Growth option and capital structure: Evidence from an emerging markets

In the financial literature, the relationships between capital structure and growth

options are explained in two main theories including trade – off theory and pecking – order

theory. Numerous studies have been done to examine the relationships between capital

structure and growth option in the economic field of finance and capital analysis following

these theories (for instance, see Adedeji (2002), Antoniou et al. (2008), Antoniou et al.

(2008), and Antoniou et al. (2008)). In fact, these empirical works on the capital structure and

growth options under the light of trade – off theory and pecking – order theory have been

taken in the context of developed countries such as US, Japan, UK, which have strong market

disciplines, corporate governance and less agency problems (Harford et al., 2012).

Some recent studies consider these theories in the context of emerging countries such

as China with the results favor the existence of pecking – order theory. For example, Chen

(2004) finds that neither the trade-off model nor the Pecking order hypothesis derived from

the Western settings provides convincing explanations for the capital choices of the Chinese

firms. Where, the capital choice decision of Chinese firms seems to follow a „„new Pecking

order‟-retained profit, equity, and long-term debt, this is because the fundamental institutional

assumptions underpinning the Western models are not valid in China. Tong and Green (2005)

find a significant negative correlation between leverage and profitability, and a significant

positive correlation between current leverage and past dividends, that results broadly support

the pecking order hypothesis over trade-off theory in Chinese companies. Yao-hui and Yuan

lue (2007) use independent variable order property of ordered-probit model, their findings

support the pecking order theory as far as exterior financing order of Chinese companies. Ni

and Yu (2008) examine whether the financial structure of China's listed companies follows a

pecking order from debt to equity, they find no evidence that China's listed companies follow

a pecking order when they need funds to finance investment projects. More precisely, they

indicate that big companies follow a pecking order and small and medium companies do not,

this result suggests that the Chinese capital market is still under development.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Growth option and capital structure: Evidence from an emerging markets

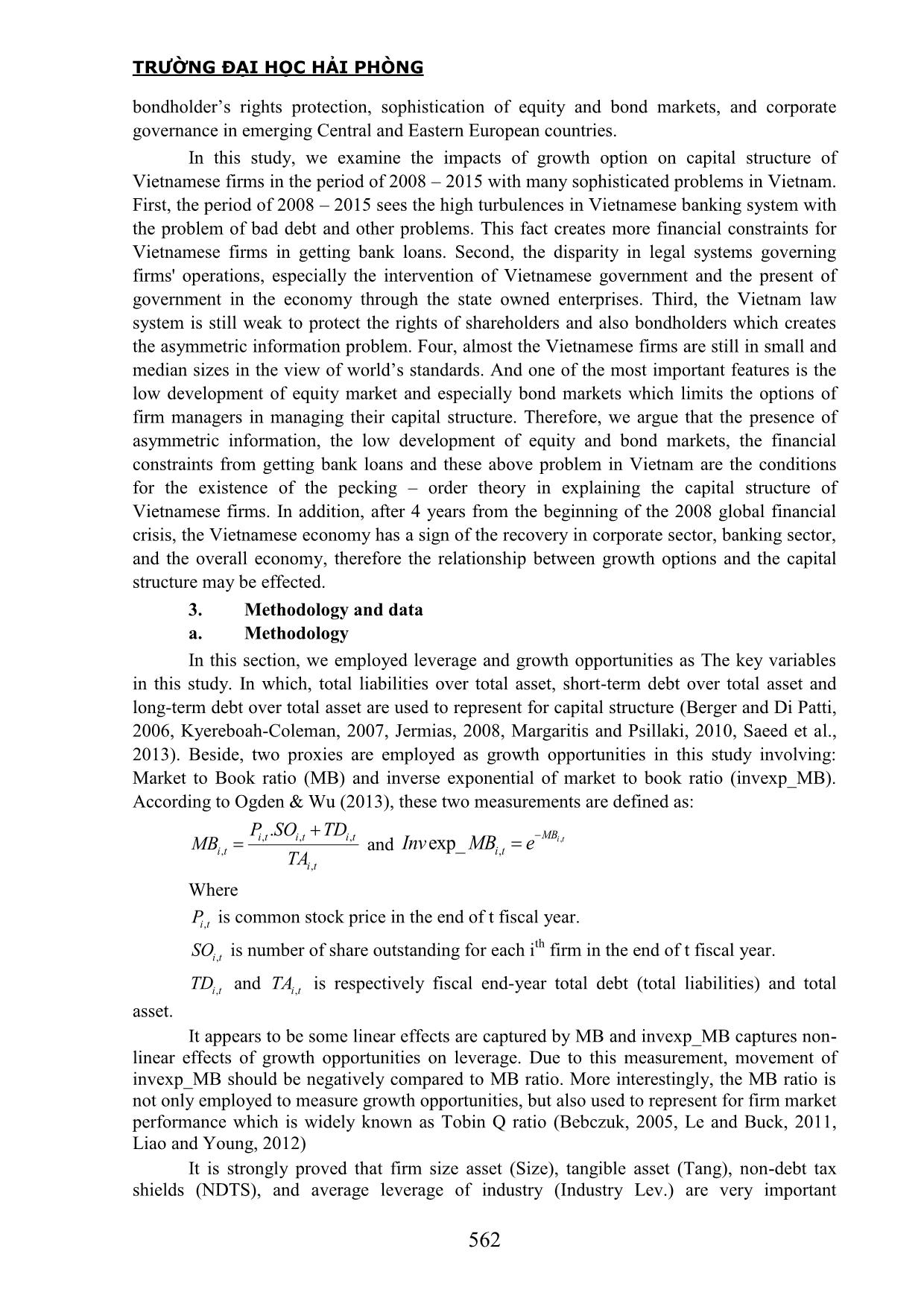

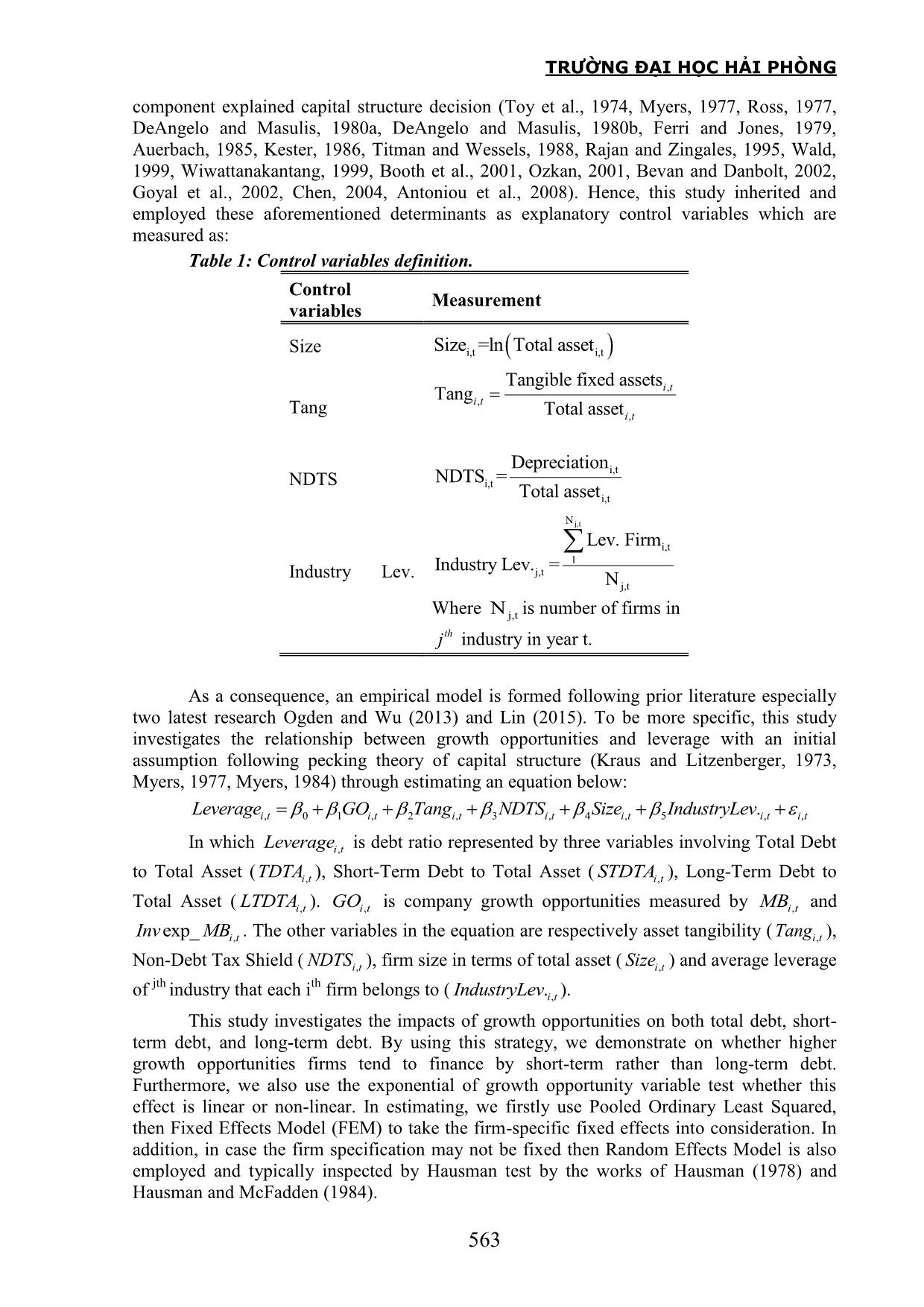

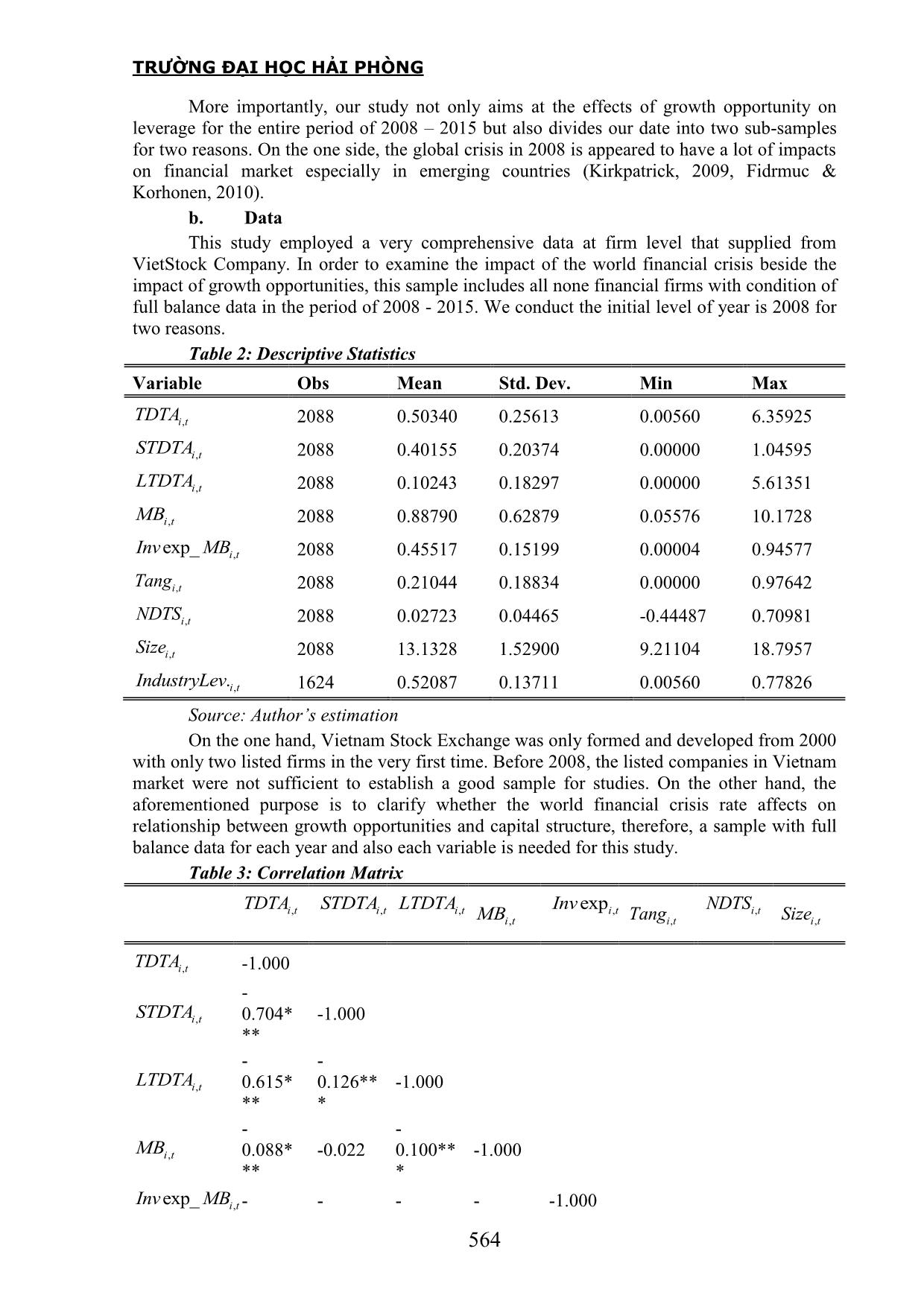

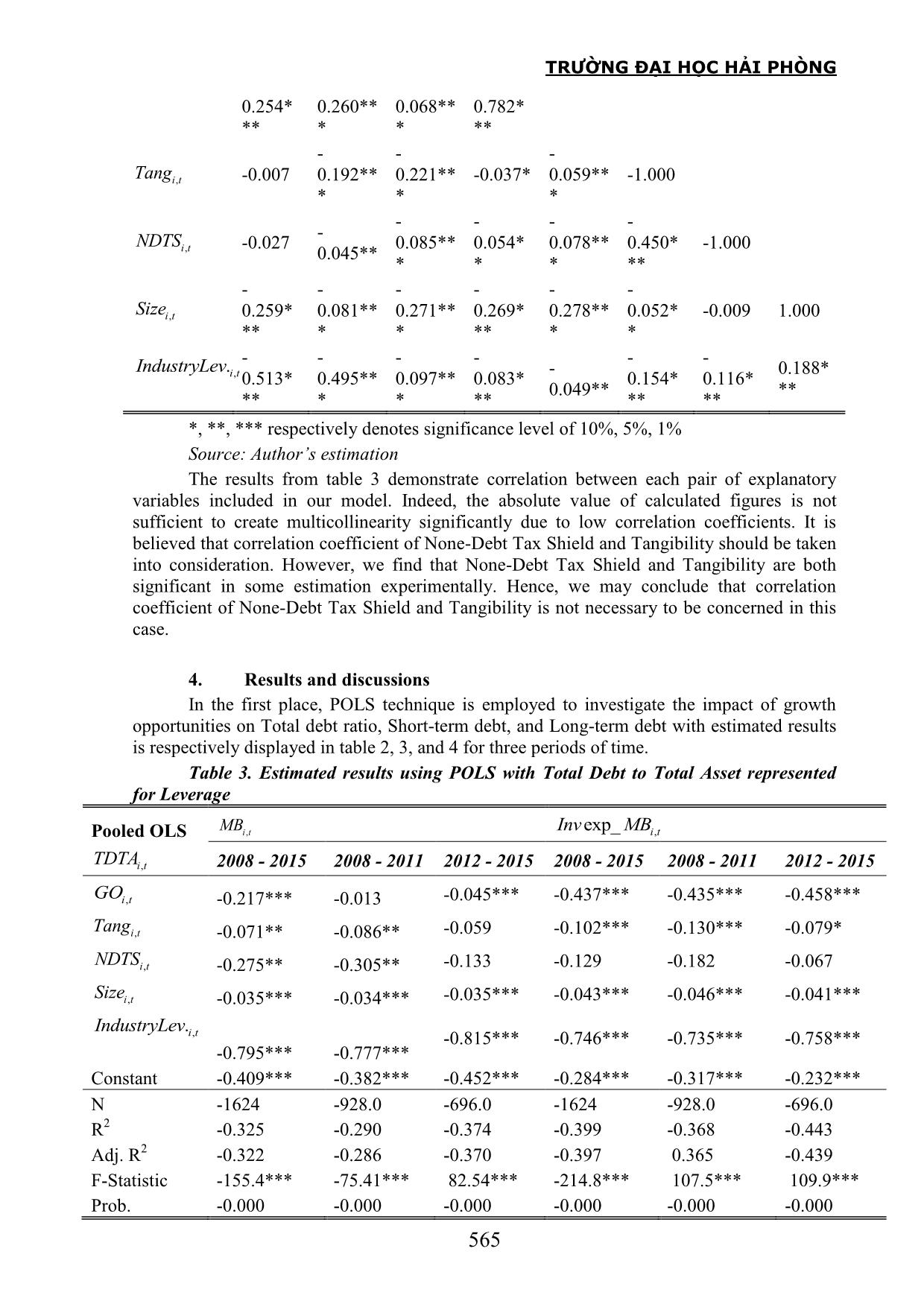

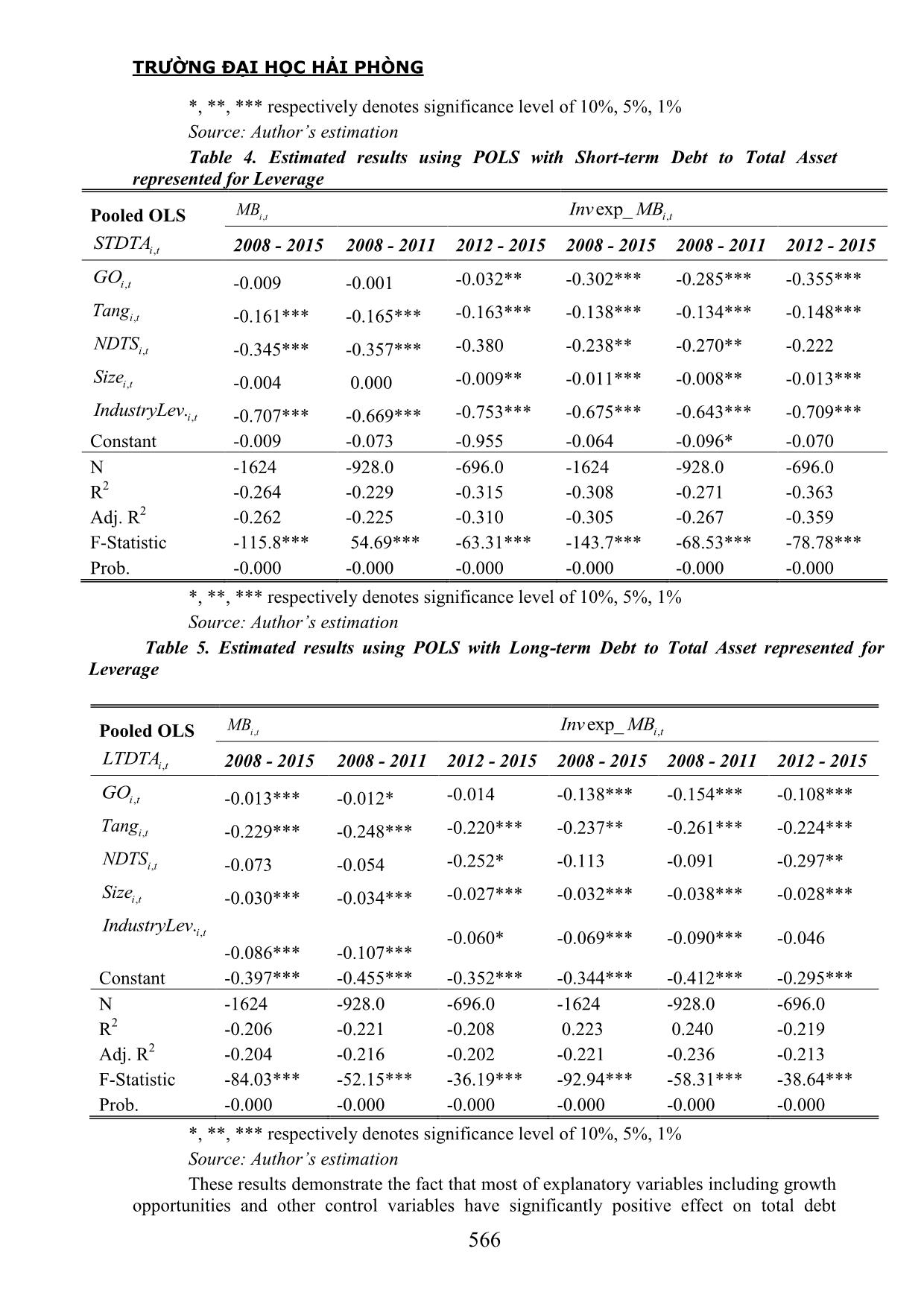

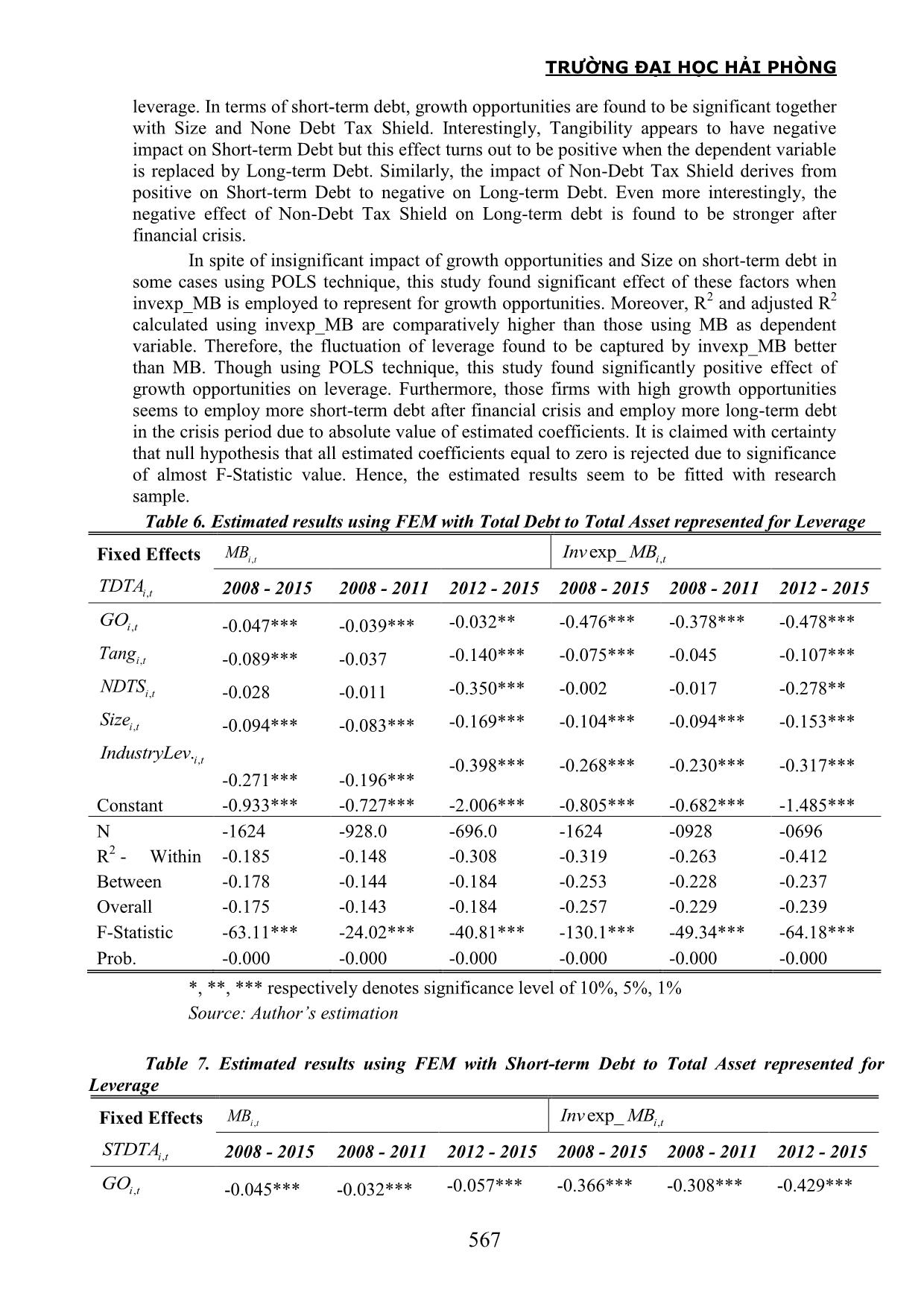

TRƯỜNG ĐẠI HỌC HẢI PHÒNG 558 GROWTH OPTION AND CAPITAL STRUCTURE: EVIDENCE FROM AN EMERGING MARKETS ThS. Nguyễn Công Thành Department of Economics & Finance - School of Business & Management RMIT University Vietnam TS. Nguyễn Phúc Cảnh Deputy Editor-in-Chief, Journal of Economic Development (JED) Trƣờng Đại học Kinh tế Tp. HCM ThS. Phạm Thị Anh Thƣ School of Economics, University of Rennes 1 Abstract This study examines the impacts of firm growth opportunities on capital structure of Vietnamese firms. By employing Pooled Ordinary Least Squared (POLS), Fixed Effects Models (FEM) and Random Effects Models (REM) techniques for balance panel data, we find significant statistic evidences supporting for pecking order theory which defines the positive effects of growth option on capital structure. Interestingly, we find that capital structure is positively affected by tangibility, but this effect appears to be a consequence of the impact of tangibility on long-term debt rather than short-term debt. Keywords: capital structure, growth option, emerging markets, pecking order theory, trade-off theory. JEL classifications: G31, G34. 1. Introduction In the financial literature, the relationships between capital structure and growth options are explained in two main theories including trade – off theory and pecking – order theory. Numerous studies have been done to examine the relationships between capital structure and growth option in the economic field of finance and capital analysis following these theories (for instance, see Adedeji (2002), Antoniou et al. (2008), Antoniou et al. (2008), and Antoniou et al. (2008)). In fact, these empirical works on the capital structure and growth options under the light of trade – off theory and pecking – order theory have been taken in the context of developed countries such as US, Japan, UK, which have strong market disciplines, corporate governance and less agency problems (Harford et al., 2012). Some recent studies consider these theories in the context of emerging countries such as China with the results favor the existence of pecking – order theory. For example, Chen (2004) finds that neither the trade-off model nor the Pecking order hypothesis derived from the Western settings provides convincing explanations for the capital choices of the Chinese firms. Where, the capital choice decision of Chinese firms seems to follow a „„new Pecking order‟-retained profit, equity, and long-term debt, this is because the fundamental institutional assumptions underpinning the Western models are not valid in China. Tong and Green (2005) find a significant negative correlation between leverage and profitability, and a significant positive correlation between current leverage and past dividends, that results broadly support the pecking order hypothesis over trade-off theory in Chinese companies. Yao-hui and Yuan- TRƯỜNG ĐẠI HỌC HẢI PHÒNG 559 lue (2007) use independent variable order property of ordered-probit model, their findings support the pecking order theory as far as exterior financing order of Chinese companies. Ni and Yu (2008) examine whether the financial structure of China's listed companies follows a pecking order from debt to equity, they find no evidence that China's listed companies follow a pecking order when they need funds to finance investment projects. More precisely, they indicate that big companies follow a pecking order and small and medium companies do not, this result suggests that the Chinese capital market is still under development. Moreover, the turbulences of the 2008 global financial crisis have revised the attention to the relationships between growth options and financial leverages in emerging markets, especially in a small one such as Vietnam, which is suffered from a hardship period from 2008 to 2012 with many cases of firm‟s bankruptcy and problem in banking system (Vo and Nguyen, 2014). In addition, the stock market of Vietnam has been developed from the beginning of 2000 (Vo and Nguyen, 2016), which creates new channel for Vietnamese firms in choosing funds for their projects besides the loans from commercial banks as the traditional way, therefore the behaviors of Vietnamese firms may be impacted. Therefore, this study fills the gap of financial literature by examining the relationship between growth options and financial structure of 261 Vietnamese firms in the period of 2008 – 2015. By using the estimation techniques for balance panel data, this study firstly estimates the relationship between growth options and financial leverages of Vietnamese firms, then we divide the data into two sub-periods: the period from 2008 to 2011 which presents for the period of crisis, and the period from 2012 to 2015 which presents for the period of post – crisis. The rest of this study is organized as following manners. Section 2 presents ... , Growth Opportunities measured by MB and other explanatory variables excluding Tangibility have significantly positive impact on leverage with respect to total debt and short-term debt. In addition, None Debt Tax Shield once again tends to have more obviously positive effects on Short-term Debt and negative on Long-term Debt after financial crisis based on evidences of POLS and random effects model. From the one side, tangible asset displays significantly negative impact on short-term debt. From the other side, tangibility demonstrates opposite effects on long- term debt. Another point to note is that Size and average industry leverage almost perform significantly impact on either short-term or long-term debt in all cases. Nonetheless, the effects of average industry leverage on Long-term Debt are found to be insignificant in both fixed effects and random effects technique. It is claimed that the impact of the inverse exponential of MB on leverage become more visible compare to MB due to prominent R 2 and TRƯỜNG ĐẠI HỌC HẢI PHÒNG 571 adjusted R 2 in almost cases. The final important fact is that Wald chi-squared and F-Statistics are demonstrated to be significant in any cases throughout the three technique involving POLS, Fixed Effects Model and Random Effects Model. As a consequence, all null hypothesis of zero estimated coefficients in all cases are rejected then an indirect conclusion could be make is that all estimations are suitable with provided dataset. Table 12. Parameters Test, Hausman Test and Breusch & Pagan Lagrange multiplier Test. TDTA MB INVEPX. MB 2008 - 2015 2008 - 2011 2012 - 2015 2008 - 2015 2008 - 2011 2012 - 2015 POLS vs FE F-Statistic 32.39*** 26.74*** 28.12*** 36.95*** 29.03*** 31.24*** Prob. 0.000 0.000 0.000 0.000 0.000 0.000 RE vs FE Chi 2 72.51*** 53.91*** 01.92*** 79.97*** 54.07*** 76.68*** Prob. 0.000 0.000 0.000 0.000 0.000 0.000 POLS vs RE Chibar 2 2991.*** 947.1*** 536.2*** 3083.*** 967.5*** 545.0*** Prob. 0.000 0.000 0.000 0.000 0.000 0.000 STDTA POLS vs FE F-Statistic 23.12*** 15.74*** 23.25*** 24.42*** 16.49*** 24.52*** Prob. 0.000 0.000 0.000 0.000 0.000 0.000 RE vs FE Chi 2 77.04*** 44.92*** 23.06*** 73.99*** 40.34*** 17.48*** Prob. 0.000 -0.000 -0.000 0.000 0.000 0.000 POLS vs RE Chibar 2 2558.*** 803.0*** 530.6*** 2613.*** 827.0*** 533.4*** Prob. 0.000 0.000 -0.000 0.000 0.000 0.000 LTDTA POLS vs FE F-Statistic 17.41*** 15.58*** 15.60*** 17.36*** 15.36*** 15.15*** Prob. 0.000 0.000 0.000 0.000 0.000 0.000 RE vs FE Chi 2 19.62*** 21.87*** 42.23*** 20.92*** 26.66*** 32.41*** Prob. 0.002 0.001 0.000 0.001 0.000 0.000 POLS vs RE Chibar 2 2229.*** 798.7*** 459.3*** 2209.*** 782.1*** 461.1*** Prob. 0.000 0.000 0.000 0.000 0.000 0.000 *, **, *** respectively denotes significance level of 10%, 5%, 1% Source: Author’s estimation From a particular point of view using a combination of the three given test, the results appear to be encouraged to base on Fixed Effects Model. To be more precise, the core of parameters test is to check whether coefficients of all dummy variables represented for firm- specific equal to zero. The results are found to reject the null-hypothesis then firm-specific seems to exist in collected dataset. The results of Hausman test appeared to reject the null TRƯỜNG ĐẠI HỌC HẢI PHÒNG 572 hypothesis that coefficients estimated by fixed effects technique are equaled to those estimated by random effects technique. Hence, fixed effects model tends to give a more persistent result. The heart of final test is to check for variance of firm-specific characteristics equals to zero. Consequently, rejecting null hypothesis leads to the result that POLS may face with bios regression because the average of error term different from zero. 5. Conclusions There are solid evidences that Growth Opportunities demonstrate significantly positive impact on Leverage in most of the cases including Short-term Debt to Total Asset, Long-term Debt to Total Asset. Even in the period of the world financial crisis or after the crisis, the effects of Growth Opportunities on leverage usually appear to be significantly positive. Therefore, Pecking order theory seems to be supported in our study case. However, this effect seems to imply more obvious on Short-term Debt rather than Long-term Debt. Moreover, this study also found little evidence of negative effects of Growth Opportunities on Long-term Debt after the financial crisis. More importantly, many substantial evidence disclose the information that Growth Opportunities comes into sight to have non-linear impact on Leverage in either short-term or long-term debt. Tangible asset tends to have negative effects on short-term debt and positive effects on long-term debt. Especially, the impact of Tangibility seems to be clarified after crisis period. Nevertheless, the effects of None Debt Tax Shield appear to have positive influence on short-term debt and negative effect on long-term debt. In contrary, the positive impacts of Size and average Industry Leverage are found to be consistent because these effects are significant in most of cases. However, the influence of average Industry Leverage on long- term debt is not found to be significant after financial crisis period. In general, a combination of provided evidence in this study seems to support the pecking other theory base in Vietnam Market database in the period of 2008 – 2015. REFERENCES ADEDEJI, A. 2002. A cross-sectional test of Pecking Order Hypothesis Against Static Trade-off Theory on UK data. Available at SSRN 302827. ANTONIOU, A., GUNEY, Y. & PAUDYAL, K. 2008. The determinants of capital structure: capital market-oriented versus bank-oriented institutions. Journal of financial and quantitative analysis, 43, 59-92. AUERBACH, A. J. 1985. Real determinants of corporate leverage. Corporate capital structures in the United States. University of Chicago Press. BANCEL, F. & MITTOO, U. R. 2004. Cross-country determinants of capital structure choice: a survey of European firms. Financial Management, 103-132. BARCLAY, M. J., MORELLEC, E. & SMITH, C. W. 2001. On the debt capacity of growth options. Simon School of Business Working Paper No. FR, 01-07. BARCLAY, M. J., SMITH, C. W. & WATTS, R. L. 1995. The determinants of corporate leverage and dividend policies. Journal of applied corporate finance, 7, 4-19. BEBCZUK, R. N. 2005. Corporate governance and ownership: measurement and impact on corporate performance and dividend policies in Argentina. Documentos de Trabajo. BERGER, A. N. & DI PATTI, E. B. 2006. Capital structure and firm performance: A TRƯỜNG ĐẠI HỌC HẢI PHÒNG 573 new approach to testing agency theory and an application to the banking industry. Journal of Banking & Finance, 30, 1065-1102. BEVAN, A. A. & DANBOLT, J. 2002. Capital structure and its determinants in the UK-a decompositional analysis. Applied Financial Economics, 12, 159-170. BHADURI, S. N. 2002. Determinants of capital structure choice: a study of the Indian corporate sector. Applied Financial Economics, 12, 655-665. BOOTH, L., AIVAZIAN, V., DEMIRGUC‐KUNT, A. & MAKSIMOVIC, V. 2001. Capital structures in developing countries. The journal of finance, 56, 87-130. BRADLEY, M., JARRELL, G. A. & KIM, E. 1984. On the existence of an optimal capital structure: Theory and evidence. The journal of Finance, 39, 857-878. CHEN, J. J. 2004. Determinants of capital structure of Chinese-listed companies. Journal of Business research, 57, 1341-1351. DEANGELO, H. & MASULIS, R. W. 1980a. Leverage and dividend irrelevancy under corporate and personal taxation. The Journal of Finance, 35, 453-464. DEANGELO, H. & MASULIS, R. W. 1980b. Optimal capital structure under corporate and personal taxation. Journal of financial economics, 8, 3-29. DEESOMSAK, R., PAUDYAL, K. & PESCETTO, G. 2004. The determinants of capital structure: evidence from the Asia Pacific region. Journal of Multinational Financial Management, 14, 387-405. DELCOURE, N. 2007. The determinants of capital structure in transitional economies. International Review of Economics & Finance, 16, 400-415. FAMA, E. F. & FRENCH, K. R. 2002. Testing trade-off and pecking order predictions about dividends and debt. Review of financial studies, 15, 1-33. FAZZARI, S. M., HUBBARD, R. G., PETERSEN, B. C., BLINDER, A. S. & POTERBA, J. M. 1988. Financing constraints and corporate investment. Brookings papers on economic activity, 1988, 141-206. FERRI, M. G. & JONES, W. H. 1979. Determinants of financial structure: A new methodological approach. The Journal of Finance, 34, 631-644. GOYAL, V. K., LEHN, K. & RACIC, S. 2002. Growth opportunities and corporate debt policy: the case of the US defense industry. Journal of Financial Economics, 64, 35-59. HACKBARTH, D., HENNESSY, C. A. & LELAND, H. E. 2007. Can the trade-off theory explain debt structure? Review of Financial Studies, 20, 1389-1428. HARFORD, J., MANSI, S. A. & MAXWELL, W. F. 2012. Corporate governance and firm cash holdings in the US. Corporate Governance. Springer. HARRIS, M. & RAVIV, A. 1991. The theory of capital structure. the Journal of Finance, 46, 297-355. HAUSMAN, J. & MCFADDEN, D. 1984. Specification tests for the multinomial logit model. Econometrica: Journal of the Econometric Society, 1219-1240. HAUSMAN, J. A. 1978. Specification tests in econometrics. Econometrica: Journal of the Econometric Society, 1251-1271. HIJAZI, S. T. & TARIQ, Y. B. 2006. Determinants of capital structure: A case for Pakistani cement industry. Lahore Journal of Economics, 11, 63-80. JERMIAS, J. 2008. The relative influence of competitive intensity and business strategy on the relationship between financial leverage and performance. The British Accounting Review, 40, 71-86. JUNG, K., KIM, Y.-C. & STULZ, R. 1996. Timing, investment opportunities, managerial discretion, and the security issue decision. Journal of Financial Economics, 42, 159-186. TRƯỜNG ĐẠI HỌC HẢI PHÒNG 574 KESTER, W. C. 1986. Capital and ownership structure: A comparison of United States and Japanese manufacturing corporations. Financial management, 5-16. KRAUS, A. & LITZENBERGER, R. H. 1973. A state‐preference model of optimal financial leverage. The journal of finance, 28, 911-922. KYEREBOAH-COLEMAN, A. 2007. The impact of capital structure on the performance of microfinance institutions. The Journal of Risk Finance, 8, 56-71. LE, T. V. & BUCK, T. 2011. State ownership and listed firm performance: a universally negative governance relationship? Journal of Management & Governance, 15, 227-248. LIAO, J. & YOUNG, M. 2012. The impact of residual government ownership in privatized firms: New evidence from China. Emerging Markets Review, 13, 338-351. LIN, Q. 2015. Growth options effect on leverage: Evidence from China. Pacific-Basin Finance Journal, 34, 152-168. LONG, M. & MALITZ, I. 1985. The investment-financing nexus: Some empirical evidence. Midland Corporate Finance Journal, 3, 53-59. MARGARITIS, D. & PSILLAKI, M. 2010. Capital structure, equity ownership and firm performance. Journal of Banking & Finance, 34, 621-632. MYERS, S. C. 1977. Determinants of corporate borrowing. Journal of financial economics, 5, 147-175. MYERS, S. C. 1984. The capital structure puzzle. The journal of finance, 39, 574-592. MYERS, S. C. & MAJLUF, N. S. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of financial economics, 13, 187-221. NI, J. & YU, M. 2008. Testing the pecking-order theory: Evidence from Chinese listed companies. Chinese Economy, 41, 97-113. OGDEN, J. P. & WU, S. 2013. Reassessing the effect of growth options on leverage. Journal of Corporate Finance, 23, 182-195. OZKAN, A. 2001. Determinants of capital structure and adjustment to long run target: evidence from UK company panel data. Journal of Business Finance & Accounting, 28, 175- 198. PANDEY, I. 2004. Capital structure, profitability and market structure: Evidence from Malaysia. The Asia Pacific Journal of Economics & Business, 8, 78. RAJAN, R. G. & ZINGALES, L. 1995. What do we know about capital structure? Some evidence from international data. The journal of Finance, 50, 1421-1460. ROSS, S. A. 1977. The determination of financial structure: the incentive-signalling approach. The bell journal of economics, 23-40. SAEED, M. M., GULL, A. A. & RASHEED, M. Y. 2013. Impact of capital structure on banking performance (A case study of Pakistan). Interdisciplinary journal of contemporary research in business, 4, 393-403. SEIFERT, B. & GONENC, H. 2010. Pecking order behavior in emerging markets. Journal of International Financial Management & Accounting, 21, 1-31. SERRASQUEIRO, Z. & CAETANO, A. 2015. Trade-Off Theory versus Pecking Order Theory: capital structure decisions in a peripheral region of Portugal. Journal of Business Economics and Management, 16, 445-466. SMITH, C. W. & WATTS, R. L. 1992. The investment opportunity set and corporate financing, dividend, and compensation policies. Journal of financial Economics, 32, 263-292. TITMAN, S. & WESSELS, R. 1988. The determinants of capital structure choice. The Journal of finance, 43, 1-19. TRƯỜNG ĐẠI HỌC HẢI PHÒNG 575 TONG, G. & GREEN, C. J. 2005. Pecking order or trade-off hypothesis? Evidence on the capital structure of Chinese companies. Applied Economics, 37, 2179-2189. TOY, N., STONEHILL, A., REMMERS, L., WRIGHT, R. & BEEKHUISEN, T. 1974. A comparative international study of growth, profitability, and risk as determinants of corporate debt ratios in the manufacturing sector. Journal of Financial and Quantitative Analysis, 9, 875-886. VO, X. V. & NGUYEN, P. C. 2014. Monetary Policy and Bank Credit Risk in Vietnam Pre and Post Global Financial Crisis. Risk Management Post Financial Crisis: A Period of Monetary Easing. VO, X. V. & NGUYEN, P. C. 2016. Impacts of the US monetary policy on the Vietnamese stock market. Afro-Asian Journal of Finance and Accounting, 6, 119-134. WALD, J. K. 1999. How firm characteristics affect capital structure: an international comparison. Journal of Financial research, 22, 161-187. WIWATTANAKANTANG, Y. 1999. An empirical study on the determinants of the capital structure of Thai firms. Pacific-Basin Finance Journal, 7, 371-403. YAO-HUI, Q. & YUAN-LUE, F. 2007. The Pecking Order Theory Verified by Chinese Companies Data: Test on Preference of Equity Financing Again [J]. Journal of Finance and Economics, 2, 108-118. ZWIEBEL, J. 1996. Dynamic capital structure under managerial entrenchment. The American Economic Review, 1197-1215.

File đính kèm:

growth_option_and_capital_structure_evidence_from_an_emergin.pdf

growth_option_and_capital_structure_evidence_from_an_emergin.pdf