Đề xuất mô hình nghiên cứu các nhân tố ảnh hưởng đến việc áp dụng kế toán trách nhiệm trong doanh nghiệp

Nền kinh tế Việt Nam đã và đang ngày càng hội nhập với nền kinh tế thế giới. Quá trình

này đã tạo ra nhiều cơ hội nhưng cũng đặt ra không ít những khó khăn, thách thức. Bối cảnh đó

đặt ra cho các doanh nghiệp Việt Nam phải nghiên cứu các công cụ quản lý hiệu quả nhằm phục

vụ cho việc ra quyết định. Một trong những công cụ quản lý quan trọng đó là kế toán trách nhiệm.

Kế toán trách nhiệm là một công cụ quản lý hiệu quả nhằm thực hiện việc kiểm soát trên cả góc

độ tài chính và chiến lược, tăng cường sự phát triển bền vững cho các doanh nghiệp trong giai

đoạn hội nhập. Tuy nhiên, việc áp dụng kế toán trách nhiệm trong doanh nghiệp phụ thuộc vào

rất nhiều yếu tố cả bên trong lẫn bên ngoài doanh nghiệp. Qua tổng hợp các nghiên cứu tiền

nhiệm, nhóm nghiên cứu tiến hành tổng hợp và đề xuất mô hình nghiên cứu cho các nghiên cứu

thực nghiệm trong tương lai về các nhân tố ảnh hưởng đến việc áp dụng kế toán trách nhiệm ở

Việt Nam.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Tóm tắt nội dung tài liệu: Đề xuất mô hình nghiên cứu các nhân tố ảnh hưởng đến việc áp dụng kế toán trách nhiệm trong doanh nghiệp

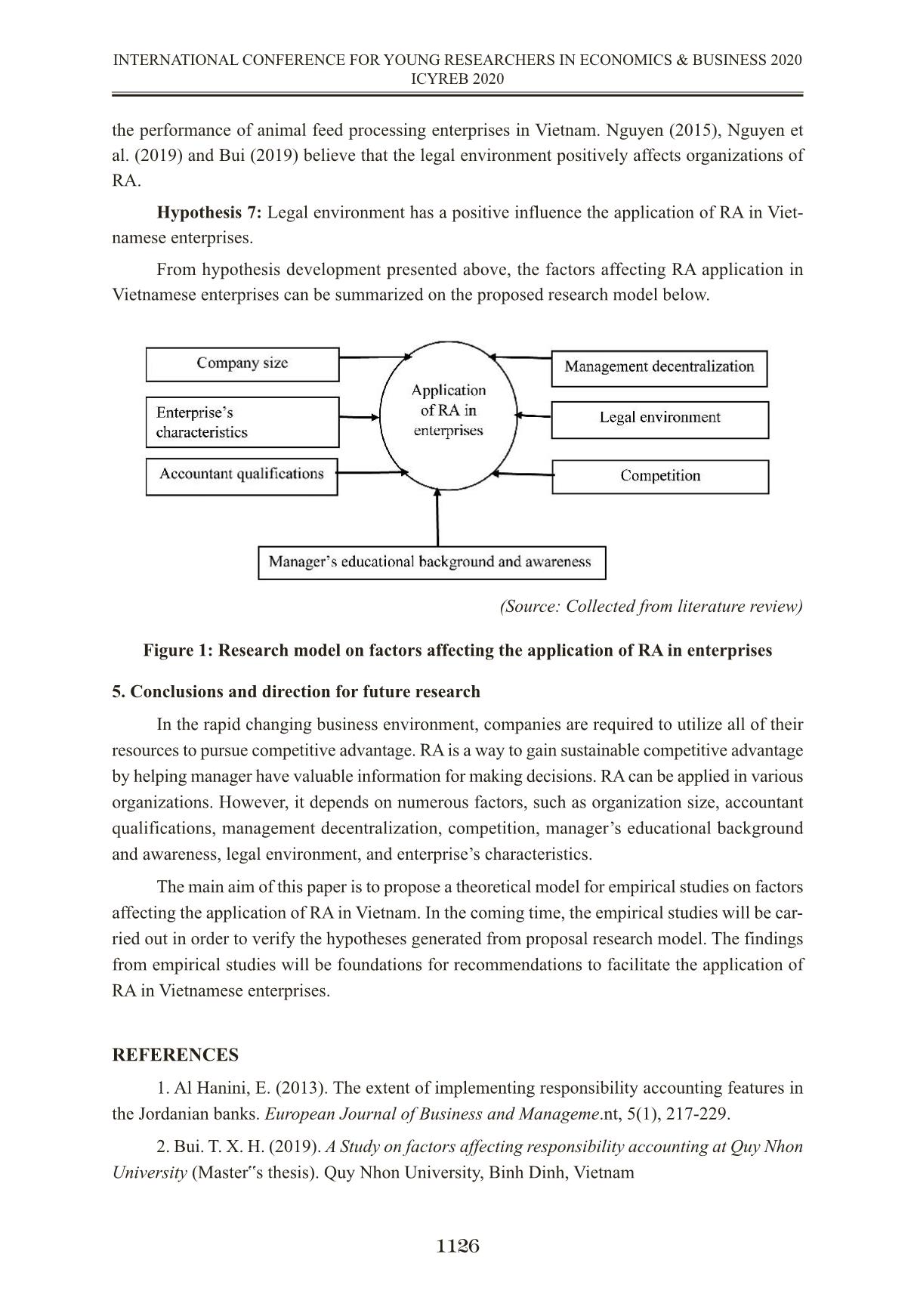

PROPOSING A MODEL OF FACTORS AFFECTING THE APPLICA- TION OF RESPONSIBILITY ACCOUNTING IN ENTERPRISES ĐỀ XUẤT MÔ HÌNH NGHIÊN CỨU CÁC NHÂN TỐ ẢNH HƯỞNG ĐẾN VIỆC ÁP DỤNG KẾ TOÁN TRÁCH NHIỆM TRONG DOANH NGHIỆP MA. Chu Thi Huyen - Ass. Prof.Dr. Pham Duc Hieu Thuongmai University chuthihuyendhtm@gmail.com Abstract Vietnamese economy has been constantly integrating into the world. The integration process has created opportunities but also posed many difficulties and challenges. Therefore, local enterprises are searching for effective management tools that assist them in making deci- sions. One of the key management tools is responsibility accounting (RA). RA is an effective gov- ernance tool to execute control over both financial and strategic aspects, strengthen sustainable development of enterprises in integration stage. However, the application of RA in enterprises depends on many internal and external factors. By reviewing previous research, the authors syn- thesize and propose a research model for future empirical studies on factors affecting application of RA in Vietnam. Keywords: Responsibility accounting, Influencing factors, Enterprises, Vietnam Tóm tắt Nền kinh tế Việt Nam đã và đang ngày càng hội nhập với nền kinh tế thế giới. Quá trình này đã tạo ra nhiều cơ hội nhưng cũng đặt ra không ít những khó khăn, thách thức. Bối cảnh đó đặt ra cho các doanh nghiệp Việt Nam phải nghiên cứu các công cụ quản lý hiệu quả nhằm phục vụ cho việc ra quyết định. Một trong những công cụ quản lý quan trọng đó là kế toán trách nhiệm. Kế toán trách nhiệm là một công cụ quản lý hiệu quả nhằm thực hiện việc kiểm soát trên cả góc độ tài chính và chiến lược, tăng cường sự phát triển bền vững cho các doanh nghiệp trong giai đoạn hội nhập. Tuy nhiên, việc áp dụng kế toán trách nhiệm trong doanh nghiệp phụ thuộc vào rất nhiều yếu tố cả bên trong lẫn bên ngoài doanh nghiệp. Qua tổng hợp các nghiên cứu tiền nhiệm, nhóm nghiên cứu tiến hành tổng hợp và đề xuất mô hình nghiên cứu cho các nghiên cứu thực nghiệm trong tương lai về các nhân tố ảnh hưởng đến việc áp dụng kế toán trách nhiệm ở Việt Nam. Từ khoá: Kế toán trách nhiệm, các nhân tố ảnh hưởng, doanh nghiệp, Việt Nam 1. Introduction In the context of international economic integration, businesses have realized that for better decision-making they should rely on advanced management techniques. Among them, the one that helps businesses develop sustainably is responsibility accounting (RA) (Nguyen, 2017; Tran, 1120 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 2017; Meda, 2003). RA is a management control system based on the principles of delegating authorities and assigning responsibilities in an enterprise. The authorities and responsibilities are delegated to managers of different responsibility centers (i.e. investment center, revenue center, cost center, and profit center). Therefore, RA is expected to provide financial and non-financial information useful for evaluating managers or heads of departments performance on what is under their control. The primary objective of responsibility accounting is to motivate managers and their subordinates by emphasizing their performance. Starting with Higgins’ research in 1952, RA is an interesting research topic for more than 70 years. Research findings show that RA has made a significant contribution to the success of businesses operating in different fields around the world, such as manufacturing (Lin and Yu, 2002; Akenbor et al., 2013), bank industry (Pajrok, 2014; Hanini, 2013), and healthcare services (Nyakuwanik et al., 2012; Karasioglu et al., 2012). However, not all businesses can successfully apply RA. In Vietnam, RA is still a new concept in both theoretical and practical aspects and not widely adopted by local companies. Recently, some empirical researches try to provide and ex- plain the reasons for the late adoption of RA in Vietnam. However, the findings are contradictory and lack of generalization due to the absence of a stable research framework. Therefore, this is the main reason that motivates the authors to develop a research model on factors affecting the application of RA in Vietnam. The main purpose of this paper is that the proposed research frame- work will be tested by empirical studies in Vietnam in order to recognize the facilitating factors for the adoption of RA in Vietnamese firms in the coming time. The paper is structured as follows. The next section presents theoretical framework that considers as foundation for RA development. The third section is literature review and research hypothesis development, followed by the proposed research framework for studying factors af- fecting RA application in Vietnam. Finally, the paper concludes with conclusions and directions for future research. 2. Theoretical framework 2.1. Agency Theory Agency theory refers to shareholders, ‘the principals’, and managers, ... ifications. 3. Literature Review, Hypothesis Development and Proposed Research Model Company size: Nowak (2000) and Zimnicki (2015) argue that the company size affects the definition of responsibility centers. They state that besides the size of the company, the types of centres are affected by the following factors: the scope and specificity of the company’s activity, the complexity of the economic process, and the ability to define the scope of authorities and re- sponsibilities. The studies of RaJan (2011) and Alshormaly (2013) conclude that the size of rev- enue, total assets, employees and financial resources have significant influence on RA application. Mohamad et al. (2014) show that RA is related with the size of an organization. It is useful for the large-scale companies, while small-scale companies are not useful as compared to large scale. According to Kamilah (2012) and Quesado et al. (2016), there is an impact of company size on the application of RA in a firm. Research shows that large-scale enterprises, to better manage 1123 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 them, need to implement decentralization and this affects the RA organization in the business. Similarly, the studies of Tran (2105), Ngo and Ngo (2018), Le and Pham (2018), Huynh and Ta (2018), Ma and Tran (2019), Tran et al. (2020) conclude that organization size has a positive im- pact on the application of RA. Inspired from the above studies, the first hypothesis is generated as follows: Hypothesis 1: Company size has a positive influence on the application of RA in Viet- namese enterprises. Enterprise’s characteristics: The establishment of RA depends on characteristics of each enterprise (Shields, 1995). Nowak (2000) argues that the specificity of business operations is one of the factors affecting the responsibility centers. Meanwhile, the identification of responsibility centers is an important content of RA. Research by Venkatrathnam and Reddy (2008) also showed that RA is related to corporate control system because it is based on the principles of authorization and determination of responsibility. Similarly, Fowzia (2011) also emphasizes that RA is a control tool under the enterprise’s control system. So the control system is a factor that affects RA in an enterprise. Nguyen et al. (2019) state that we need to use enterprise characteristics to design the RA system that is suitable and effective when operating control activities for target objectives. The divisions of an organization into responsibility centers are based on its operational charac- teristics (Nguyen, 2020). The researches of Nguyen et al. (2019) and Bui (2019) show that orga- nization’s operational characteristics affect the application RA of businesses. Therefore, the second hypothesis is developed: Hypothesis 2: Firm’s characteristics have a positive influence on the application of RA in Vietnamese enterprises. Accountant qualifications: Researches by Haldma and Laats (2002), Alomiri (2003), Is- mail and King (2007) shows that the accountant’s qualifications are related to the level of RA application in an enterprise. The qualifications of accountants are considered as one of the po- tential factors that can affect the organization of RA in the business. McChlery et al. (2004) claim that qualified accountants helps RA in business growth. The study of Nawaiseh et al. (2014) also indicated that the insufficiency of employee training programs in managerial accounting in Jor- danian Industrial Companies listed at Amman Stock Exchange was one of the factors hindering the implementation of RA at a very high level, accounting for 74.8%. Similarly, the research re- sults of Ern et al. (2016) also show that the presence of qualified accountants is related to the high degree of RA application. The research results of Nguyen (2015), Tran and Ly (2018), Le and Pham (2018), Huynh and Ta (2018), Ma and Tran (2019), Nguyen and Le (2019) showed that accountant qualifications affect the RA applications. From previous results, the next hypoth- esis is formulated as follows Hypothesis 3: Accountant qualifications have a positive influence on the application of RA in Vietnamese enterprises. Management decentralization: Vlogel (1962) refers to the construction and establishment of RA in an enterprise, the author believes that RA should be built on the basis of management decentralization to collect information, implement business control, and provide information for managers to make effective decisions. Similarly, Gordon (1963) shows that RA only actives when 1124 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 the business is decentralized and organized. The studies of Belkaoui (1981) and Anderson (1995) also state that management decentralization has a significant influence on the application of RA in an enterprise. In 1997, Atkitson et al. concluded that RA can only be implemented when the business has a clearly decentralized organizational structure. Similarly, by analyzing the factors that influence the RA system, the studies of Casey et al. (2008), Fowzia (2009), Fowzia (2011), Smith et al. (2012), Nguyen (2015), Ngo and Vu (2017), Ngo and Ngo (2018), Tran and Ly (2018), Huynh and Ta (2018), Nguyen et al. (2019), Bui (2019), Ma and Tran (2019), Nguyen (2020) show that management decentralization affects the application of RA in enterprises. Hence, the next hypothesis is developed. Hypothesis 4: Management decentralization has a positive influence on the application of RA in Vietnamese enterprises. Manager’s educational background and awareness: Gordon (1963) argued that if econ- omists were only interested in economic efficiency without caring about attitudes of subordinate administrators, the RA would not be able to fulfill its inherent role. Koske and Muturi (2015) argue that when managers understand the usefulness of RA in performance assessment, the more likely they apply RA for its benefits. Shixian (2014) believes that the application of RA in busi- nesses is significantly affected by the training and qualifications of business leaders. Nyakuwanika et al. (2012) identify the relationship between the human factors and RA, without the participation of managers in the design of the RA system, it will not be effective. The research results of Nguyen (2015), Tran (2105), Ngo and Vu (2017), Tran and Ly (2018), Le and Pham (2018), Ngo and Ngo (2018), Huynh and Ta (2018), Ma and Tran (2019), Nguyen and Le (2019), Tran et al. (2020) show that manager’s educational background and awareness has an impact on the organ- izations of RA. As a result, the following hypothesis is formulated as follows: Hypothesis 5: Manager’s educational background and awareness have a positive influence on the application of RA in Vietnamese enterprises. Competition: Researches by Hwang (2005), Huang et al. (2010) emphasized the need to consider the level of competition in management accounting in general and RA in particular. Ac- cording to Doan (2012), the competition factor implies the extent to which an enterprise have to cope with rivals in terms of sources of raw materials, human resources, product quality, services, prices, distribution channels, and diversity of products. The studies of Libby and Waterhouse (1996), Granlund and Lukka (1998), Mia and Clare (1999), and O’Conner et al. (2004) state that the keener the competition an enterprise is facing, the more management accounting devices are employed. Similarly, Doan’s (2012) conclusion also shows that the competition has profound impacts on strategic management accounting application. The studies of Ahmad (2012), Le and Pham (2018) show that competition has an impact on the application of RA in enterprises. Hypothesis 6: Competition has a positive influence on the application of RA in Vietnamese enterprises. Legal environment: Li (2017) believes that legal environment is an important external fac- tor and forms a good foundation for the development of management accounting. RA is a part of management accounting needs to be flexible in order to adapt to changes in the legal environment (Shields, 1995). Nguyen et al. (2019) show that legal environment is one of the factors that affect 1125 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 the performance of animal feed processing enterprises in Vietnam. Nguyen (2015), Nguyen et al. (2019) and Bui (2019) believe that the legal environment positively affects organizations of RA. Hypothesis 7: Legal environment has a positive influence the application of RA in Viet- namese enterprises. From hypothesis development presented above, the factors affecting RA application in Vietnamese enterprises can be summarized on the proposed research model below. (Source: Collected from literature review) Figure 1: Research model on factors affecting the application of RA in enterprises 5. Conclusions and direction for future research In the rapid changing business environment, companies are required to utilize all of their resources to pursue competitive advantage. RA is a way to gain sustainable competitive advantage by helping manager have valuable information for making decisions. RA can be applied in various organizations. However, it depends on numerous factors, such as organization size, accountant qualifications, management decentralization, competition, manager’s educational background and awareness, legal environment, and enterprise’s characteristics. The main aim of this paper is to propose a theoretical model for empirical studies on factors affecting the application of RA in Vietnam. In the coming time, the empirical studies will be car- ried out in order to verify the hypotheses generated from proposal research model. The findings from empirical studies will be foundations for recommendations to facilitate the application of RA in Vietnamese enterprises. REFERENCES 1. Al Hanini, E. (2013). The extent of implementing responsibility accounting features in the Jordanian banks. European Journal of Business and Manageme.nt, 5(1), 217-229. 2. Bui. T. X. H. (2019). A Study on factors affecting responsibility accounting at Quy Nhon University (Master‟s thesis). Quy Nhon University, Binh Dinh, Vietnam 1126 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 3. Doan N. P .A. Factors Affecting Strategic Management Accounting in Vietnam’s Medium and LargeSized Enterprises. Journal of Economic Development, October 2012 . 81-90 4. Davood Askarany and Malcolm Smith. Diffusion of innovation and business size: a lon- gitudinal study of PACIA. Managerial Auditing Journal Vol. 23 No. 9, 2008. 900-915 5. Fowzia, R. (2011). Use of responsibility accounting and measure the satisfaction levels of service organizations in Bangladesh. International Review of Business Research Papers 6. Hoang V. T. (2010). Organize management accounting with strengthening management of business activities in Vietnam construction enterprises, National Economics University Pub- lishing House 7. Hoang T. H. Responsibility accounting and acutal application in Vietnam, Financial Re- view February.– 2016. 8. Huynh D. L Duc Long, Ta T. C. Q, “Factors influencing RA organization at logistics enterprises in Ho Chi Minh City”, Industry and Trade Magazine, No. 12, September 2018, P. 404-410 9. Jensen, C., Meckling, H., (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3 (4), 305-360. 10. Mojgan, S. (2012). Examining the role of responsibility accounting in organizational structure. American Academic & Scholarly Research Journal, 4 (5), 401-432. 11. Ma V.V, Tran.V.L. Factors affecting the application of RA in textile enterprises in the southern provinces”. Journal of Accounting and Auditing, No. 11, June 2019, P. 453-462. 12. Nyakuwanika, M., GutuG, J., Zhou, S., Tagwireyi, F., & Chidoko, C. (2012). An analy- sis of effective responsibility accounting system strategies in the Zimbabwean Health Sector Re- search Journal of Finance and Accounting, 3 (8), 86-92 13. Nguyen H. P. (2014). Responsibility accounting for construction corporations under the Ministry of Transport, Ho Chi Minh Economic University, Ho Chi Minh. 14. Nguyen T. D , Le D. M. D , Vo H. N. T , Nguyen H. T, Nguyen D. Factors affecting re- sponsibility accounting at joint stock commercial banks in Vietnam ,Journal of Southwest Jiao- tong University. Vol. 55 No. 4 Apr. 2020 15. Nguyen T. D, Le T. Q, “Analysis of factors affecting the ability to effectively apply RA in manufacturing enterprises in the Southeast region”, Journal of Asia-Pacific Economy, Number of March 2019, P 50-51. 16. Nguyen T. M. P. (2013). Building responsibility accounting model in Vietnam dairy manufacturing enterprises. National Economics University, Ha Noi city. 17. Ngo V. L, Vu T. H. N. Impacts of factors affecting the application of RA in import-ex- port enterprises. Journal of Finance and Accounting. No. 12 (173) -2017.P54- 58 18. Owino, P., (2017). Responsibility accounting in Ugandan public universities: Agency relation consideration. International Journal of Educational Policy Research. 4 (4), 62-71 1127 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 19. Nguyen N. T et al. (2019). Factors affecting the responsibility accounting in Vietnamese firms: A case study for livestock food processing enterprises. Management Science Letters, 9(9), 1349-1360. 20. Nguyen N. T. (2020). Factors Affecting Responsibility Accounting at Public Universi- ties: Evidence from Vietnam. Journal of Asian Finance, Economics and Business, 7(4), 275-286. https:// doi.org/10.13106/-jafeb.2020.vol7.no4.275 21. Nguyen T.B.L et al. Application of responsibility accounting in operations of Viet- namese enterprises, Financial Review March.– 2017 22. Seleshi Sisaye and Jacob Birnberg. Extent and scope of diffusion and adoption of process innovations in management accounting systems. International Journal of Accounting and Information Management Vol. 18 No. 2, 2010. 118-139 23. Tran T.T. (2015). Responsibility accounting research in Vietnamese cement manufac- turing enterprises. National Economics University, Ha Noi city 24. Tran T.T and et al. (2020). The effects of organization size and manager’s educational background on responsibility accounting: Evidences from Vietnamese cement enterprises, Li- censee Growing Science, Canada 25. Tran V.T. (2010). Develop a system of management responsibility assessment reports in listed companies in Vietnam. University of Economics Ho Chi Minh City 1128 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020

File đính kèm:

de_xuat_mo_hinh_nghien_cuu_cac_nhan_to_anh_huong_den_viec_ap.pdf

de_xuat_mo_hinh_nghien_cuu_cac_nhan_to_anh_huong_den_viec_ap.pdf