Factors affecting foreign direct investment attraction a case study of Thai Nguyen province

In recent years, a big change in trend of FDI

inflows with a remarkable growth in FDI to

developing countries has been witnessed.

Especially in 2012, developing countries have

surpassed their developed counterparts in

attracting FDI with 9 developing countries

ranked in top 20 FDI attractive countries

(UNCTAD, 2013).

As reported by the United Nations

Conference on Trade and Development

(UNCTAD, 2012), developing countries in

Asia are the leadings to attract FDI during the

period from 2008 to 2012. Despite the

decrease of 7% in FDI inflows in the whole

region in 2012, some countries including

Vietnam were bright spots for labor-intensive

FDI. Vietnam was also considered one of

most FDI attractive among low-income host

countries (together with Combodia, Myanmar

and Philippines). UNCTAD (2012) forecasted

that Vietnam would be one of the potential

attractive hosts for the period 2013-2015.

Thai Nguyen is the central province of the

Northern mountainous and midland region of

Vietnam which includes 16 provinces. Its

location is 80 kilometers from Hanoi

northward. Thai Nguyen‟s economy focuses

on mining, manufacturing, tea production and

agriculture. In recent years, Thai Nguyen did

not stay beyond the general trend of the

country in attracting FDI for the economic

and social development. Thai Nguyen

province hit the peak of FDI attraction and

ranked first in the whole country within the

first ten months of 2013 when the total

registered FDI was more than USD 3.4

billion, accounted for 17.7% of total

registered FDI in Vietnam. This was an

unprecedented growth ever since Vietnam

began receiving FDI from foreign investors.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Tóm tắt nội dung tài liệu: Factors affecting foreign direct investment attraction a case study of Thai Nguyen province

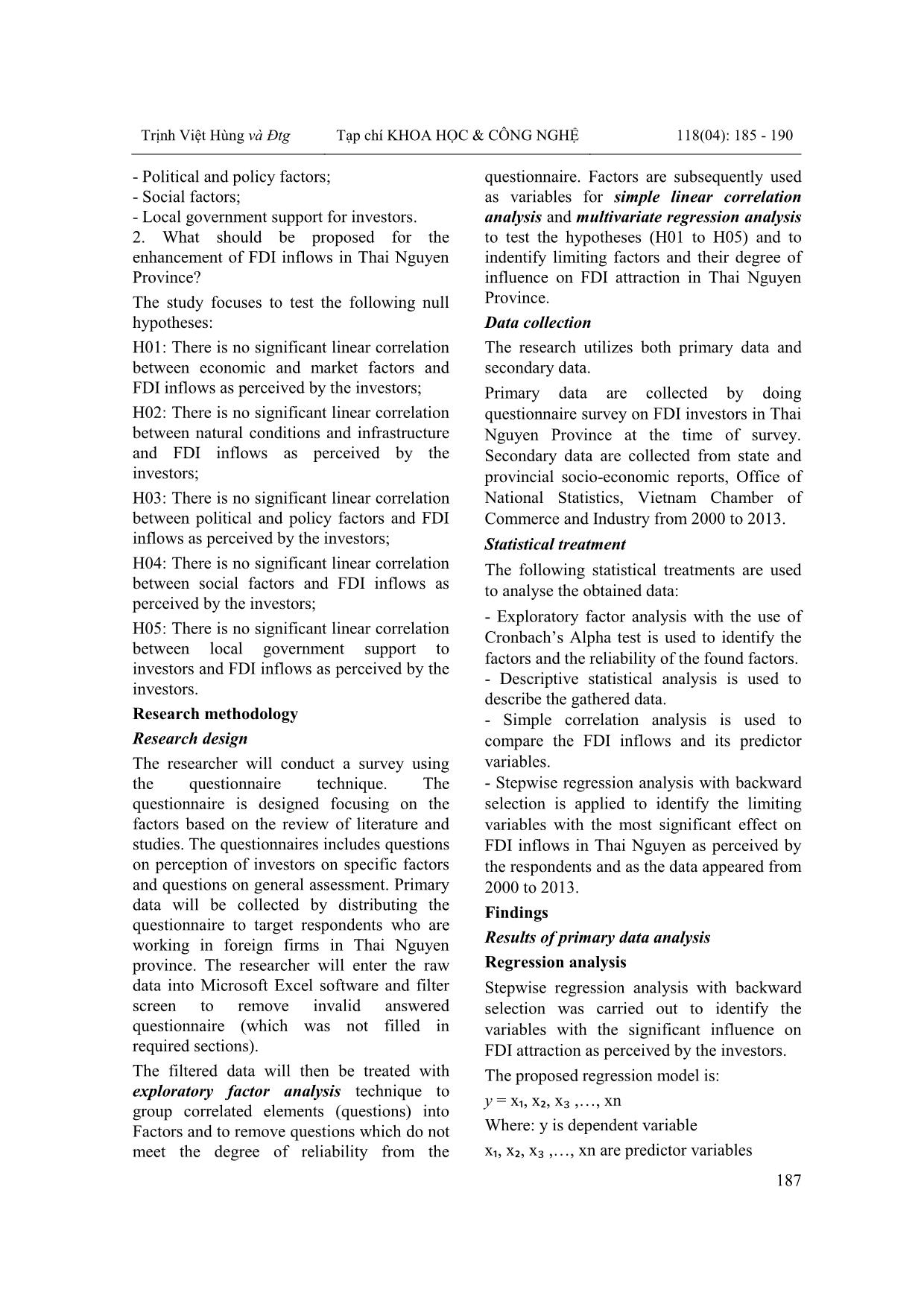

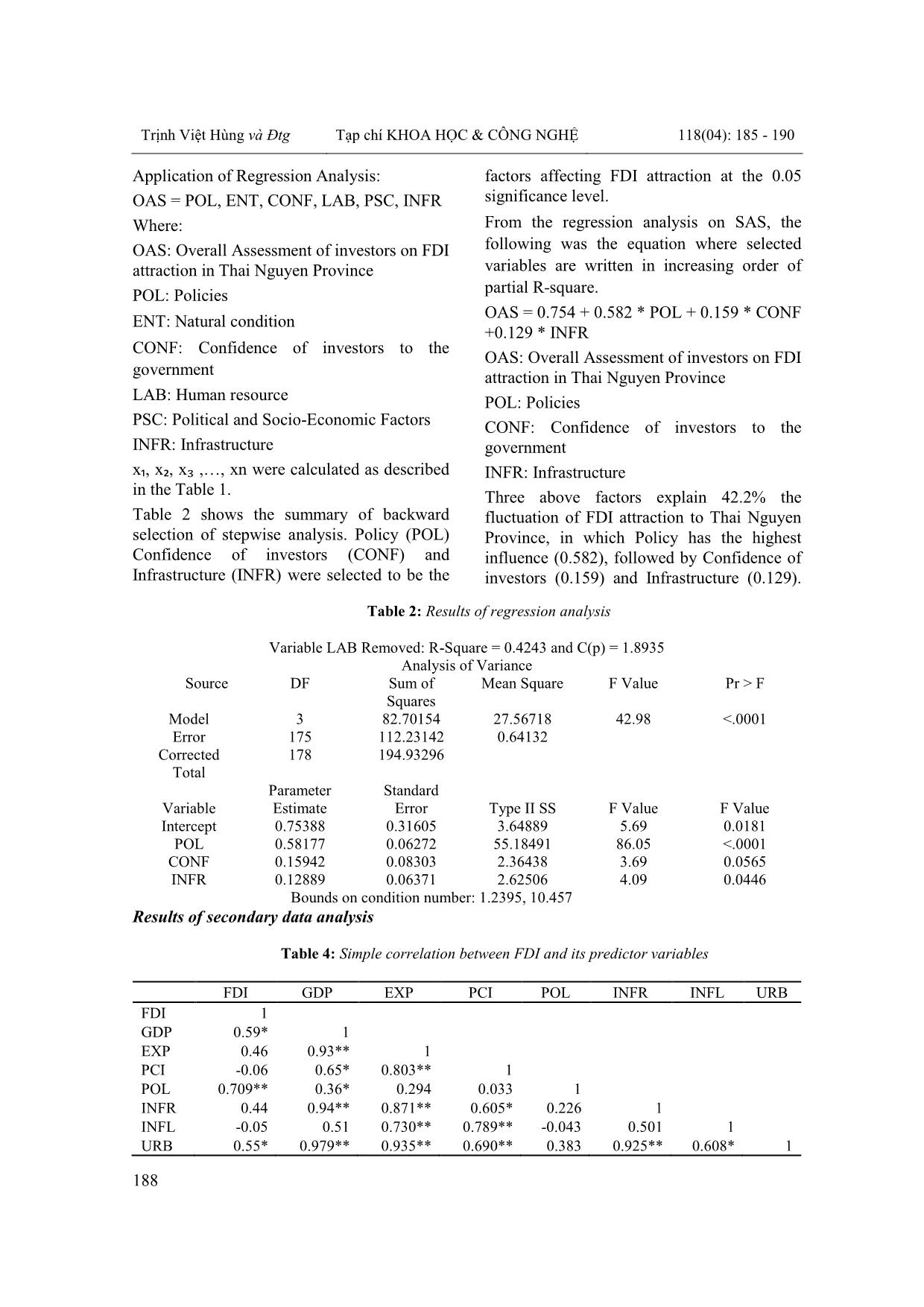

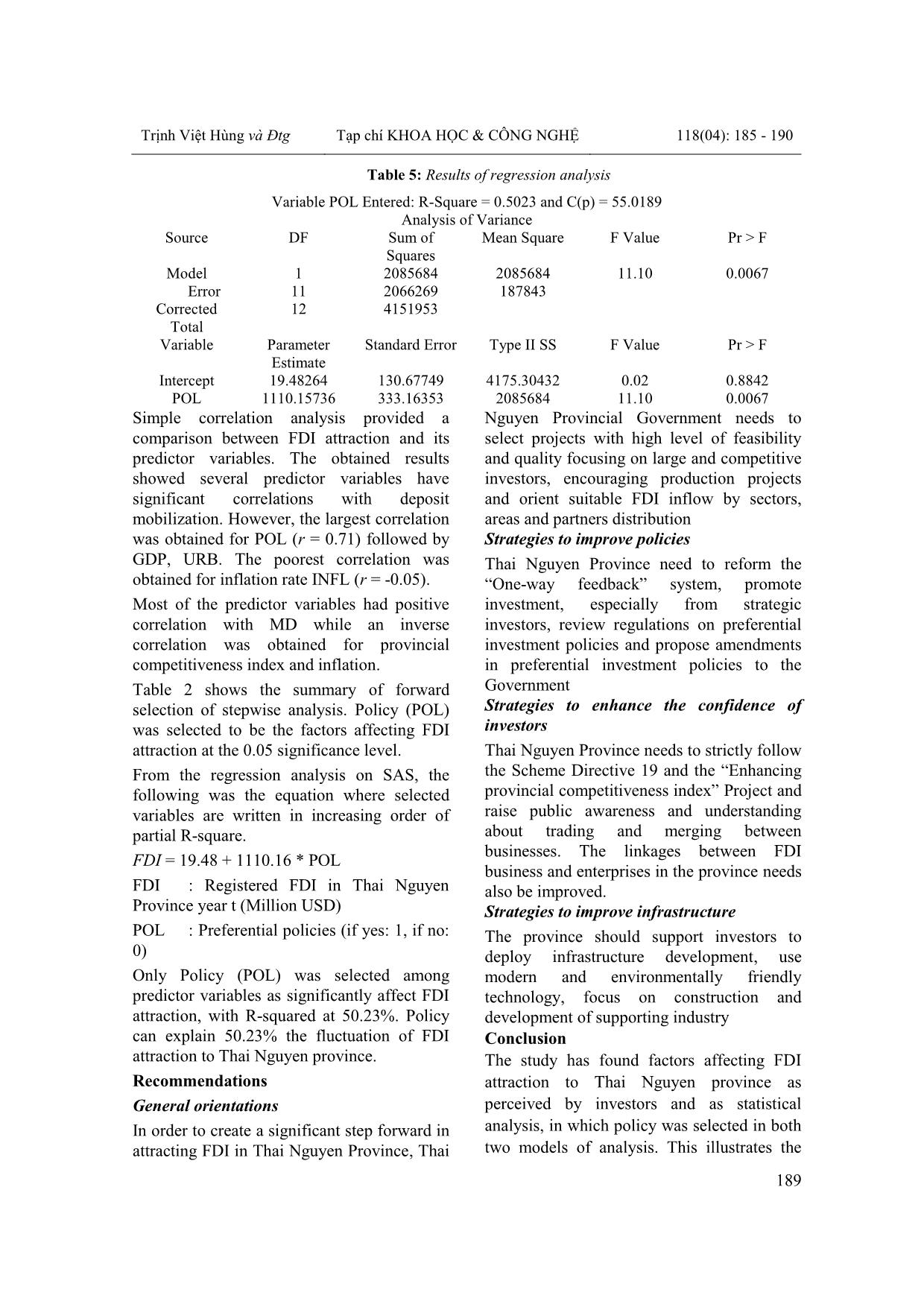

Trịnh Việt Hùng và Đtg Tạp chí KHOA HỌC & CÔNG NGHỆ 118(04): 185 - 190 185 FACTORS AFFECTING FOREIGN DIRECT INVESTMENT ATTRACTION A CASE STUDY OF THAI NGUYEN PROVINCE Trinh Viet Hung 1* , Tran Anh Vu, Quan Thai Ha, Nguyen Tuan Anh, Đoan Quang Duy2 1Office of Thai Nguyen Provincial Government, 2International School of Thai Nguyen University SUMMARY The objectives of the study is to analyse the factors affecting FDI attraction to Thai Nguyen Province. The study was conducted in August 2013 in Thai Nguyen. The data utilized in the research included primary data obtained through a questionnaire survey with 32 FDI investors in Thai Nguyen Province in August 2013 and secondary data from statistical yearbook and reports of the provincial and central government. The results obtained from exploratory factor analysis and multivariate regression analysis showed that factors affecting FDI attraction to Thai Nguyen Province included: Policy, Confidence of Investors, Infrastructure. In which, Policy has the highest fluence on FDI attraction. Key words: FDI, sustainable, Thai Nguyen Province, factors Introduction * In recent years, a big change in trend of FDI inflows with a remarkable growth in FDI to developing countries has been witnessed. Especially in 2012, developing countries have surpassed their developed counterparts in attracting FDI with 9 developing countries ranked in top 20 FDI attractive countries (UNCTAD, 2013). As reported by the United Nations Conference on Trade and Development (UNCTAD, 2012), developing countries in Asia are the leadings to attract FDI during the period from 2008 to 2012. Despite the decrease of 7% in FDI inflows in the whole region in 2012, some countries including Vietnam were bright spots for labor-intensive FDI. Vietnam was also considered one of most FDI attractive among low-income host countries (together with Combodia, Myanmar and Philippines). UNCTAD (2012) forecasted that Vietnam would be one of the potential attractive hosts for the period 2013-2015. Thai Nguyen is the central province of the Northern mountainous and midland region of Vietnam which includes 16 provinces. Its location is 80 kilometers from Hanoi northward. Thai Nguyen‟s economy focuses * Tel: 0912 111223, Email: hungtv@thainguyen.gov.vn on mining, manufacturing, tea production and agriculture. In recent years, Thai Nguyen did not stay beyond the general trend of the country in attracting FDI for the economic and social development. Thai Nguyen province hit the peak of FDI attraction and ranked first in the whole country within the first ten months of 2013 when the total registered FDI was more than USD 3.4 billion, accounted for 17.7% of total registered FDI in Vietnam. This was an unprecedented growth ever since Vietnam began receiving FDI from foreign investors. So what have made this extraordinary growth in this province and how to maintain this sustainably as well as to retain the investment in Thai Nguyen province? There have been a number of studies and research on factors affecting FDI attraction in the context of region and country. This paper aims at the analysis of the factors affecting the decision making process as perceived by the investors in Thai Nguyen Province. In more particular, the study will help to answer the following questions: 1. What are factors affecting FDI attraction of Thai Nguyen province as perceived by the investors and their degree of influence on the FDI attraction. Trịnh Việt Hùng và Đtg Tạp chí KHOA HỌC & CÔNG NGHỆ 118(04): 185 - 190 186 2. How to predict the decision of investors based on factor assessment. In the next section, previous research and studies in the world and in Vietnam on factors affecting FDI inflows are presented. Section 3 illustrates data and research methodology. Section 4 presents the results of the study and finally suggests some recommendation for improvements of FDI attraction. Literature and study review A number of research has been conducted to define determinants of FDI. In this section, the researcher focused on the publications in the context of developing countries, especially in Asia as well as publication on FDI in Vietnam. Different factors were concluded to be significant elements of FDI inflows, which can be divided into groups as follows: Economic and market factors Among factors that were found to be important in encouraging FDI, products seems to be discovered as contribute to FDI inflows by most researchers. Marcelo and Mário (2004)‟s research on a sample of 33 developing countries who played the role of FDI hosts during the period from 1975 to 2000 using panel data methodology found that the average rate of gross national products (GNP) growth over the previous 5 years had significant influence on FDI inflows. Ho ... raction, including change in government leadership (Root and Ahmed, 1979), intracountry political events (Nigh, 1985), number of political strikes and riots in host countries (Schneider and Frey, 1985) and other sociopolitical instability. According to Justice and Gloria (2012), degree of democracy in host countries was also important variable for FDI inflows. Natural resources and geographical conditions Natural resources were argued to have great influence on FDI attraction (Asiedu and Lien (2004), Deichmann et al. (2003), Onyeiwu and Shrestha (2004) and Jadhav (2012). Ohlin (1933) also concluded that secure sources of raw materials are determinant for FDI attraction. Campos and Kinoshita (2003) and Garibaldi and others (2001) also included abundant natural resources in the motivations for FDI attraction in transition countries during 1990-1998. Natural resources also impacted the decision making of investment by foreign investors in Vietnam (Loc and Tuyet, 2013). Social conditions Foreign investment is producing outside of the home country, firms therefore will have less initiatives in employing labor for the production process. Labor, at this stage, is a heavy burden to foreign investors. As found in previous papers, investors would be most concerned about years of schooling of labor force (Nunnenkamp and Spatz, 2002), level of schooling (Marcelo and Mario, 2004), cost/wages of labor (Campos and Kinoshita (2003), Flamm (1984), Schneider and Frey (1985), Lucas (1993), and Wheeler and Mody (1992). Human capital was also found to be more significant in less developed countries than in developed countries (Buckley and others, 2002). Research questions and hypotheses The study aims to seek answers to the following questions: 1. What are factors affecting FDI attraction of Thai Nguyen province as perceived by the investors in terms of: - Economic and market factors; - Natural conditions and infrastructure; Trịnh Việt Hùng và Đtg Tạp chí KHOA HỌC & CÔNG NGHỆ 118(04): 185 - 190 187 - Political and policy factors; - Social factors; - Local government support for investors. 2. What should be proposed for the enhancement of FDI inflows in Thai Nguyen Province? The study focuses to test the following null hypotheses: H01: There is no significant linear correlation between economic and market factors and FDI inflows as perceived by the investors; H02: There is no significant linear correlation between natural conditions and infrastructure and FDI inflows as perceived by the investors; H03: There is no significant linear correlation between political and policy factors and FDI inflows as perceived by the investors; H04: There is no significant linear correlation between social factors and FDI inflows as perceived by the investors; H05: There is no significant linear correlation between local government support to investors and FDI inflows as perceived by the investors. Research methodology Research design The researcher will conduct a survey using the questionnaire technique. The questionnaire is designed focusing on the factors based on the review of literature and studies. The questionnaires includes questions on perception of investors on specific factors and questions on general assessment. Primary data will be collected by distributing the questionnaire to target respondents who are working in foreign firms in Thai Nguyen province. The researcher will enter the raw data into Microsoft Excel software and filter screen to remove invalid answered questionnaire (which was not filled in required sections). The filtered data will then be treated with exploratory factor analysis technique to group correlated elements (questions) into Factors and to remove questions which do not meet the degree of reliability from the questionnaire. Factors are subsequently used as variables for simple linear correlation analysis and multivariate regression analysis to test the hypotheses (H01 to H05) and to indentify limiting factors and their degree of influence on FDI attraction in Thai Nguyen Province. Data collection The research utilizes both primary data and secondary data. Primary data are collected by doing questionnaire survey on FDI investors in Thai Nguyen Province at the time of survey. Secondary data are collected from state and provincial socio-economic reports, Office of National Statistics, Vietnam Chamber of Commerce and Industry from 2000 to 2013. Statistical treatment The following statistical treatments are used to analyse the obtained data: - Exploratory factor analysis with the use of Cronbach‟s Alpha test is used to identify the factors and the reliability of the found factors. - Descriptive statistical analysis is used to describe the gathered data. - Simple correlation analysis is used to compare the FDI inflows and its predictor variables. - Stepwise regression analysis with backward selection is applied to identify the limiting variables with the most significant effect on FDI inflows in Thai Nguyen as perceived by the respondents and as the data appeared from 2000 to 2013. Findings Results of primary data analysis Regression analysis Stepwise regression analysis with backward selection was carried out to identify the variables with the significant influence on FDI attraction as perceived by the investors. The proposed regression model is: y = x₁, x₂, x₃ ,, xn Where: y is dependent variable x₁, x₂, x₃ ,, xn are predictor variables Trịnh Việt Hùng và Đtg Tạp chí KHOA HỌC & CÔNG NGHỆ 118(04): 185 - 190 188 Application of Regression Analysis: OAS = POL, ENT, CONF, LAB, PSC, INFR Where: OAS: Overall Assessment of investors on FDI attraction in Thai Nguyen Province POL: Policies ENT: Natural condition CONF: Confidence of investors to the government LAB: Human resource PSC: Political and Socio-Economic Factors INFR: Infrastructure x₁, x₂, x₃ ,, xn were calculated as described in the Table 1. Table 2 shows the summary of backward selection of stepwise analysis. Policy (POL) Confidence of investors (CONF) and Infrastructure (INFR) were selected to be the factors affecting FDI attraction at the 0.05 significance level. From the regression analysis on SAS, the following was the equation where selected variables are written in increasing order of partial R-square. OAS = 0.754 + 0.582 * POL + 0.159 * CONF +0.129 * INFR OAS: Overall Assessment of investors on FDI attraction in Thai Nguyen Province POL: Policies CONF: Confidence of investors to the government INFR: Infrastructure Three above factors explain 42.2% the fluctuation of FDI attraction to Thai Nguyen Province, in which Policy has the highest influence (0.582), followed by Confidence of investors (0.159) and Infrastructure (0.129). Table 2: Results of regression analysis Variable LAB Removed: R-Square = 0.4243 and C(p) = 1.8935 Analysis of Variance Source DF Sum of Squares Mean Square F Value Pr > F Model 3 82.70154 27.56718 42.98 <.0001 Error 175 112.23142 0.64132 Corrected Total 178 194.93296 Parameter Standard Variable Estimate Error Type II SS F Value F Value Intercept 0.75388 0.31605 3.64889 5.69 0.0181 POL 0.58177 0.06272 55.18491 86.05 <.0001 CONF 0.15942 0.08303 2.36438 3.69 0.0565 INFR 0.12889 0.06371 2.62506 4.09 0.0446 Bounds on condition number: 1.2395, 10.457 Results of secondary data analysis Table 4: Simple correlation between FDI and its predictor variables FDI GDP EXP PCI POL INFR INFL URB FDI 1 GDP 0.59* 1 EXP 0.46 0.93** 1 PCI -0.06 0.65* 0.803** 1 POL 0.709** 0.36* 0.294 0.033 1 INFR 0.44 0.94** 0.871** 0.605* 0.226 1 INFL -0.05 0.51 0.730** 0.789** -0.043 0.501 1 URB 0.55* 0.979** 0.935** 0.690** 0.383 0.925** 0.608* 1 Trịnh Việt Hùng và Đtg Tạp chí KHOA HỌC & CÔNG NGHỆ 118(04): 185 - 190 189 Table 5: Results of regression analysis Variable POL Entered: R-Square = 0.5023 and C(p) = 55.0189 Analysis of Variance Source DF Sum of Squares Mean Square F Value Pr > F Model 1 2085684 2085684 11.10 0.0067 Error 11 2066269 187843 Corrected Total 12 4151953 Variable Parameter Estimate Standard Error Type II SS F Value Pr > F Intercept 19.48264 130.67749 4175.30432 0.02 0.8842 POL 1110.15736 333.16353 2085684 11.10 0.0067 Simple correlation analysis provided a comparison between FDI attraction and its predictor variables. The obtained results showed several predictor variables have significant correlations with deposit mobilization. However, the largest correlation was obtained for POL (r = 0.71) followed by GDP, URB. The poorest correlation was obtained for inflation rate INFL (r = -0.05). Most of the predictor variables had positive correlation with MD while an inverse correlation was obtained for provincial competitiveness index and inflation. Table 2 shows the summary of forward selection of stepwise analysis. Policy (POL) was selected to be the factors affecting FDI attraction at the 0.05 significance level. From the regression analysis on SAS, the following was the equation where selected variables are written in increasing order of partial R-square. FDI = 19.48 + 1110.16 * POL FDI : Registered FDI in Thai Nguyen Province year t (Million USD) POL : Preferential policies (if yes: 1, if no: 0) Only Policy (POL) was selected among predictor variables as significantly affect FDI attraction, with R-squared at 50.23%. Policy can explain 50.23% the fluctuation of FDI attraction to Thai Nguyen province. Recommendations General orientations In order to create a significant step forward in attracting FDI in Thai Nguyen Province, Thai Nguyen Provincial Government needs to select projects with high level of feasibility and quality focusing on large and competitive investors, encouraging production projects and orient suitable FDI inflow by sectors, areas and partners distribution Strategies to improve policies Thai Nguyen Province need to reform the “One-way feedback” system, promote investment, especially from strategic investors, review regulations on preferential investment policies and propose amendments in preferential investment policies to the Government Strategies to enhance the confidence of investors Thai Nguyen Province needs to strictly follow the Scheme Directive 19 and the “Enhancing provincial competitiveness index” Project and raise public awareness and understanding about trading and merging between businesses. The linkages between FDI business and enterprises in the province needs also be improved. Strategies to improve infrastructure The province should support investors to deploy infrastructure development, use modern and environmentally friendly technology, focus on construction and development of supporting industry Conclusion The study has found factors affecting FDI attraction to Thai Nguyen province as perceived by investors and as statistical analysis, in which policy was selected in both two models of analysis. This illustrates the Trịnh Việt Hùng và Đtg Tạp chí KHOA HỌC & CÔNG NGHỆ 118(04): 185 - 190 190 significant importance of FDI promotion policy in FDI attraction to a region. The other factors which also have significant influence on FDI are Confidence of investors and Infrastructure. Thai Nguyen Provincial government should focus on improving those factors in order to improve its FDI attraction performance. REFERENCES 1. Abdus Samad, Ph.D. Does FDI Cause Economic Growth? Evidence from South-East Asia and Latin America. Finance and Economics Department - Utah Valley University 2. Ana, T.T.L., Angelo, C., Frederick, L.(2012). Taxes and foreign direct investment attraction: A literature review. Emerald Group Publishing Limited, Volume 7. 89-117 3. Aneta Krstevska; Magdalena Petrovska.(2012). The economic impacts of the foreign direct investments: panel estimation by sectors on the case of Macedonian economy. Journal of Central Banking Theory and Practice 4. Ashoka M., (2006), Foreign Direct Investment and the World Economy, Taylor & Francis, Dec 7, 2006 5. Bouphavanh, K., Chittipa, N., (2001), Factors Affecting Foreign Direct Investment in Savannakhet Province, Lao People’s Democratic Republic (Lao PDR), International Conference on Management, Economics and Social Sciences (ICMESS'2011) Bangkok Dec., 2011, P572-P575 6. Bushra, Y., Aamrah, H., Muhammad, A.C..(2003). Analysis of factors affecting foreign direct investment in developing countries. Pakistan Economic and Social Review, Volume XLI, No. 1&2. 59-75 7. Carlos, P.B., Zhongfei, C., Bruno, D., (2013), Attracting Foreign Direct Investment: An Analysis of Asian Countries, WP 116/2013, CEsA and ISEG. Chengqi Wang*, Peter J. Buckley**, Jeremy Clegg** and Mario Kafouros**. (2007). The impact of inward foreign direct investment on the nature and intensity of Chinese manufacturing exports. Transnational Corporations, Vol. 16, No. 2 . 8. Chien, N.D., Linh, H.T., Zhong, Z.K.(2012). FDI tại Bắc Trung Bộ và Duyên hải miền Trung Việt Nam: Mối quan hệ hai chiều với GDP, Sự cạnh tranh giữa các tỉnh thành và ảnh hƣởng của luật pháp.Tạp chí Khoa học, Đại học Huế, Tập 72B, Số 3. 47-56 TÓM TẮT CÁC YẾU TỐ ẢNH HƢỞNG ĐẾN THU HÖT VỐN ĐẦU TƢ TRỰC TIẾP TỪ NƢỚC NGOÀI – BÀI HỌC TẠI TỈNH THÁI NGUYÊN Trịnh Việt Hùng1*, Trần Anh Vũ2, Quản Thái Hà2, Nguyễn Tuấn Anh2, Đoàn Quang Duy2 1Văn phòng Tỉnh ủy Thái Nguyên,2 Khoa Quốc tế - ĐH Thái Nguyên Mục tiêu của nghiên cứu là phân tích các nhân tố ảnh hƣởng và xây dựng mô hình dự báo thu hút vốn FDI bền vững vào tỉnh Thái Nguyên. Số liệu sử dụng trong nghiên cứu bao gồm số liệu sơ cấp đƣợc thu thập từ điều tra chọn mẫu 32 doanh nghiệp đang đầu tƣ tại tỉnh Thái Nguyên tại thời điểm tháng 8/2013 và số liệu thứ cấp từ báo cáo và niên giám thống kê từ năm 2000 đến 2013. Phƣơng pháp phân tích nhân tố khám phá (EFA) kết hợp phƣơng pháp phân tích hồi quy đa biến trên cả hai nguồn số liệu đã chỉ ra các nhân tố ảnh hƣởng đến thu hút vốn FDI tại tỉnh Thái Nguyên bao gồm: Môi trƣờng chính sách và hệ thống pháp luật, Lòng tin của nhà đầu tƣ, Cơ sở hạ tầng. Trong đó Môi trƣờng chính sách là nhân tố có ảnh hƣởng lớn nhất đến thu hút vốn FDI vào tỉnh Thái Nguyên. Từ khóa: FDI, mô hình, bền vững, tỉnh Thái Nguyên, nhân tố ảnh hưởng Ngày nhận bài:13/3/2014; Ngày phản biện:15/3/2014; Ngày duyệt đăng: 25/3/2014 Phản biện khoa học: PGS.TS Đỗ Anh Tài – Đại học Thái Nguyên * Tel: 0912 111223, Email: hungtv@thainguyen.gov.vn

File đính kèm:

factors_affecting_foreign_direct_investment_attraction_a_cas.pdf

factors_affecting_foreign_direct_investment_attraction_a_cas.pdf