Mối quan hệ nhân quả giữa FDI, độ mở thương mại và tăng trưởng kinh tế ở Việt Nam bằng phương pháp Ardl kiểm định đường bao

Nghiên cứu về mối quan hệ nhân quả giữa FDI, độ mở thương mại và tăng trưởng kinh tế

ở Việt Nam trong giai đoạn 1990-2017 được phân tích bằng cách áp dụng phương pháp phan

phối trễ tự hồi quy (Autoregressive Distributed Lag ARDL) và phuong pháp kiểm định đuờng

bao (bounds tests). Hai câu hỏi được đặt ra là có hay không FDI và độ mở thương mại thực sự

thúc đẩy tăng trưởng kinh tế Việt Nam và giả thuyết mô hình tăng trưởng dựa vào FDI có đúng

với trường hợp ở Việt Nam hay không. Phương pháp đồng liên kết được sử dụng để phân tích

mối quan hệ trong dài hạn và kiểm định Granger được dùng để phân tích mối quan hệ nhân quả

trong ngắn hạn giữa các biến trong mô hình. Kết quả nghiên cứu chỉ ra rằng, trong dài hạn, có

mối quan hệ giữa FDI, độ mở thương mại, vốn là lao động đối với tăng trưởng kinh tế. Nghiên

cứu chỉ ra được tác động tích cực và có ý nghĩa về mặt thống kê của FDI và lao động đối với

tăng trưởng kinh tế của Việt Nam trong dài hạn. Nghiên cứu ủng hộ giả thuyết tăng trưởng dựa

vào FDI đối với Việt Nam và dòng vốn FDI đã những tác động tích cực cho tăng trưởng kinh tế

của Việt Nam.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Mối quan hệ nhân quả giữa FDI, độ mở thương mại và tăng trưởng kinh tế ở Việt Nam bằng phương pháp Ardl kiểm định đường bao

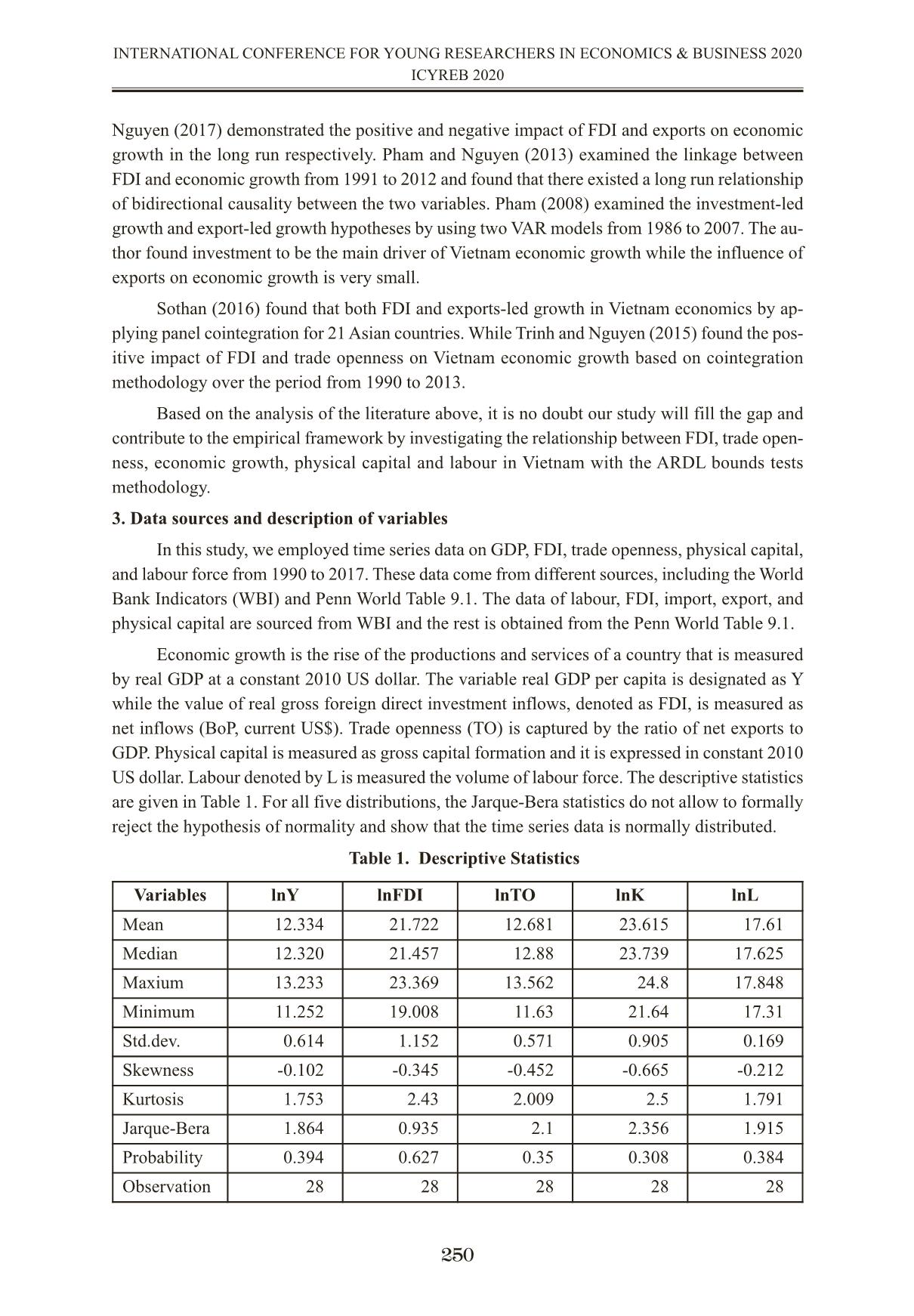

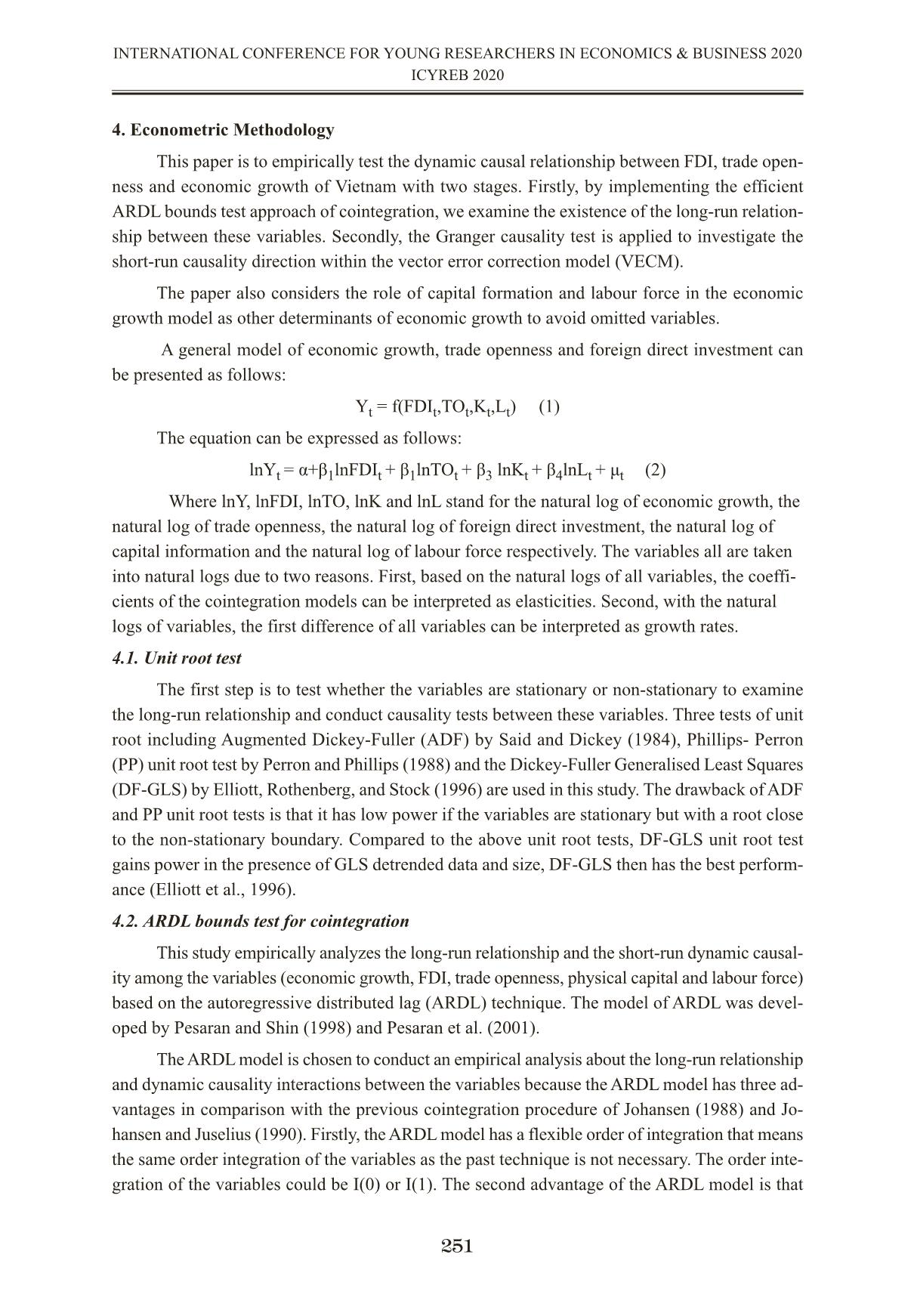

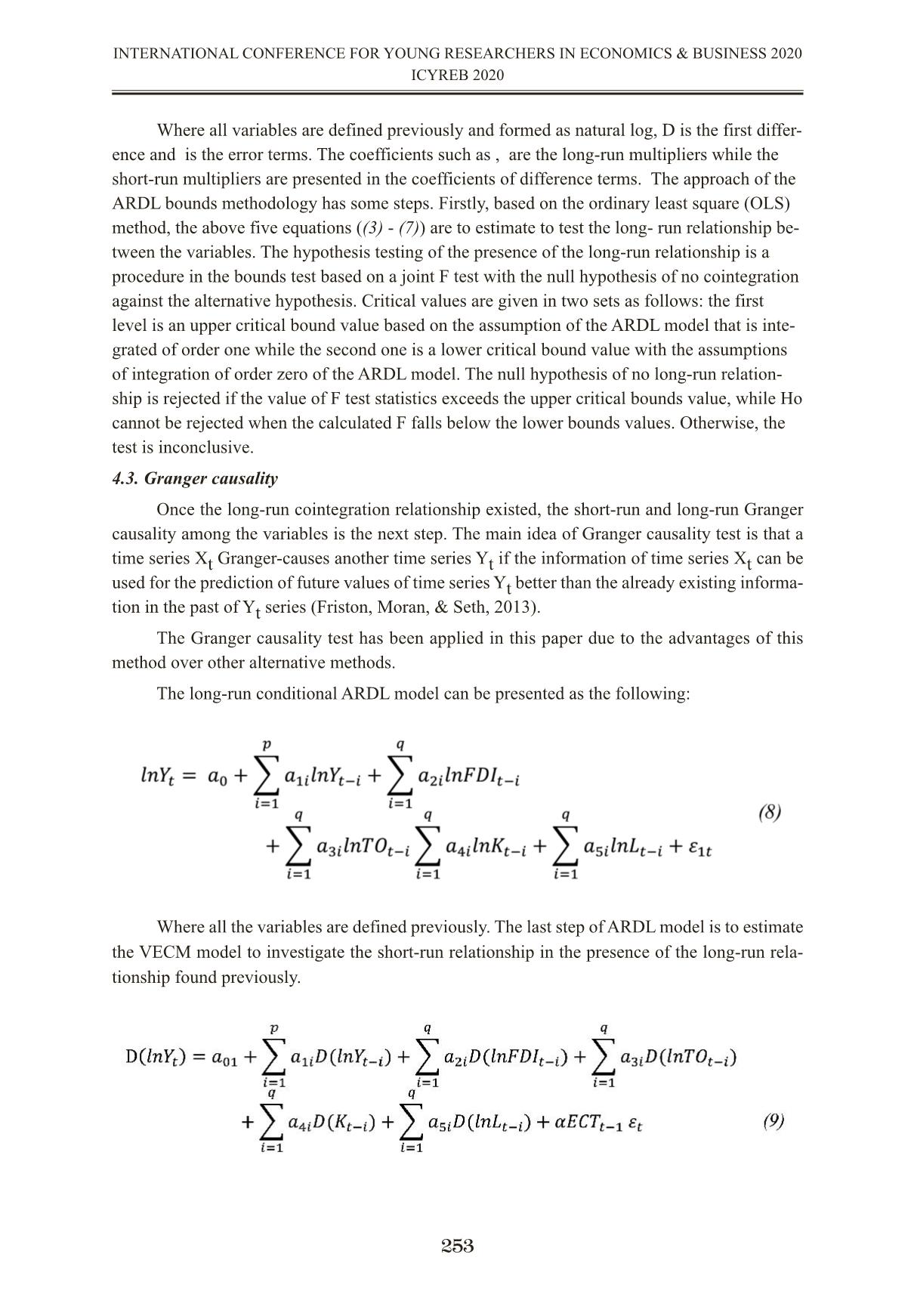

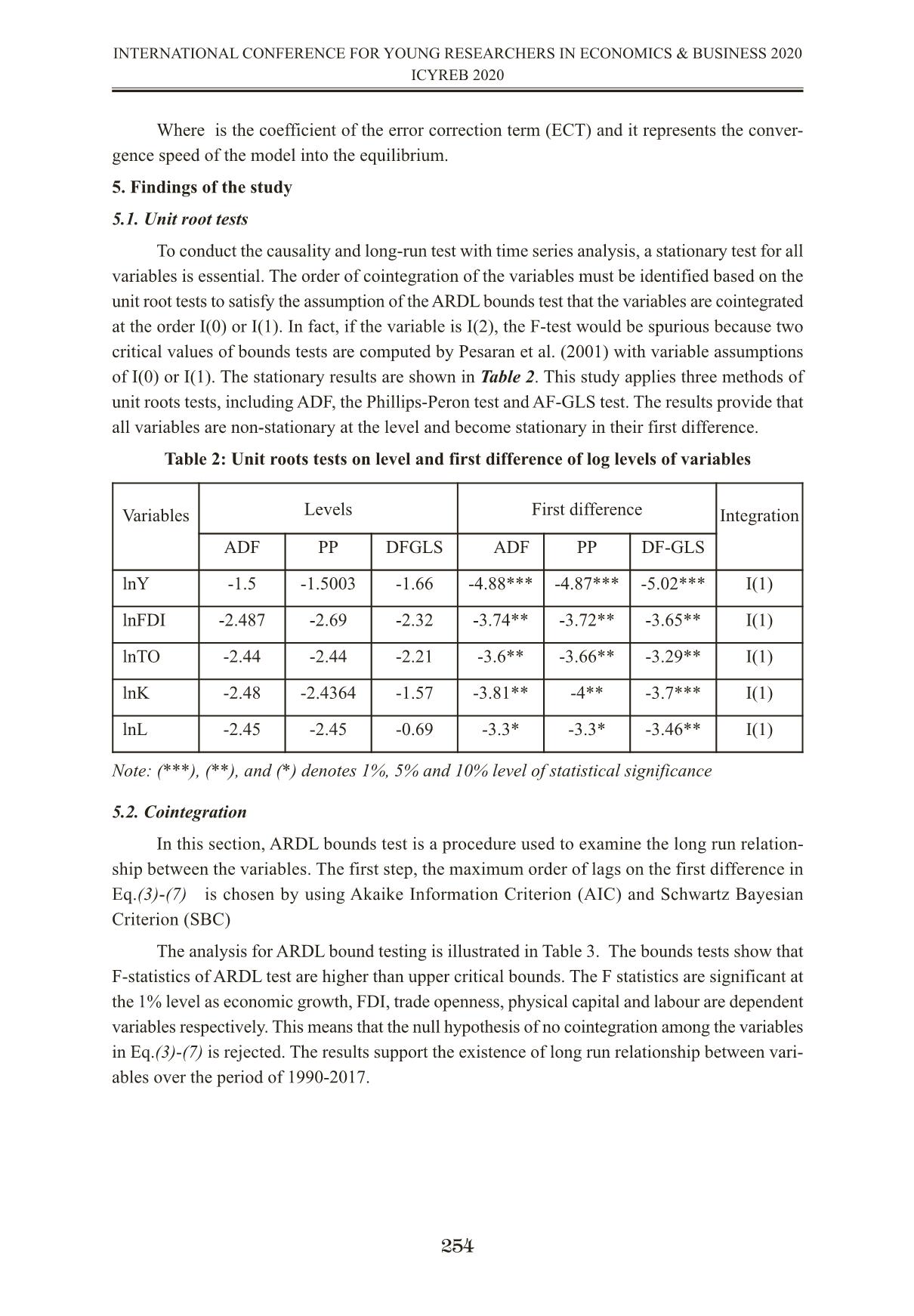

CAUSALITY INTERACTIONS BETWEEN FDI, TRADE OPENNESS AND ECONOMIC GROWTH IN VIETNAM. EVIDENCE FROM ARDL BOUNDS TESTS MỐI QUAN HỆ NHÂN QUẢ GIỮA FDI, ĐỘ MỞ THƯƠNG MẠI VÀ TĂNG TRƯỞNG KINH TẾ Ở VIỆT NAM BẰNG PHƯƠNG PHÁP ARDL KIỂM ĐỊNH ĐƯỜNG BAO Nguyen Hai Yen, MA University of Economics, Hue University nhyen@hce.edu.vn Abstract This paper examines the dynamic relationship between FDI, trade openness and economic growth in Vietnam during the period of 1990-2017. This paper tests two fundamental questions including whether FDI and trade openness indeed enhance economic growth and whether FDI- led growth model is valid for Vietnam. Unlike existing studies in Vietnam which demonstrated some limitations in terms of methodologies and presented ambiguous results in this field, this paper applies the appropriate cointegration methodology to investigate the long-run relationship between the variables using the autoregressive distributed lags (ARDL) bounds tests approach. The paper then can indicate the directional causality through test for Granger dynamic causality in the short-run. The findings of this empirical study are that there exists a long- run relationship from economic growth to FDI, trade openness, physical capital and labour force. In the long- run, FDI and labour force have a significant and positive impact on economic growth. The short- run dynamics further show that the Vietnamese economy convergency from a shock is relatively quickly. The paper supports the FDI-led growth hypothesis and that Vietnam has directly benefited from foreign trade investment inflows. The results of the Granger causality test show that there is bi-directional causality from FDI to economic growth and trade openness to economic growth. The paper, however, fails to confirm the direction of causality from FDI to labour force and trade openness to labour force as the widespread belief that FDI generates significant and positive productivity externalities for a host country. The insights of this empirical study strengthen the case for further focus on sustainable development in policy-making. Key words: ARDL bounds tests, economic growth, FDI, trade openness, Vietnam Tóm tắt Nghiên cứu về mối quan hệ nhân quả giữa FDI, độ mở thương mại và tăng trưởng kinh tế ở Việt Nam trong giai đoạn 1990-2017 được phân tích bằng cách áp dụng phương pháp phan phối trễ tự hồi quy (Autoregressive Distributed Lag ARDL) và phuong pháp kiểm định đuờng bao (bounds tests). Hai câu hỏi được đặt ra là có hay không FDI và độ mở thương mại thực sự thúc đẩy tăng trưởng kinh tế Việt Nam và giả thuyết mô hình tăng trưởng dựa vào FDI có đúng với trường hợp ở Việt Nam hay không. Phương pháp đồng liên kết được sử dụng để phân tích 245 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 mối quan hệ trong dài hạn và kiểm định Granger được dùng để phân tích mối quan hệ nhân quả trong ngắn hạn giữa các biến trong mô hình. Kết quả nghiên cứu chỉ ra rằng, trong dài hạn, có mối quan hệ giữa FDI, độ mở thương mại, vốn là lao động đối với tăng trưởng kinh tế. Nghiên cứu chỉ ra được tác động tích cực và có ý nghĩa về mặt thống kê của FDI và lao động đối với tăng trưởng kinh tế của Việt Nam trong dài hạn. Nghiên cứu ủng hộ giả thuyết tăng trưởng dựa vào FDI đối với Việt Nam và dòng vốn FDI đã những tác động tích cực cho tăng trưởng kinh tế của Việt Nam. Từ khóa: ARDL kiểm định đường bao, tăng trưởng kinh tế, FDI, độ mở thương mại, Việt Nam 1. Introduction Trade openness and foreign direct investment (FDI) have been well known as vital factors in stimulating the process of economic growth. Trade openness is defined as a ratio of exports and imports to gross domestic product (GDP). Increasing imports of final goods tend to promote competition in a local market by forcing domestic companies to adopt technological innovation and enhance product quality to compete with imported products. For exporting companies, com- petition in international marketplaces encourages businesses to upgrade their competitive capa- bilities via innovation and adoption of advanced technologies. Therefore, an increase in trade openness positively and significantly affects economic growth process via two mechanisms, in- cluding enhancing technology transfer and increasing competition in the domestic market. FDI plays an important role and has a positive impact on economic growth. It is determined to boost economic growth via the two mechanisms, including spurring competition and technol- ogy transfer. Firstly, the presence of multinational corporations as a form of FDI supports eco- nomic growth by promoting competition in the domestic market. The foreign firms have technological advantages while domestic firms have comparative advantages by using existing resources, local branches must effectively use the resources and adopt the new technology (De Mello, 1997, 1999; Wang & Blomström, 1992). ... s less than the lower critical bounds value at the 5% level of significance. The rest of variables, on the other hand, are cointegrated as capital, trade openness and foreign direct investment are considered as dependent variables due to higher value of F - statistics than upper bounds at the 5% level. This implies that there is long run relationship amongst the variables. Once a long run relationship as cointegration is established, equation (8) is estimated using the following the ARDL (1,0,0,0,0) specification for GDP, FDI, TO, K and L respectively as the order of the ARDL model selected by using AIC (see Table 4). The results indicate that the estimated coefficients of the long-run relationship are signifi- cant for foreign direct investment and labour. Foreign direct investment positively impacts eco- nomic growth in the long run. A 1% increase in foreign direct investment boosts economic growth by 0.076% keeping others constant. Similarly, labour force has a positive (3.42) and significant impact on economic growth. Considering the effect of trade openness and physical capital, the two variables are insignificant at the 5% level. The model failed to indicate any long run rela- tionship between degree of trade opennes, physical capital and economic growth. The degree of trade openness does not stimulate economic growth. 255 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Dependent variable AIC lags F-statistic Decision FlnY (lnY/ lnFDI,lnTO,lnK,lnL) 1 5.09*** Cointegration Critical values Significant level Lower bounds I(0) Upper bounds I(1) 1% 3.74 5.06 5% 2.86 4.01 Table 4: Estimated Long Run Coefficients using the ARDL Approach- ARDL(1,0,0,0,0) Having estimated the long-run model, the next step is to determine the short-run dynamic parameters by estimating error correction model associated with the long- run ARDL estimates. The results of short-run dynamic are obtained from Eq.(9) and given in Table 5. In the short run, the impact of trade openness on economic growth is significant but nega- tive. Foreign direct investment positively and significantly effects on economic growth. The estimate of the lagged error correction term is significant at the 5% level and negative as expected, which confirms the long-run relationship between the variables. The significance and negative sign of the estimated error-correction term reveals the speed of adjustment from the short-run towards the long-run equilibrium. The speed of adjustment towards long run equilibrium is high with its values at -0.775 showing that any short-run shock in economic growth in the pre- vious year converges back to the long-run equilibrium path by approximately 77.5% in the current year. In the long run, FDI, trade openness, capital formation and labour force significantly impact economic growth in the Granger sense. The finding implies that the dynamic causality runs through the error correction term from FDI, trade openness, capital and labour force to economic growth. Table 5: Short Run Results 256 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Variable Coefficient t-Statistic Probability C -48.06*** -4.23 0.0004 Ln(FDI) 0.076*** 3.016 0.0066 Ln(TO) -0.103 -1.44 0.1638 Ln(K) -0.063 -1.11 0.279 Ln(L) 3.42*** 4.24 0.0004 R-squared 0.998 - - F-statistic 2433.05 - 0.0 DW-statistic 1.344 - - Variable Coefficient t-Statistic Probability C 0.014 0.57 0.5763 D(Ln(FDI)) 0.094*** 3.61 0.0019 D(Ln(TO)) -0.22** -2.27 0.039 D(Ln(K)) -0.054 -0.65 0.5247 D(Ln(L)) 2.84** 2.46 0.0236 ECT(-1) -0.775** 0.0222 R-squared 0.628 - - F-statistic 5.354 - 0.0022 DW-statistic 1.769 - - The stability of the long run coefficient is essential and detected by the short-run dynamics. Though based on estimated model of ECM in Eq(9), the cumulative sum of recursive residuals (CUSUM) and the CUSUM of square (CUSUMSQ) tests are obtained to detect the stability of parameters (Pesaran & Pesaran, 1999). The results for CUSUM and CUSUMSQ tests are illus- trated in Figure 1 and Figure 2. The results indicate the presence of stable coefficients because graphs of CUSUM and CUSUMSQ statistic are within critical bounds at the 95% confidence in- terval of parameter stability. Figure 1: Plot of Cumulative Sum of Rescursive Residuals Figure 2: Plot of Cumulative Sum of Squares of Recursive Residuals 257 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 The diagnostic tests can be obtained from Table 6. The problem of non-normality of residual term does not exist in the results. The results show no problem of autoregressive conditional het- eroskadasticity and the serial correlation was not found. Besides, from the results of residual di- agnostic, there is no evidence of white heteroskedasticity. Table 6: Results of diagnostic tests The outcomes of the short- run Granger causality tests are given in Table 7. Based on the F-statistics of the explanatory variables, the short-run causality results show bidirectional causality between FDI and economic growth, between trade openness and economic growth, between phys- ical capital and FDI. In short-run, there is bi-directional Granger causality between trade openness and economic growth. That means the positive and significant impact of trade liberalization on growth. Indeed, the effect is not only contributed from degree of trade, but also justified from the capital move- ment in the type of FDI due to the existence Granger causality from FDI to trade openness. These seems to confirms the existence of trade openness and economic growth nexus. The hypothesis of FDI-led growth also is confirmed in the finding. This means that local businesses got benefit from multinational corporations through spillover effect mechanism. The unidirectional Granger causality runs from FDI and labour to trade openness and from economic growth and trade openness to physical capital. It is interesting that there is no significant Granger causality from FDI and trade openness to labour force. Table 7: Granger short run and long run causality tests 258 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 statistic χ2 statistic Probability Breusch-Godfrey serial correlation test 1.035 0.399 White Heteroskedsticity test 4.75 0.31 Jarque-Bera test 3.5 0.176 Dependent varibale F statistics Direction of causalityD(lnY) D(lnFDI) D(lnTO) D(lnK) D(lnL) D(lnY) —- 6.61** 6.22** 0.009 4.66** FDI”Y; TO”Y; L”Y D(lnFDI) 4.69** ——- 0.73 11.8*** 0.97 Y”FDI; K”FDI D(lnTO) 11.23*** 5.06** ——- 0.024 3.64** Y”TO; FDI”TO; L”TO D(lnK) 7.99*** 14.9*** 2.72* ——- 0.93 Y”K; FDI”K; TO”K D(lnL) 2.09 0.81 0.518 0.22 ——— The non-existence of causality from FDI to labour force in the empirical study fail to con- firm the widespread belief that FDI can generate positive productivity externalities for a host country. Instead of generating positive spillovers in case of the mobility of well-trained labour channel, foreign-owned firms skim trained labour force provided by domestic firms and free ride the good labour force provided by domestic firms at least in the short run. 6. Conclusion This study examines the causal dynamic relationship between FDI, trade openness, physical capital, labour and economic growth in Vietnam for a period of 1990-2017. This paper focuses on a fundament question whether FDI and trade openness spurs economic growth and whether FDI-led growth hypothesis is supported by time series data in Vietnam. The paper employs ARDL bounds tests to analyze the existence of the long-run interaction between the above variables and the Granger causality within VECM to test causality direction among the variables. Evidence of cointegration in the paper implies that the long-run relationship between the variables as economic growth is the dependent variable. Overall, the empirical results of this study show that FDI and trade openness spur economic growth in Vietnam. REFERENCES Alalaya, M. (2010). ARDL models applied for Jordan trade, FDI and GDP series. European Journal of Social Sciences, 13(4), 605-616. Barro, R. J., & Sala-i-Martin, X. (1995). Economic growth New York: New York : McGraw Hill. Belloumi, M. (2014). The relationship between trade, FDI and economic growth in Tunisia: An application of the autoregressive distributed lag model. Economic Systems, 38(2), 269-287. Ben-David, D., & Loewy, M. (1998). Free Trade, Growth, and Convergence. Journal of Economic Growth, 3(2), 143-170. Bonelli, R. (1992). Growth and productivity in Brazilian industries: Impacts of trade ori- entation. Journal of development economics, 39(1), 85-109. Borensztein, E., De Gregorio, J., & Lee, J. W. (1998). How does foreign direct investment affect economic growth? Journal of International Economics, 45(1), 115-135. De Mello, L. R. (1997). Foreign direct investment in developing countries and growth: A selective survey. The Journal of Development Studies, 34(1), 1-34. doi:10.1080/00220389708422501 De Mello, L. R. (1999). Foreign direct investment-led growth: evidence from time series and panel data. Oxford Economic Papers, 51(1), 133-151. Elliott, G., Rothenberg, T., & Stock, J. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64(4), 813. 259 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Engle, R. F., & Granger, C. W. J. (1987). Co-Integration and Error Correction: Represen- tation, Estimation, and Testing. Econometrica, 55(2), 251-276. Friston, K., Moran, R., & Seth, A. (2013). Analysing connectivity with Granger causality and dynamic causal modelling. Current Opinion in Neurobiology, 23(2), 172-178. Harris, R., & Sollis, R. (2003). Applied time series modelling and forecasting. Hye, Q. M. A., & Lau, W.-Y. (2015). Trade openness and economic growth: empirical ev- idence from India. Journal of Business Economics and Management, 16(1), 188-205. Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of economic dy- namics and control, 12(3), 231-254. Johansen, S., & Juselius, K. (1990). Maximum Likelihood Estimation and Inference on Cointegration - With Applications to the Demand for Money. Oxford Bulletin of Economics and Statistics, 52(2), 169. Lucas, R. E. (1988). On the Mechanics of Economic Development. Journal of Monetary Economics, 22(1), 3-42. Maha, K., & Zghidi, N. (2017). Foreign Direct Investment, Trade, and Economic Growth in MENA Countries: Empirical Analysis Using ARDL Bounds Testing Approach. Journal of the Knowledge Economy, 10(1), 397-421. Marc, A. (2011). Is foreign direct investment a cure for economic growth in developing countries? Structural model estimation applied to the case of the south shore Mediterranean coun- tries. Journal of International Business and Economics, 11(4), 32-51. Nguyen, N. T. K. (2017). The Long Run and Short Run Impacts of Foreign Direct Invest- ment and Export on Economic Growth of Vietnam. Asian Economic and Financial Review, 7(5), 519-527. Odhiambo, N. M. (2009). Energy consumption and economic growth nexus in Tanzania: An ARDL bounds testing approach. Energy Policy, 37(2), 617-622. doi:10.1016/j.enpol.2008.09.077 OECD. (2016). Economic Outlook for Southeast Asia, China and India 2016: Enhancing Regional Ties: OECD Publishing. Perron, P., & Phillips, P. C. B. (1988). Testing for a Unit Root in Time Series Regression. Biometrika, 75(2), 335-346. Pesaran, B., & Pesaran, H. (1999). Microfit 4.1 interactive econometric analysis. In: Oxford University Press, Oxford. Pesaran, M. H., & Shin, Y. (1998). An autoregressive distributed-lag modelling approach to cointegration analysis. Econometric Society Monographs, 31, 371-413. Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326. Pham, A. M. (2008). Can Vietnam’s Economic Growth be Explained by Investment or Ex- port: A VAR Analysis. Paper presented at the VDF Working Paper Series. 260 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Pham, T. A., & Nguyen, T. H. D. (2013). Bound Testing Approach to Cointegration: A Re- examination of FDI and Growth in Vietnam. Journal of Economic Development(218), 94-112. Rahman, M. (2009). Contributions Of Exports, Fdi And Expatriates’remittances To Real Gdp Of Bangladesh, India, Pakistan And Sri Lanka. Southwestern Economic Review, 36, 141- 153. Rahman, M. M., & Shahbaz, M. (2013). Do Imports and Foreign Capital Inflows Lead Economic Growth? Cointegration and Causality Analysis in Pakistan. South Asia Economic Jour- nal, 14(1), 59-81. Romer, P. M. (1986). Increasing Returns and Long-Run Growth. Journal of Political Econ- omy, 94(5), 1002-1037. Roy, S., & Mandal, K. (2012). Foreign Direct Investment and Economic Growth: An Analy- sis for Selected Asian Countries. Journal of Business Studies Quarterly, 4(1), 15-24. Said, S. E., & Dickey, D. A. (1984). Testing for unit roots in autoregressive-moving average models of unknown order. Biometrika, 71(3), 599-607. Solow, R. (1956). A contribution to the theory of economic growth. The quarterly journal of economics, 70(1), 65-94. doi:10.2307/1884513 Solow, R. (1957). Technical Change and the Aggregate Production Function. The Review of Economics and Statistics, 39, 312. Sothan, S. (2016). Foreign direct investment, exports, and long-run economic growth in Asia panel cointegration and causality analysis. International journal of economics and finance, 8(1), 26-37. Spence, M. (2011). The Next Convergence. The Future of Economic Growth in a Multispeed World. New York: Farrar, Straus and Giroux. Suyanto, Bloch, H., & Salim, R. A. (2012). Foreign Direct Investment Spillovers and Pro- ductivity Growth in Indonesian Garment and Electronics Manufacturing. The Journal of Devel- opment Studies, 48(10), 1397-1411. Trinh, N. H., & Nguyen, Q. A. M. (2015). The Impact of Foreign Direct Investment on Economic Growth: Evidence from Vietnam. Developing Country Studies, 5(20), 1-9. Varamini, H., & Vu, A. (2007). Foreign direct investment in Vietnam and its impact on economic growth. International journal of business research, 7(6), 132-139. Vu, T. B. (2008). Foreign direct investment and endogenous growth in Vietnam. Applied Economics, 40(9), 1165-1173. Wang, J.-Y., & Blomström, M. (1992). Foreign investment and technology transfer: A sim- ple model. European Economic Review, 36(1), 137-155. doi:10.1016/0014-2921(92)90021-N World Bank. (2012). 2012 World Development Report on Jobs. In. World Bank, Washing- ton, DC. 261 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020

File đính kèm:

moi_quan_he_nhan_qua_giua_fdi_do_mo_thuong_mai_va_tang_truon.pdf

moi_quan_he_nhan_qua_giua_fdi_do_mo_thuong_mai_va_tang_truon.pdf