type of tax (e.g., income tax) or concentrated on influencing factors of tax compliance. To the best of our knowledge, no research explores the support activities to enhance SMEs’ tax compliance and assesses SMEs’ tax compliance from both objective and subjective perspectives. This study, therefore, seeks to answer the following two questions. 1. What are the primary support activities to enhance SMEs’ tax compliance? 2. What is the level of tax compliance among SMEs in Thua Thien Hue? Are there any differences in the level of tax compliance among SME categories? 2 Literature review 2.1 Tax compliance Tax compliance is an essential topic for numerous tax authorities to convince taxpayers to do their duty. Song and Yarbrough [33] indicate that tax compliance is taxpayers’ ability and willingness to comply wi ... radio are very limited (16.6%). Most enterprises decide to visit the tax office (72.9%) and call directly (68.0%) to receive support and answers from the tax authorities. The less common forms are participating in the dialogue (co-)organised by tax authorities (49.4%), researching documents (33.1%), and sending official letters (16.6%). Table 3. Tax compliance enhancement activities in which the business is engaged Unit: Enterprises Activity Frequency Percentage (%) Accessing tax information from the tax authority Training at the tax authorities 280 77.3 Web portals of the tax authorities 207 57.2 Documents from the tax authorities 150 41.4 Newspaper, television and radio in collaboration with the tax authorities 60 16.6 Jos.hueuni.edu.vn Vol. 130, No. 5B, 2021 25 Activity Frequency Percentage (%) Receiving support and answered questions from the tax authority Directly go to the tax office 264 72.9 Directly call to the tax authorities 246 68.0 Attend dialogues (co-) organised by the tax authorities 179 49.4 Documents from the tax authorities 120 33.1 Send official letters to the tax authorities 60 16.6 Source: Primary data (2020) Tax compliance status through survey Table 4 describes the number and percentage of enterprises that tend to agree (i.e., if their answer is either “agree” or “totally agree”) with specific tax compliance statements. (1) Enterprises always register and supply tax registration information on time: Regarding this statement, 343 enterprises (94.8%) tend to agree, and 84.6% of them totally agree with this statement. Meanwhile, only one enterprise shows their total disagreement, and only four enterprises show their disagreement with the statement. (2) Enterprises always declare tax fully and on time (necessary information, such as tax declaration papers, financial statements, change of information, etc.): 349 enterprises (96.5%) tend to agree with the second statement. In particular, a very high percentage (88.2%) of enterprises totally agree, and only one enterprise totally disagrees with this statement. (3) Enterprises always pay taxes fully and on time: 327 enterprises (90.8%) tend to agree with this statement. While 76.5% of enterprises show their complete agreement, only two enterprises indicate their complete disagreement with the third statement. (4) Enterprises always report their tax obligations accurately and completely (according to the content of arising economic operations): Nearly 94% of enterprises tend to agree, and only 1.1% of enterprises indicate their disagreement or complete disagreement with this statement. Table 4. Tax compliance status from the SMEs survey Unit: Enterprises Statement Min Max Mean Standard deviation The number of enterprises tending to agree The percentage of enterprises tending to agree (%) 1. Enterprises always register and supply tax registration 1 7 6.32 0.934 343 94.8 Au Thi Nguyen Lien et al. Vol. 130, No. 5B, 2021 26 Statement Min Max Mean Standard deviation The number of enterprises tending to agree The percentage of enterprises tending to agree (%) information on time 2. Enterprises always declare tax fully and on time (necessary information: tax declaration papers, financial statements, change of information, etc.) 1 7 6.41 0.861 349 96.5 3. Enterprises always pay taxes fully and on time 1 7 6.06 1.046 327 90.8 4. Enterprises always report their tax obligations accurately and completely (follows the incurred business accounting events) 1 7 6.31 0.918 340 93.4 Total 362 100.0 Source. Primary data (2020) Differences in tax compliance level The test results in Table 5 show no significant difference in tax compliance among groups of enterprises in terms of duration, type, working capital, number of employees, and revenue, and significant differences between enterprises in different tax assessment fields. Specifically, the average level of compliance with tax declaration in the construction sector is higher than that of enterprises in industry/manufacturing, trade/service, etc. Table 5. Testing the differences in tax compliance assessment among different types of enterprises (p value) Classification criteria Tax compliance Always register and supply information on time Always declare tax completely and on time Always pay tax in full and on time Always report tax responsibility in full and accurately Duration 0.170 0.219 0.371 0.134 Type 0.355 0.425 0.812 0.404 Sector 0.1931 0.022*1 0.883 0.528 Working capital 0.4001 0.3351 0.537 0.189 Number of employees 0.604 0.966 0.851 0.968 Revenue 0.750 0.270 0.487 0.803 Note: *: statistically significant (p 0.05); 1: Welch test Source. Primary data (2020) Jos.hueuni.edu.vn Vol. 130, No. 5B, 2021 27 5 Conclusions and implications Based on data in Thua Thien Hue, we explored the support activities for SEMs’ tax compliance and evaluated SMEs’ tax compliance objectively and subjectively. The research shows that training and web portals are the most popular channels for SMEs to access tax information. Visiting or calling the tax authorities is the most popular activity to receive support and answered questions. Further, secondary data from the tax authorities indicate that the number of new registrations has increased over the years. All ratios related to tax declaration and tax reports have an increasing trend. However, the debt ratio in tax payment is still high compared with the limitation regulated by the tax authorities. The survey data also show a similar pattern of SMEs’ tax compliance. The percentage of enterprises that agree that they comply adequately with tax registration, tax declaration, and tax reports is relatively high. Meanwhile, the rate of SMEs deciding that they always pay taxes fully and on time is slightly lower. There is no significant difference in tax compliance self-evaluation among groups of enterprises except a slightly higher difference from enterprises in the construction sector in evaluating the tax declaration. Based on these results, we proposed managerial and policy implications in improving tax compliance of small and medium enterprises. 5.1 Implications for tax authorities in tax management First, in terms of tax service models, the global trend of improving tax compliance for SMEs is based on tax authorities’ support and guide forms. Therefore, tax authorities need to consider enhancing support activities for SMEs. Accordingly, tax authorities should provide complete tax information, quickly solve businesses’ problems, and meet businesses’ requirements to improve their tax compliance. In addition, tax authorities need to promptly deploy electronic tax services, such as tax declaration, tax payment, and tax reporting. Second, tax officers should be ready to provide tax services with early warnings to solve businesses’ problems. Further, tax officers in internal functional departments of tax authorities should coordinate with external agencies, such as treasury and bank, to provide timely dossiers, quick guidance, and support and solve businesses’ problems. 5.2 Implications for SMEs to enhance tax compliance First, tax accountants of enterprises need to regularly update official tax service channels of tax authorities to minimise tax errors and tax risks leading to penalties for tax administrative violations. Tax guidance from tax authorities is considered the official information that provides various tax supports and new tax policies, including policies for SEMs. SMEs, therefore, need to proactively update their tax policies and request guidance from tax authorities to enhance their tax compliance. Au Thi Nguyen Lien et al. Vol. 130, No. 5B, 2021 28 Second, SMEs should regularly update tax declaration versions and electronic tax applications of tax authorities to implement tax compliance well. Besides, SMEs should periodically update information and change equipment to meet the digital transformation required by tax authorities. Finally, improving tax accountants’ competencies is a crucial requirement for SMEs to enhance tax compliance, thus minimising the risk of tax issues. Therefore, SMEs need to focus on building quality human resources for their tax accountants. References 1. Alm J., Cherry T., Jones M. & McKee M. (2010), Taxpayer Information Assistance Services and Tax Compliance Behavior, Journal of Economic Psychology, 31(4), 577–86. 2. Andreoni J., Erard B. & Feinstein J. (1998), Tax Compliance, Journal of Economic Literature, 36(2), 818–60. 3. Au Thi Nguyet Lien & Hoang Trong Hung (2018), Improving the Quality of Tax Support Services for Small and Medium Enterprises in Vietnam, International Scientific Conference - Industrial Revolution 4.0: Opportunities and challenges for Vietnam’s economic development, ISBN 978-604-55-3230-0, 515–529. (in Vietnamese) 4. Au Thi Nguyet Lien & Hoang Trong Hung (2019), International Experience in Improving Tax Compliance for Small and Medium Enterprises And Vietnam’s Implications, International conference – Entrepreneurship and innovation – Opportunities and challenges for Vietnam's enterprises, ISBN 978-604-55-4620-8, 189–203. (in Vietnamese) 5. Azmi A., Sapiei N., Mustapha M. & Abdullah M. (2016), SMEs’ Tax Compliance Costs and It Adoption: The Case of a Value-Added Tax, International Journal of Accounting Information Systems 23, 1–13. 6. Bui Ngoc Toan (2017), Factors Influencing Corporate Income Tax Compliance – Experimental Study in Ho Chi Minh City, Hue University Journal of Science: Economics and Development, 126(5A), 77–88. (in Vietnamese) 7. Tax Department of Thua Thien Hue Province (2019), Summary Report on Implementation of Tax Tasks in 2019; Tax Tasks And Solutions 2020, Thua Thien Hue, Tax Department of TT Hue province. (in Vietnamese) 8 Duong Thi Binh Minh & Vu Thi Bich Quynh (2018), Taxpayers’ Personal Income Tax Compliance Behavior Management Model – Study in HCM City, Journal of Asian Economics and Business Studies, 29(2), 63–83. (in Vietnamese) 9. Gangl K., Muehlbacher S., de Groot M., Goslinga S., Hofmann E., Kogler C., Antonides G. & Kirchler E. (2013), “How Can I Help You?” Perceived Service Orientation of Tax Authorities and Tax Compliance, FinanzArchiv: Public Finance Analysis, 69(4), 487–510. Jos.hueuni.edu.vn Vol. 130, No. 5B, 2021 29 10. General Department of Taxation (2017), Report on Summary of Tax Activities in 2016, Orientation of Political Tasks in 2017, Hanoi. (in Vietnamese) 11. General Department of Taxation (2018), Report on Summary of Taxation 2017, Orientation of Political Tasks in 2018, Hanoi. (in Vietnamese) 12. General Department of Taxation (2019), Report on Summary of Taxation in 2018, Orientation of Political Tasks in 2019, Hanoi. (in Vietnamese) 13. Hauptman L., Horvat M. & Korez-Vide R. (2014), Improving Tax Administration’s Services as a Factor of Tax Compilance: The Case of Tax Audit, Lex localis 12(3), 481–501. 14. IRS (2008), The Taxpayer Assistance Blueprint Phase 2: Was Generally Reliable, but Oversight of the Survey Design Needs Improvement Washington, D. C., Department of Treasury Internal Revenue Service. 15. IRS (2018), The Taxpayer Assistance Blueprint: "Tax Services Improvements". Washington, D. C. Department of Treasury Internal Revenue Service. 16. Kirchler E. (2007), The Economic Psychology of Tax Behaviour. Cambridge. 17. Krejcie R. & Morgan D. (1970), Determining Sample Size for Research Activities. Educational and Psychological Measurement 30, 607–10. 18. Le Chi Cong & Nguyen Thi Hai Anh (2017), Study on Effect of Tax Policy on Tax Compliance Behavior of Enterprises in Nha Trang City, Journal of Banking Technology (139), 77. (in Vietnamese) 19. Le Thi Kim Anh (2020), Enterprise Satisfaction About Electronic Tax Payment Service Quality - Study at Tax Department of Dong Hoa Town, Phu Yen Province, Journal of Industry and Trade 16 (July 2020), 1–10. (in Vietnamese) 20. Leng Minh Hoang (2017), Improving Tax Compliance for Taxpayers in Vietnam, Thesis, Ph.D., Academy of Finance. (in Vietnamese) 21. Ministry of Finance (2015), Regulations On Applying Risk Management In Tax Administration, Hanoi. (in Vietnamese) 22. National Taxpayer Advocate (2017), 2016 Annual Report to Congress, Washington, D. C. IRS. 23. OECD (2004), Compliance Risk Management: Managing and Improving Tax Compliance, Edit by Centre For Tax Policy And Administration, OECD. 24. OECD (2007), Guidance Note: Improving Taxpayer Service Delivery: Channel Strategy Development Edited by Forum on Tax Administration Taxpayer Services Sub-group Committee on Fiscal Affairs. Paris: OECD. 25. OECD (2010), Survey of Trends and Developments in the Use of Electronic Services for Taxpayer Service Delivery, Edited by Centre For Tax Policy And Administration, Paris: OECD. Au Thi Nguyen Lien et al. Vol. 130, No. 5B, 2021 30 26. OECD (2010), Forum on Tax Administration: Information Note: Tax Compliance and Tax Accounting Systems Edited by Centre For Tax Policy And Administration, Paris: OECD. 27. OECD (2014), Tax Compliance by Design: Achieving Improved Sme Tax Compliance by Adopting a System Perspective, Paris: OECD Publishing. 28. OECD (2015), Taxation of Smes in Oecd and G20 Countries, Vol. 23, OECD Tax Policy Studies, Paris: OECD Publishing. 29. Oladipupo A. & Obazee U. (2016), Tax Knowledge, Penalties and Tax Compliance in Small and Medium Scale Enterprises in Nigeria, iBusiness 8, 1–9. 30. Rusdi H., Siti R. & Bambang W. (2014), Measurement Model of Service Quality, Regional Tax Regulations, Taxpayer Satisfaction Level, Behavior and Compliance Using Confirmatory Factor Analysis, World Applied Sciences Journal, 29(1), 56–61. 31. Saad N. (2014), Tax Knowledge, Tax Complexity and Tax Compliance: Taxpayers’ View, Procedia-Social and Behavioral Sciences, 109(2014), 1069–75. 32. Savitri E. (2015), The Effect of Tax Socialization, Tax Knowledge, Expediency of Tax Id Number and Service Quality on Taxpayers Compliance with Taxpayers Awareness as Mediating Variables, Procedia-Social and Behavioral Sciences, 211(2015), 163–69. 33. Song Y. & Yarbrough T. (1978), Tax Ethics and Taxpayer Attitudes: A Survey, Public Administration Review, 38(5), 442–52. 34. World Bank, General Department of Taxation & VCCI (2015), Report on Corporate Satisfaction with Tax Authority 2014, Hanoi, General Department of Taxation World Bank, VCCI. (in Vietnamese) 35. World Bank, General Department of Taxation & VCCI (2017), Report on Corporate Satisfaction with Tax Authority in 2016. Hanoi, General Department of Taxation World Bank, VCCI. (in Vietnamese)

File đính kèm:

tax_compliance_of_small_and_medium_enterprises_a_case_study.pdf

tax_compliance_of_small_and_medium_enterprises_a_case_study.pdf