Creating working motivation for civil servants at Thanh Hoa tax department

Creating motivation and long-term commitment of civil servants will increase

operational efficiency of the organization, while saving time and costs due to the need to hire

new staff. Creating work motivation is an issue that every agency, organization or business

needs to pay attention. In this study, the authors assess the working motivation of Thanh Hoa

Tax Department by collecting secondary and preliminary data from the Department. The

study used questionnaire to survey 335 civil servants at Thanh Hoa Tax Department and used

descriptive statistical methods to analyze the primary data. Survey results show that there is

still a small part (about 15%) of civil servants not satisfied with the motivational methods

applied at the Department. Based on the reality, the authors offer solutions and

recommendations to increase working motivation for civil servants of Thanh Hoa Tax

Department in the near future.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Creating working motivation for civil servants at Thanh Hoa tax department

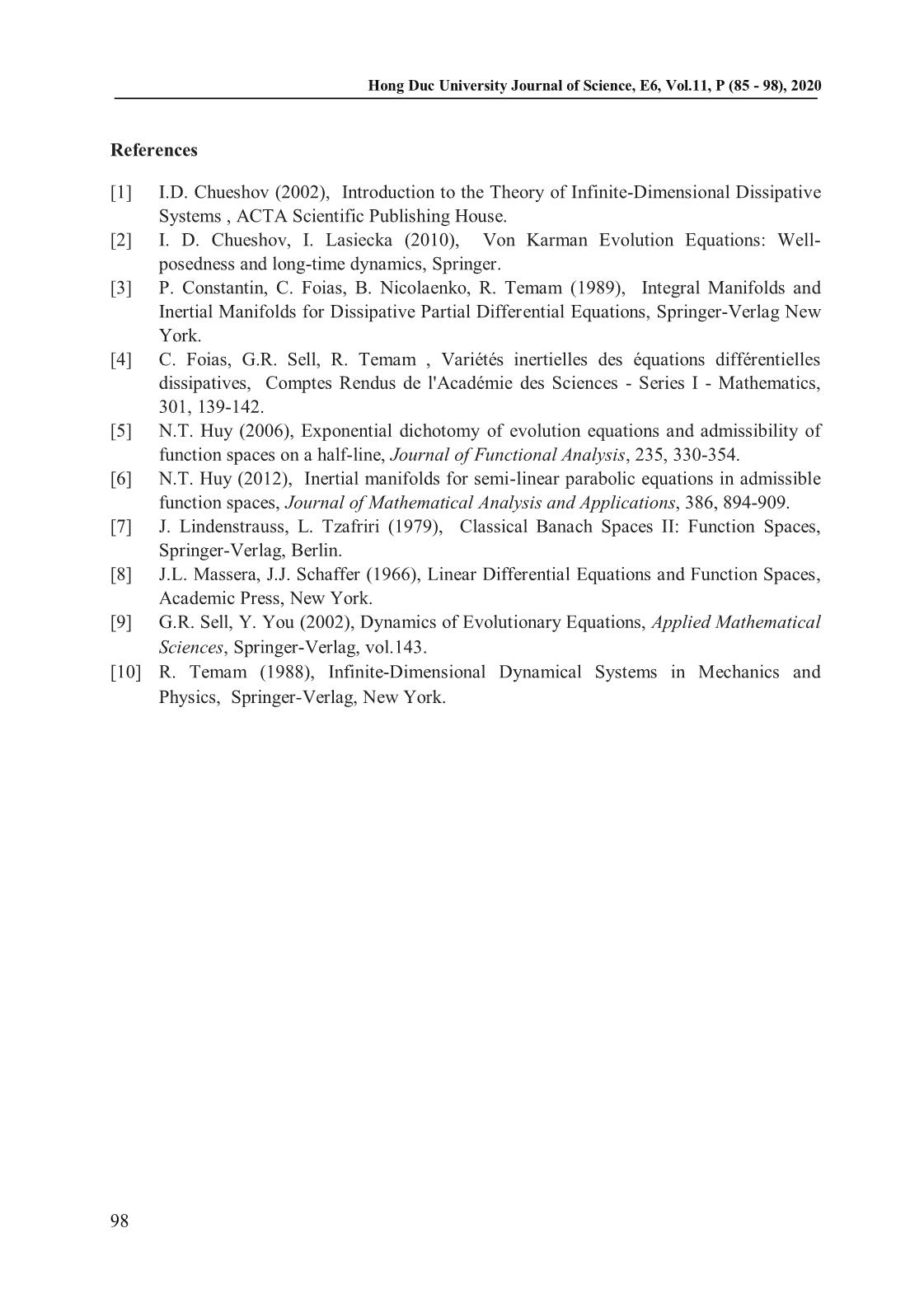

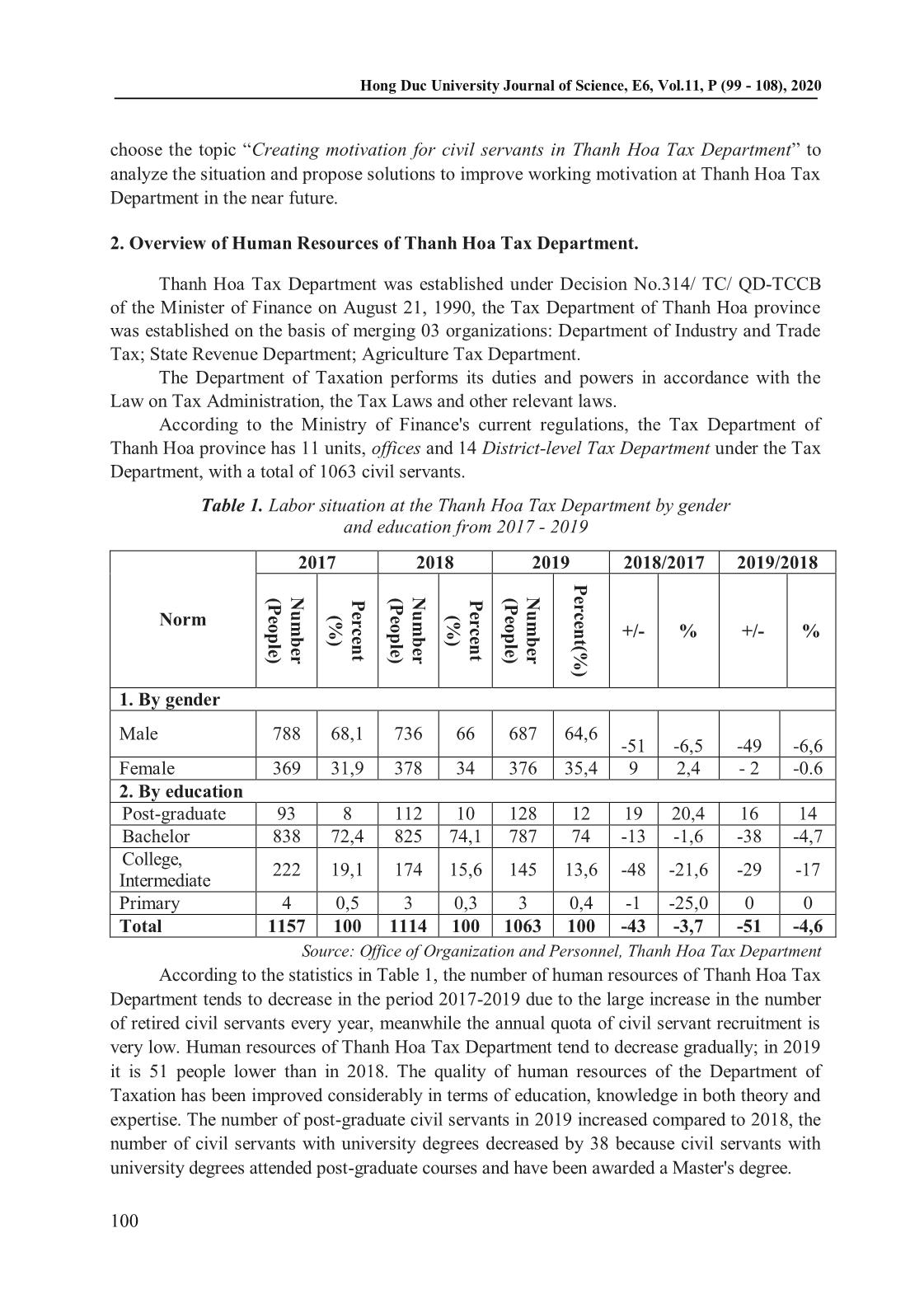

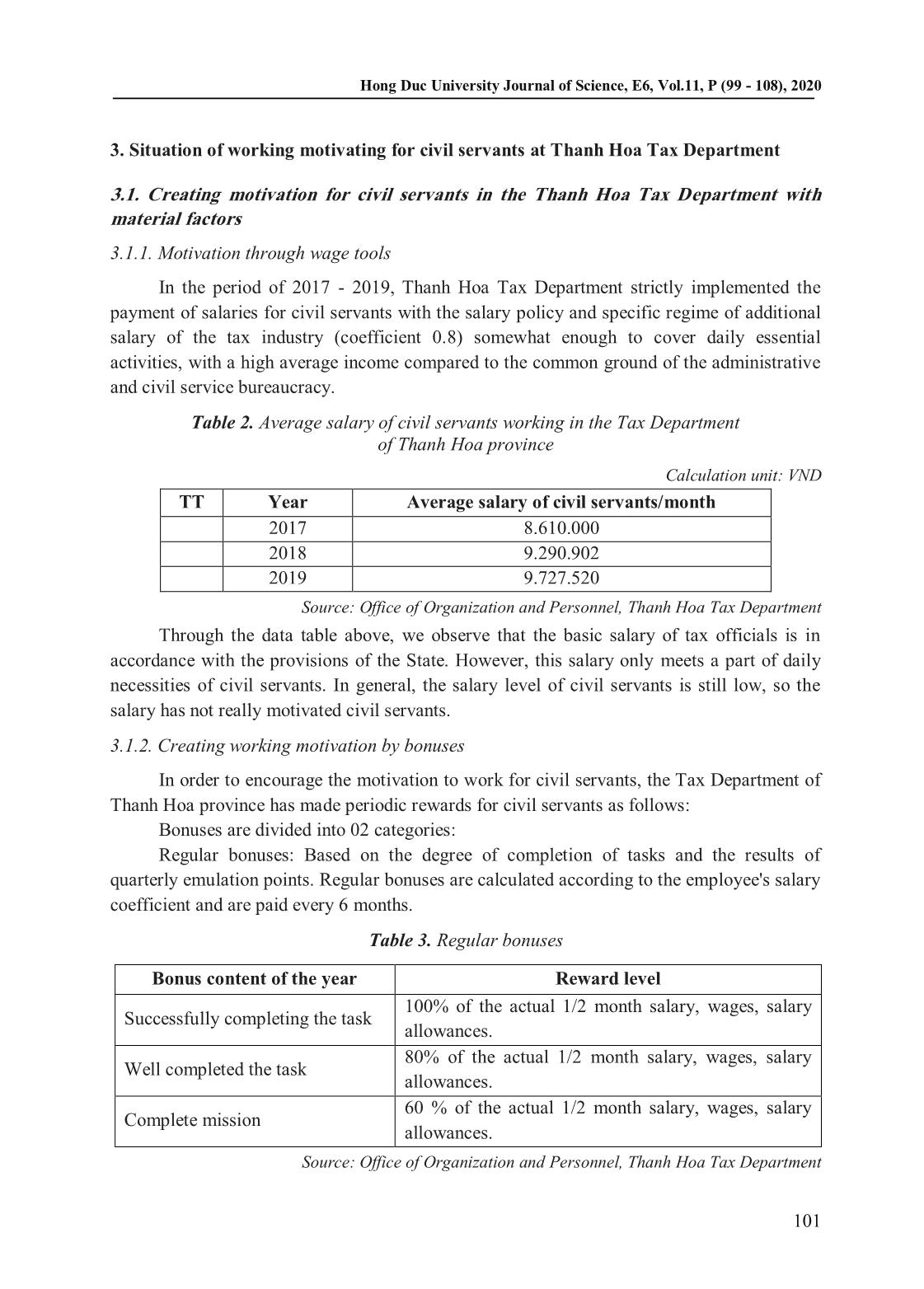

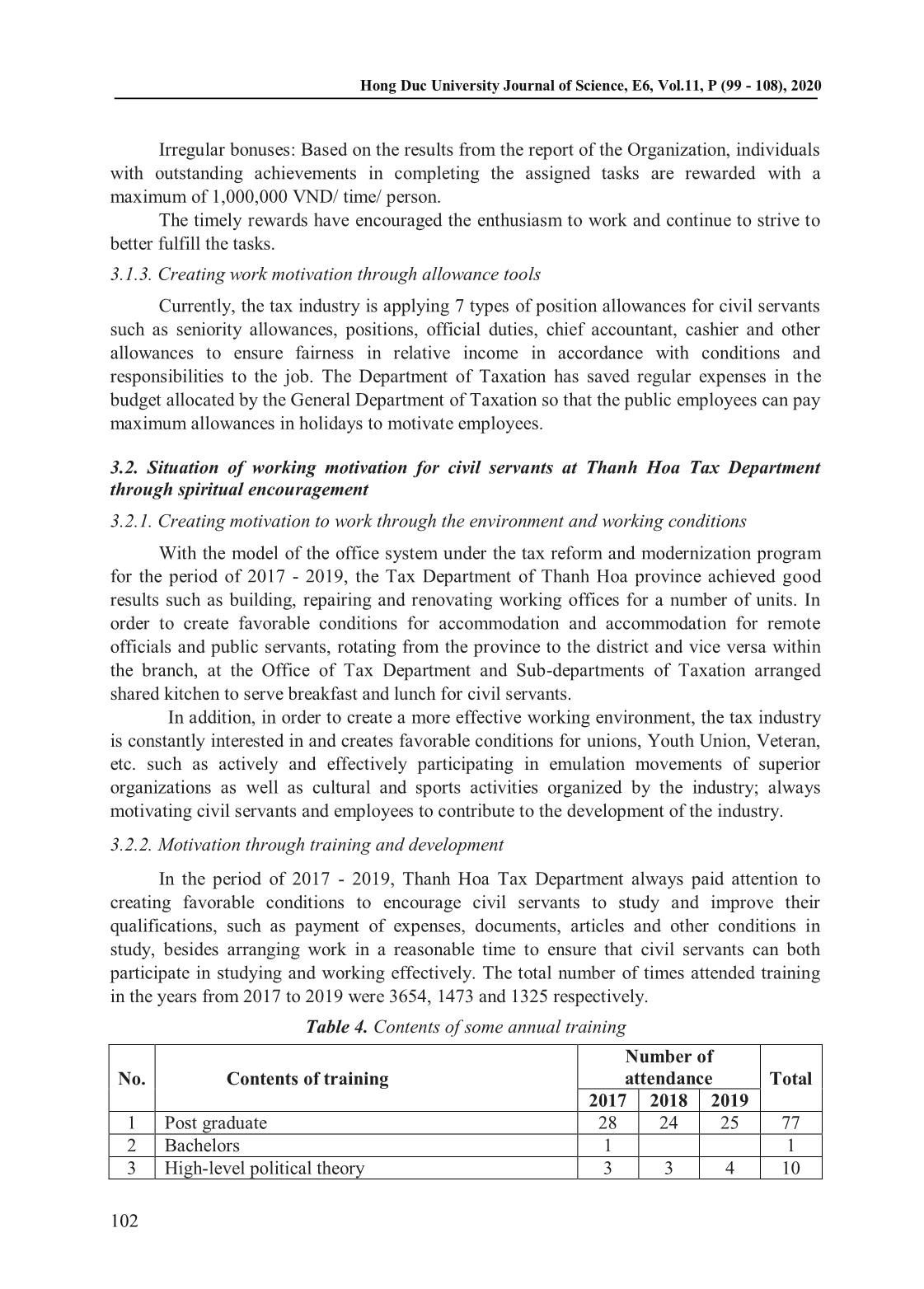

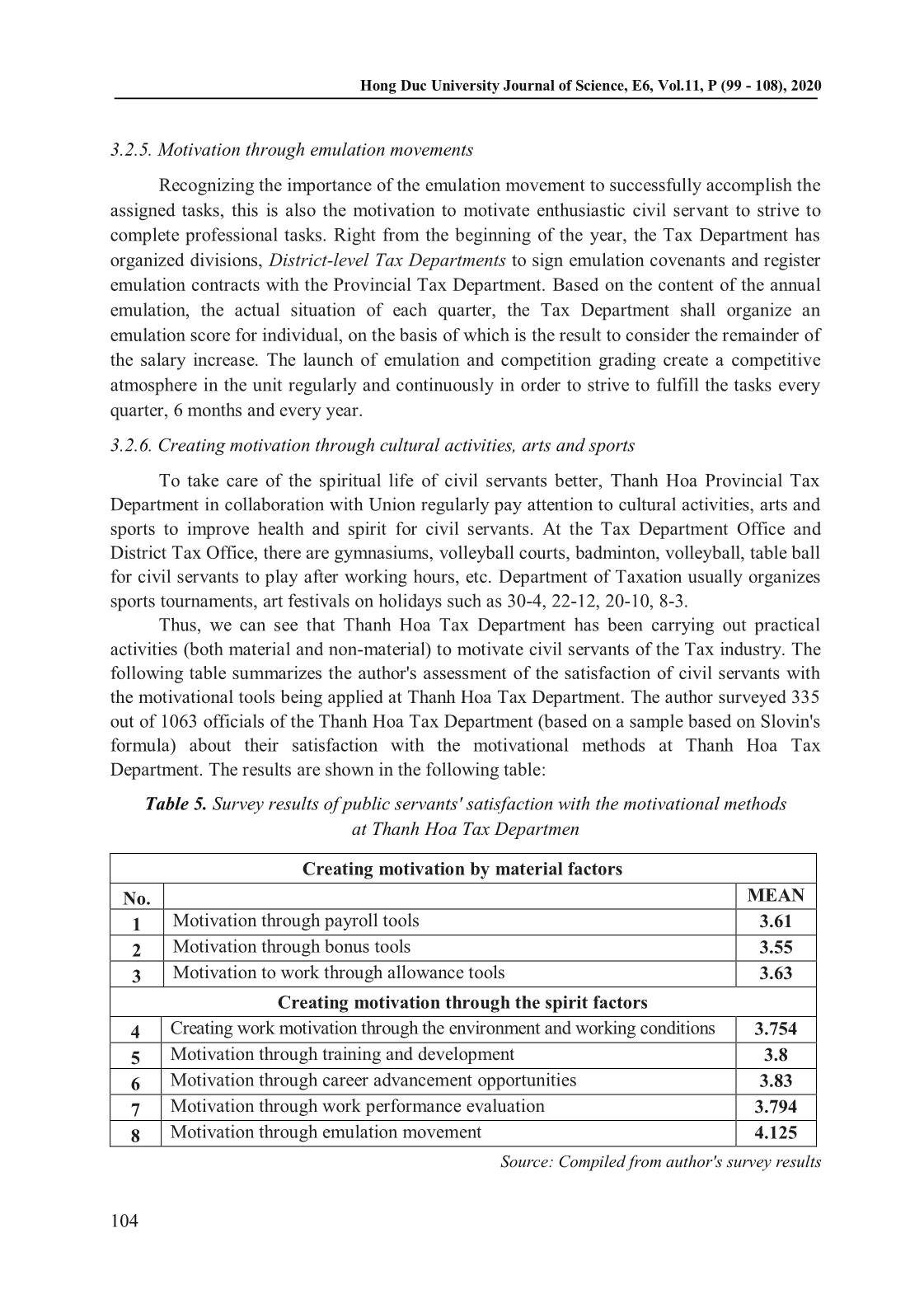

Hong Duc University Journal of Science, E6, Vol.11, P (85 - 98), 2020 98 F ac. o f G rad . S tu d ies, M ah id o l U n iv . M . M . (In tern atio n al H o sp itality M an ag em en t) / 9 8 References [1] I.D. Chueshov (2002), Introduction to the Theory of Infinite-Dimensional Dissipative Systems , ACTA Scientific Publishing House. [2] I. D. Chueshov, I. Lasiecka (2010), Von Karman Evolution Equations: Well- posedness and long-time dynamics, Springer. [3] P. Constantin, C. Foias, B. Nicolaenko, R. Temam (1989), Integral Manifolds and Inertial Manifolds for Dissipative Partial Differential Equations, Springer-Verlag New York. [4] C. Foias, G.R. Sell, R. Temam , Variétés inertielles des équations différentielles dissipatives, Comptes Rendus de l'Académie des Sciences - Series I - Mathematics, 301, 139-142. [5] N.T. Huy (2006), Exponential dichotomy of evolution equations and admissibility of function spaces on a half-line, Journal of Functional Analysis, 235, 330-354. [6] N.T. Huy (2012), Inertial manifolds for semi-linear parabolic equations in admissible function spaces, Journal of Mathematical Analysis and Applications, 386, 894-909. [7] J. Lindenstrauss, L. Tzafriri (1979), Classical Banach Spaces II: Function Spaces, Springer-Verlag, Berlin. [8] J.L. Massera, J.J. Schaffer (1966), Linear Differential Equations and Function Spaces, Academic Press, New York. [9] G.R. Sell, Y. You (2002), Dynamics of Evolutionary Equations, Applied Mathematical Sciences, Springer-Verlag, vol.143. [10] R. Temam (1988), Infinite-Dimensional Dynamical Systems in Mechanics and Physics, Springer-Verlag, New York. Hong Duc University Journal of Science, E6, Vol.11, P (99 - 108), 2020 99 F ac. o f G rad . S tu d ies, M ah id o l U n iv . M . M . (In tern atio n al H o sp itality M an ag em en t) / 9 9 CREATING WORKING MOTIVATION FOR CIVIL SERVANTS AT THANH HOA TAX DEPARTMENT Le Thi Nuong, Le Quang Hieu, Nguyen Thi Loan 1 Received: 28 July 2020/ Accepted: 1 September 2020/ Published: September 2020 Abstract: Creating motivation and long-term commitment of civil servants will increase operational efficiency of the organization, while saving time and costs due to the need to hire new staff. Creating work motivation is an issue that every agency, organization or business needs to pay attention. In this study, the authors assess the working motivation of Thanh Hoa Tax Department by collecting secondary and preliminary data from the Department. The study used questionnaire to survey 335 civil servants at Thanh Hoa Tax Department and used descriptive statistical methods to analyze the primary data. Survey results show that there is still a small part (about 15%) of civil servants not satisfied with the motivational methods applied at the Department. Based on the reality, the authors offer solutions and recommendations to increase working motivation for civil servants of Thanh Hoa Tax Department in the near future. Keywords: Civil servants, working motivation, Thanh Hoa Tax Department. 1. Introduction Human resources are always considered as an important factor, which plays a decisive role in the success of any organization. In order to achieve the goals set out by each agency, the organizarion need to know how to use and maximize the current human resources. Working motivation plays an extremely important role in improving productivity and working efficiency of individuals and organizations. The most important purpose of motivation is the rational use of labor resources, the effective exploitation of human resources in order to continuously improve the operational efficiency of organizations. Increasing working motivation will encourage individuals to work hard and improving working efficiency. Thus, it can be said that using labor resources effectively and motivating employees is extremely necessary and brings practical meaning to agencies and units. Being aware of the influence of creating motivation for the stability and sustainable development of the organization, Thanh Hoa Tax Department has paid more and more attention to activities to motivate civil servants and create conditions for civil servants to take the initiative in creativity and promote their forte. However, through practical work and evaluation of civil servants working in the Tax Department of Thanh Hoa province, it is realized that the motivational work still has certain shortcomings and limitations from which employees have not really tried with all their efforts for work, some civil servants also tend to be bored and frustrated with difficulties. Stemming from the above requirements, the authors Le Thi Nuong, Le Quang Hieu, Nguyen Thi Loan Faculty of Economics, Business Administration, Hong Duc University Email: lethinuong@hdu.edu.vn ( ) Hong Duc University Journal of Science, ... grading according to 4 levels: (1) Successfully fulfilling the tasks- rated A; (2) Complete the task well - Rank B; (3) Complete the tasks - rank C and (4) Do not complete the tasks of category D. However, when conducting the evaluation of the results of year-end civil servants classification, the Decree No. 56/2015/ ND-CP dated June 9, 2015 of the Government, which is divided into 4 levels: (1) Successfully completing the task; (2) Completing the task well; (3) Completing the task with limited capacity and (4) Not completing the task. Therefore, it is difficult to distinguish between task completion and task completion which is still limited in capacity causing inadequacies in determining the evaluation level. According to the quarterly scorecard of the Tax Department, the organization used the same form to evaluate working efficiency for all civil servants (including both leaders and staff); the evaluation criterias remain so common and have not been classified for each target group, so the scoring is sometimes not close to reality. Hong Duc University Journal of Science, E6, Vol.11, P (99 - 108), 2020 104 F ac. o f G rad . S tu d ies, M ah id o l U n iv . M . M . (In tern atio n al H o sp itality M an ag em en t) / 1 0 4 3.2.5. Motivation through emulation movements Recognizing the importance of the emulation movement to successfully accomplish the assigned tasks, this is also the motivation to motivate enthusiastic civil servant to strive to complete professional tasks. Right from the beginning of the year, the Tax Department has organized divisions, District-level Tax Departments to sign emulation covenants and register emulation contracts with the Provincial Tax Department. Based on the content of the annual emulation, the actual situation of each quarter, the Tax Department shall organize an emulation score for individual, on the basis of which is the result to consider the remainder of the salary increase. The launch of emulation and competition grading create a competitive atmosphere in the unit regularly and continuously in order to strive to fulfill the tasks every quarter, 6 months and every year. 3.2.6. Creating motivation through cultural activities, arts and sports To take care of the spiritual life of civil servants better, Thanh Hoa Provincial Tax Department in collaboration with Union regularly pay attention to cultural activities, arts and sports to improve health and spirit for civil servants. At the Tax Department Office and District Tax Office, there are gymnasiums, volleyball courts, badminton, volleyball, table ball for civil servants to play after working hours, etc. Department of Taxation usually organizes sports tournaments, art festivals on holidays such as 30-4, 22-12, 20-10, 8-3. Thus, we can see that Thanh Hoa Tax Department has been carrying out practical activities (both material and non-material) to motivate civil servants of the Tax industry. The following table summarizes the author's assessment of the satisfaction of civil servants with the motivational tools being applied at Thanh Hoa Tax Department. The author surveyed 335 out of 1063 officials of the Thanh Hoa Tax Department (based on a sample based on Slovin's formula) about their satisfaction with the motivational methods at Thanh Hoa Tax Department. The results are shown in the following table: Table 5. Survey results of public servants' satisfaction with the motivational methods at Thanh Hoa Tax Departmen Creating motivation by material factors No. MEAN 1 Motivation through payroll tools 3.61 2 Motivation through bonus tools 3.55 3 Motivation to work through allowance tools 3.63 Creating motivation through the spirit factors 4 Creating work motivation through the environment and working conditions 3.754 5 Motivation through training and development 3.8 6 Motivation through career advancement opportunities 3.83 7 Motivation through work performance evaluation 3.794 8 Motivation through emulation movement 4.125 Source: Compiled from author's survey results Hong Duc University Journal of Science, E6, Vol.11, P (99 - 108), 2020 105 F ac. o f G rad . S tu d ies, M ah id o l U n iv . M . M . (In tern atio n al H o sp itality M an ag em en t) / 1 0 5 From the survey results in Table 5, we can see that the level of satisfaction of civil servants at Thanh Hoa Tax Department is quite good, ranging from 3.5 to 3.8 (the maximum is 5.0). This may explain that the majority of Thanh Hoa Tax Department officials feel satisfied with the agency's motivation tools. And officials at the Thanh Hoa Tax Department feel more satisfied with non-material motivational factors than physical motivators, but the results also show that in most criteria, there are individuals (about 15%) who are not really satisfied with the motivation tools that the agency is applying. Thus, the Department of Taxation needs to have solutions to improve the satisfaction of civil servants, thereby increasing officers‟ motivation. 4. Solutions to create work motivation for officials at Thanh Hoa Tax Department 4.1. Solutions group about financial instruments In order for salary policy to become a working motivation for tax officials, it is necessary to focus on implementing the following measures: Associated with the salary and the nature of the work, the degree of completion of the work, in order to get the results of the quarterly emulation score after each month of work, it should be evaluated and graded as a basis for the end of the review quarter, to avoid equalized statues of increased wages. The work of evaluating and classifying officials must be conducted in an objective and fair manner, on the basis of monthly evaluation and rating so that at the end of the quarter, payment of additional salaries and bonuses to tax officials will be fair. Studying and promptly implementing the regulations on irregular rewards for collectives and individuals with achievements in the working fields. For welfare expenses: Right from the beginning of the year when setting up the expenditure estimates, it is recommended to build at the maximum expense level to proactively fund the welfare expenses for the Holidays and New Year to motivate civil servants in practice. Implement administrative savings (such as Electricity, Water, Telephone, Stationery, etc.) to create a budget to pay for periodic medical examinations for civil servants as prescribed by the General Department Tax. 4.2. Solutions group for non-financial instruments To motivate better working for civil servants in the Department of Taxation of Thanh Hoa province, the author offers some solutions on non-financial tools: 4.2.1. Attention to working environment and working conditions Carry out a review and physical inspection of facilities, working equipment of each Division, Sub-Department of Taxation, Tax Team. From there, perform renovation, repair, purchase additional computers and other physical equipment, etc. timely for the affiliated units. Hong Duc University Journal of Science, E6, Vol.11, P (99 - 108), 2020 106 F ac. o f G rad . S tu d ies, M ah id o l U n iv . M . M . (In tern atio n al H o sp itality M an ag em en t) / 1 0 6 Department of Taxation needs to research and deploy for self-assessment officials, re- statistics of the volume and frequency of work performed by civil servants every year. On that basis, in order to have a plan for assigning, re-arranging suitable human resources, ensuring the well-performing tasks. Implement the rotation, mobilization and periodic change of positions for civil servants in accordance with the regulations of the Ministry of Finance and the Government. 4.2.2. Improve development training Right from the beginning of the year when the training plan is formulated, an overall review should be conducted, all subjects and fields of work need to be focused on training to make a budget plan and report to the General Department of Taxation for approval. For basic skills training in 4 main Tax Administration functions: The Tax Department proactively develops a self-training plan so that all civil servants can access and timely update new knowledge and work-solving methods. Periodically every 6 months, check and review training funding sources provided by the General Department of Taxation with plans to adjust appropriate training programs. Limiting the return of funding while civil servants are not trained in necessary skills. Annually organize the review and re-evaluation of the training needs and training results of the units, ensuring the completion of the training plan, meeting the needs and desires of civil servants. 4.2.3. Complete the performance evaluation Study to complete the personal emulation scorecard with specific criteria, distinguishing each target group based on job characteristics to make the assessment closely with the results and nature of the job. Agree on how to classify according to quarterly emulation points and evaluate the classification of civil servants at the end of the year: Completing tasks or completing tasks with limited capacity. Research to develop job tracking software for each civil servant monthly or quarterly about the results and level of completion of the job so that it can be used as a basis for assessing the work on a quarterly and yearly basis. Research and apply different evaluation methods. For civil servants doing administrative work, the office applies the internal evaluation method; For civil servants who regularly interact with taxpayers, they may seek comments and assessments of taxpayers' comments to give an objective and comprehensive view of such tax officials. 4.2.4. Create opportunities for career development and promotion for civil servants Carry out a general review of the units that are still under-represented (Head of Division, Head of Department, Team Leader) and human resources planning to implement, implement the process of appointing civil servants to units currently missing. For the planned human resources, it is necessary to consider, evaluate and discuss carefully to select outstanding personnel, best meet the task requirements. Hong Duc University Journal of Science, E6, Vol.11, P (99 - 108), 2020 107 F ac. o f G rad . S tu d ies, M ah id o l U n iv . M . M . (In tern atio n al H o sp itality M an ag em en t) / 1 0 7 4.2.5. Build a sports, cultural and artistic movement for civil servants The Department should organize at least 01 sports tournament or mass festivals every year on the anniversary of the establishment of Vietnam's tax industry (10.9) or the founding date of Thanh Hoa Tax Department (1.10). Besides, the Board of Directors of the Department of Taxation; Heads and Sub-Departments of Taxation should pay attention to the life of civil servants, listen to their opinions, grasp their aspirations, and promptly encourage officials when well performing tasks or when facing difficulties, create close relationships for tax officials to always trust, unite and work together to build the increasingly developed Thanh Hoa Tax industry. 5. Some recommendations and proposals 5.1. For the General Department of Taxation The General Department of Taxation should study and submit to the Ministry of Finance to propose to the Government for consideration and creation of conditions for the tax industry to enjoy seniority allowances to increase incomes and meet daily-life demands, especially is to be fair to other industries. Assign autonomy and self-responsibility in recruiting civil servants to Tax Departments of provinces and cities under the supervision and management of the General Department of Taxation. Develop and gradually apply modern human resource management methods through the development of standards of tax officials in each field of work and job position; 5.2. Recommendations to the Provincial People's Committee and relevant departments Regularly reward and timely encourage achievements of tax officials and tax branches to encourage tax officials to strive to successfully fulfill their assigned tasks. People's Councils and Provincial People's Committees, when assigning targets to strive for annual State budget collection, should consider and assess objectively and closely with the socio-economic development situation in the whole province, creating favorable conditions for the tax sector to fulfill its tasks duty and does not put too much pressure on civil servants when assigned to perform the task. 6. Conclusion The study has assessed the status of working motivation for civil servants at Thanh Hoa Tax Department. Although Thanh Hoa Tax Department has been applied measures to increase working motivation, such as creating favourable working environment, increasing salary and bonus, providing opportunities for training and development, measure of working performance, extra activities, etc.; there were still limitations and a number of civil servants have not satisfied with those policies and mearsures. Therefore, the authors offer solutions and recommendations to motivate civil servants at Thanh Hoa Tax Department. Hong Duc University Journal of Science, E6, Vol.11, P (99 - 108), 2020 108 F ac. o f G rad . S tu d ies, M ah id o l U n iv . M . M . (In tern atio n al H o sp itality M an ag em en t) / 1 0 8 References [1] Tran Xuan Cau (2012), Textbook of Human Resource Economics, Publisher of National Economics University, pp.252. [2] Nguyen Van Diem, Nguyen Ngoc Quan (2007), Curriculum of Human Resource, Statistics Publishing House, Hanoi. [3] Nguyen Thanh Do, Nguyen Ngoc Huyen (2011), Business Administration Curriculum, National Economics University Publishing House, Hanoi. [4] Le Thanh Ha (2009), Textbook of Human Resource, Labor - Social Publishing House, Hanoi. [5] Law No. 22/2008 / QH12 of the XII National Assembly, 4th session, November 13, 2008: Law on civil servants. [6] Nguyen Tai Phuc, Bui Van Chiem (2013), Texbook of Human Resource Management, Hue University Press, pp.193-196. [7] Preliminary report on 5-year implementation of Directive No.31-CT/ TW of the Politburo on continued innovation in emulation and commendation work and a summary of 10 years of implementing the “nationwide” emulation movement. [8] Summary report on Taxation - Tasks of solutions for implementing tax work for the years 2017,2018,2019 of Thanh Hoa Tax Department. [9] Bui Anh Tuan, Pham Thuy Huong (2009), Textbook of Organizational Behavior, Publisher of National Economics University, Hanoi.

File đính kèm:

creating_working_motivation_for_civil_servants_at_thanh_hoa.pdf

creating_working_motivation_for_civil_servants_at_thanh_hoa.pdf