Tác động về địa lý đối với các chính sách cổ tức thực trạng tại các công ty Việt Nam

Tóm tắt

Nghiên cứu này xem xét mối quan hệ giữa vị trí địa lý của doanh nghiệp và chính sách cổ

tức. Theo lý thuyết đại diện, các công ty có vị trí địa lý xa có thể đưa ra mức cổ tức cao hơn để

giảm xung đột lợi ích giữa cổ đông và ban giám đốc. Sự xung đột này có thể đến từ khó khăn của

cổ đông trong việc quan sát các quyết định của ban giám đốc. Bên cạnh đó, theo lý thuyết tín

hiệu, do sự bất cân xứng thông tin, các công ty ở xa muốn giữ mức cổ tức cao hơn để báo hiệu

cho các nhà đầu tư về triển vọng của họ. Sử dụng dữ liệu của doanh nghiệp Việt Nam, nghiên

cứu này cho thấy các kết quả thực nghiệm hỗ trợ cho giả thuyết này. Những kết quả này đóng

góp vào các kết quả nghiên cứu trước đây về vị trí địa lý và hành vi của doanh nghiệp, đặc biệt

là mối quan hệ giữa vị trí địa lý và chính sách cổ tức, vốn bị bỏ qua trong các nghiên cứu này.

Từ khoá: hiệu ứng địa lý, vị trí doanh nghiệp, chính sách cổ tức

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Tóm tắt nội dung tài liệu: Tác động về địa lý đối với các chính sách cổ tức thực trạng tại các công ty Việt Nam

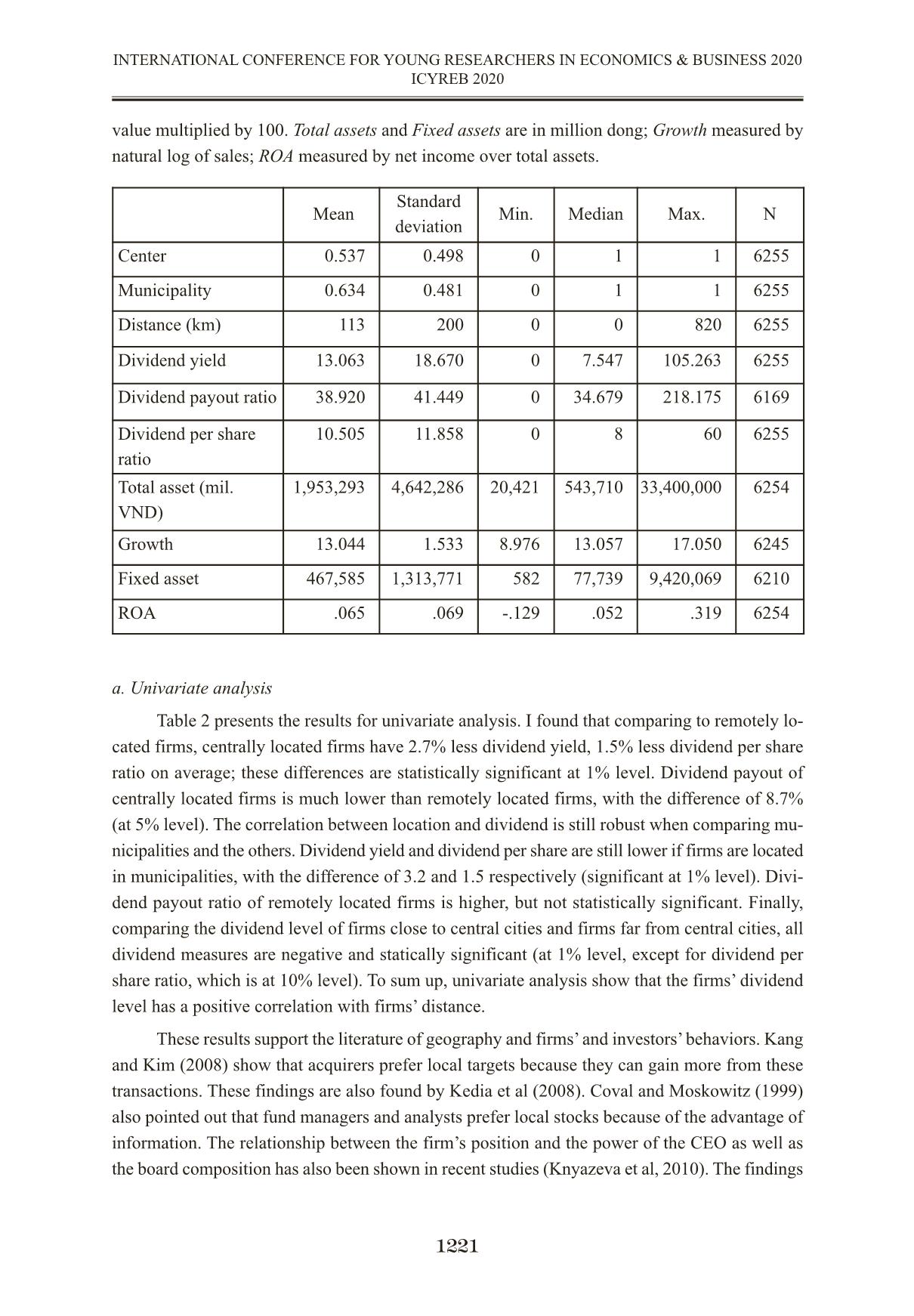

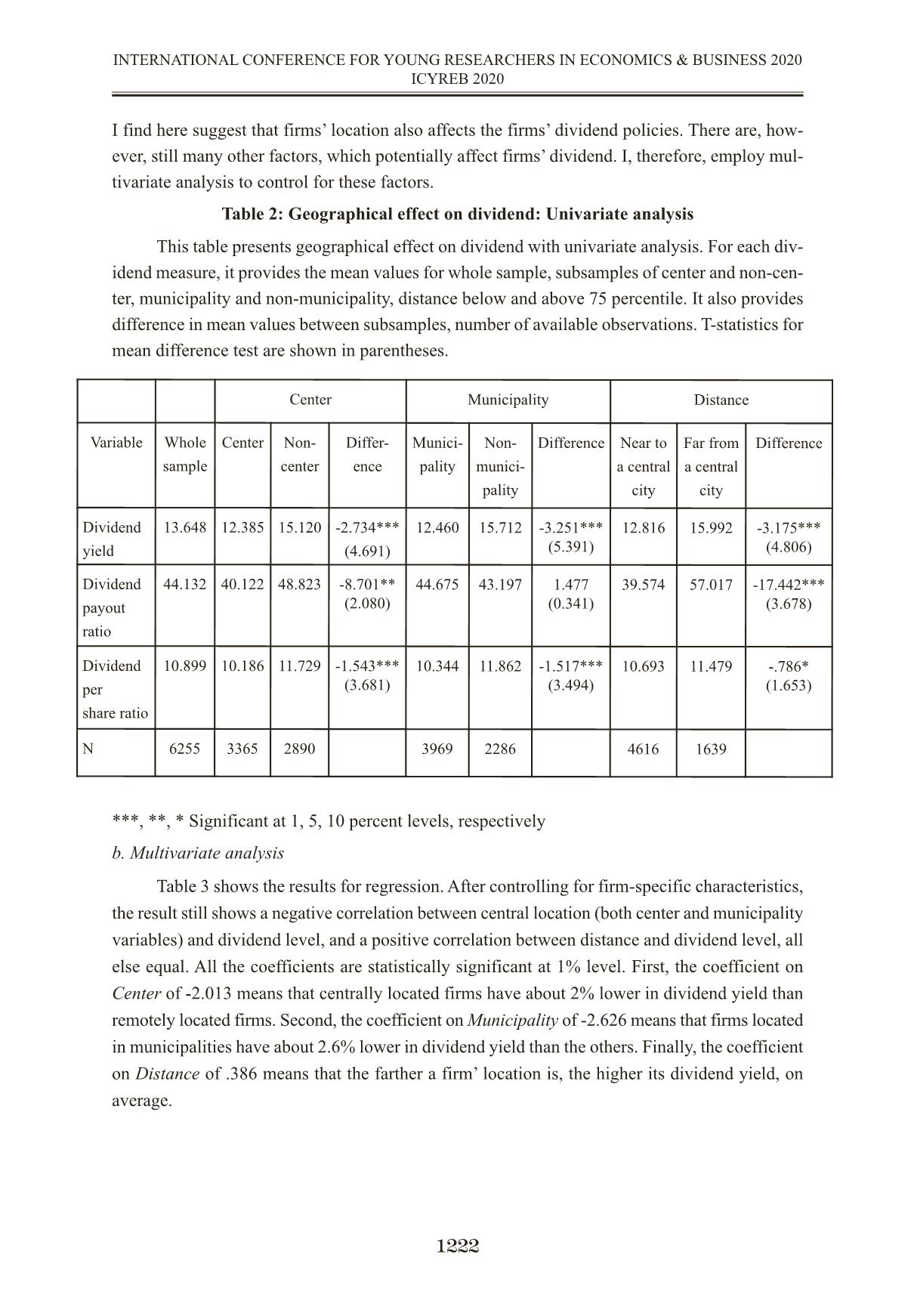

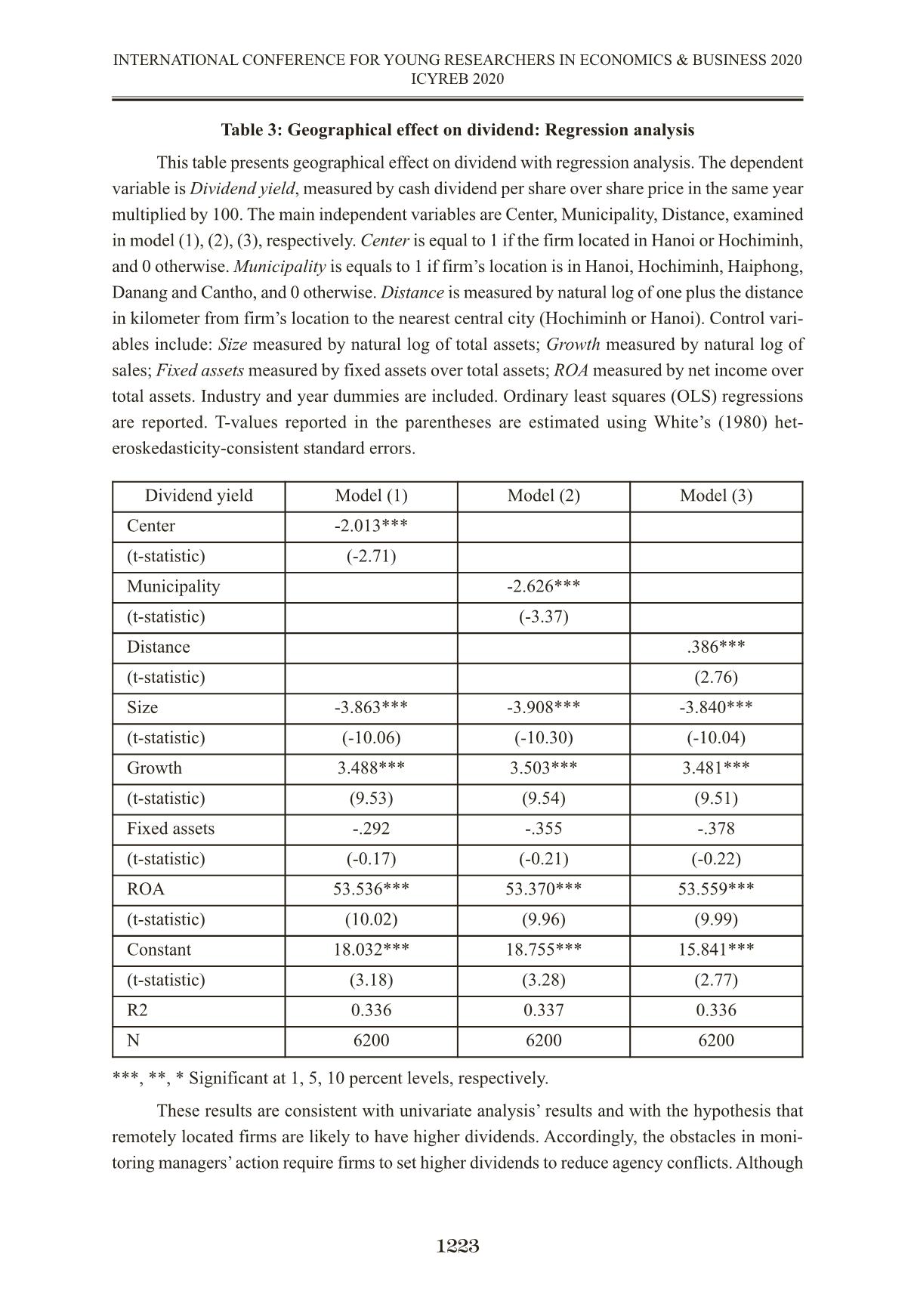

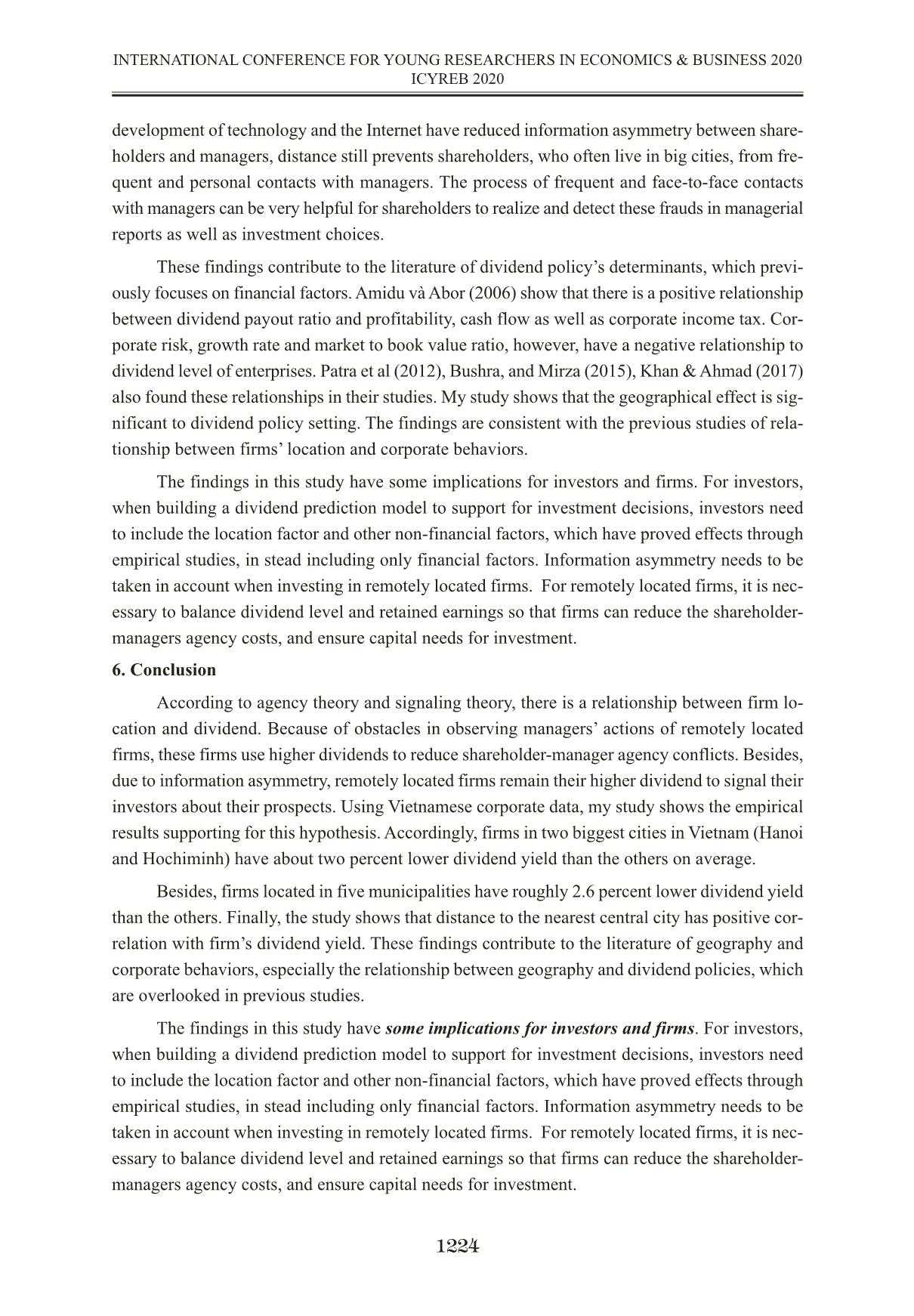

GEOGRAPHICAL EFFECT ON DIVIDEND POLICY EVIDENCE FROM VIETNAMESE COMPANIES TÁC ĐỘNG VỀ ĐỊA LÝ ĐỐI VỚI CÁC CHÍNH SÁCH CỔ TỨC THỰC TRẠNG TẠI CÁC CÔNG TY VIỆT NAM MA, Vu Duc Kien Academy of Finance vuduckien231@gmail.com Abstract This study examines the relationship between firm location and dividend. According to agency theory, remotely located firms may use higher dividends to reduce shareholder-manager agency conflicts because of obstacles in observing the managers’ actions. Besides, according to signaling theory, due to information asymmetry, remotely located firms may remain their higher dividend to signal their investors about their prospects. Using Vietnamese corporate data, my study shows the empirical results supporting for this hypothesis. These findings contribute to the literature of geography and corporate behaviors, especially the relationship between geography and dividend policies, which are overlooked in previous studies. Keywords: geographical effect, firms’ location, dividend policy Tóm tắt Nghiên cứu này xem xét mối quan hệ giữa vị trí địa lý của doanh nghiệp và chính sách cổ tức. Theo lý thuyết đại diện, các công ty có vị trí địa lý xa có thể đưa ra mức cổ tức cao hơn để giảm xung đột lợi ích giữa cổ đông và ban giám đốc. Sự xung đột này có thể đến từ khó khăn của cổ đông trong việc quan sát các quyết định của ban giám đốc. Bên cạnh đó, theo lý thuyết tín hiệu, do sự bất cân xứng thông tin, các công ty ở xa muốn giữ mức cổ tức cao hơn để báo hiệu cho các nhà đầu tư về triển vọng của họ. Sử dụng dữ liệu của doanh nghiệp Việt Nam, nghiên cứu này cho thấy các kết quả thực nghiệm hỗ trợ cho giả thuyết này. Những kết quả này đóng góp vào các kết quả nghiên cứu trước đây về vị trí địa lý và hành vi của doanh nghiệp, đặc biệt là mối quan hệ giữa vị trí địa lý và chính sách cổ tức, vốn bị bỏ qua trong các nghiên cứu này. Từ khoá: hiệu ứng địa lý, vị trí doanh nghiệp, chính sách cổ tức 1. Introduction The literature of corporate dividend policies shows that many studies explored firm-specific factors affecting the firms’ dividend policies. Amidu và Abor (2006) show that there is a positive relationship between dividend payout ratio and profitability, cash flow as well as corporate income tax. Corporate risk, growth rate and market to book value ratio, however, have a negative rela- tionship to dividend level of enterprises. Patra et al (2012), Bushra, and Mirza (2015), Khan & 1217 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Ahmad (2017) also found these relationships in their studies. It is noticeable that the previous studies of dividend determinants merely focus on financial factors. Non-financial factors have been unobserved. Meanwhile, previous studies have shown significant effects between a firm’s location on its behaviors as well as its stakeholders. Kang and Kim (2008) show that acquirers prefer local targets because they can gain more from these transactions. These findings are also found by Kedia et al (2008). Coval and Moskowitz (1999) also pointed out that fund managers and analysts prefer local stocks because of the advantage of information. The relationship between the firm’s position and the power of the CEO as well as the board composition has also been shown in recent studies (Knyazeva et al, 2010). There have been many studies of geography and the be- haviors of firms and of investors. Few studies, however, have studied the relationship between firm location and dividend policy. According to agency theory, the separation between shareholders and managers can create shareholder-manager conflict, since their objectives are diverged. While shareholders would like to maximize their values through positive net present value investments, managers are tempted by utilities of empire building. Accordingly, managers can raise their financial benefits (i.e. com- pensation, bonus) through increasing the firm’s size (overinvestment); even these actions can damage the firm’s value (Jensen (1986). These problems will be more aggravated if there are po- tential barriers preventing shareholders from monitoring managers’ actions. Location can be one of these barriers. Distance may reduce the monitoring ability of shareholders through frequent or personal contacts with managers. Investors often concentrate in big cities because these cities have high population density with well-educated people. Also, financial systems are more developed in these cities. Frauds in managerial reports can often exist, and frequent and face-to-face contacts with managers can be helpful for shareholders to realize and detect these problems. Investors, who often lives in big cities, therefore face difficulties to ensure that the investment decisions of a remotely located firm’ managers precise. In addition, agency theory suggests that reducing free cash flow in firms can help to mitigate the agency problem of eq ... om one percentile values to min- imize the effect of possibly spurious outliers in the data. 5. Findings and discussion Table 1 shows the summary statistics for firms in the sample. About 53.7% of firms in the sample are located in Hanoi and Hochiminh city, and roughly 63.4 of firms have headquarters in top-five central cities in Vietnam. This implies that firms listed in stock exchanges are mainly located in big cities. On average, the distance of a firm to a main central city is 113 kilometers. The farthest distance is 820 kilometers. In terms of dividend payment, the majority of firms in the sample pays dividend with the dividend payout ratio ranging from zero percent to roughly 218%. Annual dividend per share ratio is also various, ranging from 0% to 60%. As for other financial measures, Table 1 shows the firms in sample are diverse in total as- sets, growth, fixed assets and profitability. The firms’ sizes is from 20,421 to 33,400,000 million dong. All the firms in sample have positive growth rate (from 8.976% to 17.050%). The sizes of fixed assets are very different. The smallest is 582 million dong, while the largest is 9,420,069 million dong. On average, the firms achieve 6.5% return on assets. Table 1: Summary statistics of the variables This table reports summary statistics for all the variables used in this study. Each variable is reported mean, standard deviation, minimum, median, maximum values, and number of ob- servations. Sample includes all the companies listed in Hanoi and Hochiminh stock exchanges (669 companies) with 6255 observations. Center is equal to 1 if the firm located in Hanoi or Hochiminh, and 0 otherwise. Municipality equals to 1 if firm’s location is in Hanoi, Hochiminh, Haiphong, Danang and Cantho, and 0 otherwise. Distance is the number of kilometers from firm’s location to the nearest central city. Dividend yield is measured by cash dividend per share over share price in the same year multiplied by 100. Dividend payout ratio is calculated by dividend over net income multiplied by 100. Dividend per share ratio is calculated by dividend over par 1220 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 value multiplied by 100. Total assets and Fixed assets are in million dong; Growth measured by natural log of sales; ROA measured by net income over total assets. a. Univariate analysis Table 2 presents the results for univariate analysis. I found that comparing to remotely lo- cated firms, centrally located firms have 2.7% less dividend yield, 1.5% less dividend per share ratio on average; these differences are statistically significant at 1% level. Dividend payout of centrally located firms is much lower than remotely located firms, with the difference of 8.7% (at 5% level). The correlation between location and dividend is still robust when comparing mu- nicipalities and the others. Dividend yield and dividend per share are still lower if firms are located in municipalities, with the difference of 3.2 and 1.5 respectively (significant at 1% level). Divi- dend payout ratio of remotely located firms is higher, but not statistically significant. Finally, comparing the dividend level of firms close to central cities and firms far from central cities, all dividend measures are negative and statically significant (at 1% level, except for dividend per share ratio, which is at 10% level). To sum up, univariate analysis show that the firms’ dividend level has a positive correlation with firms’ distance. These results support the literature of geography and firms’ and investors’ behaviors. Kang and Kim (2008) show that acquirers prefer local targets because they can gain more from these transactions. These findings are also found by Kedia et al (2008). Coval and Moskowitz (1999) also pointed out that fund managers and analysts prefer local stocks because of the advantage of information. The relationship between the firm’s position and the power of the CEO as well as the board composition has also been shown in recent studies (Knyazeva et al, 2010). The findings 1221 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Mean Standard deviation Min. Median Max. N Center 0.537 0.498 0 1 1 6255 Municipality 0.634 0.481 0 1 1 6255 Distance (km) 113 200 0 0 820 6255 Dividend yield 13.063 18.670 0 7.547 105.263 6255 Dividend payout ratio 38.920 41.449 0 34.679 218.175 6169 Dividend per share ratio 10.505 11.858 0 8 60 6255 Total asset (mil. VND) 1,953,293 4,642,286 20,421 543,710 33,400,000 6254 Growth 13.044 1.533 8.976 13.057 17.050 6245 Fixed asset 467,585 1,313,771 582 77,739 9,420,069 6210 ROA .065 .069 -.129 .052 .319 6254 I find here suggest that firms’ location also affects the firms’ dividend policies. There are, how- ever, still many other factors, which potentially affect firms’ dividend. I, therefore, employ mul- tivariate analysis to control for these factors. Table 2: Geographical effect on dividend: Univariate analysis This table presents geographical effect on dividend with univariate analysis. For each div- idend measure, it provides the mean values for whole sample, subsamples of center and non-cen- ter, municipality and non-municipality, distance below and above 75 percentile. It also provides difference in mean values between subsamples, number of available observations. T-statistics for mean difference test are shown in parentheses. ***, **, * Significant at 1, 5, 10 percent levels, respectively b. Multivariate analysis Table 3 shows the results for regression. After controlling for firm-specific characteristics, the result still shows a negative correlation between central location (both center and municipality variables) and dividend level, and a positive correlation between distance and dividend level, all else equal. All the coefficients are statistically significant at 1% level. First, the coefficient on Center of -2.013 means that centrally located firms have about 2% lower in dividend yield than remotely located firms. Second, the coefficient on Municipality of -2.626 means that firms located in municipalities have about 2.6% lower in dividend yield than the others. Finally, the coefficient on Distance of .386 means that the farther a firm’ location is, the higher its dividend yield, on average. 1222 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Center Municipality Distance Variable Whole sample Center Non- center Differ- ence Munici- pality Non- munici- pality Difference Near to a central city Far from a central city Difference Dividend yield 13.648 12.385 15.120 -2.734*** (4.691) 12.460 15.712 -3.251*** (5.391) 12.816 15.992 -3.175*** (4.806) Dividend payout ratio 44.132 40.122 48.823 -8.701** (2.080) 44.675 43.197 1.477 (0.341) 39.574 57.017 -17.442*** (3.678) Dividend per share ratio 10.899 10.186 11.729 -1.543*** (3.681) 10.344 11.862 -1.517*** (3.494) 10.693 11.479 -.786* (1.653) N 6255 3365 2890 3969 2286 4616 1639 Table 3: Geographical effect on dividend: Regression analysis This table presents geographical effect on dividend with regression analysis. The dependent variable is Dividend yield, measured by cash dividend per share over share price in the same year multiplied by 100. The main independent variables are Center, Municipality, Distance, examined in model (1), (2), (3), respectively. Center is equal to 1 if the firm located in Hanoi or Hochiminh, and 0 otherwise. Municipality is equals to 1 if firm’s location is in Hanoi, Hochiminh, Haiphong, Danang and Cantho, and 0 otherwise. Distance is measured by natural log of one plus the distance in kilometer from firm’s location to the nearest central city (Hochiminh or Hanoi). Control vari- ables include: Size measured by natural log of total assets; Growth measured by natural log of sales; Fixed assets measured by fixed assets over total assets; ROA measured by net income over total assets. Industry and year dummies are included. Ordinary least squares (OLS) regressions are reported. T-values reported in the parentheses are estimated using White’s (1980) het- eroskedasticity-consistent standard errors. ***, **, * Significant at 1, 5, 10 percent levels, respectively. These results are consistent with univariate analysis’ results and with the hypothesis that remotely located firms are likely to have higher dividends. Accordingly, the obstacles in moni- toring managers’ action require firms to set higher dividends to reduce agency conflicts. Although 1223 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Dividend yield Model (1) Model (2) Model (3) Center -2.013*** (t-statistic) (-2.71) Municipality -2.626*** (t-statistic) (-3.37) Distance .386*** (t-statistic) (2.76) Size -3.863*** -3.908*** -3.840*** (t-statistic) (-10.06) (-10.30) (-10.04) Growth 3.488*** 3.503*** 3.481*** (t-statistic) (9.53) (9.54) (9.51) Fixed assets -.292 -.355 -.378 (t-statistic) (-0.17) (-0.21) (-0.22) ROA 53.536*** 53.370*** 53.559*** (t-statistic) (10.02) (9.96) (9.99) Constant 18.032*** 18.755*** 15.841*** (t-statistic) (3.18) (3.28) (2.77) R2 0.336 0.337 0.336 N 6200 6200 6200 development of technology and the Internet have reduced information asymmetry between share- holders and managers, distance still prevents shareholders, who often live in big cities, from fre- quent and personal contacts with managers. The process of frequent and face-to-face contacts with managers can be very helpful for shareholders to realize and detect these frauds in managerial reports as well as investment choices. These findings contribute to the literature of dividend policy’s determinants, which previ- ously focuses on financial factors. Amidu và Abor (2006) show that there is a positive relationship between dividend payout ratio and profitability, cash flow as well as corporate income tax. Cor- porate risk, growth rate and market to book value ratio, however, have a negative relationship to dividend level of enterprises. Patra et al (2012), Bushra, and Mirza (2015), Khan & Ahmad (2017) also found these relationships in their studies. My study shows that the geographical effect is sig- nificant to dividend policy setting. The findings are consistent with the previous studies of rela- tionship between firms’ location and corporate behaviors. The findings in this study have some implications for investors and firms. For investors, when building a dividend prediction model to support for investment decisions, investors need to include the location factor and other non-financial factors, which have proved effects through empirical studies, in stead including only financial factors. Information asymmetry needs to be taken in account when investing in remotely located firms. For remotely located firms, it is nec- essary to balance dividend level and retained earnings so that firms can reduce the shareholder- managers agency costs, and ensure capital needs for investment. 6. Conclusion According to agency theory and signaling theory, there is a relationship between firm lo- cation and dividend. Because of obstacles in observing managers’ actions of remotely located firms, these firms use higher dividends to reduce shareholder-manager agency conflicts. Besides, due to information asymmetry, remotely located firms remain their higher dividend to signal their investors about their prospects. Using Vietnamese corporate data, my study shows the empirical results supporting for this hypothesis. Accordingly, firms in two biggest cities in Vietnam (Hanoi and Hochiminh) have about two percent lower dividend yield than the others on average. Besides, firms located in five municipalities have roughly 2.6 percent lower dividend yield than the others. Finally, the study shows that distance to the nearest central city has positive cor- relation with firm’s dividend yield. These findings contribute to the literature of geography and corporate behaviors, especially the relationship between geography and dividend policies, which are overlooked in previous studies. The findings in this study have some implications for investors and firms. For investors, when building a dividend prediction model to support for investment decisions, investors need to include the location factor and other non-financial factors, which have proved effects through empirical studies, in stead including only financial factors. Information asymmetry needs to be taken in account when investing in remotely located firms. For remotely located firms, it is nec- essary to balance dividend level and retained earnings so that firms can reduce the shareholder- managers agency costs, and ensure capital needs for investment. 1224 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 REFERENCES Bushra, A., & Mirza, N. (2015). The determinants of corporate dividend policy in Pak- istan. The Lahore Journal of Economics, 20(2), 77. Coval, J. D., & Moskowitz, T. J. (1999). Home bias at home: Local equity preference in domestic portfolios. The Journal of Finance, 54(6), 2045-2073. Dewasiri, N. J., Koralalage, W. B. Y., Azeez, A. A., Jayarathne, P. G. S. A., Kurup- puarachchi, D., & Weerasinghe, V. A. (2019). Determinants of dividend policy: Evidence from an Emerging and Developing market. Managerial Finance. Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American economic review, 76(2), 323-329. Kang, J. K., & Kim, J. M. (2008). The geography of block acquisitions. The Journal of Fi- nance, 63(6), 2817-2858. Khan, F. A., & Ahmad, N. (2017). Determinants of dividend payout: an empirical study of pharmaceutical companies of pakistan stock exchange (PSX). Journal of Financial Studies & Re- search, 16. Knyazeva, A., Knyazeva, D., & Masulis, R. W. (2010, November). Local director talent and board composition. In 23rd Australasian Finance and Banking Conference. Kumar, P. (1988). Shareholder-manager conflict and the information content of dividends. The Review of Financial Studies, 1(2), 111-136. Miller, M. H., & Rock, K. (1985). Dividend policy under asymmetric information. The Journal of finance, 40(4), 1031-1051. Patra, T., Poshakwale, S., & Ow-Yong, K. (2012). Determinants of corporate dividend pol- icy in Greece. Applied Financial Economics, 22(13), 1079-1087. Uysal, V. B., Kedia, S., & Panchapagesan, V. (2008). Geography and acquirer returns. Jour- nal of Financial Intermediation, 17(2), 256-275. Yao, S., Zhang, W. W., & Lin, C. M. (2019). Firm location and corporate dividend policy: evidence from China. Applied Economics, 51(58), 6213-6234. 1225 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020

File đính kèm:

tac_dong_ve_dia_ly_doi_voi_cac_chinh_sach_co_tuc_thuc_trang.pdf

tac_dong_ve_dia_ly_doi_voi_cac_chinh_sach_co_tuc_thuc_trang.pdf