Discussion on minimum wage in Viet Nam

Wage is not only the economic category but

also the top factor of the social policies directly

related to employee’s life. Wage has impacts on

economic management, finance, labour management

and production promotion. The State policies on

wage has changed through periods. However; in the

current context of high inflation, wage policies are

exposing many disadvantages and employee’s life

has many difficulties. Those are the main reasons

for lots of strikes in the enterprise area and brain

drain in the State business and administrative

agencies. Minimum wage is a constitutional part

of wage regime which plays a crucial role in the

wage system because it has influences to the whole

wage policy. Wage is not only simply applied for

employees but also the important legal framework

which is the payment basis for labor in the society.

Minimum wage regulation has the very important

meaning for not only employees but also the

economic development, the labor relation stability

and the socio-political stability. Nevertheless, in

the current context of price changes, the existing

regulated minimum wage is too low and not suitable

to the real circumstance, and cannot do its function

to ensure employee’s minimum living standards.

For further understanding of conception, role and

impacts ofminimum wage, I select the research

“Discussion on minimum wage in Vietnam” to

make a contribution to theoretical meaning as

well as more systematical and full acknowledge of

minimum wage in Viet Nam.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Tóm tắt nội dung tài liệu: Discussion on minimum wage in Viet Nam

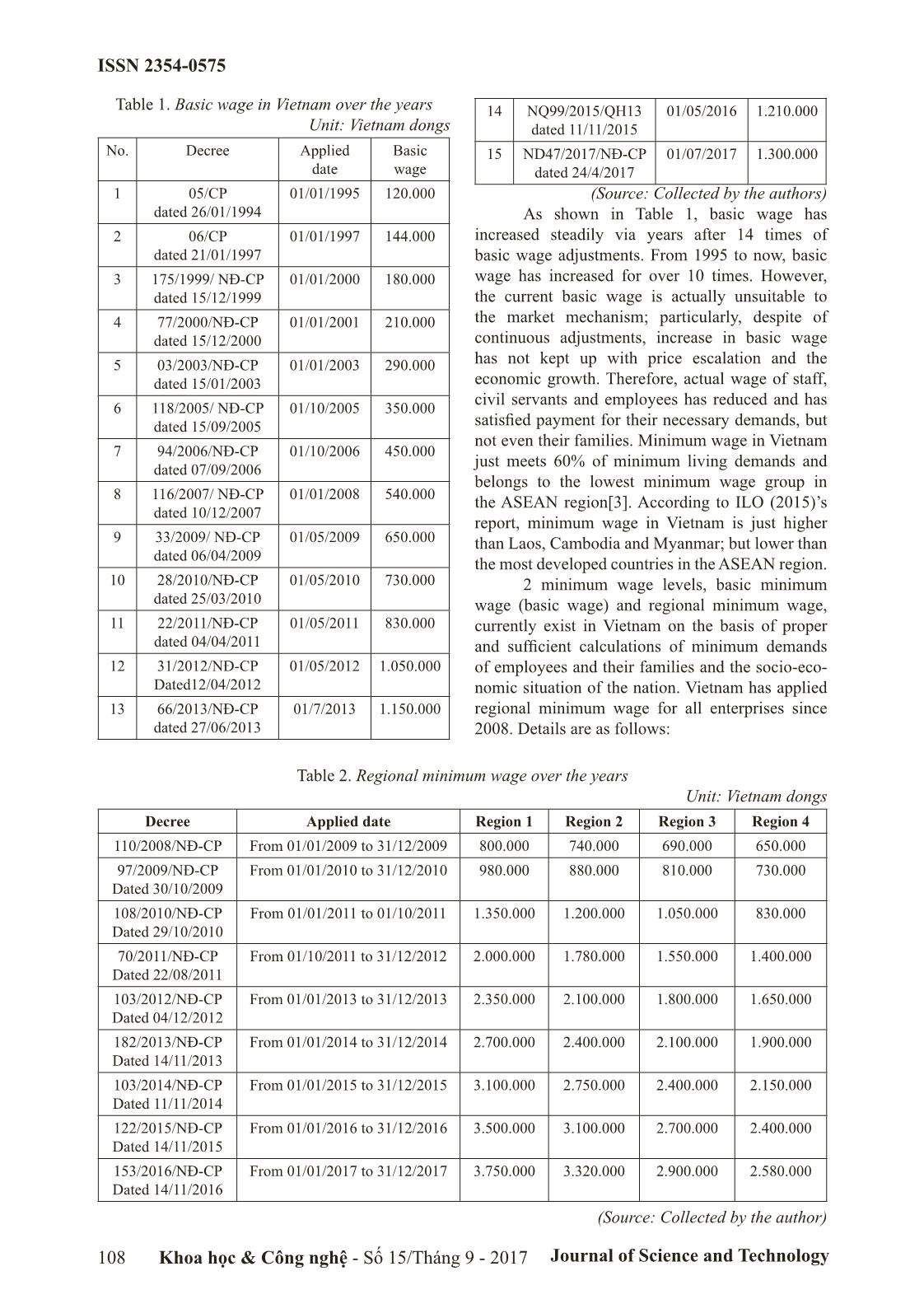

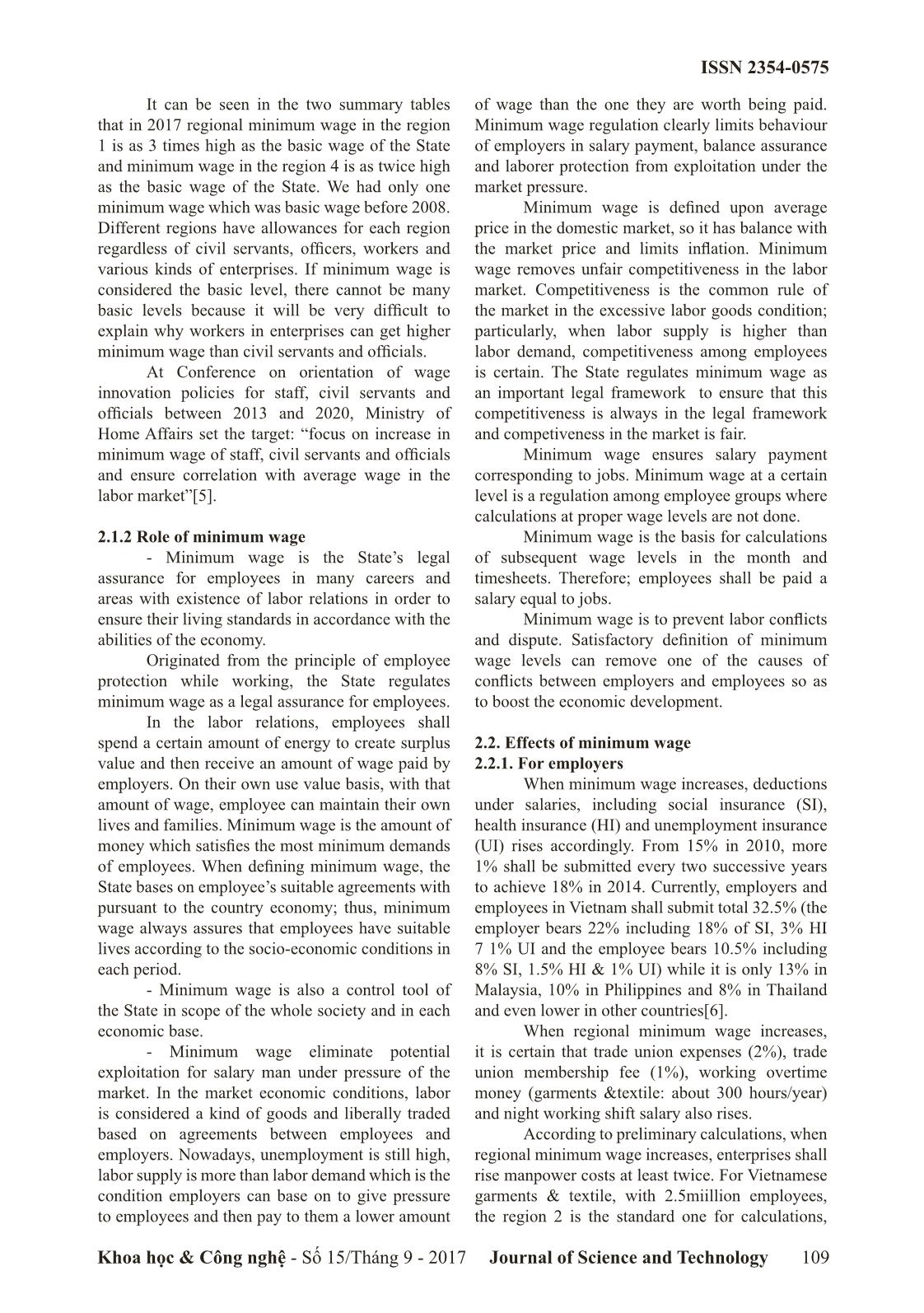

ISSN 2354-0575 Khoa học & Công nghệ - Số 15/Tháng 9 - 2017 Journal of Science and Technology 107 DISCUSSION ON MINIMUM WAGE IN VIETNAM Nguyen Thi Mo1, Bui Thi Thu Thuy1, Le Thi Hong Quyen1, Hoang Van Hue1, Nguyen Thi Xuan Hai2 1 Hung Yen University of Technology and Education 2 County Committee Van Lam Received: 20/03/2017 Revised: 10/06/2017 Accepted for publication: 10/07/2017 Abstract: In this article the authors give opinions on minimum wage and discussion on basic minimum wage and regional minimum wage in Vietnam. The authors thereby define the role and effects of minimum wage on employers, employees and the economy. Keywords: minimum wage, minimum living standards. 1. Introduction Wage is not only the economic category but also the top factor of the social policies directly related to employee’s life. Wage has impacts on economic management, finance, labour management and production promotion. The State policies on wage has changed through periods. However; in the current context of high inflation, wage policies are exposing many disadvantages and employee’s life has many difficulties. Those are the main reasons for lots of strikes in the enterprise area and brain drain in the State business and administrative agencies. Minimum wage is a constitutional part of wage regime which plays a crucial role in the wage system because it has influences to the whole wage policy. Wage is not only simply applied for employees but also the important legal framework which is the payment basis for labor in the society. Minimum wage regulation has the very important meaning for not only employees but also the economic development, the labor relation stability and the socio-political stability. Nevertheless, in the current context of price changes, the existing regulated minimum wage is too low and not suitable to the real circumstance, and cannot do its function to ensure employee’s minimum living standards. For further understanding of conception, role and impacts ofminimum wage, I select the research “Discussion on minimum wage in Vietnam” to make a contribution to theoretical meaning as well as more systematical and full acknowledge of minimum wage in Viet Nam. 2. Content 2.1. Minimum wage and role of minimum wage 2.1.1. Concept of minimum wage (minimum wage level) First of all, according to the theoretical acknowledge, understanding and agreement of the minimum wage concept are different. One of the arguments is that for whom minimum wage is defined and which objects get benefit from minimum wage? As specified in Item 1, Clause 91, Labor Law 2012 “Minimum wage is the lowest level paid for employees who do the simplest job in the normal working condition and shall ensure the minimum living demands of the employees and their families”.[1] According to the above concept, who do the simplest jobs? Are they gate guards and odd job men? In the speech at Conference on minimum wage policies - International experiences and recommendations for Vietnam in September, 2011, Representative from Department of Labor-Wage addressed “In fact, it is difficult for this kind of labors to exist”[4]. According to Socio-Economic Issue Committee under Parliament, minimum wage is to defend only the most vulnerable groups in the sections such as garments & textile where working conditions are still not good and income is low”. As stated in the Economy and Human Resource Management textbook: “Minimum wage is the amount of currency, regulated by the State, to be paid to the simplest jobs in the normal working conditions in the society. The simplest jobs such as odd job men, drinking water waiters and gate guards, etc.[2] are the ones which any healthy person without any training can do” According to the development routine, Vietnam commits to increase minimum wage step by step to meet employee’s minimum living demands. From 1995 to now basic wage has changed continuously. ISSN 2354-0575 Journal of Science and Technology108 Khoa học & Công nghệ - Số 15/Tháng 9 - 2017 Table 1. Basic wage in Vietnam over the years Unit: Vietnam dongs No. Decree Applied date Basic wage 1 05/CP dated 26/01/1994 01/01/1995 120.000 2 06/CP dated 21/01/1997 01/01/1997 144.000 3 175/1999/ NĐ-CP dated 15/12/1999 01/01/2000 180.000 4 77/2000/NĐ-CP dated 15/12/2000 01/01/2001 210.000 5 03/2003/NĐ-CP dated 15/01/2003 01/01/2003 290.000 6 118/2005/ NĐ-CP dated 15/09/2005 01/10/2005 350.000 7 94/2006/NĐ-CP dated 07/09/2006 01/10/2006 450.000 8 116/2007/ NĐ-CP dated 10/12/2007 01/01/2008 540.000 9 33/2009/ NĐ-CP dated 06/04/2009 01/05/2009 650.000 10 28/2010/NĐ-CP dated 25/03/2010 01/05/2010 730.000 11 22/2011/NĐ-CP dated 04/04/2011 01/05/2011 830.000 12 31/2012/NĐ-CP Dated12/04/2012 01/05/2012 1.050.000 13 66/2013/NĐ-CP dated 27/06/2013 01/7/2013 1.150.000 14 NQ99/2015/QH13 dated 11/11/2015 01/05/2016 1.210.000 15 ND47/2017/NĐ-CP dated 24/4/2017 01/07/2017 1.300.000 (Source: Collected by the authors) As shown in Table 1, basic wage has increased steadily via years after 14 times of basic wage adjustments. From 1995 to now, basic wage has increased for over 10 times. However, the current basic wage is actually unsuitable to the market mechanism; particularly, despite of continuous adjustments, increase in basic wage has not kept up with price escalation and the economic growth. Therefore, actual wage of staff, civil servants and employees has reduced and has satisfied payment for their necessary demands, but not even their families. Minimum wage in Vietnam just meets 60% of minimum living demands and belongs to the lowest minimum wage group in the ASEAN region[3]. According to ILO (2015)’s report, minimum wage in Vietnam is just higher than Laos, Cambodia and Myanmar; but lower than the most developed countries in the ASEAN region. 2 minimum wage levels, basic minimum wage (basic wage) and regional minimum wage, currently exist in Vietnam on the basis of proper and sufficient calculations of minimum demands of employees and their families and the socio-eco- nomic situation of the nation. Vietnam has applied regional minimum wage for all enterprises since 2008. Details are as follows: Table 2. Regional minimum wage over the years Unit: Vietnam dongs Decree Applied date Region 1 Region 2 Region 3 Region 4 110/2008/NĐ-CP From 01/01/2009 to 31/12/2009 800.000 740.000 690.000 650.000 97/2009/NĐ-CP Dated 30/10/2009 From 01/01/2010 to 31/12/2010 980.000 880.000 810.000 730.000 108/2010/NĐ-CP Dated 29/10/2010 From 01/01/2011 to 01/10/2011 1.350.000 1.200.000 1.050.000 830.000 70/2011/NĐ-CP Dated 22/08/2011 From 01/10/2011 to 31/12/2012 2.000.000 1.780.000 1.550.000 1.400.000 103/2012/NĐ-CP Dated 04/12/2012 From 01/01/2013 to 31/12/2013 2.350.000 2.100.000 1.800.000 1.650.000 182/2013/NĐ-CP Dated 14/11/2013 From 01/01/2014 to 31/12/2014 2.700.000 2.400.000 2.100.000 1.900.000 103/2014/NĐ-CP Dated 11/11/2014 From 01/01/2015 to 31/12/2015 3.100.000 2.750.000 2.400.000 2.150.000 122/2015/NĐ-CP Dated 14/11/2015 From 01/01/2016 to 31/12/2016 3.500.000 3.100.000 2.700.000 2.400.000 153/2016/NĐ-CP Dated 14/11/2016 From 01/01/2017 to 31/12/2017 3.750.000 3.320.000 2.900.000 2.580.000 (Source: Collected by the author) ISSN 2354-0575 Khoa học & Công nghệ - Số 15/Tháng 9 - 2017 Journal of Science and Technology 109 It can be seen in the two summary tables that in 2017 regional minimum wage in the region 1 is as 3 times high as the basic wage of the State and minimum wage in the region 4 is as twice high as the basic wage of the State. We had only one minimum wage which was basic wage before 2008. Different regions have allowances for each region regardless of civil servants, officers, workers and various kinds of enterprises. If minimum wage is considered the basic level, there cannot be many basic levels because it will be very difficult to explain why workers in enterprises can get higher minimum wage than civil servants and officials. At Conference on orientation of wage innovation policies for staff, civil servants and officials between 2013 and 2020, Ministry of Home Affairs set the target: “focus on increase in minimum wage of staff, civil servants and officials and ensure correlation with average wage in the labor market”[5]. 2.1.2 Role of minimum wage - Minimum wage is the State’s legal assurance for employees in many careers and areas with existence of labor relations in order to ensure their living standards in accordance with the abilities of the economy. Originated from the principle of employee protection while working, the State regulates minimum wage as a legal assurance for employees. In the labor relations, employees shall spend a certain amount of energy to create surplus value and then receive an amount of wage paid by employers. On their own use value basis, with that amount of wage, employee can maintain their own lives and families. Minimum wage is the amount of money which satisfies the most minimum demands of employees. When defining minimum wage, the State bases on employee’s suitable agreements with pursuant to the country economy; thus, minimum wage always assures that employees have suitable lives according to the socio-economic conditions in each period. - Minimum wage is also a control tool of the State in scope of the whole society and in each economic base. - Minimum wage eliminate potential exploitation for salary man under pressure of the market. In the market economic conditions, labor is considered a kind of goods and liberally traded based on agreements between employees and employers. Nowadays, unemployment is still high, labor supply is more than labor demand which is the condition employers can base on to give pressure to employees and then pay to them a lower amount of wage than the one they are worth being paid. Minimum wage regulation clearly limits behaviour of employers in salary payment, balance assurance and laborer protection from exploitation under the market pressure. Minimum wage is defined upon average price in the domestic market, so it has balance with the market price and limits inflation. Minimum wage removes unfair competitiveness in the labor market. Competitiveness is the common rule of the market in the excessive labor goods condition; particularly, when labor supply is higher than labor demand, competitiveness among employees is certain. The State regulates minimum wage as an important legal framework to ensure that this competitiveness is always in the legal framework and competiveness in the market is fair. Minimum wage ensures salary payment corresponding to jobs. Minimum wage at a certain level is a regulation among employee groups where calculations at proper wage levels are not done. Minimum wage is the basis for calculations of subsequent wage levels in the month and timesheets. Therefore; employees shall be paid a salary equal to jobs. Minimum wage is to prevent labor conflicts and dispute. Satisfactory definition of minimum wage levels can remove one of the causes of conflicts between employers and employees so as to boost the economic development. 2.2. Effects of minimum wage 2.2.1. For employers When minimum wage increases, deductions under salaries, including social insurance (SI), health insurance (HI) and unemployment insurance (UI) rises accordingly. From 15% in 2010, more 1% shall be submitted every two successive years to achieve 18% in 2014. Currently, employers and employees in Vietnam shall submit total 32.5% (the employer bears 22% including 18% of SI, 3% HI 7 1% UI and the employee bears 10.5% including 8% SI, 1.5% HI & 1% UI) while it is only 13% in Malaysia, 10% in Philippines and 8% in Thailand and even lower in other countries[6]. When regional minimum wage increases, it is certain that trade union expenses (2%), trade union membership fee (1%), working overtime money (garments &textile: about 300 hours/year) and night working shift salary also rises. According to preliminary calculations, when regional minimum wage increases, enterprises shall rise manpower costs at least twice. For Vietnamese garments & textile, with 2.5miillion employees, the region 2 is the standard one for calculations, ISSN 2354-0575 Journal of Science and Technology110 Khoa học & Công nghệ - Số 15/Tháng 9 - 2017 when minimum wage increases by 300.000 dongs, manpower costs of the whole section will increase by 20.000billion dongs which also means that profits of enterprises shall reduce. 2.2.2. For employees For employees, increase in minimum wage is an expectation; however, the State’s increase in minimum wage only compensates for increase in inflation. If increase in minimum wage can be closely controlled, a certain amount of employees who is getting lower salary than regional minimum wage shall receive an increase (by some 10%) so as to make sure that their salaries are not lower than minimum wage. In case enterprise’s health is good enough, the remaining employee’s salary can be risen accordingly. In case enterprises are not strong enough, they will decrease income of the major of employees from the “soft” salary (accounting for 30% of income) to compensate for insurances and increase in trade union fee and a certain amount shared by stakeholders. Weak enterprises, especially small & medium enterprises might risk stopping production and bankrupt. One remarkable thing is that according to data given by the tax sector in 2014, up to 483,000 enterprises in Vietnam are small and supersmall; of which, 70% of them do not have ineffective business operation [7]. Enterprises have difficulties, so they have no accumulation for investment into new technologies and plant for labor productivity improvement resulting into conditions for stable increase in employee’s income. 2.2.3. For the economy Continuous increase in minimum wage at high levels in association with high deductions under salaries will reduce enterprises’ profits and direct revenue from enterprise income tax. Indirect impact is that domestic enterprises will have no capabilities of investments into production extension for job creation and labor recruitment which shall then make a contribution to rural agricultural economic structure transition. In contrast, foreign investors with advantages of funds, technologies and management, etc. shall defeat domestic enterprises and utilize advantages benefited from free trade agreements. 2.3. Some proposals and recommendations In order to enable minimum wage to promote positive effects, it is required to tackle many related issues and implementation conditions such as finance and organization. Thus, the authors hereby recommend as follows: Firstly, properly define objects who benefit minimum wage. Hence, minimum wage shall be defined based on minimum living standards and suitable to changes of inflation and the economic growth. Minimum living standards shall be annually surveyed and issued by General Statistics Office. Secondly, add minimum daily wage and minimum hour wage to more strictly defend employee’s rights. Thirdly, complete the minimum living standard definition method step by step; of which, clearly define minimum good structures and minimum expenses related to employees. Fourthly, make sure that minimum wage adjustment shall show three criteria: compensation for price escalation, conformity with increase in annual labor productivity and simultaneously gain a certain increase to shorten routines and ensure employee’s minimum living standards set by the State. 3. Conclusions Minimum wage has very big impacts on not only employees but also the national socio- economic development. Hence, the State shall have to draw policies and routines for increase in minimum wage accordingly to promote maximum effectiveness and defend employee’s rights. 4. Acknowledgement This research is supported by the Center for Applied Research in Science and Technology, Hung Yen University of Technology and Education References [1]. Labor Law 2012. [2]. Tran Xuan Cau, Economy and Human Resource Management textbook National Economics University, 2014, P.285. [3]. Hong Nhung, Minimum Wage and Minimum Living Standards, Audit Magazine in the end of Month No.33, March, 2015. [4]. Conference on Minimum Wage Policies - International Experiences and Recommendations for Vietnam. Ministry of Labor, War Invalids & Social Welfare and International Labor Organization. September, 2011. ISSN 2354-0575 Khoa học & Công nghệ - Số 15/Tháng 9 - 2017 Journal of Science and Technology 111 [5]. Conference on Orientation of Wage Policy Innovation for Staff, Civil Servants and Officials between 2013 and 2020. Ministry of Home Affairs and UNDP Vietnam, December, 2011. [6]. [7]. BÀN VỀ TIỀN LƯƠNG TỐI THIỂU Ở VIỆT NAM Tóm tắt: Trong bài viết này, tác giả đưa ra các quan niệm về mức lương tối thiểu và những bàn luận về mức lương tối thiểu chung, mức lương tối thiểu vùng của Việt Nam. Qua đó, tác giả xác định được vai trò và tác động của mức lương tối thiểu đối với người sử dụng lao động, người lao động và nền kinh tế. Từ khóa: tiền lương tối thiểu, mức sống tối thiểu.

File đính kèm:

discussion_on_minimum_wage_in_viet_nam.pdf

discussion_on_minimum_wage_in_viet_nam.pdf