Hành vi hối lộ, tiếp cận tín dụng, sức mạnh đàm phán của doanh nghiệp và sức ép cạnh tranh trên thị trường: bằng chứng từ số liệu doanh nghiệp đa quốc gia

Nghiên cứu này sử dụng dữ liệu doanh nghiệp đa quốc gia, bao gồm 104 quốc gia trong

giai đoạn từ 2010 tới 2019 để nghiên cứu tác động của hành vi đút lót tới việc tiếp cận tài chính

của doanh nghiệp sở hữu sức mạnh đàm phán và/hoặc hoạt động trên thị trường có nhiều cạnh

tranh. Chúng tôi sử dụng kích thước doanh nghiệp và trạng thái pháp lý để ghi nhận sức mạnh

đàm phán của doanh nghiệp, trong khi chúng tôi sử dụng thông tin về số lượng đối thủ cạnh

tranh trên cùng lĩnh vực để đánh giá mức độ cạnh tranh trên thị trường mà doanh nghiệp hoạt

động. Kết quả thực nghiệm chỉ ra bằng chứng ủng hộ giả thuyết bôi trơn để được tiếp cận các

nguồn tài chính, tín dụng. Ngoài ra, tác động của hành vi đút lót trở nên mạnh hơn đối với

doanh nghiệp có quy mô lớn hoặc doanh nghiệp đăng ký kinh doanh chính thức, hoặc doanh

nghiệp không bị sức ép cạnh tranh quá lớn. Tác động cũng trở nên mạnh hơn khi cúng tôi kiểm

soát vấn đề nội sinh.

Từ khóa: Hối lộ, tiếp cận tín dụng, sức mạnh đàm phán của doanh nghiệp, cạnh tranh

trên thị trường 1.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Hành vi hối lộ, tiếp cận tín dụng, sức mạnh đàm phán của doanh nghiệp và sức ép cạnh tranh trên thị trường: bằng chứng từ số liệu doanh nghiệp đa quốc gia

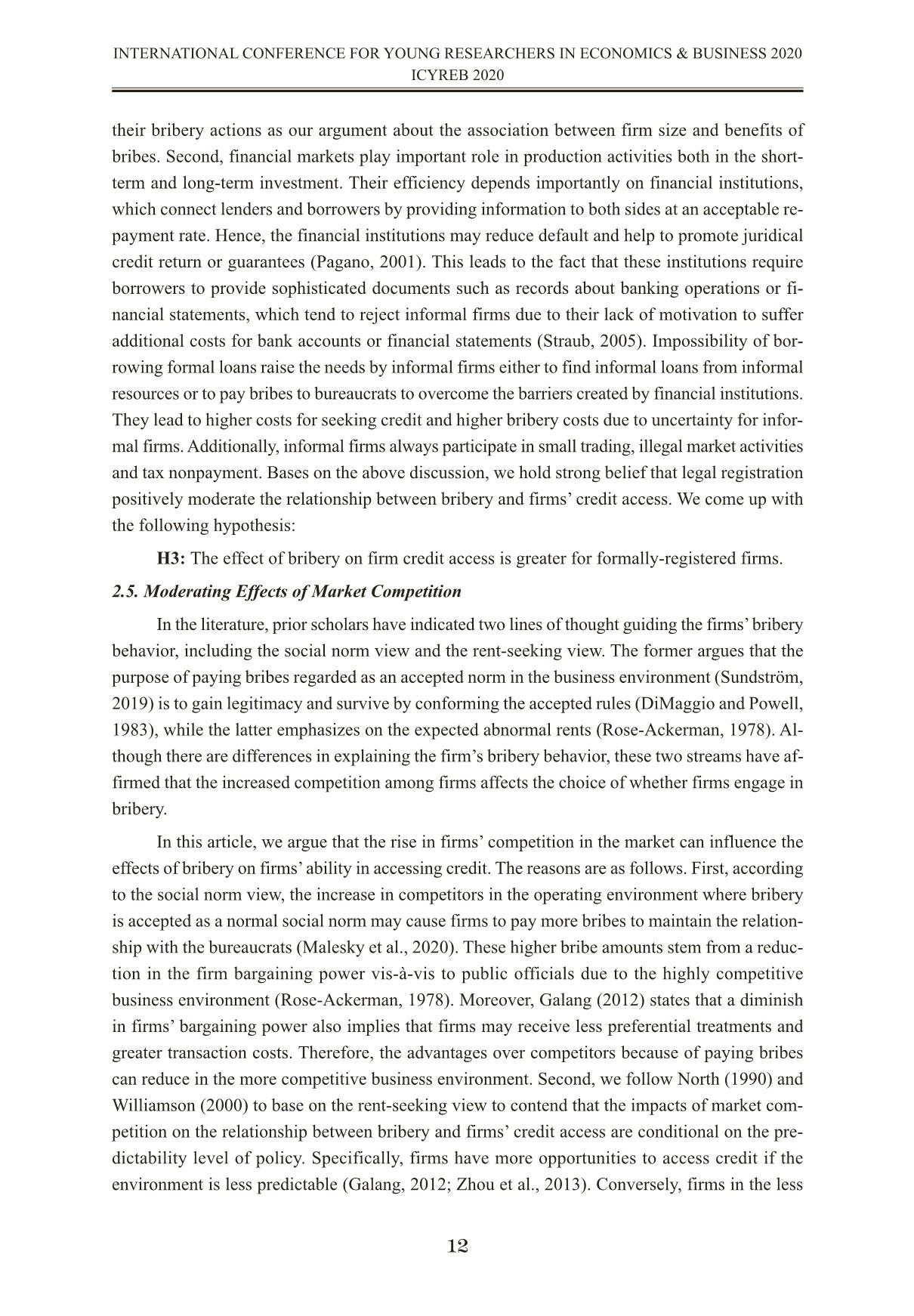

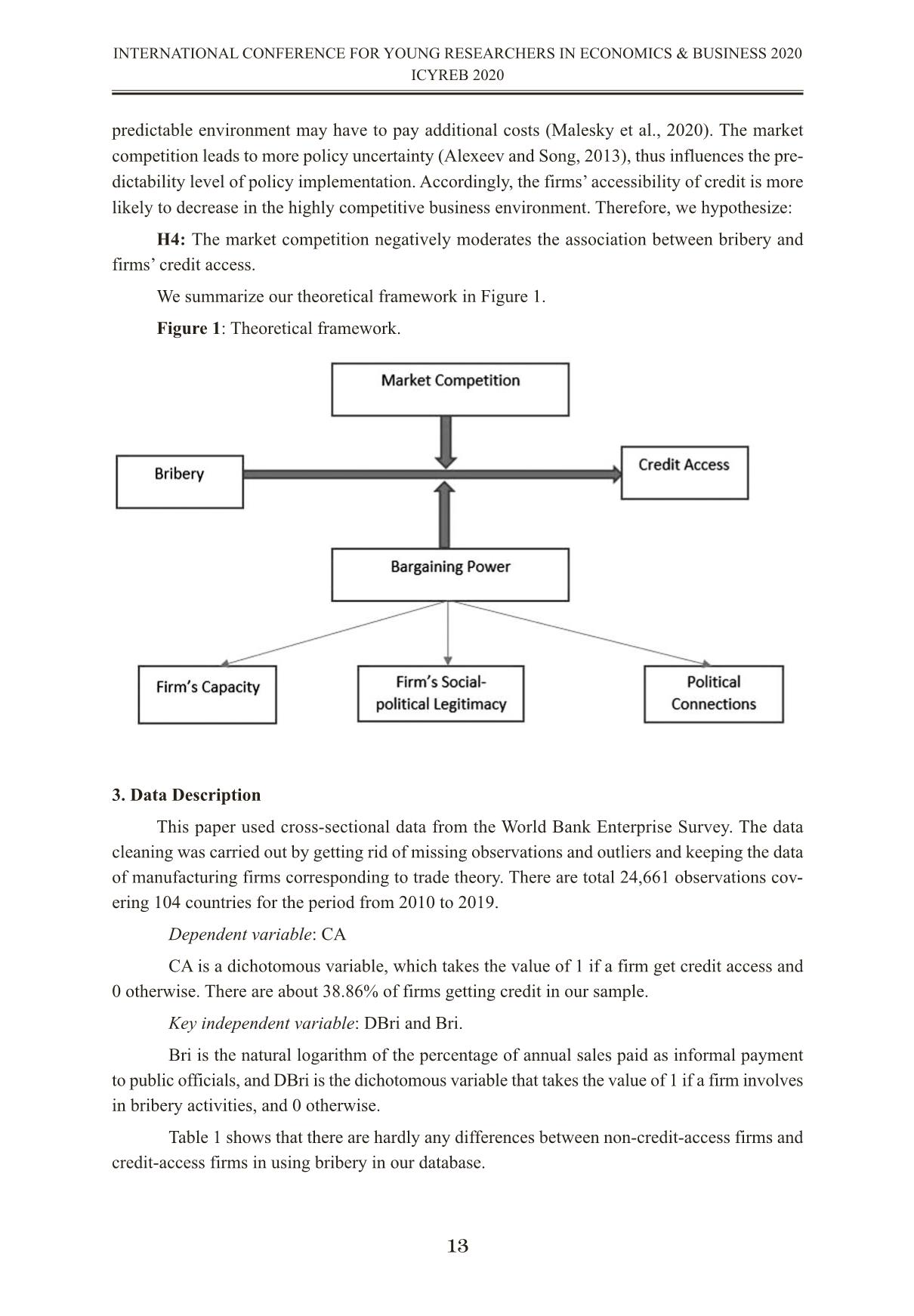

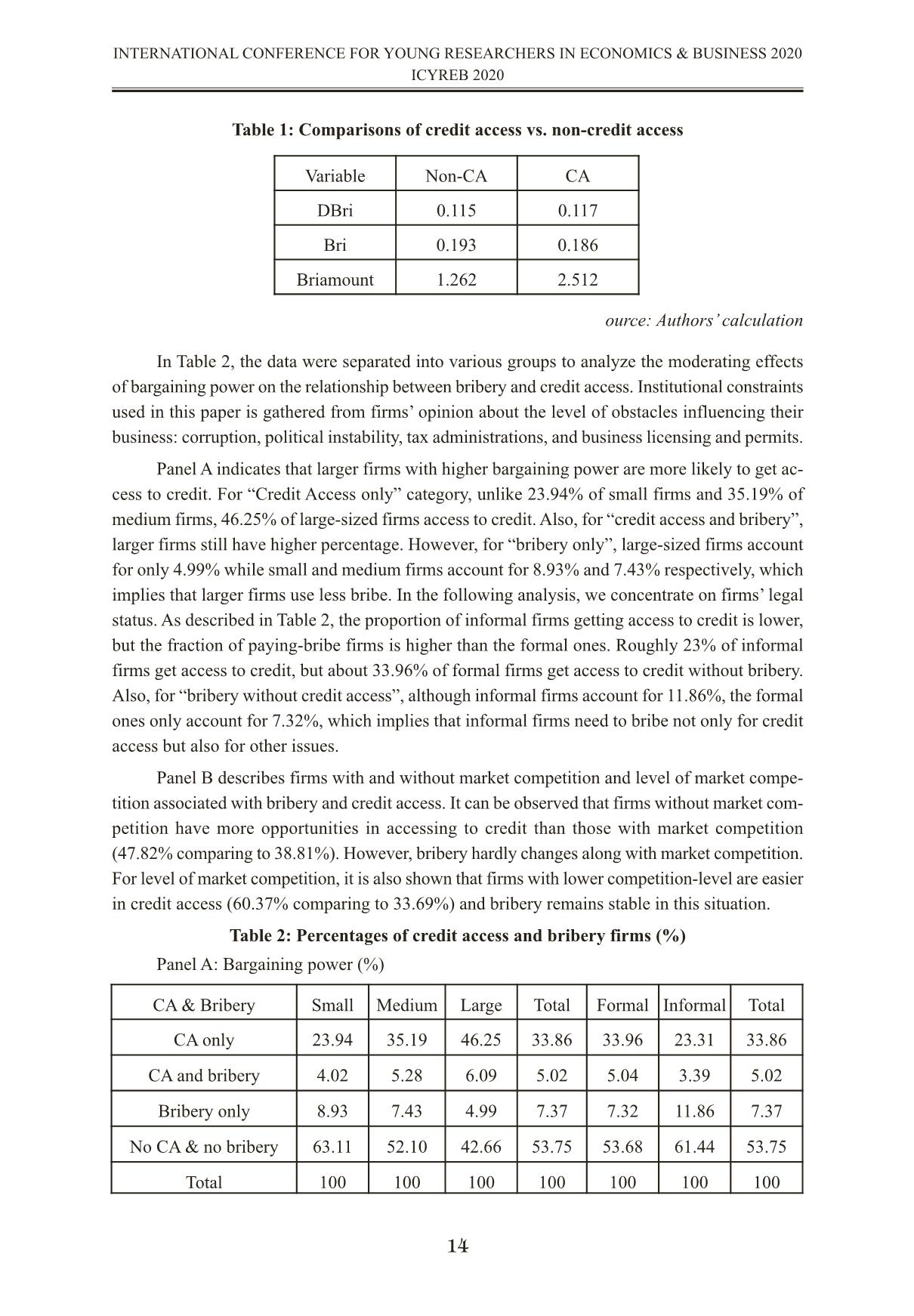

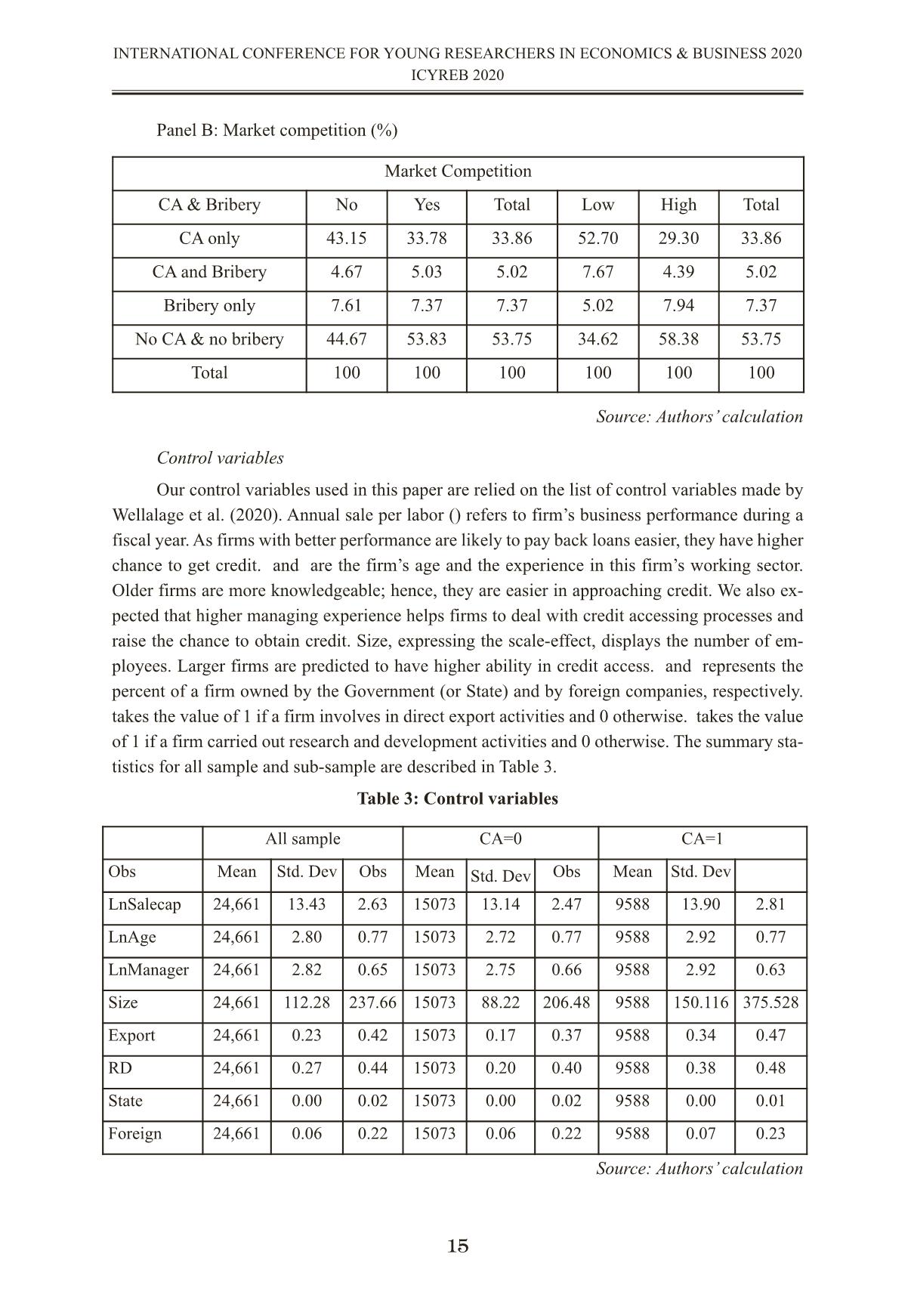

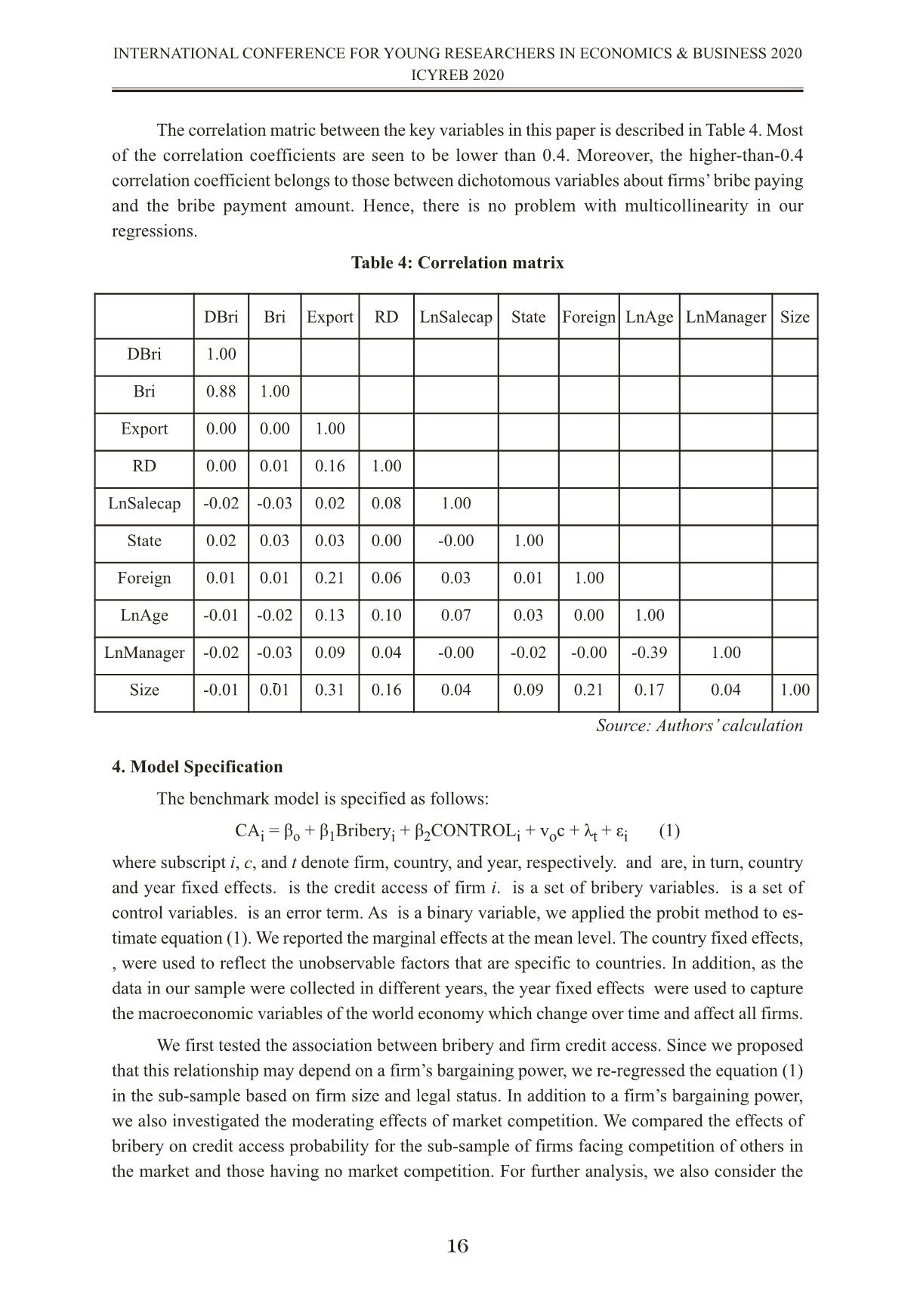

BRIBERY, CREDIT ACCESS, BARGAINING POWER AND MARKET COMPETITION: EVIDENCE FROM CROSS-COUNTRY FIRM-LEVEL DATA HÀNH VI HỐI LỘ, TIẾP CẬN TÍN DỤNG, SỨC MẠNH ĐÀM PHÁN CỦA DOANH NGHIỆP VÀ SỨC ÉP CẠNH TRANH TRÊN THỊ TRƯỜNG: BẰNG CHỨNG TỪ SỐ LIỆU DOANH NGHIỆP ĐA QUỐC GIA Dr. Le Thanh Ha; Dao Hanh Le; Nguyen Ngoc Mai National Economics University lethanhha@neu.edu.vn Abstract This paper used the multi-country firm-level data covering 104 countries for the period from 2010 to 2019 to investigate the effects of bribery on credit access for firms holding bargain- ing power and/or facing market competition. We used firms’ size and legal status to capture their bargaining power, while the levels of market competition were analyzed according to the number of competitors in the same working field. Our empirical results provided evidence to support the “greasing-the-wheels-of-credit access” hypothesis. Furthermore, the effects of bribery become stronger for larger-sized or formally-registered firms, and those facing no market competition. These effects also become pronounced if we controlled the endogeneity problem. Keywords: Bribery, Credit Access, Bargaining Power, Market Competition, Cross-country Firm-level. Tóm tắt Nghiên cứu này sử dụng dữ liệu doanh nghiệp đa quốc gia, bao gồm 104 quốc gia trong giai đoạn từ 2010 tới 2019 để nghiên cứu tác động của hành vi đút lót tới việc tiếp cận tài chính của doanh nghiệp sở hữu sức mạnh đàm phán và/hoặc hoạt động trên thị trường có nhiều cạnh tranh. Chúng tôi sử dụng kích thước doanh nghiệp và trạng thái pháp lý để ghi nhận sức mạnh đàm phán của doanh nghiệp, trong khi chúng tôi sử dụng thông tin về số lượng đối thủ cạnh tranh trên cùng lĩnh vực để đánh giá mức độ cạnh tranh trên thị trường mà doanh nghiệp hoạt động. Kết quả thực nghiệm chỉ ra bằng chứng ủng hộ giả thuyết bôi trơn để được tiếp cận các nguồn tài chính, tín dụng. Ngoài ra, tác động của hành vi đút lót trở nên mạnh hơn đối với doanh nghiệp có quy mô lớn hoặc doanh nghiệp đăng ký kinh doanh chính thức, hoặc doanh nghiệp không bị sức ép cạnh tranh quá lớn. Tác động cũng trở nên mạnh hơn khi cúng tôi kiểm soát vấn đề nội sinh. Từ khóa: Hối lộ, tiếp cận tín dụng, sức mạnh đàm phán của doanh nghiệp, cạnh tranh trên thị trường 1. 1. Introduction Undoubtedly, a capital plays an essential role for firms in contributing to the sustainable 7 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 growth and efficiency in firms’ operation activities, along with labors and technology (Aghion and Howitt, 2007). In addition to equity capital, firms use debt capital such as bank credit for their business activities. Accordingly, the access conditions to bank credit are important for the survival and development of both small-medium sized (SMEs) and large firms (Levine et al., 2000). Specifically, the micro and small firms make up for a large proportion of the developing economy (De Mel et al., 2009; Nichter and Goldmark, 2009) and financial constraints are con- sidered as a major obstacle for their daily business operations (Ayyagari et al., 2008; Beck and Demirguc-Kunt, 2008). However, the rigid financial system can create lots of challenges for firm to meets the conditions of financial institutions to issue the loans (Liu et al., 2020). Under this circumstance, firms may experience inefficient resource allocations and show the poor per- formance. In many countries, the government interferes in the economy by laws or regulations, there- fore, the quality of institutional environment not only plays an important role in credit market but also affect firms’ credit registrations (Galli et al., 2017). A great deal of papers studies the de- terminants of the quality of institutional environment such as performance in practicing laws (La Porta et al., 1997; Djankov et al., 2008). Firms may face difficulties to satisfy the requirements stemming from legal regulations requested by the government. Under this circumstance, paying bribes, with hardly any other choice is considered as a strategic behavior that allows firms to avoid the constraints from both the governments and banks (Zhou and Peng, 2012). Since bribery often happens in countries where the government involves in the economy (Klitgaard, 1988) or public servants possess low wages (Kraay and Van Rijckeghem, 1995), bribery can be served as a powerful tool for firms to help them to connect with public officials, then control their private benefits (Martin et al., 2007). In the literature, prior scholars have investigated the association between bribery and credit access. For example, Fungacova et al. (2015) provided empirical results that bribery has signif- icantly positive impacts on total firms’ bank debt in the short-term but negative impact in the long-term. Şeker and Yang (2014) claim that making informal payments such as bribery may cre- ate bigger burdens on the developmen ... nsive sector remain quite similar to each other. Table 10 also shows that there is no significant difference in effects of bribery on the probability of accessing credit across sectors. Table 10: Estimation results of sub-sample by sector Robust standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1 25 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 VARIABLES Supplier-dominated Scale-intensive Science-based CA CA CA CA CA CA DBri 0.21*** 0.21*** 0.24*** (0.050) (0.072) (0.058) Bri 0.09*** 0.08* 0.09*** (0.026) (0.039) (0.032) RD 0.32*** 0.32*** 0.29*** 0.29*** 0.37*** 0.37*** (0.035) (0.035) (0.052) (0.052) (0.038) (0.038) Export 0.32*** 0.32*** 0.37*** 0.37*** 0.24*** 0.24*** (0.037) (0.037) (0.060) (0.060) (0.044) (0.044) LnSalecap 0.10*** 0.10*** 0.08*** 0.08*** 0.12*** 0.12*** (0.011) (0.011) (0.017) (0.017) (0.014) (0.014) State 0.13 0.14 -1.64 -1.66 -0.13 -0.08 (0.651) (0.648) (1.236) (1.234) (0.828) (0.827) Foreign -0.40*** -0.40*** -0.34*** -0.34*** -0.46*** -0.46*** (0.069) (0.068) (0.109) (0.109) (0.080) (0.080) LnAge 0.02 0.02 0.00 0.00 0.07*** 0.08*** (0.021) (0.021) (0.034) (0.034) (0.026) (0.026) LnManager 0.05** 0.05** 0.12*** 0.12*** 0.07** 0.06** (0.025) (0.025) (0.039) (0.039) (0.031) (0.031) Size 0.00*** 0.00*** 0.00*** 0.00*** 0.00*** 0.00*** (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) Constant -2.06*** -2.06*** -1.23** -1.21** -2.79*** -2.78*** (0.268) (0.268) (0.547) (0.547) (0.422) (0.420) Observations 9,421 9,421 4,373 4,373 6,652 6,652 Pseudo R2 0.197 0.197 0.186 0.185 0.200 0.199 5.3. IV Estimation Until now, we have not dealt with the endogeneity issue that might cause our estimation results to be biased. We, therefore, concentrate on this issue in this part. We follow Wellalage et al. (2020) to use the sector-country average bribing amount (GBri_ivb and GBri_ivr) and firm’s attitude toward the level of judiciary system corruption (Weak_Judiciary) as our instruments. We then re-investigate the effects of bribery on the probability of credit access by employing instru- mental variable probit models. We construct two sets of instruments: (GBri_ivb and Weak_Judi- ciary) for DBri and (GBri_ivr and Weak_Judiciary) for Bri. The results of the IV regression on full sample and sub-sample are displayed in Table 11. Comparing to the benchmark estimation results in Table 5, our hypothesis about the effects of bribery in credit access remains unchanged. All coefficients’ signs stay steadily with our earlier estimations, but the marginal effects are substantially greater. These results firmly reinforce our argument about the existence of “greasing the wheel of credit access” hypothesis. Overall, the results coming from this IV model estimation strengthen our main conclusion that bribery has positive effect on firm credit access. When contemplating endogeneity issue, the influence of bribery on credit access is notably greater. Table 11: IV model estimation 26 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 VARIABLES (1) (2) (5) (6) CA GDBri CA GBri GDBri 0.45*** (0.119) GBri 0.17*** (0.062) RD 0.32*** 0.01*** 0.32*** 0.03*** (0.023) (0.005) (0.023) (0.009) Export 0.33*** 0.02*** 0.33*** 0.03*** (0.025) (0.005) (0.025) (0.010) LnSalecap 0.11*** -0.01*** 0.11*** -0.02*** (0.007) (0.002) (0.007) (0.003) State -0.61 0.10 -0.58 0.17 (0.472) (0.096) (0.472) (0.180) Foreign -0.36*** -0.02** -0.37*** -0.02 (0.045) (0.009) (0.045) (0.017) LnAge 0.03** 0.00 0.04** 0.00 (0.014) (0.003) (0.014) (0.005) LnManager 0.08*** -0.01*** 0.08*** -0.02*** (0.017) (0.003) (0.017) (0.006) Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1 6. Conclusion This paper represented an attempt to seek the answer to the question of how bribery affects firms’ credit access in developing markets. We used a firm-level cross-country dataset covering 104 countries for the period from 2010 to 2019 to provide empirical evidence to support the “greasing-the-wheels of credit access” hypothesis. Furthermore, we have shown that the effects of bribery on firms’ accessibility to credit were heterogeneous. In particular, the effect of bribery was especially strong for either larger-sized as well as formally-registered firms or those facing no competition or operating in low-level market competition. The findings of this study suggest some policy implications. In the developing countries characterized by weak and poor quality of institutions, firms’ scale and legalization are the key factors determining the ability of firms to access finance. Our study suggests increasing firm credit access relies mainly on government assistance. The government should take plans to sup- port and help firms to expand their business. The administration procedure and the legal barriers regarding business registration can be alleviated. Moreover, a market competition plays an im- portant role on promoting the ability of firms to access financial markets, therefore, the govern- ment should also propose policies to reduce the market competition in a typical market. REFERENCES Aghion, P. & Howitt, P. (2007). Capital, Innovation, and Growth Accounting. Oxford Re- view of Economic Policy, 23(1), 79–93. 27 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Size 0.00*** -0.00 0.00*** -0.00* (0.000) (0.000) (0.000) (0.000) GBri_ivb 0.98*** (0.025) Weak_Judiciary 0.03*** 0.06*** (0.006) (0.011) GBri_ivr 0.98*** (0.024) Constant -2.26*** 0.00 -2.25*** 0.04 (0.199) (0.041) (0.199) (0.077) Observations 21,708 21,708 21,708 21,708 Pseudo R2 0.0718 0.0718 0.189 0.189 Alexeev, M., & Song, Y. (2013). Corruption and product market competition: An empirical investigation. Journal of Development Economics, 103, 154–166. Ayyagari, M., Demirguc-Kunt, A., & Maksimovic, V. (2008). How important are financing constraints? The role of finance in the business environment. World Bank Economic Review, 22 (3), 483-516. Barth, J. R., Lin, C., Lin, P., & Song, F. M. (2009). Corruption in bank lending to firms: Cross-country micro evidence on the beneficial role of competition and information sharing. Journal of Financial Economics, 91(3), 361–388. Beck, P. J., & Maher, M. W. (1986). A comparison of bribery and bidding in thin markets. Economics Letters, 20(1), 1–5. Beck, T., & Demirguc-Kunt, A. (2008). Access to finance – An unfinished agenda. World Bank Economic Review, 22 (3), 383-396. Beck, T., Demirguc-Kunt, A., & Levine, R. (2006). Bank supervision and corruption in lending. Journal of Monetary Economics, 53(8), 2131–2163. Bliss, C., & Tella, R. D. (1997). Does competition kill corruption? Journal of Political Economy, 105(5), 1001–1023. Cai, H. B., Fang, H. M., & Xu, L. C. (2011). Eat, drink, firms, government: An investigation of corruption from the entertainment and travel costs of Chinese firms. The Journal of Law and Economics, 54(1), 55-78. Chen, Y., Liu, M., & Su, J. (2013). Greasing the wheels of bank lending: Evidence from private firms in China. Journal of Banking & Finance, 37(7), 2533–2545 Cuervo-Cazurra, A. (2006). Who cares about corruption? Journal of International Business Studies, 37, 807–822. DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 147–160. De Mel, S., McKenzie, D. J., & Woodruff, C. (2009). Measuring microenterprise profits: Must we ask how the sausage is made?. Journal of Development Economics, 88 (1), 19-31. De Paula, A., & Scheinkman, J. A. (2007). The Informal Sector, NBER Working Paper Se- ries, Working Paper 13486, De Soto, H. (1989). The other path. New York: Harper and Row Publisher. De Soto, H. (2000). The mystery of capital: Why capitalism triumphs in the west and fails every-where else. New York: Basic Books Publisher. Diaby, A., & Sylwester, K. (2015). Corruption and Market Competition: Evidence from Post-Communist Countries. World Development, 66, 487–499. Djankov S, La Porta R, Lopez-de-Silanes F, Shleifer A (2008) The law and economics of self dealing. Journal of Financial Economics, 88, 430 465. Faccio, M., Masulis, R. W., & McConnell, J. J. (2006). Political connections and corporate bailouts. The Journal of Finance, 61(6), 2597–2635. 28 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Faccio, M. (2010). Differences between politically connected and nonconnected firms: A cross-country analysis. Financial Management, 39 (3), 905-927. Farazi, S. (2014). Informal firms and financial inclusion: Status and determinants. Journal of International Commerce, Economics and Policy, 5 (3), 1440011. Firth, M., Lin, C., Liu, P., & Wong, S. M. L. (2009). Inside the black box: Bank credit al- location in China’s private sector. Journal of Banking & Finance, 33(6), 1144–1155. Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics, 83(1), 63–75. Fungáčová, Z., Kochanova, A., & Weill, L. (2015). Does money buy credit? Firm-level evidence on bribery and bank debt, World Development 68, 308-322. Galang, R. M. N. (2012). Victim or victimizer: Firm responses to government corruption. Journal of Management Studies, 49(2), 429–462 Galli, E., Mascia, D. V., & Rossi, S. P. S. (2017). Does corruption affect access to bank credit for micro and small business? Evidence from European MSMES? ADBI Working Paper Series, 23. Gonzalez, V. M. (2015). The financial crisis and corporate debt maturity: The role of bank- ing structure. Journal of Corporate Finance, 35, 310-328. Guriev, S. (2004). Red tape and corruption. Journal of Development Economics, 73(2), 489–504. Johnson, S., La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (2000). Tunneling. American Economic Review, 90 (2), 22-27. Honhyan, Y. (2009). The determinants of capital structure of the SMEs: An empirical study of Chinese listed manufacturing companies. Retrieved from www.seiofbluemountain.com/search/detail.php?id=4414 Klitgaard, R. (1988). Controlling Corruption, University of California Press, Berkeley, CA. Kraay, A., & Van Rijckeghem, C. (1995). Employment and wages in the public sector: A cross-country study. IMF Working Paper (95/70). La Porta. R., Lopez-De-Silanes, F., Shleifer, A., & Vishny, R. W. (1997). Legal determinants of external finance. The Journal of Finance, 7(3), 1131–1150. La Porta, R., Lopez-De-Silanes, F., Shleifer, A., & Vishny, R. W. (2002). Investor protection and corporate valuation. The Journal of Finance, 57(3), 1147–1170. Levine, R., Loayza, N., & Beck. T. (2000) Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46, 31-77. Li, H. B., Meng, L. S., Wang, Q., & Zhou, L. A. (2008). Political connections, financing and firm performance: Evidence from Chinese private firms. Journal of Development Economics, 87 (2), 283-299. Liu, P., Li, H., & Guo, H. (2020). The Impact of corruption on firms’ access to bank loans: Evidence from China. Economic Research-Ekonomska Istraživanja, 33 (1), 1963–84. 29 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Lui, F. T. (1985). An equilibrium queuing model of bribery. Journal of Political Economy, 93(4), 760-781. Malesky J. E., Thang, V. N., Thang, N. B., & Bao D. H. (2020). The effect of market com- petition on bribery in emerging economies: An empirical analysis of Vietnamese firms. World Development, 131, 104957. Martin, K. D., John, B. C., Jean, L. J, & Parboteeah, K. P. (2007). Deciding to bribe: A cross-level analysis of firm and home country influences on bribery activity. Academy of Man- agement Journal, 50 (6), 1401–22. Nichter, S., & Goldmark, L. (2009). Small firm growth in developing countries. World De- velopment, 37 (9), 1453-1464. Nguyen, T. V., Le, N. T. B., Dinh, H. L. H., & Pham, H. T. L. (2020). Do entrepreneurial firms suffer more from bribery? An empirical study of businesses in Vietnam. Post-Communist Economies. Nguyen, V. T., Le, Q. C., Nguyen, V. H., & Bach, N. T. (2017). Tham nhũng dựa trên “cấu kết” và định hướng mới trong phòng chống tham nhũng ở việt nam [Collusion-based corruption and new direction for anti-corruption agenda in Vietnam]. Tap Chi Kinh Te & Phat Trien [Journal of Economics & Development], 241(Thang 7), 10–16. North, D. C. (1990). Institutions, institutional change and economic performance. Cam- bridge: Cambridge University Press. Pagano, M. (Ed.). (2001). Defusing Default, Incentives and Institutions. IDB and OECD, John Hopkins University Press, Washington, DC. Rose-Ackerman, S. (1978). Corruption – A study in political economy. New York: Aca- demic Press. Rose-Ackerman, S. (1998). Corruption and development, B. Pleskovic and J. Stiglitz (eds.). Annual World Bank Conference on Development Economics 1997, World Bank, Washington DC, pp. 35–58. Rothenberf, A. D., Gaduh, A., Burger, N. E., Charina, C., Tjandraningsih, I., Radikun, R., Sutera, C., & Weilant, S. (2016). Rethinking Indonesia’s informal sector. World Development, 80, 96-113. Şeker, M., & Yang, J. S. (2014). Bribery solicitations and firm performance in the Latin America and Caribbean region. Journal of comparative economics, 42(1), 246–264. Stein, J. C. (2002). Information production and capital allocation: Decentralized vs. hier- archical firms. Journal of Finance, 57, 1891-1921. Straub, S. (2005). Informal sector: The credit market channel. Journal of Development Economics, 78(2), 299–321. Sundström, A. (2019). Why Do People Pay Bribes? A Survey Experiment with Resource Users. Social Science Quarterly, 100(3), 725–735. Tomiura, E. (2007). Effects of R&D and networking on the export decision of Japanese 30 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 firms. Research Policy, 36(5), 758-767. Weill, L. (2011). Does corruption hamper bank lending? Macro and micro evidence. Em- pirical Economics, 41, 25–42. Wellalage, H., Locke, S., & Samujh, H. (2019). Firm bribery and credit access: Evidence from Indian SMEs. Small Business Economics, 55 (1), 283-304. Williamson, O. E. (2000). The new institutional economics: Taking stock, looking ahead. Journal of Economic Literature, 38(3), 595–613. Zhou, J. Q., & Peng, M. W. (2012). Does bribery help or hurt firm growth around the world? Asia Pacific Journal of Management, 29(4), 907–921. Zhou, X., Han, Y., & Wang, R. (2013). An empirical investigation on firms’ proactive and passive motivation for bribery in China. Journal of Business Ethics, 118(3), 461–472. 31 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020

File đính kèm:

hanh_vi_hoi_lo_tiep_can_tin_dung_suc_manh_dam_phan_cua_doanh.pdf

hanh_vi_hoi_lo_tiep_can_tin_dung_suc_manh_dam_phan_cua_doanh.pdf