Ảnh hưởng của cạnh tranh và quy trình sản xuất sản phẩm đến kế toán quản trị cho việc ra quyết định và tác động của nó đến hiệu quả hoạt động của doanh nghiệp: Nghiên cứu tại các doanh nghiệp sản xuất cơ khí Việt Nam

Tóm tắt

Nghiên cứu được thực hiện nhằm xác định mức độ ảnh hưởng của 2 yếu tố: cạnh tranh và

yêu cầu đối với quy trình sản xuất sản phẩm đến kế toán quản trị cho việc ra quyết định tại các

DN sản xuât cơ khí Việt Nam. Dữ liệu được thu thập thông qua khảo sát các nhà quản trị cấp

cao và những người phụ trách công tác kế toán của 38 DN sản xuất cơ khí Việt Nam. Kết quả

nghiên cứu chỉ ra rằng cả áp lực cạnh tranh và yêu cầu đối với quy trình sản xuất sản phẩm đều

có ảnh hưởng đến KTQT cho việc ra quyết định tại các DN được khảo sát. Ngoài ra, KTQT cho

việc ra quyết định còn có vai trò tích cực đối với hiệu quả hoạt động của doanh nghiệp. Từ đó,

chúng tôi đã đưa ra một số khuyến nghị cần thiết nhằm phát huy tối đa vai trò của KTQT cho

việc ra quyết định trong các DNSX cơ khí Việt Nam.

Từ khóa: Kế toán quản trị, ra quyết đị

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Ảnh hưởng của cạnh tranh và quy trình sản xuất sản phẩm đến kế toán quản trị cho việc ra quyết định và tác động của nó đến hiệu quả hoạt động của doanh nghiệp: Nghiên cứu tại các doanh nghiệp sản xuất cơ khí Việt Nam

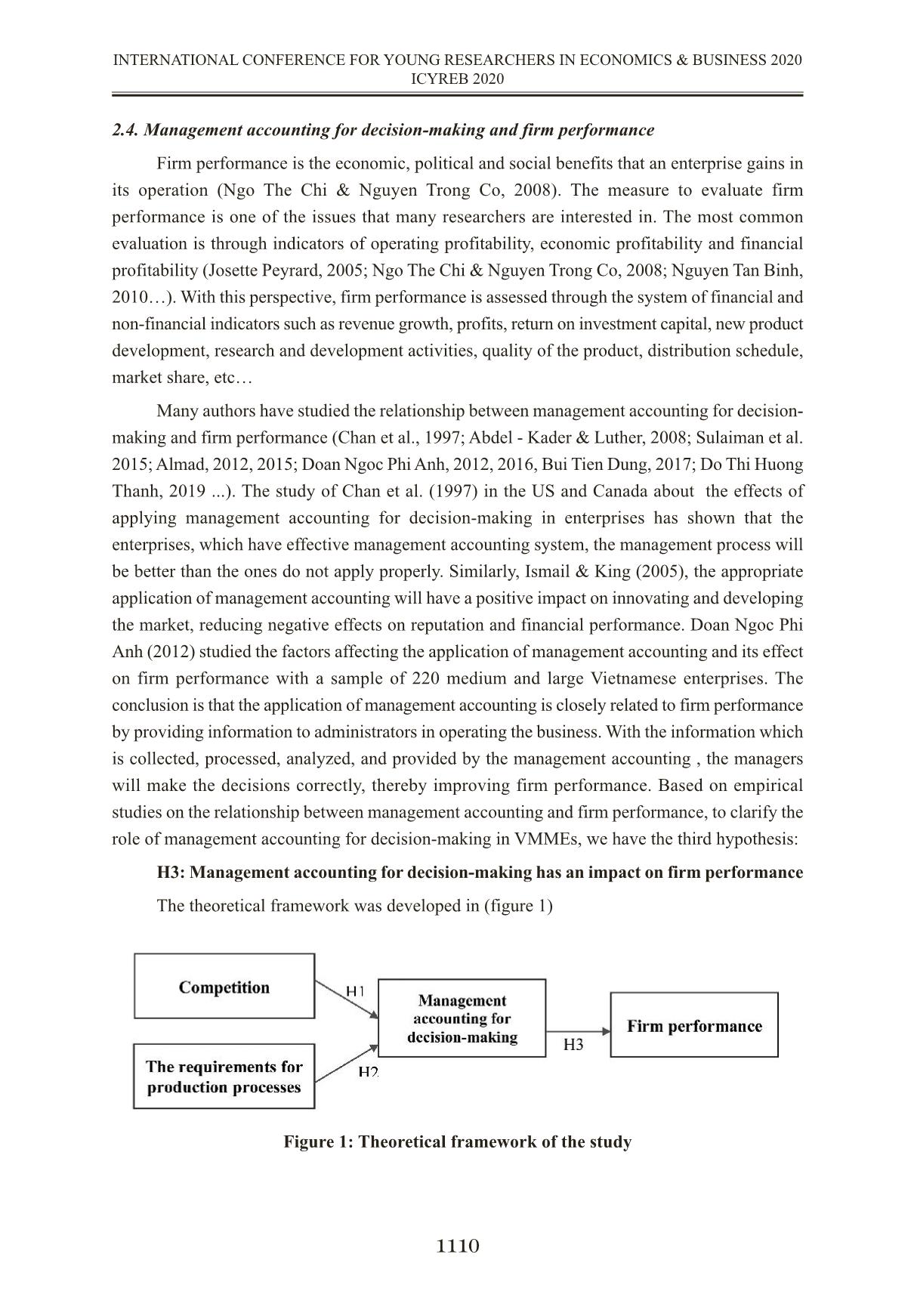

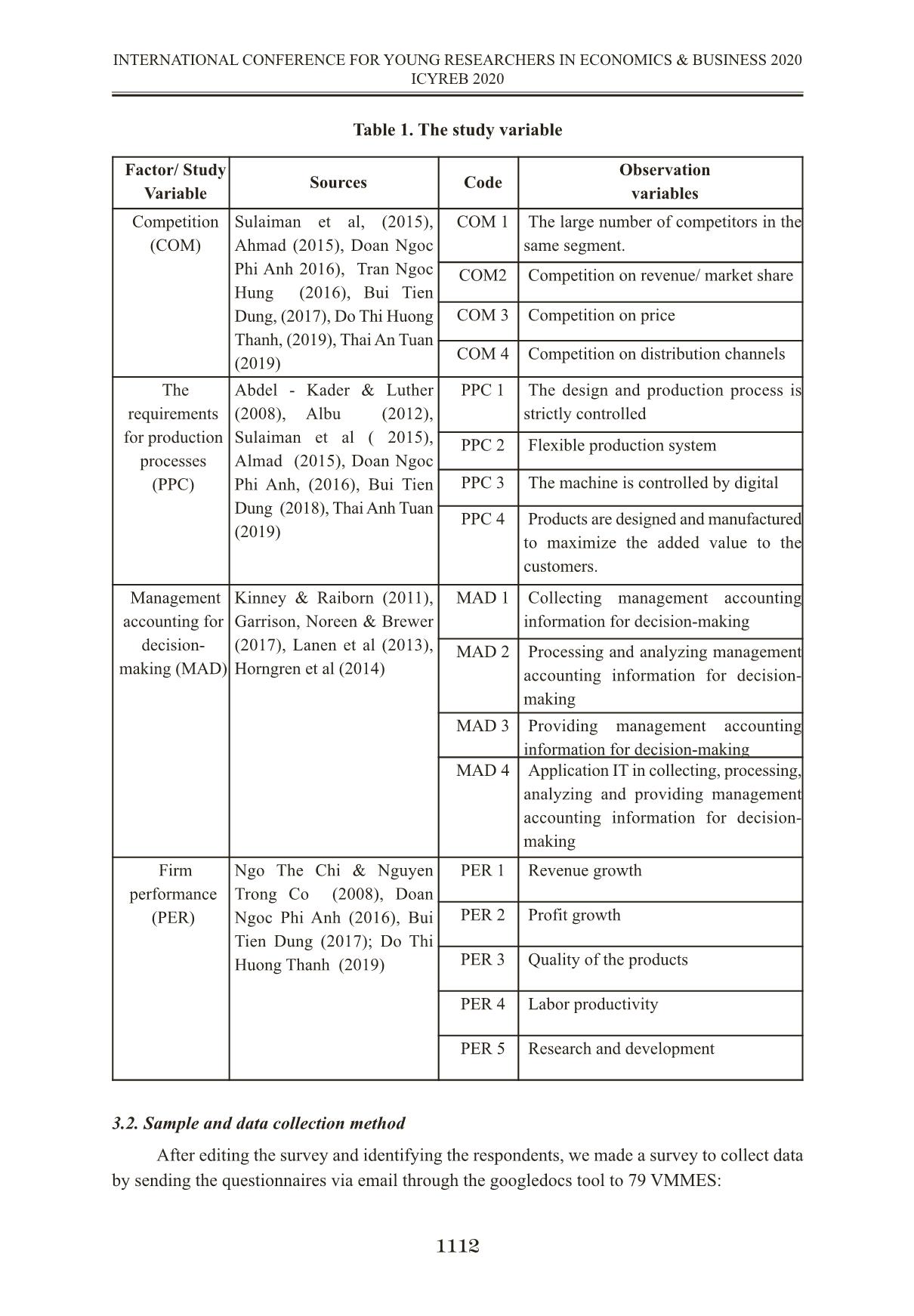

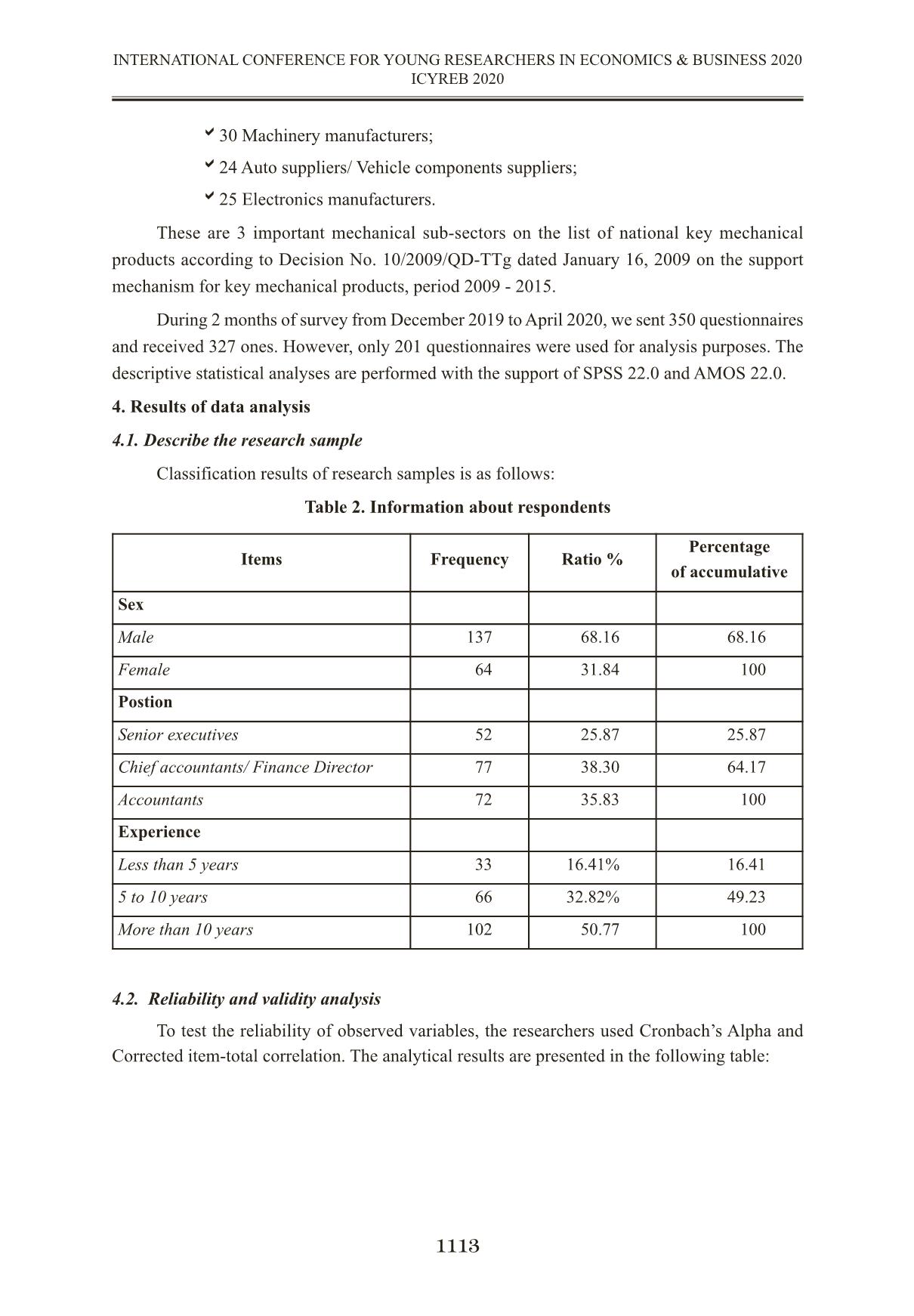

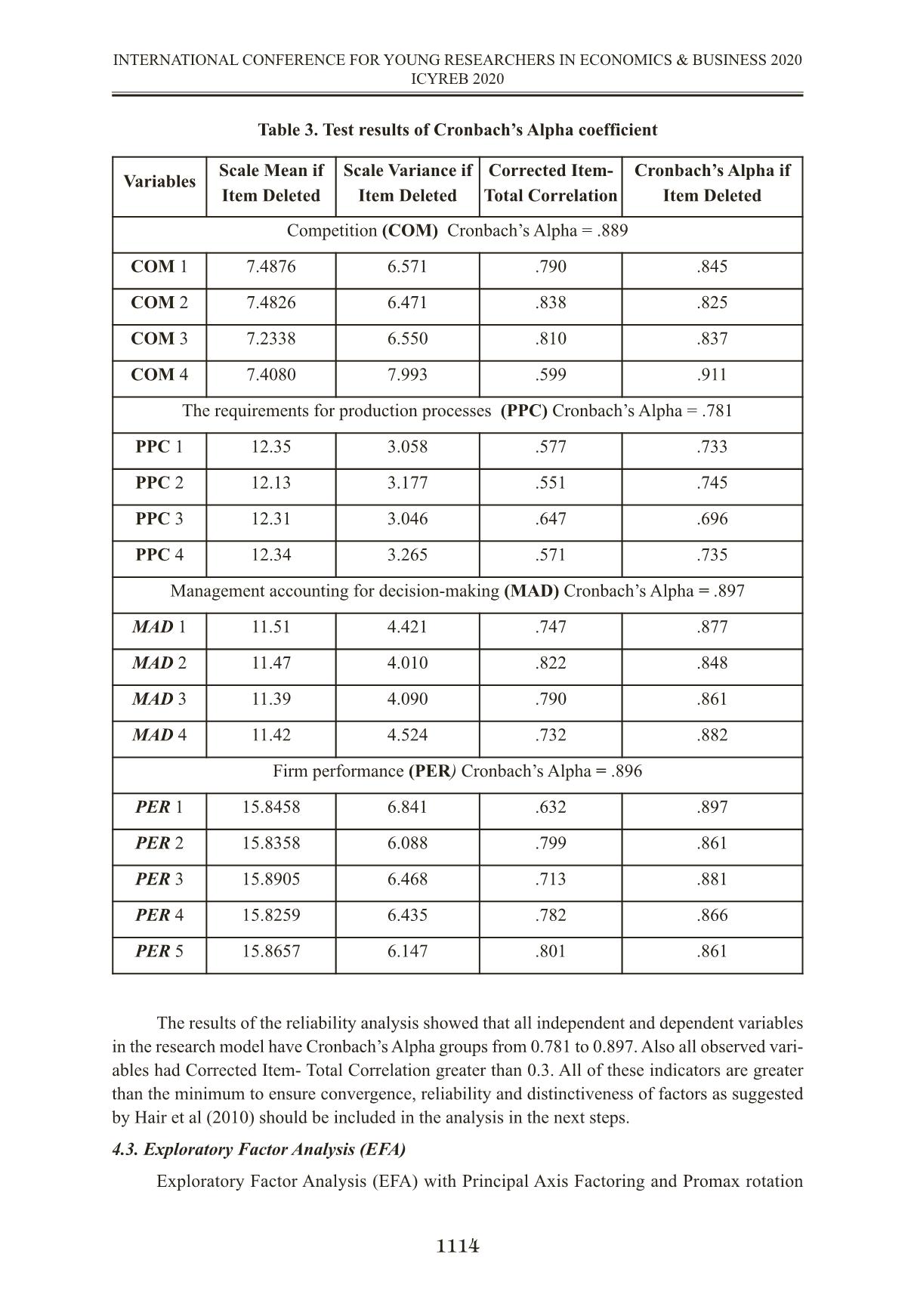

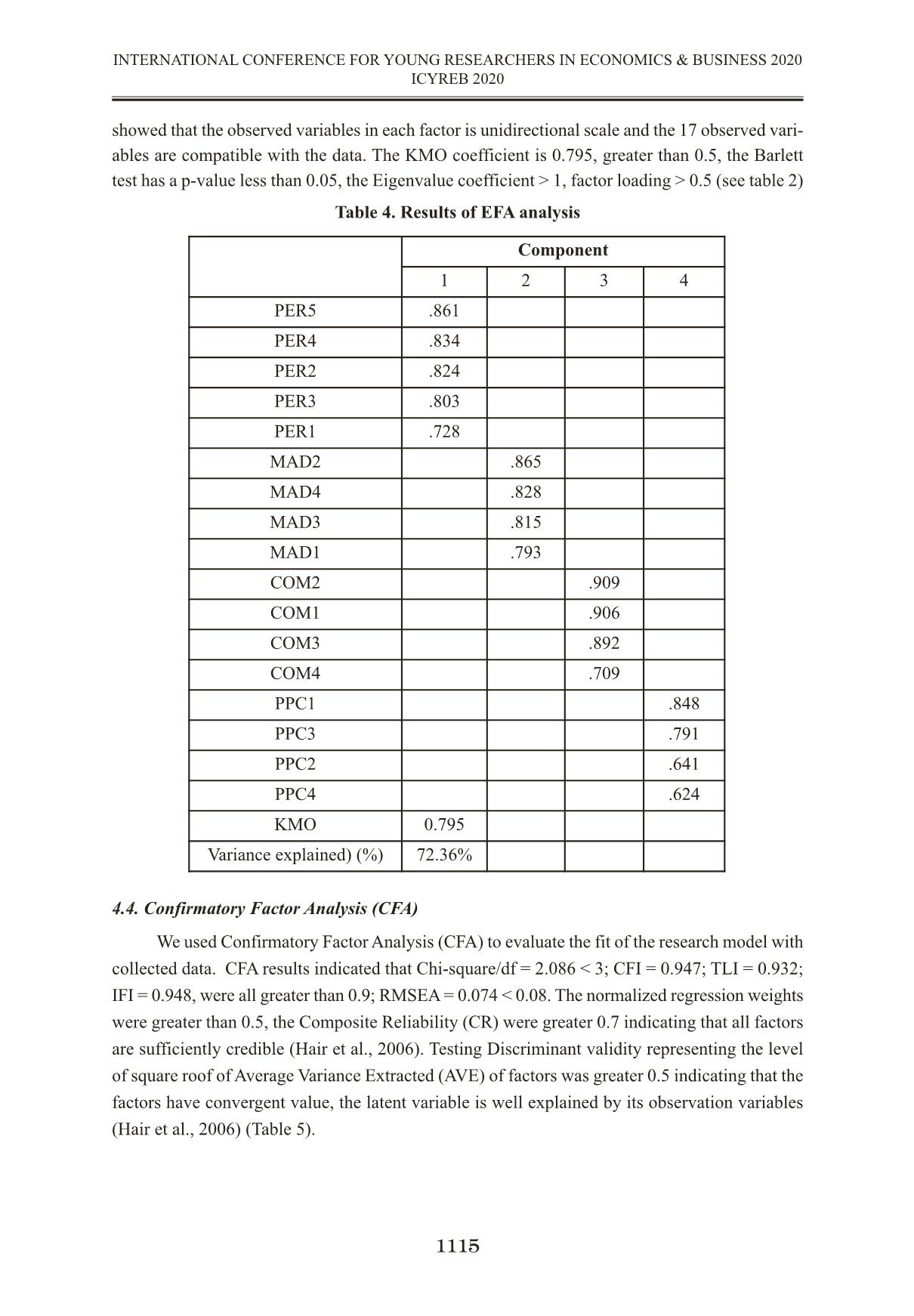

INFLUENCE OF COMPETITION AND THE REQUIREMENTS FOR PRODUCTION PROCESS ON MANAGEMENT ACCOUNTING FOR DECISION - MAKING AND ITS IMPACT ON FIRM PERFORMANCE: A SURVEY IN VIETNAMESE MECHANICAL MANUFACTURING ENTERPRISES ẢNH HƯỞNG CỦA CẠNH TRANH VÀ QUY TRÌNH SẢN XUẤT SẢN PHẨM ĐẾN KẾ TOÁN QUẢN TRỊ CHO VIỆC RA QUYẾT ĐỊNH VÀ TÁC ĐỘNG CỦA NÓ ĐẾN HIỆU QUẢ HOẠT ĐỘNG CỦA DOANH NGHIỆP: NGHIÊN CỨU TẠI CÁC DOANH NGHIỆP SẢN XUẤT CƠ KHÍ VIỆT NAM MA, Nguyen Quynh Trang - Thuongmai University quynhtrangnguyen2408@gmail.com Abstract The purpose of this study is to determine the influence of competition and the requirements for production process on management accounting for decision-making in Vietnamese mechanical manufacturing enterprises (VMMEs). The sample was collected from a survey of senior executives, chief accountants and accountants of 38 VMMEs in July 2020.The results showed that both competition and requirements for production processes have an impact on management accounting for decision-making in these enterprises. In addition, management accounting for decision-making also contributes to improving firm performance. From the results, the study proposes some suggestions to promote the role of management accounting for decision-making in VMMEs. Keywords: Management accounting for decision-making, competition, production processes, firm performance. Tóm tắt Nghiên cứu được thực hiện nhằm xác định mức độ ảnh hưởng của 2 yếu tố: cạnh tranh và yêu cầu đối với quy trình sản xuất sản phẩm đến kế toán quản trị cho việc ra quyết định tại các DN sản xuât cơ khí Việt Nam. Dữ liệu được thu thập thông qua khảo sát các nhà quản trị cấp cao và những người phụ trách công tác kế toán của 38 DN sản xuất cơ khí Việt Nam. Kết quả nghiên cứu chỉ ra rằng cả áp lực cạnh tranh và yêu cầu đối với quy trình sản xuất sản phẩm đều có ảnh hưởng đến KTQT cho việc ra quyết định tại các DN được khảo sát. Ngoài ra, KTQT cho việc ra quyết định còn có vai trò tích cực đối với hiệu quả hoạt động của doanh nghiệp. Từ đó, chúng tôi đã đưa ra một số khuyến nghị cần thiết nhằm phát huy tối đa vai trò của KTQT cho việc ra quyết định trong các DNSX cơ khí Việt Nam. Từ khóa: Kế toán quản trị, ra quyết định. 1106 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 1. Introduction Mechanical manufacturing is a fundamental industry to the country’s socio-economic development. In recent years, the number of VMMEs accounts for nearly 30% of the total processing and manufacturing enterprises in Vietnam (General Statistics Office of Vietnam, 2019). Vietnam is a developing country, before the requirements of economic restructuring towards industrialization and modernization, the mechanical industry must be strong enough to carry out the contents of the Industrial revolution 4.0 and technological innovation for other economic sectors. However, with the development trend of the market economy, production and business activities of corporations are increasingly expanded, VMMEs are facing to some difficulties: Firstly, the mechanical industry is a diversified product industry but the pressure of competition is great. Competition makes economic relationships arising in the business process of enterprises become complicated. Enterprise must be competed with domestic and foreign businesses. In fact, many domestic manufacturing enterprises are not competitive enough, not ready to access new technologies to meet the increasing demand for quality technology products. Secondly, difficulties comes from the specific characteristics of the mechanical manufacturing industry. This is a production industry, that the production process goes through many different stages, requires very high accuracy in terms of technology level and production inputs. The main materials are iron, steel and other color alloys. Most of these materials cannot be domestically produced, so they must be imported. Therefore, the price of input materials fluctuates and affected by the world market. For labour, this is a field that requires highly skilled and specialized labor to exploit and operate technology in design and production consultancy process. This is also a big challenge for VMMEs. In the context of the Industrial revolution 4.0 and economic integration with other economies in the region and the world, VMMEs must change to be able to adapt and survive and develop. In fact, managers of these enterprises are facing many difficulties in identifying, collecting, processing and analyzing information in decision-making. They have a great demand for modern management knowledge and the support of management tools. In particular, management accounting is effective tool for providing useful information for manager. In recent years, the perception of managers about the role of management accounting has also changed. It directly affects to the application of management accounting in the enterprises.. In ... ly controlled PPC 2 Flexible production system PPC 3 The machine is controlled by digital PPC 4 Products are designed and manufactured to maximize the added value to the customers. Management accounting for decision- making (MAD) Kinney & Raiborn (2011), Garrison, Noreen & Brewer (2017), Lanen et al (2013), Horngren et al (2014) MAD 1 Collecting management accounting information for decision-making MAD 2 Processing and analyzing management accounting information for decision- making MAD 3 Providing management accounting information for decision-making MAD 4 Application IT in collecting, processing, analyzing and providing management accounting information for decision- making Firm performance (PER) Ngo The Chi & Nguyen Trong Co (2008), Doan Ngoc Phi Anh (2016), Bui Tien Dung (2017); Do Thi Huong Thanh (2019) PER 1 Revenue growth PER 2 Profit growth PER 3 Quality of the products PER 4 Labor productivity PER 5 Research and development b30 Machinery manufacturers; b24 Auto suppliers/ Vehicle components suppliers; b25 Electronics manufacturers. These are 3 important mechanical sub-sectors on the list of national key mechanical products according to Decision No. 10/2009/QD-TTg dated January 16, 2009 on the support mechanism for key mechanical products, period 2009 - 2015. During 2 months of survey from December 2019 to April 2020, we sent 350 questionnaires and received 327 ones. However, only 201 questionnaires were used for analysis purposes. The descriptive statistical analyses are performed with the support of SPSS 22.0 and AMOS 22.0. 4. Results of data analysis 4.1. Describe the research sample Classification results of research samples is as follows: Table 2. Information about respondents 4.2. Reliability and validity analysis To test the reliability of observed variables, the researchers used Cronbach’s Alpha and Corrected item-total correlation. The analytical results are presented in the following table: 1113 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Items Frequency Ratio % Percentage of accumulative Sex Male 137 68.16 68.16 Female 64 31.84 100 Postion Senior executives 52 25.87 25.87 Chief accountants/ Finance Director 77 38.30 64.17 Accountants 72 35.83 100 Experience Less than 5 years 33 16.41% 16.41 5 to 10 years 66 32.82% 49.23 More than 10 years 102 50.77 100 Table 3. Test results of Cronbach’s Alpha coefficient The results of the reliability analysis showed that all independent and dependent variables in the research model have Cronbach’s Alpha groups from 0.781 to 0.897. Also all observed vari- ables had Corrected Item- Total Correlation greater than 0.3. All of these indicators are greater than the minimum to ensure convergence, reliability and distinctiveness of factors as suggested by Hair et al (2010) should be included in the analysis in the next steps. 4.3. Exploratory Factor Analysis (EFA) Exploratory Factor Analysis (EFA) with Principal Axis Factoring and Promax rotation 1114 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Variables Scale Mean if Item Deleted Scale Variance if Item Deleted Corrected Item- Total Correlation Cronbach’s Alpha if Item Deleted Competition (COM) Cronbach’s Alpha = .889 COM 1 7.4876 6.571 .790 .845 COM 2 7.4826 6.471 .838 .825 COM 3 7.2338 6.550 .810 .837 COM 4 7.4080 7.993 .599 .911 The requirements for production processes (PPC) Cronbach’s Alpha = .781 PPC 1 12.35 3.058 .577 .733 PPC 2 12.13 3.177 .551 .745 PPC 3 12.31 3.046 .647 .696 PPC 4 12.34 3.265 .571 .735 Management accounting for decision-making (MAD) Cronbach’s Alpha = .897 MAD 1 11.51 4.421 .747 .877 MAD 2 11.47 4.010 .822 .848 MAD 3 11.39 4.090 .790 .861 MAD 4 11.42 4.524 .732 .882 Firm performance (PER) Cronbach’s Alpha = .896 PER 1 15.8458 6.841 .632 .897 PER 2 15.8358 6.088 .799 .861 PER 3 15.8905 6.468 .713 .881 PER 4 15.8259 6.435 .782 .866 PER 5 15.8657 6.147 .801 .861 showed that the observed variables in each factor is unidirectional scale and the 17 observed vari- ables are compatible with the data. The KMO coefficient is 0.795, greater than 0.5, the Barlett test has a p-value less than 0.05, the Eigenvalue coefficient > 1, factor loading > 0.5 (see table 2) Table 4. Results of EFA analysis 4.4. Confirmatory Factor Analysis (CFA) We used Confirmatory Factor Analysis (CFA) to evaluate the fit of the research model with collected data. CFA results indicated that Chi-square/df = 2.086 < 3; CFI = 0.947; TLI = 0.932; IFI = 0.948, were all greater than 0.9; RMSEA = 0.074 < 0.08. The normalized regression weights were greater than 0.5, the Composite Reliability (CR) were greater 0.7 indicating that all factors are sufficiently credible (Hair et al., 2006). Testing Discriminant validity representing the level of square roof of Average Variance Extracted (AVE) of factors was greater 0.5 indicating that the factors have convergent value, the latent variable is well explained by its observation variables (Hair et al., 2006) (Table 5). 1115 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Component 1 2 3 4 PER5 .861 PER4 .834 PER2 .824 PER3 .803 PER1 .728 MAD2 .865 MAD4 .828 MAD3 .815 MAD1 .793 COM2 .909 COM1 .906 COM3 .892 COM4 .709 PPC1 .848 PPC3 .791 PPC2 .641 PPC4 .624 KMO 0.795 Variance explained) (%) 72.36% Table 5. Result of Confirmatory Factor Analysis (CFA) 4.5. Structural Equation Modeling Analysis and Hypothesis Testing The analysis of structural equation modeling showed that the model fits the data, Chi- square/df = 2.211 < 3; CFI = 0.941; TLI = 0.924; IFI = 0.942, were greater than 0.9; RMSEA = 0.078 < 0.08, P.Value = 0.000 < 0.05. The estimated results of relationships among factors are shown in Figure 2. Figure 2. Standardized structural equation modeling analysis The two factors: competition (COM) and the requirements for production processes(PPC) both have positive impact on management accounting for decision-making (MAD). This result is also consistent with the findings of previous studies (Abdel - Kader & Luther, 2008; Albu, 2012; Sulaiman et al, 2015; Almad, 2012, 2015; Doan Ngoc Phi Anh, 2012, 2016; Bui Tien Dung, 2018; Thai Anh Tuan, 2019; Do Thi Huong Thanh, 2019). In which PPC with beta coefficients of .618 has a stronger influence on MAD than COM (β = 0.248). In addition, the results also indicate that management accounting for decision-making (MAD) has a positive effect on firm performance (PER) with beta coefficients of.541. As a result, three hypotheses are accepted. 1116 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Factor Number of observation variables Composite Reliability Average Variance Ex- tracted Minimum nor- malized regres- sion weight Competition (COM) 4 .886035 .904 .816453 The requirements for production processes (PPC) 4 .781831 .796 .633493 Management accounting for decision-making (MAD) 4 .897714 .911 .829178 Firm performance (PER) 5 .90636 .903 .815423 Table 6. Regression analysis and hypothesis results 5. Conclusion The requirements for production process are factors that motivate VMMEs to increase the application management accounting techniques in collecting, processing, analyzing and providing information for decision-making. Specifically, the characteristic of the mechanical manufacturing industry is an industry with a complex technological process, requiring very high precision of technology and production inputs. In the context of globalization and the effects of the Industrial revolution 4.0, VMMEs should apply modern technology to their production. The application of scientific and technological advances will help enterprises use rationally and efficiently production resources, improve quality of products and labor productivity, thereby increasing competitiveness. Therefore, the authors suggest that VMMEs should establish / maintain R&D centers. These centers are responsible for researching and improving of products and manufacturing processes, designing and updating of modern manufacturing processes. In addition, these enterprises should build flexible production systems, integrate computer and robot systems with fast, accurate and safe job processing speed. We believe that the application of advanced and modern production technology not only motivates VMEs to increase the implementation of management accounting contents for decision-making but also for the process of collecting, processing, analyzing and providing management accounting information more smoothly and effectively. On the other hand, research also shows that competition also affects the implementation of management accounting for decision-making in VMMEs. In fact, the competitiveness of these enterprises is not high. Especially in the context of the Industrial revolution 4.0, VMMEs have to compete in many aspects: input materials, selling price, market share, labor skills, production equipment, distribution, product diversification ... In order to survive and develop, each enterprise needs to choose one / a number of different competitive advantages which can compare with other competitors in the market. The results of this study also show that, in VMMEs, the implementation management accounting for decision-making (collecting, processing, analyzing, providing information and the application of IT for decision-making) also contributes to improving firm performance (both financial and non-financial perspective). Therefore, administrators in these enterprises should promote the investment in modern technology in production and apply measures to increase the competitiveness of enterprises, facilitate the implementation of management accounting contents value for decision-making. 1117 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Estimate S.E. C.R. P MAD <—- COM .248 .077 3.231 .001 MAD <—- PPC .618 .096 6.460 .000 PER <—- MAD .541 .091 5.912 .000 From a macro perspective, we need to have appropriate policies to enhance the advantages of management accounting, thereby encouraging enterprises to implement management accounting for decision-making. To do this, it is important to pay attention to the role of professional associations, as well as universities and training centers in introducing, disseminating, and guiding the work process of accounting management and related techniques for enterprises. 6. Limitations and further research The results of these studies are the basis for managers in VMMES to consider in establishing a management accounting system in their enterprises as well as applying management accounting techniques for controlling and operating enterprise.The research also has a number of limitations. Due to limited time, our research only investigated 2 factors affecting management accounting for decision-making in VMMEs. There are some factors which influence the appli- cation of management accounting for decision-making that have not been included in the research model such as organizational structure, managers’ knowledge, culture, qualification of accountants,... Therefore, these issues may be further clarified in further research. REFERENCES Abdel-Kader, M. and Luther, R. (2006). Management accounting practices in the British food and drinks industry, British Food Journal, 108: 336-357. Abdel-Kader M,. and Luther, R. (2008). The impact of firm characteristics on management accounting practices: A UK - based empirical analysis. The British Accounting Review, 40: 2-27. Ahmad, K. (2012). The use of management accounting practices in Malaysia SMEs. PhD thesis, University of Exeter. https://ore.exeter.ac.uk/repository/handle/10036/3758 Atkinson, A. et al., 2012, Management accounting: information for decision-making and strategy executive, 6th editiozn, Pearson Prentice Hall. Burns, J. and Vaivio, J. (2001). Management accounting change, Management Accounting Research, 12:389-402. Chenhall, R.H. (2003). Management control systems design within its organizational con- text: findings from contingency-based research and directions for the future. Accounting, Organ- izations and Society, 28: 127-168. CIMA (2015). Management Accounting Official Terminology. The Chartered Institute of Management Accountant. Doan Ngoc Phi Anh (2012). Factors affecting strategic management accounting in Vietnamese enterprises. Economic Development Magazine Do Thi Huong Thanh (2019). Research on using management accounting methods in Vietnamese manufacturing enterprises, PhD thesis, National Economics University, Vietnam Drury, C. et al. (1993). A survey of management accounting practices in UK manufacturing companies, Chartered Association of Certified Accountants. 1118 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020 Joshi, P.L. (2001). The International Diffusion of New Management Accounting Practices: The case of India. Journal of International Accounting, Auditing and Taxation, 10, 85-109. Garrison, R., Noreen, E., & Brewer, P. (2017). Managerial Accounting (15th ed.). Mc- Graw-Hill/Irwin. A Business Unit of the McGraw-Hill Companies Inc. 1221 Avenue of the Amer- icas, New York. Ghosh, B.C & Chan, Y.K. (1997). Management Accounting in Singapore – Well in Place. Managerial Auditing Journal, 12(1), 16-18. IFAC (1998). International Management Accounting Practice Statement: Management Ac- counting Concept, Financial and Management Accounting Committee, March 1998. Hair J.F., Black W.C., Babin B.J., Anderson R. E., Tatham R. L. (2006), Mutilvariate Data Analysis (6th edition). Upper Saddle River, NJ: Prentice Hall. Hair, J.F., Black, W.C., Babin, B.J., &Anderson, R.E. (2010), Multivariate Data Analysis, New Jersey: Pearson Academic. Kaplan, R. and Atkinson, A.( 1998). Advanced Management Accounting. 3th edition. USA, Hall Inc. Prentice International. Langfield-Smith K., Hellen Thorne, Hilton Ronald W. (2009). Management Accounting: Information for creating and managing value, 5th ed, McGraw-Hill Irwin. Thai Anh Tuan (2019). Influence of factors on the application of management accounting techniques in enterprises in the North of Vietnam, PhD thesis, National Economics University, Vietnam. Tran Ngoc Hung (2016). Factors affecting the application of management accounting in small and medium enterprises in Vietnam, PhD thesis, Ho Chi Minh University of Economics. Waweru, N. M (2010). The origin and evolution of management accounting: a review of the theoretical framework, Problems and Perpectives in Management, Volume 8, Issue 3. 1119 INTERNATIONAL CONFERENCE FOR YOUNG RESEARCHERS IN ECONOMICS & BUSINESS 2020 ICYREB 2020

File đính kèm:

anh_huong_cua_canh_tranh_va_quy_trinh_san_xuat_san_pham_den.pdf

anh_huong_cua_canh_tranh_va_quy_trinh_san_xuat_san_pham_den.pdf